Get the free Broker Agency Application Form

Get, Create, Make and Sign broker agency application form

Editing broker agency application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out broker agency application form

How to fill out broker agency application form

Who needs broker agency application form?

Comprehensive Guide to Completing the Broker Agency Application Form

Understanding the broker agency application form

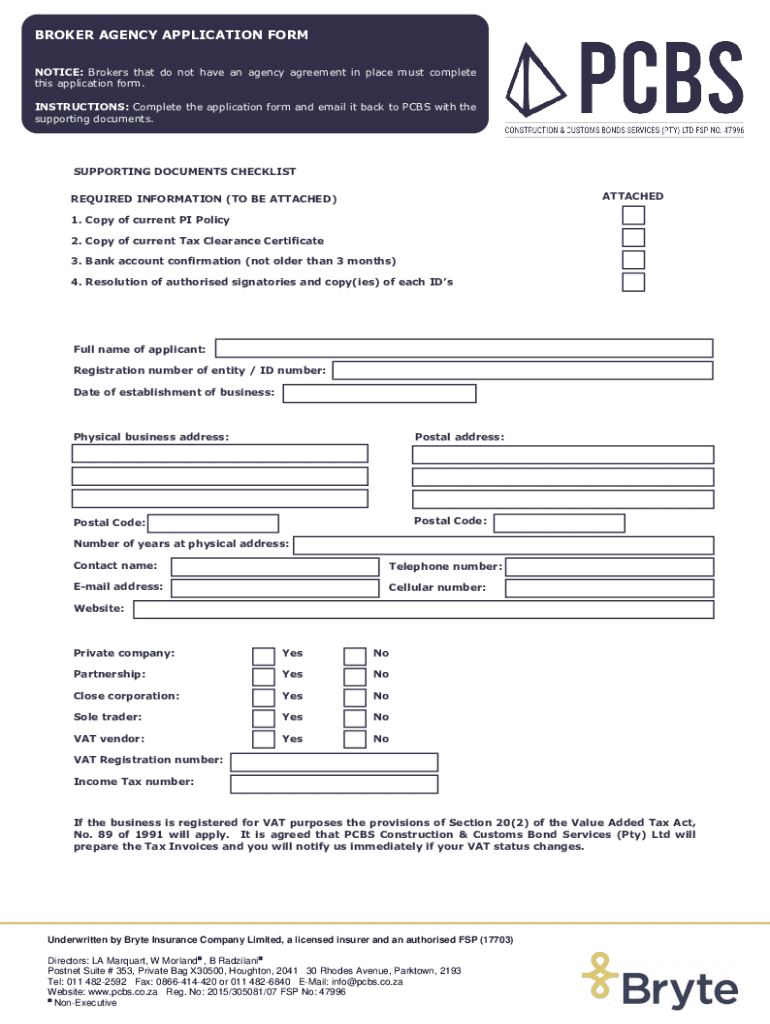

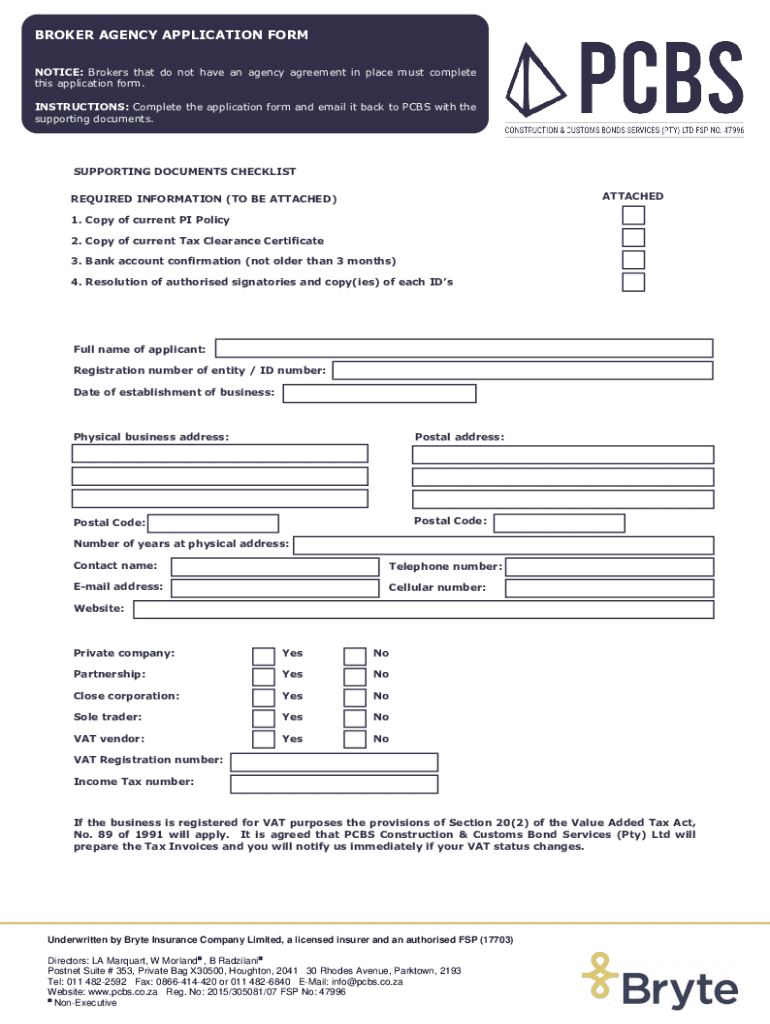

The broker agency application form is a crucial document that insurance brokers and agencies must complete to operate legally within specific jurisdictions. This application serves as a formal request to obtain the necessary licenses from regulatory agencies responsible for overseeing the insurance industry. By providing detailed information about the applicant’s identity, business structure, and compliance with industry regulations, this form lays the groundwork for approval and establishment as a licensed operation.

