Get the free promis life claim form

Get, Create, Make and Sign promis life claim form

How to edit promis life claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out promis life claim form

How to fill out claim form

Who needs claim form?

Claim form - Promislife form: A comprehensive how-to guide

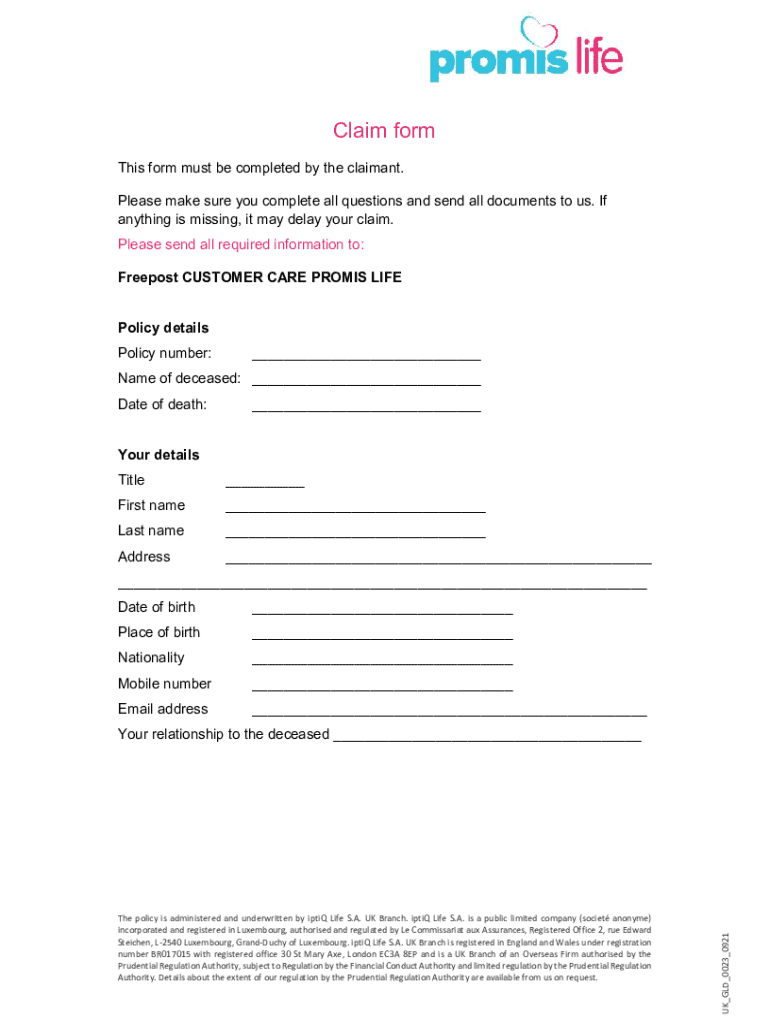

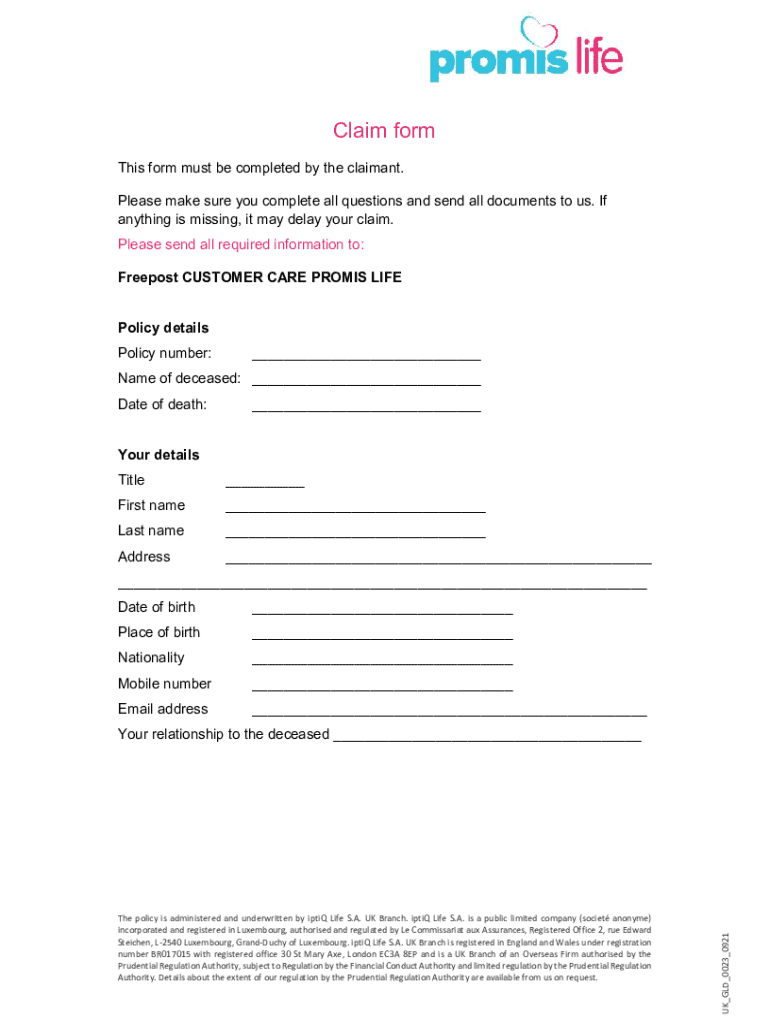

Understanding the Promislife claim form

The Promislife claim form serves as a vital component of the claims process for life insurance. Its main purpose is to provide the necessary documentation that confirms the validity of a claim, ensuring that beneficiaries can receive the financial support intended by the life insurance policy. This form is crucial for keeping the claims process organized and compliant with legal and insurance standards.

