Get the free Annual Notification Form

Get, Create, Make and Sign annual notification form

Editing annual notification form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual notification form

How to fill out annual notification form

Who needs annual notification form?

A comprehensive guide to the annual notification form

Understanding the annual notification form

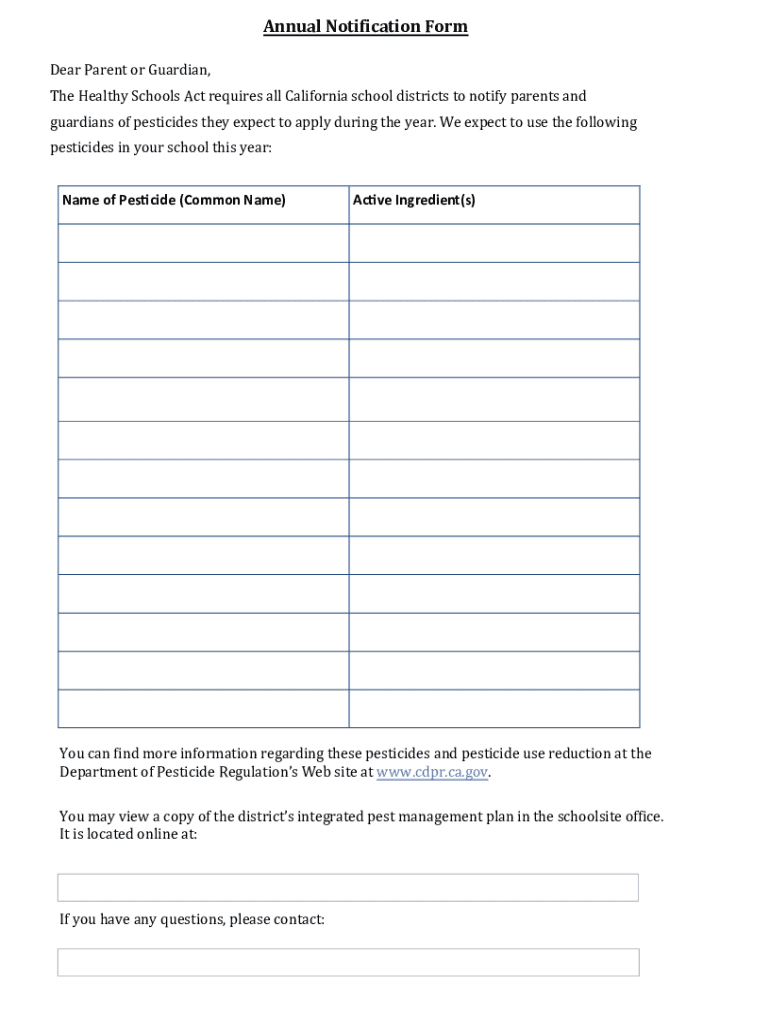

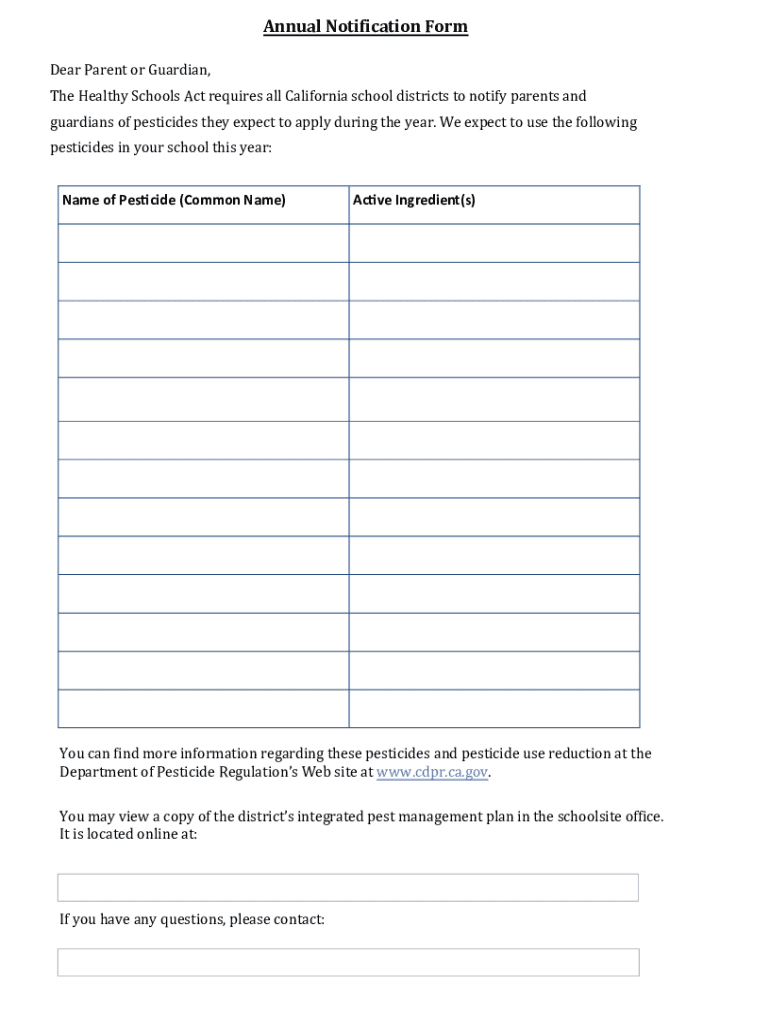

The annual notification form is a standardized document used across various sectors to provide essential information, disclosures, and regulatory updates to relevant parties. This form serves a critical role in ensuring compliance with local, state, or federal regulations, making it a vital tool for individuals and organizations alike.

