Get the free Mf Fbp

Get, Create, Make and Sign mf fbp

Editing mf fbp online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mf fbp

How to fill out mf fbp

Who needs mf fbp?

MF FBP Form: A How-to Guide

Understanding the MF FBP form

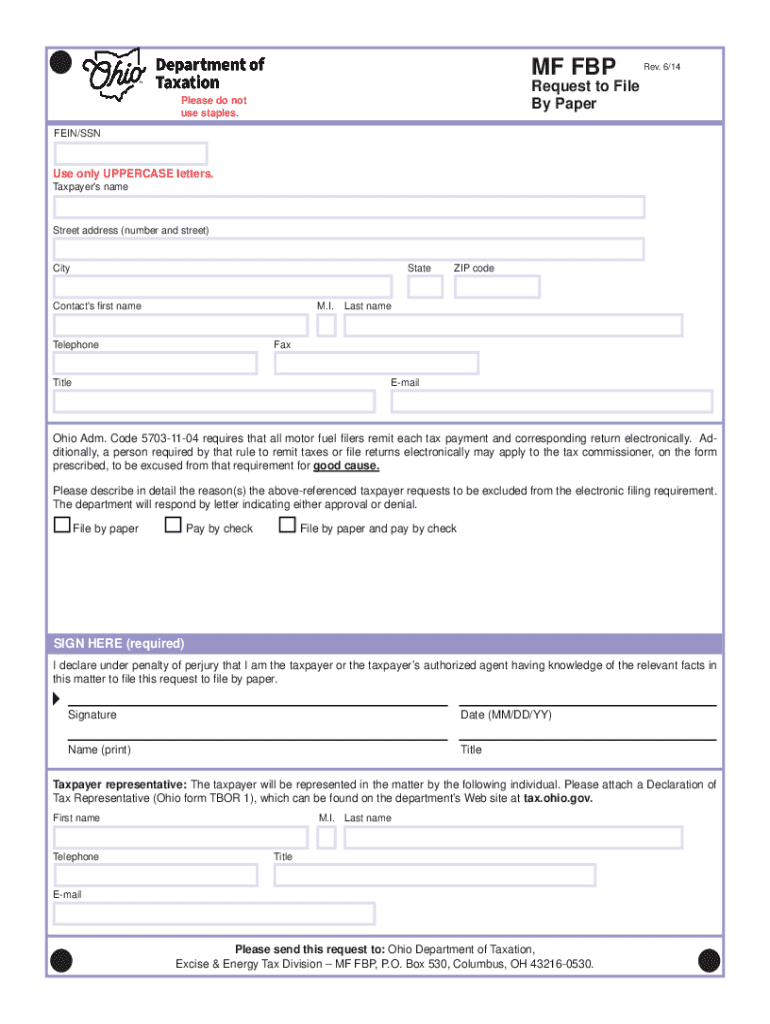

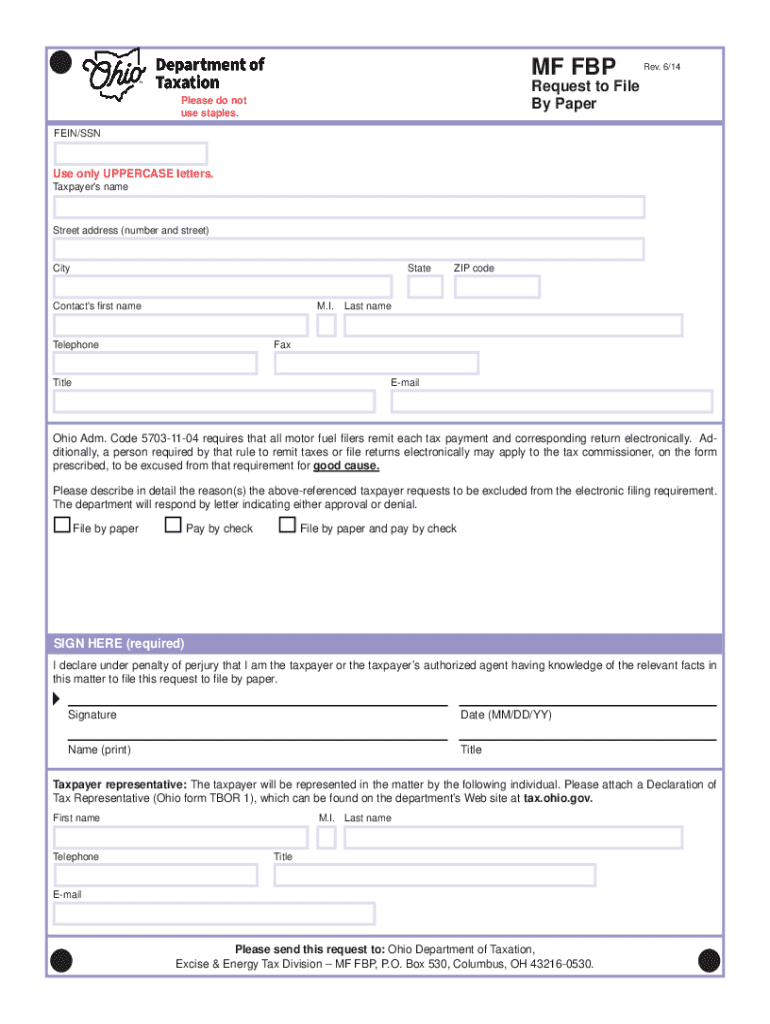

The MF FBP form is an essential document designed for the state's financial compliance framework. Specifically tailored for the Ohio Department of Taxation, this form is crucial for individuals and businesses alike to meet regulatory obligations regarding financial reporting. It ensures that the necessary financial information is accurately filed and reviewed, helping in preventing issues related to taxation deficiencies.

