Get the free Conflict of Interest Disclosure Statement

Get, Create, Make and Sign conflict of interest disclosure

Editing conflict of interest disclosure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out conflict of interest disclosure

How to fill out conflict of interest disclosure

Who needs conflict of interest disclosure?

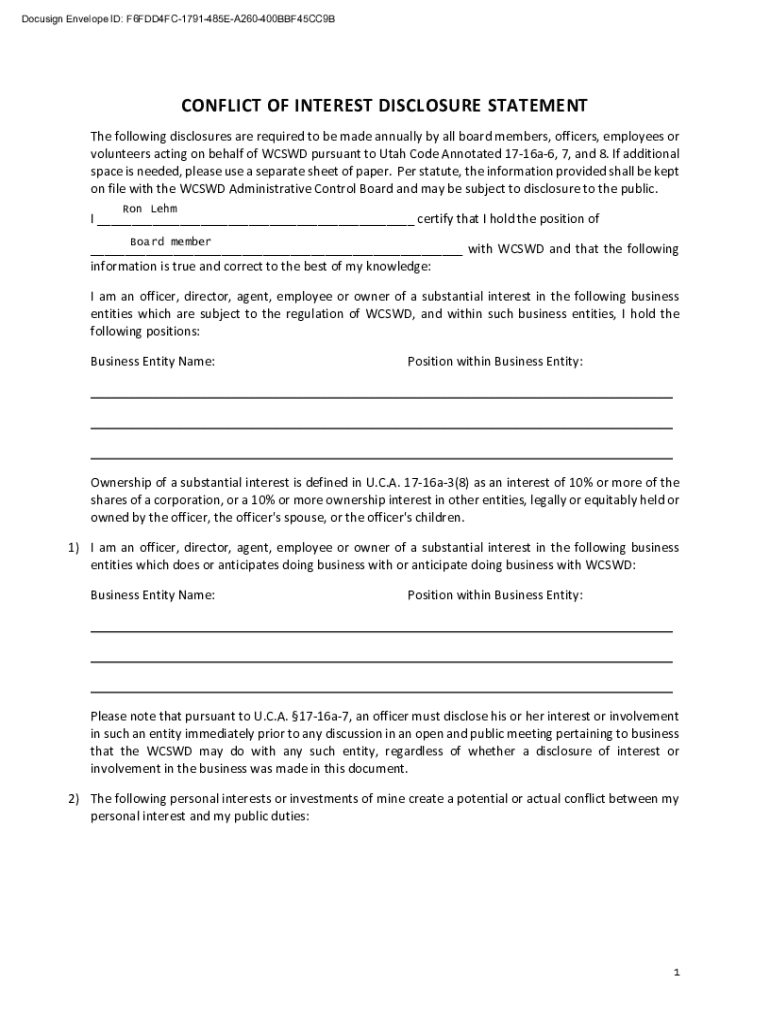

Understanding the Conflict of Interest Disclosure Form

Understanding the conflict of interest disclosure form

A conflict of interest disclosure form is an essential document used by individuals and organizations to identify and manage potential conflicts that might arise due to personal interests conflating with professional responsibilities. This form serves as a written record where individuals list any interests that may influence their decision-making processes or the integrity of their roles.

The primary purpose of this form is to ensure transparency and maintain the trustworthiness of professional environments. By disclosing such information, organizations can proactively address possible issues that could undermine their credibility or lead to legal repercussions.

Legal and ethical considerations

The legal obligations surrounding conflict of interest disclosures can vary by jurisdiction but typically include guidelines set forth by regulatory agencies. These laws necessitate that individuals in specific roles, such as public officials, corporate executives, and non-profit board members, disclose any interests that may influence their decisions. Failure to comply with these laws can result in significant penalties for both individuals and organizations.

From an ethical perspective, transparency is paramount. Organizations that foster a culture of openness encourage employees to disclose potential conflicts without fear of reprisal. This culture not only protects the organization’s reputation but also promotes a sense of accountability and integrity within the workforce.

Key components of the form

A thorough conflict of interest disclosure form includes several key components. First and foremost, it requires personal details such as the name, position, and organization of the individual completing the form. This foundational information lays the groundwork for later assessments of conflicts.