Organizations must submit the annual notification form annually to communicate key information to stakeholders. This form highlights compliance with regulations, updates about policies, and individual disclosures that may affect other parties. The significance of this form cannot be overstated; it protects the organization, informs the stakeholders, and supports regulatory compliance.

Key components of the annual notification form

When dealing with the annual notification form, understanding its components is essential for successful completion. Typically, the form consists of required fields and optional sections. Let's explore these elements in detail.

Required information usually includes personal and contact details, relevant dates and deadlines, and specific disclosures or statements that need attention. These elements vary depending on regulatory requirements or the specific context within which the form is being used.

Optional sections allow users to include additional notes or comments that might be relevant. Moreover, there may be provisions for attaching supporting documentation. Utilizing these areas enhances the overall quality of the submission and ensures all pertinent information is communicated effectively.

Preparing to fill out the annual notification form

Before filling out the annual notification form, preparation is key to ensuring a smooth process. This involves gathering all required documents, such as identification papers and any financial records that may apply in your specific context. Having all necessary information at hand makes it easier to complete the form accurately.

It is equally important to be aware of common pitfalls when completing this form. Incomplete sections, providing incorrect information, or missing deadlines can lead to complications. Consequently, taking the time to double-check the completed form helps avoid potential issues and benefits overall compliance.

Step-by-step instructions for completing the annual notification form

Completing the annual notification form requires careful attention to detail. Begin by accessing the form through the proper channels, whether it is available in a digital format on your organization's website or printed out for manual completion. Make sure you’re using the correct version, as there can be variations based on the regulatory body or organization.

When filling out the form, start by filling each section methodically. Provide complete answers and ensure clarity in your responses. For example, when entering dates, use a consistent format to avoid confusion. It's a good practice to refer to any guidelines provided with the form that outline the expectations for each section.

Finally, after filling out the entire form, review it for accuracy. Make use of tools like pdfFiller to edit and make necessary adjustments. This can assist in ensuring compliance by providing options to check for errors or omissions before finalizing the submission.

Editing and customizing your form with pdfFiller

One of the significant advantages of using pdfFiller is the convenience it offers for editing and customizing your annual notification form. The platform provides an array of tools that allow users to modify text, adjust fields, and even add or remove sections as needed. This level of customization ensures that the form can be tailored to fit specific organizational requirements.

Moreover, pdfFiller enables collaboration among team members, streamlining the editing process. You can invite colleagues to provide feedback directly on the document, allowing for a comprehensive review before submission. Tracking changes and comments becomes effortless, fostering a collaborative environment that enhances the quality of your form.

Signing and submitting the annual notification form

Once the annual notification form is properly filled out and reviewed, the next step involves signing the document. pdfFiller provides various electronic signature options, enabling users to sign digitally, which is both convenient and legally valid in many jurisdictions. This feature simplifies the signing process, especially for remote teams or those needing to manage multiple documents efficiently.

After signing, the submission process follows. Depending on the requirements, you may submit the form electronically or via traditional mail. It's important to verify receipt of the submission to ensure it has been successfully processed. This can often be accomplished through a confirmation email or tracking number.

Common issues and troubleshooting

Completing and submitting the annual notification form can sometimes lead to technical issues or compliance concerns. Familiarizing yourself with common errors may save time and frustration. For instance, software errors might prevent the form from being processed correctly, but many of these can be resolved with simple troubleshooting steps.

If your form is rejected for any reason, addressing compliance concerns promptly is crucial. Understanding the reason for the rejection will guide you in correcting mistakes. Typically, contacting support will provide clarification and guidance on how to proceed and resubmit the form in compliance with regulations.

Managing your annual notification form after submission

After submitting the annual notification form, it is essential to manage its status effectively. Keeping track of submission status can provide peace of mind, ensuring that the form was received and is being processed appropriately. Many platforms, including pdfFiller, offer tracking features for submitted documents.

Storing the annual notification form securely is another crucial step. Utilizing tools like pdfFiller aids in document management, enabling users to organize, retrieve, and protect their submissions easily. Implementing best practices for digital storage ensures that vital documents remain accessible while mitigating the risk of loss or data breaches.

Conclusion: Streamlining your document workflow

Utilizing pdfFiller not only simplifies the management of your annual notification form but also streamlines your overall document workflow. By taking advantage of its editing, collaboration, and signing features, users can seamlessly handle their document needs in one platform. This integrated approach leads to heightened efficiency and enhances organizational communication.

As the importance of precise documentation continues to grow, embracing tools like pdfFiller will help you navigate your documentation responsibilities with ease and confidence. Whether you are an individual or part of a team, finding solutions that simplify the complexities of form management will undoubtedly benefit both your productivity and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute annual notification form online?

How do I make edits in annual notification form without leaving Chrome?

How do I fill out annual notification form using my mobile device?

What is annual notification form?

Who is required to file annual notification form?

How to fill out annual notification form?

What is the purpose of annual notification form?

What information must be reported on annual notification form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.