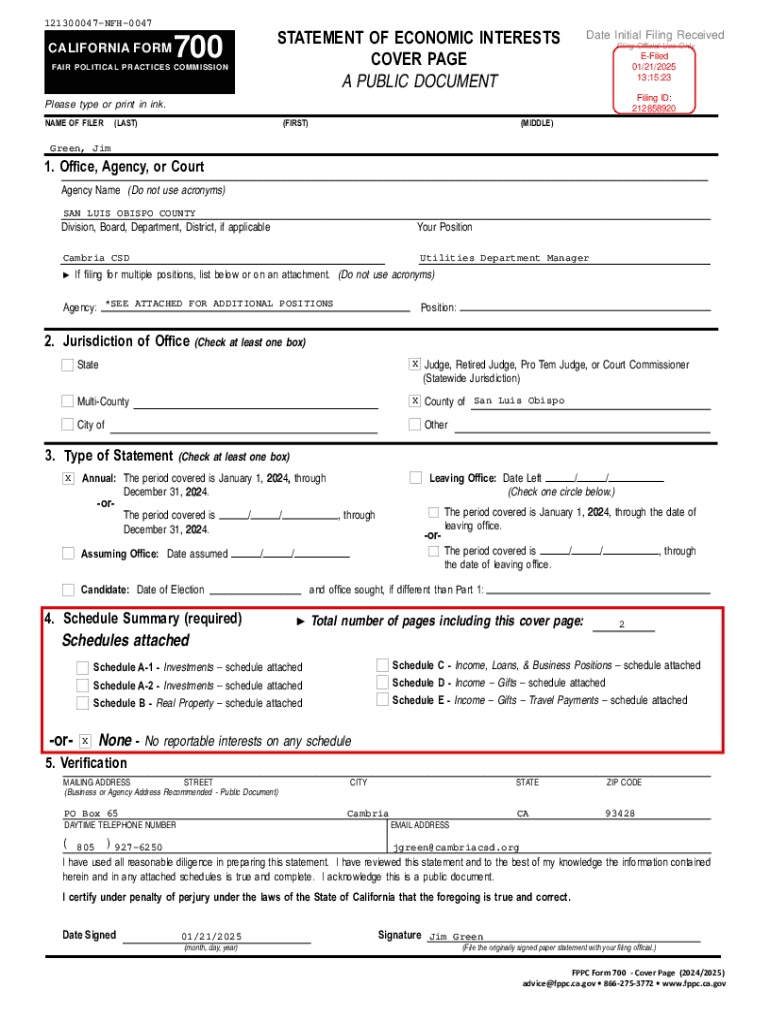

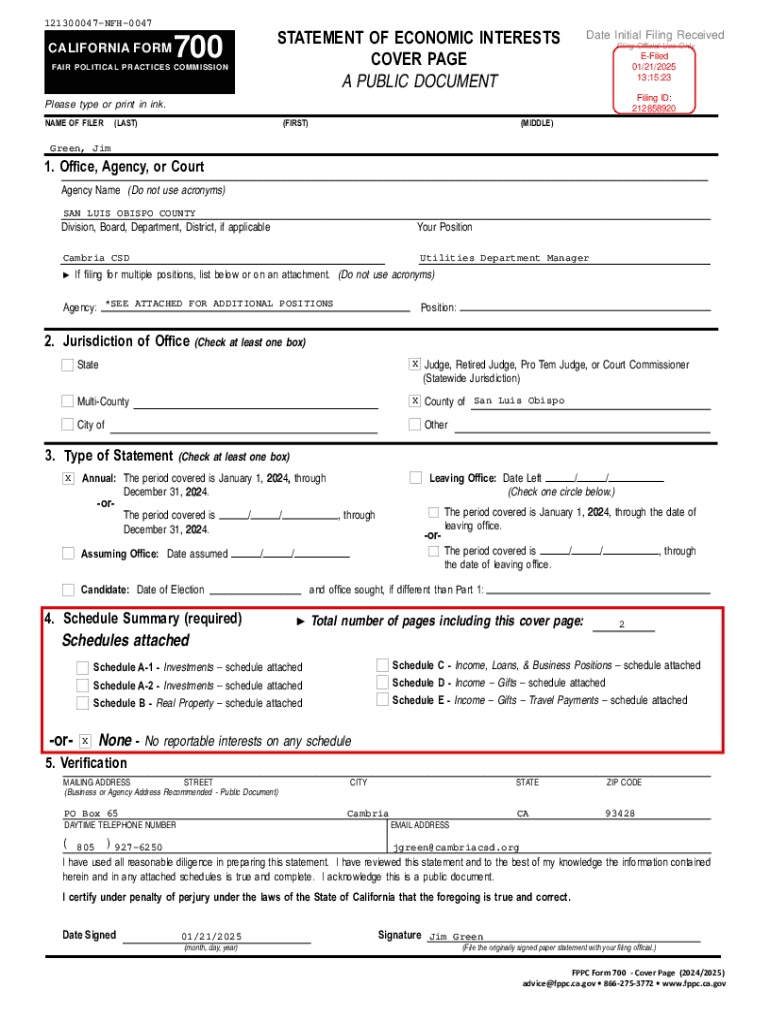

Get the free form 700 statement of economic interests

Get, Create, Make and Sign form 700 statement of

How to edit form 700 statement of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 700 statement of

How to fill out california form 700

Who needs california form 700?

A Comprehensive Guide to California Form 700: Filers' Economic Interests Explained

Understanding California Form 700: Statements of Economic Interests

California Form 700, officially known as the Statement of Economic Interests, serves a crucial purpose in maintaining transparency amongst public officials. This form is designed to disclose financial interests that could influence the decisions made by individuals in positions of authority. The importance of this form cannot be overstated; it acts as a safeguard against corruption and conflicts of interest, ensuring that public servants act in the best interest of the communities they serve.