In the context of life insurance, this form is instrumental for both policyholders and beneficiaries. It encapsulates the information required for the insurance company to assess the claim accurately, allowing them to process it efficiently and in a timely manner.

Who needs to fill out the form?

Individuals who find themselves needing to fill out the Promislife claim form often do so on behalf of their loved ones during a difficult time. This situation typically arises when a family member passes away, leading the beneficiary to seek funds from a life insurance policy. On the other hand, teams managing claims for clients or employees in a corporate environment may also need to utilize this form to ensure a smooth claims process for those they represent.

Understanding who should fill out the form helps tailor the details needed and ensures that accurate information is submitted to Promislife. Whether you are an individual or a representative, being prepared can facilitate a more straightforward claims process.

Step-by-step instructions for filling out the Promislife claim form

To effectively complete the Promislife claim form, it's essential to gather all necessary information to avoid delays. Start by ensuring you have the personal details required for the form, such as your name, contact information, and the policy number of the deceased. You'll also need to provide vital documentation, including the death certificate, which serves as evidence for the claim.

Completing each section of the form

The Promislife claim form is typically divided into several sections that need detailed attention. Here’s a breakdown of each:

Editing and finalizing your claim form

Once you have filled out the form, it is crucial to ensure its accuracy before submission. Using pdfFiller’s editing tools makes this process straightforward. You can upload the form directly to pdfFiller, where you can edit text, adjust fields, and insert any additional information as required. This flexibility allows you to correct any errors or omissions quickly.

Before hitting the submit button, run through a checklist to double-check every entry you have made. Look for completeness, ensuring all necessary fields are filled and that the information is consistent across all documentation.

Signing the claim form electronically

In today's fast-paced world, the convenience of electronically signing documents is invaluable. By utilizing pdfFiller’s eSigning feature, you can finalize your Promislife claim form without the need for printing or scanning. This saves both time and ensures that the submission is made promptly.

To eSign your claim form, simply follow this process: upload your document to pdfFiller, click on the eSign option, and either draw your signature, upload an image of your signature, or use the type signature option. You can also add initials and date stamps as needed throughout the document.

Submitting your claim form

After signing, the next step is submitting your claim form. You have several submission options available through pdfFiller. You can upload the completed form directly via the pdfFiller platform, or you may prefer to download it and send it to the designated recipient at Promislife via email or postal service.

To keep track of your claim status, utilize the tracking features available on pdfFiller. You can monitor the progress of your claim and, if necessary, reach out to Promislife for follow-up inquiries. Being proactive ensures that you stay updated throughout the process.

Common issues and resolutions

While filling out the Promislife claim form, individuals often encounter common issues. For instance, claims might be denied due to incomplete forms or missing documentation. If you find yourself facing a denial, don’t hesitate to contact Promislife to understand the reasons and what can be rectified. Being informed can pave the way for a successful re-submission.

Tips for a smooth claims process

To prevent common pitfalls when filling out the Promislife claim form, ensure you have all documents readily available before you begin. Proper organization can lead to a smooth claims process. Additionally, if you have any uncertainties while filling out the form, consider consulting customer service for guidance.

This proactive approach allows you to address potential issues early on, ensuring your claim is processed without unnecessary delays.

Advantages of using pdfFiller for your claim forms

Utilizing pdfFiller offers several advantages when handling your Promislife claim form. Its cloud-based convenience means you can access your documents from any device, anytime, enhancing flexibility during a challenging period. You can quickly collaborate in real-time with team members if necessary, ensuring everyone is on the same page.

Additionally, pdfFiller provides comprehensive document management capabilities, allowing you to store and organize all related documents in one secure location. This level of organization will benefit you not only now but in any future claims you might need to file.

Next steps after submitting your claim

After submitting your Promislife claim form, it is important to understand what to expect next. Processing times can vary, but typically, you will be informed of the status within a few weeks. Keeping your documentation organized will be beneficial for any follow-up actions, as it keeps everything accessible should you need to reference your submission.

For future claims, maintaining an organized file of all related documents, including life insurance policies and previous claims, will expedite any future processes. This foresight can save time and reduce stress when needed again.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get promis life claim form?

How do I make edits in promis life claim form without leaving Chrome?

Can I create an electronic signature for the promis life claim form in Chrome?

What is claim form?

Who is required to file claim form?

How to fill out claim form?

What is the purpose of claim form?

What information must be reported on claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.