Get the free Madison Unit Trust Account Opening Form

Get, Create, Make and Sign madison unit trust account

Editing madison unit trust account online

Uncompromising security for your PDF editing and eSignature needs

How to fill out madison unit trust account

How to fill out madison unit trust account

Who needs madison unit trust account?

Madison Unit Trust Account Form: A Comprehensive Guide

Understanding the Madison Unit Trust Account

A Madison Unit Trust Account serves as a popular investment vehicle designed to pool funds from various investors, allowing them to collectively invest in trust assets. The primary purpose of such accounts is to provide individual and institutional investors with access to diversified portfolios managed by experienced professionals, significantly reducing investment risk.

Key features of the Madison Unit Trust Account include professional management, liquidity, and a range of investment options tailored to different financial goals. Investors can select from equity, fixed income, or balanced investment strategies, making it a flexible tool suitable for various market conditions.

The benefits of using a Madison Unit Trust Account extend beyond diversification. Investors enjoy ease of access to financial markets without the burden of managing individual investments. Furthermore, these accounts often come with detailed reports, which help investors track performance and make informed decisions.

Types of Madison Unit Trust Accounts

Madison Unit Trust Accounts are available in several varieties to cater to different investor needs. Below are the main types:

Getting started with the Madison Unit Trust Account form

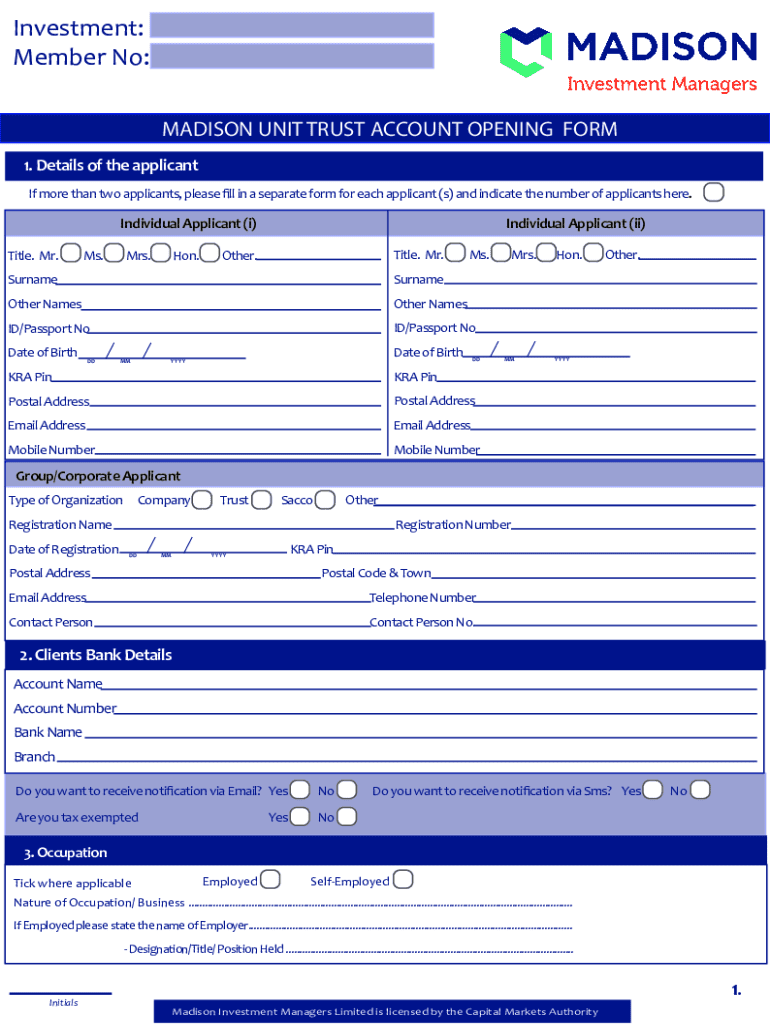

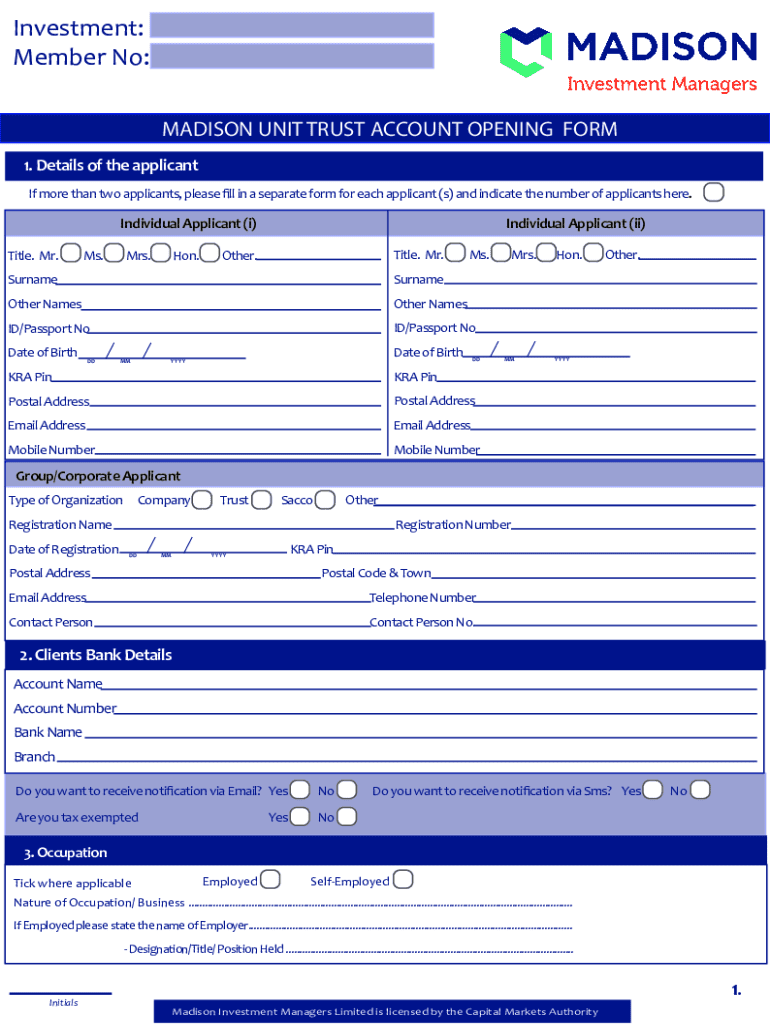

To open a Madison Unit Trust Account, you need to complete the designated form. The application process is straightforward, usually requiring personal information, account type selection, and investment options.

It's crucial to provide accurate information, as errors could delay account setup or affect investment performance. The Madison Unit Trust Account form is designed to guide applicants through the necessary details, ensuring a seamless application experience.

Using the Madison Unit Trust Account Form effectively means being aware of what information is required and how to present it. This results in a quicker approval process and helps avoid unnecessary back-and-forth communications.

Step-by-step guide to filling out the Madison Unit Trust Account form

Section 1: Personal information

In the first section, you'll need to provide essential personal details, including your name, address, date of birth, and contact information. Ensure that all entries are up-to-date and accurately reflect your identification.

Common mistakes to avoid include using nicknames in the name field, providing outdated addresses, or omitting contact numbers. Each piece of information is essential for verifying your identity and setting up your account.

Section 2: Account type selection

You'll then select the type of account you wish to open—individual, joint, or corporate. Each option has different implications, so consider your financial goals and circumstances carefully before making a selection.

Section 3: Investment options

The investment choices within the Madison Unit Trust Account range from conservative to aggressive strategies. Carefully assess your risk tolerance and financial goals when selecting your investment options. This section will allow you to choose from the available funds that align with your preferences.

Section 4: Authorized signatories (for joint and corporate accounts)

For joint and corporate accounts, you must list all authorized signatories. Necessary documentation may include identification for all parties involved and proof of status as an authorized signatory for corporate applications. Ensure all required verification documents are prepared to avoid delays.