Every individual who holds a specific position within California’s state and local government is required to file this form. This includes elected officials, certain appointed officials, employees of designated public agencies, and members of various regulatory boards. Compliance with filing Form 700 is not only a legal obligation but also a matter of ethical duty, reinforcing public trust in government operations.

The importance of filing California Form 700

Filing California Form 700 is essential for promoting ethical governance and transparency in public service. By requiring public officials to disclose their financial interests, it allows for public scrutiny and helps identify potential conflicts of interest. Transparency is a key element that fosters trust between the government and its constituents, enabling informed public engagement and accountability.

The consequences for failing to comply with Form 700 filing requirements can be severe, ranging from administrative penalties to criminal charges depending on the severity of the non-compliance. Failing to file or inaccurately reporting interests can damage an official's reputation and undermine public confidence, highlighting the critical nature of this disclosure.

How to fill out California Form 700

Filling out California Form 700 may seem daunting at first, but breaking it down into manageable steps makes the process straightforward. Begin by gathering all necessary financial information, including income records, investment interests, and any gifts received, as these are critical for accurate reporting.

Next, as you fill out the form, pay careful attention to each section. The form includes various categories such as:

Finally, reviewing your entries is crucial to ensure accuracy and completeness. Double-checking your financial disclosures is pivotal in maintaining compliance and integrity.

Filing process for California Form 700

Once you have completed California Form 700, submitting it is the next essential step. Individuals can choose between electronic submission via platforms such as pdfFiller or mailing in their forms. For electronic submissions, ensure all fields are accurately filled prior to finalization to facilitate a smooth process.

Mail-in submissions require attention to detail regarding the address and any required documentation. Make sure to include all pertinent information for your specific filing situation. Moreover, it is vital to keep track of deadlines, which vary for first-time filers versus annual submissions. Generally, the annual filing deadline is April 1st for most public officials, but checking specific agency requirements is recommended.

Additional schedules and amendments

There are scenarios in which additional schedules may be needed when filing California Form 700. For instance, if you have multiple business interests or extensive investments, attaching supplementary schedules can provide clarity and thoroughness. Understanding which additional forms are required is essential to ensure compliance with disclosure laws.

Amending a previously filed Form 700 may also be necessary when financial circumstances change, or if an error is identified post-submission. An easy way to amend your filings is to include a clear statement of the changes and re-submit via the same method chosen for your initial filing. Navigating amendments gracefully can contribute to maintaining a transparent record.

Special considerations for consultants & new positions

Consultants working with public agencies also face disclosure requirements similar to full-time employees, though specific rules may vary. Understanding these nuances is key. For example, consultants must disclose economic interests related to their consulting duties, including financial interests in clients and projects related to their work.

Job changes within public agencies can impact disclosure requirements significantly. When transitioning into new positions, it is crucial to evaluate existing interests and declare any newly acquired economic interests promptly. Always err on the side of caution and ensure complete clarity in subsequent filings to avoid potential conflicts.

Common mistakes to avoid when filing Form 700

When filing California Form 700, common mistakes can undermine the integrity of your submissions. One frequent issue is incomplete disclosures, where filers might neglect certain sections or fail to report all income sources. This can lead to misunderstandings and misinterpretations that can impact compliance.

Another area of confuse is the misclassification of ‘income’ categories. A clear understanding of what constitutes 'income' is necessary for accurate reporting. For example, not recognizing certain benefits or earnings may result in unintentional omissions. To avoid these pitfalls, seek guidance to ensure completeness and accuracy in your disclosures.

Understanding late penalties and how to avoid them

Late filings of California Form 700 can lead to significant penalties, both financially and professionally. The Fair Political Practices Commission (FPPC) outlines several penalties for missed deadlines, including fines that can accumulate quickly. Understanding the gravity of these penalties is essential for all filers.

To ensure timely filings, it is advisable to adopt structured reminders for filing deadlines. Utilizing cloud-based platforms like pdfFiller can facilitate proactivity with deadline notifications and built-in checks for completeness. Establishing a routine for regular reviews of your financial disclosures can help avoid last-minute scrambles that often lead to errors or late submissions.

Utilizing pdfFiller for efficient form management

Leveraging a cloud-based platform like pdfFiller can significantly streamline the process of managing California Form 700. With capabilities for seamless editing, eSigning, and collaboration, users can efficiently navigate the complexities of filing with confidence while ensuring their documents are stored securely.

When using pdfFiller, accessing templates specific to California Form 700 is straightforward. The intuitive platform allows for easy navigation to find form-specific tools. By utilizing pdfFiller’s features, individuals can manage their disclosures effectively, ensuring everything is in order before submission.

FAQs on California Form 700

Addressing common queries regarding California Form 700 is crucial for new filers. Questions often arise about what specific interests need to be disclosed or how to handle ambiguities in financial reporting. There is a wealth of resources available through the FPPC and detailed guidance on using platforms like pdfFiller to ensure accuracy and thoroughness.

For any personalized assistance, pdfFiller provides robust support channels that cater to user inquiries and guide them through potential filing obstacles. Staying informed and utilizing helpful resources ensures smoother compliance with California’s stringent disclosure requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the form 700 statement of electronically in Chrome?

How can I edit form 700 statement of on a smartphone?

How do I edit form 700 statement of on an Android device?

What is california form 700?

Who is required to file california form 700?

How to fill out california form 700?

What is the purpose of california form 700?

What information must be reported on california form 700?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.