Next, the form must include specifics of any potential conflicts. This can involve a range of disclosures, such as financial interests in companies, ownership of stocks, or familial relationships that could influence decision-making. Furthermore, a signature and date are typically required at the end, affirming that the information provided is accurate to the best of the individual's knowledge.

Situations requiring disclosure

Various types of conflicts can trigger the need for disclosure. Financial interests often form the most apparent basis for concerns, where an individual owns shares in a company that might be affected by their decisions or policies. Similarly, personal relationships—like familial ties, partnerships, or close friendships—must also be disclosed, as they can create biases.

Employers and board members are often required to report multiple affiliations that could lead to perceived or real conflicts. For instance, if an employee holds a secondary job that overlaps with company operations, that could necessitate disclosure as it raises questions about loyalty and decision-making.

Step-by-step guide to filling out the form

To accurately complete a conflict of interest disclosure form, start by gathering all necessary documentation and information. This may include reviewing previous disclosures and understanding organizational policies surrounding conflicts of interest, which can often be found on internal websites or handbooks.

Once you’ve prepared, follow these detailed instructions for each section of the form:

Tips for accurate and honest disclosures

Being transparent in disclosures is crucial to maintaining credibility and trust within your organization. Ensure that you provide full and honest information, even in situations where you think the conflict may be minor. Transparency builds trust, while omitting information can lead to serious consequences.

Several common pitfalls can occur during the disclosure process. For instance, individuals might unintentionally omit details, or misrepresent situations, thinking they are less significant than they actually are. If you are in doubt about whether something qualifies as a conflict of interest, it's advisable to seek guidance from a compliance officer or a relevant mentioned authority.

Submitting and managing your disclosure

After completing the form, you should understand how to submit it properly. This usually involves submitting the document electronically, perhaps via pdfFiller, which provides a streamlined process for editing and signing documents. Organizations might also have alternative submission methods, such as emailing the form to a designated compliance office or submitting it through an internal portal.

Managing and updating disclosures is an essential part of the process. Individuals should keep track of when and how disclosures were submitted, updating them when circumstances change. If new financial interests or relationships arise, re-evaluating and disclosing these conflicts help maintain organizational trust.

Tools and resources for effective management

Utilizing pdfFiller’s collaboration features can greatly enhance the management of your disclosures. With tools that allow you to share forms with colleagues or compliance officers, you can streamline the review process. Real-time edits and comments facilitate clear communication and help ensure everyone is on the same page concerning any potential conflicts of interest.

Additionally, pdfFiller offers pre-filled templates that simplify the filing process. These templates can save time and effort, while their FAQs and support options assist users in resolving any inquiries they may have regarding the form or its completion.

Frequently asked questions (FAQs)

Many individuals have queries related to conflict of interest disclosures. Common questions include those regarding the confidentiality of their disclosures and retention records. It is vital for individuals to understand their rights and the protocols surrounding the management of these sensitive documents within their organization.

Furthermore, clarity on who will access their disclosures and the policies for maintaining confidentiality can help alleviate anxieties about submitting these forms. Organizations should strive to maintain clear guidelines to help employees feel secure in their disclosures.

Best practices for compliance and record-keeping

To ensure compliance, regularly reviewing potential conflicts of interest is advisable for all employees. Creating an up-to-date log of disclosures helps track changes over time and allows organizations to manage conflicts effectively. Essential to this ongoing process is engaging in training that can reinforce ethical practices and highlight the importance of regular disclosures.

Organizations and individuals should not only rely on the submission of the conflict of interest disclosure form as a one-off task but see it as part of a broader commitment to ethical standards. By integrating these practices into their operations, they solidify their dedication to transparency and uphold integrity in their professional landscapes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit conflict of interest disclosure from Google Drive?

Can I create an electronic signature for the conflict of interest disclosure in Chrome?

Can I create an electronic signature for signing my conflict of interest disclosure in Gmail?

What is conflict of interest disclosure?

Who is required to file conflict of interest disclosure?

How to fill out conflict of interest disclosure?

What is the purpose of conflict of interest disclosure?

What information must be reported on conflict of interest disclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.