The MF FBP form serves various purposes, including aiding in the assessment of tax liabilities and compliance with local laws. Its importance cannot be overstated; innate within its design is the framework for accountability, ensuring that accurate information is provided for both personal and corporate financial obligations.

When is the MF FBP form required?

Understanding the specific situations that necessitate the MF FBP form is vital for compliance. For instance, it is mandatory when filing annual financial statements or if you are making significant changes to your financial status, such as starting a business or reporting substantial income changes. Failure to submit the MF FBP form in these scenarios can lead to potential penalties, interest on unpaid taxes, and even legal repercussions.

To avoid complications, it’s essential to be proactive about filing the MF FBP form whenever you encounter significant changes in your financial landscape or as required by deadlines set forth by the Ohio Department of Taxation.

Key features of the MF FBP form

The MF FBP form consists of several sections, each crafted to collect specific types of data. This includes personal information such as name, address, and identification numbers alongside crucial financial data, including income sources and tax deductions. Each section has a designated purpose, ensuring that all submitted information is structured clearly and effectively for the review process.

When filling out the MF FBP form, common mistakes can lead to unnecessary setbacks. These might include incorrect data entry, failing to sign the form, or omitting necessary documentation. To mitigate these risks, take the time to review instructions thoroughly and refer to the filing guidelines provided by the Ohio Department of Taxation to ensure compliance.

Step-by-step instructions for filling out the MF FBP form

Preparing to fill out the MF FBP form begins with collecting necessary documents and information. This includes personal income statements, business financial records, and any relevant tax documents. Additionally, leveraging tools like pdfFiller can simplify the process significantly—it offers features that facilitate form filling, editing, and document organization.

When you start filling out the form, begin with the first section: personal details. Ensure your name matches official documentation and double-check for accuracy. Next, move to the financial information section. Here, detail your income sources—it's best practice to cross-verify this data against your statements to avoid discrepancies. Continue through the form, following the same principles of accuracy and completeness as you engage additional sections.

After completing the MF FBP form, it's crucial to review it comprehensively. Essential checks include validating that all sections are filled, confirming the correctness of information, and ensuring that required documents are attached. Utilizing pdfFiller's editing tools can aid in structuring your document and making adjustments as needed before final submission.

Editing and signatures

Effective editing of the MF FBP form is paramount after initial completion. Tools available on pdfFiller can enhance the form’s readability; consider using options for adding comments, highlights, and formatting adjustments to clarify your entries. This ensures that your submission stands out positively during the review process.

Adding signatures, particularly eSignatures, is another critical component. Signatures confirm the authenticity of the information provided. With pdfFiller, signing the MF FBP form is streamlined; simply navigate to the designated signature line, and follow the platform’s step-by-step guide to add your signature electronically. This adds a layer of convenience while ensuring compliance with electronic signature regulations.

Submitting the MF FBP form

Submission of the MF FBP form can be pursued through various channels, including online submission, mailing the completed form, or delivering it in person to the relevant department. Understanding your options equips you to choose the most suitable submission method based on timing and convenience.

Typically, processing times can vary depending on the submission method chosen. Online submissions tend to be processed quicker than mailed forms. To keep tabs on your submission, ensure to retain any confirmation notices or tracking information generated during the submission process. In the event of delays or rejections, responding promptly by providing any additional information requested can help remedy the situation and keep your filing in compliance.

Related topics and forms

Aside from the MF FBP form, it may be beneficial to familiarize yourself with related forms such as the FIT FBP form which also pertains to financial reporting in Ohio. Understanding the relationships among these forms can simplify your overall filing obligations and enhance your compliance with local regulations.

For those seeking additional learning, numerous resources — including instructional articles, video tutorials, and compliance guidelines — can be found online. Utilizing these can ensure that you stay informed about filing best practices and changes in compliance requirements.

Frequently asked questions (FAQs)

Common inquiries regarding the MF FBP form often include what steps to take if amendments are needed after submission. If errors are identified, promptly amending the submitted form is crucial to maintain compliance. Depending on the nature of the discrepancy, you may need to fill out a specific amendment form or provide a letter explaining the changes.

Legal considerations regarding the MF FBP form also surface often. It’s essential to understand any implications associated with providing incorrect information. Engaging with resources for assistance, such as consultations with tax professionals or help sections on the Ohio Department of Taxation’s website can provide clarity tailored to individual situations.

Interactive tools and features on pdfFiller

pdfFiller offers a robust suite of tools for document management which helps streamline the entire form filling process. Users can create, edit, store, and collaborate on forms from anywhere, enhancing efficiency and ensuring that team members have access to the latest versions of important documents.

Collaboration tools within pdfFiller facilitate effective teamwork, especially relevant for organizations managing multiple filings. Features like shared access, version control, and commenting functionalities allow teams to work closely, ensuring all inputs are considered and the final submission is precisely what is needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mf fbp to be eSigned by others?

How do I edit mf fbp in Chrome?

Can I sign the mf fbp electronically in Chrome?

What is mf fbp?

Who is required to file mf fbp?

How to fill out mf fbp?

What is the purpose of mf fbp?

What information must be reported on mf fbp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.