Understanding the importance of the broker agency application is paramount in navigating the complexities of the insurance industry. This application not only facilitates legal compliance but also instills confidence in clients regarding the legitimacy of the broker or agency. Key players involved in this process include individual applicants, business owners, regulatory agencies such as state departments of insurance, and affiliated agents who work under the agency’s banner.

Prerequisites for filling out the application

Before embarking on the completion of the broker agency application form, it’s essential to gather all required documents and information. Personal identification documents are crucial and may include a driver's license or passport. Business details are equally imperative, requiring applicants to outline organizational structure, trade names, and their operational framework. Additionally, presenting professional licenses verifies that applicants are qualified and compliant with industry standards.

Eligibility criteria vary significantly between individual and business applications. Individuals seeking to apply must meet particular standards set forth by state insurance departments, which may include age and educational requirements. Furthermore, states harbor differing specifics regarding insurance licensing that potential applicants must thoroughly research and understand.

Step-by-step guide to completing the broker agency application form

Successfully filling out the broker agency application form requires meticulous attention to detail. Following a structured approach will ensure that all required sections are addressed accurately. The form generally comprises several key sections, each requiring specific information.

Common mistakes can hinder the approval process, so it’s vital to double-check all entries for accuracy. Errors such as missing signatures, incorrect business names, or incorrect agent listings can lead to delays or denials. Therefore, a thorough review, preferably through a trusted partner or tool like pdfFiller, will safeguard the application against preventable issues.

Tools to aid in completing the broker agency application

Utilizing technology can streamline the application process significantly. The pdfFiller platform offers interactive features that enhance the user experience, such as online editing capabilities that allow users to update the document as necessary without aligning it with complicated software. The convenience of cloud storage ensures that vital documentation is always accessible, regardless of the location, which is essential for agents on the go.

Incorporating templates can further expedite the submission process. By using up-to-date forms, applicants can ensure compliance with the latest regulatory requirements while leveraging efficient workflows.

Submitting your broker agency application

Submission options for the broker agency application are diverse, allowing flexibility based on individual needs. Applicants can choose to submit their forms online through the pdfFiller platform, which simplifies the process with intuitive submission steps. Alternatively, options for mail and in-person submission are also available, ensuring that applicants can select the method they feel most comfortable with.

After submission, applicants should anticipate a processing timeline that can vary based on the regulatory agency's workload. It's important to stay informed, as communication from the department will typically provide insights into the status of the application and any additional actions required.

Following up on your application

An integral part of the application process is tracking the application status. Regular follow-ups can prevent surprises and help applicants understand when they might expect an approval or further revisions. If issues arise or delays occur, having a plan of action is critical.

In cases where the application is denied, applicants must carefully review feedback from the regulatory body, as this will guide necessary changes or appeals for future submissions.

Modifying your application after submission

If circumstances change after submission, applicants have the right to request modifications to their broker agency application. The process for requesting changes typically involves submitting a written request to the regulatory agency, clearly outlining the modifications needed.

Amendments may be necessary for various reasons, including changes in agency ownership, updated financial information, or the addition of new affiliated agents. Being proactive in submitting these changes can demonstrate commitment to compliance and regulation adherence.

Frequently asked questions (FAQs)

Navigating the broker agency application process generates numerous questions for applicants. One common inquiry is regarding the steps to take if an applicant moves state after submission. Typically, they would need to reapply in the new state and fulfill that jurisdiction’s requirements. Addressing prior license issues can also be a critical concern, as past infractions or lapses can affect new applications.

Further, understanding the role of continuing education can be pivotal; many states require completion of educational courses to maintain good standing and facilitate the application’s approval.

Best practices for managing applications with pdfFiller

pdfFiller excels in document management, particularly for the broker agency application form, providing tools for collaboration among team members. Users can effortlessly share drafts and feedback using the platform’s collaborative features, refining the application collectively before submission.

Moreover, pdfFiller’s eSignature functionality accelerates approvals, allowing users to ensure that all necessary parties sign off on documents without the delays associated with traditional methods. With secure document management practices in place, users can rest assured that their information is protected throughout the application process.

Additional considerations

Understanding local and state regulations regarding broker agency applications is essential for compliance. Each state has distinct requirements, and staying current with these changes is a necessity for operational efficacy. New agents and brokers should prioritize resources for continuous learning, including ongoing education opportunities that can enhance their understanding of broker agency management.

By leveraging these insights and resources, applicants can streamline their journey through the broker agency application process, ensuring that they submit complete, compliant applications that set the stage for successful operations in the competitive insurance landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send broker agency application form for eSignature?

How can I get broker agency application form?

How do I make edits in broker agency application form without leaving Chrome?

What is broker agency application form?

Who is required to file broker agency application form?

How to fill out broker agency application form?

What is the purpose of broker agency application form?

What information must be reported on broker agency application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.