Editing the Madison Unit Trust Account form

After filling out the Madison Unit Trust Account form, you may need to modify pre-filled information. Utilizing tools like pdfFiller can ease the editing process, allowing you to correct any inaccuracies quickly.

pdfFiller provides user-friendly tools for easy edits, ensuring your form is accurate and up-to-date before submission. You can save your changes and share the edited form with stakeholders as needed.

Signing the Madison Unit Trust Account form

Once the form is completed and edited, it requires signatures to finalize the application. pdfFiller offers an eSigning feature, making it easy to add digital signatures securely.

The benefits of digital signatures include increased efficiency and security. Additionally, with pdfFiller, the process is straightforward—simply follow the instructions to add your signature and those of joint signatories.

Submitting the Madison Unit Trust Account form

After signing, the Madison Unit Trust Account form can be submitted through various methods, including online, via mail, or fax. It's advisable to choose the method that provides you with the quickest confirmation.

You can also track your submission status through the Madison Unit Trust website or portal, keeping you updated on the approval process. Expect to receive communications about your account setup or any additional steps needed.

Managing your Madison Unit Trust Account

Once your Madison Unit Trust Account is established, managing it becomes essential. Accessing your account online through pdfFiller simplifies this process by providing you with tools to monitor investments, make changes, and review performance metrics.

Updating personal information like contact details can usually be done directly via the online portal. Additionally, keep track of account activity through performance reports and alerts to stay informed about any significant changes to your investments.

Troubleshooting common issues

As with any financial form, issues may arise during the submission process. If your application is denied or if you encounter submission errors, it's vital to carefully review the rejection reasons. Often, missing information can be the culprit.

For complex issues, reaching out to support promptly can help clarify any confusion and facilitate a quicker resolution. Be prepared to provide specific details regarding your submission when you contact support.

Frequently asked questions (FAQs)

Account holders often have questions about the features and fees associated with Madison Unit Trust Accounts. Clarifications typically relate to differences between unit trusts and other investment vehicles, including tax implications that can affect overall returns.

It's advisable to consult with a financial advisor if you require personalized guidance on managing your investments within the context of your overall financial plan.

Additional considerations

Before finalizing your Madison Unit Trust Account form, consider how changes in your financial status might impact your investment strategy. Life events such as marital changes, job loss, or economic downturns can necessitate adjustments.

Understanding your risk tolerance for investments in unit trusts is equally important. Be honest about your comfort level with fluctuations in market value, as this will guide you in selecting appropriate investments within the trust.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my madison unit trust account in Gmail?

Can I sign the madison unit trust account electronically in Chrome?

How do I fill out madison unit trust account on an Android device?

What is madison unit trust account?

Who is required to file madison unit trust account?

How to fill out madison unit trust account?

What is the purpose of madison unit trust account?

What information must be reported on madison unit trust account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.