Get the free NIP Tax Credits

Get, Create, Make and Sign nip tax credits

How to edit nip tax credits online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nip tax credits

How to fill out nip tax credits

Who needs nip tax credits?

NIP Tax Credits Form: How-to Guide

Understanding NIP Tax Credits

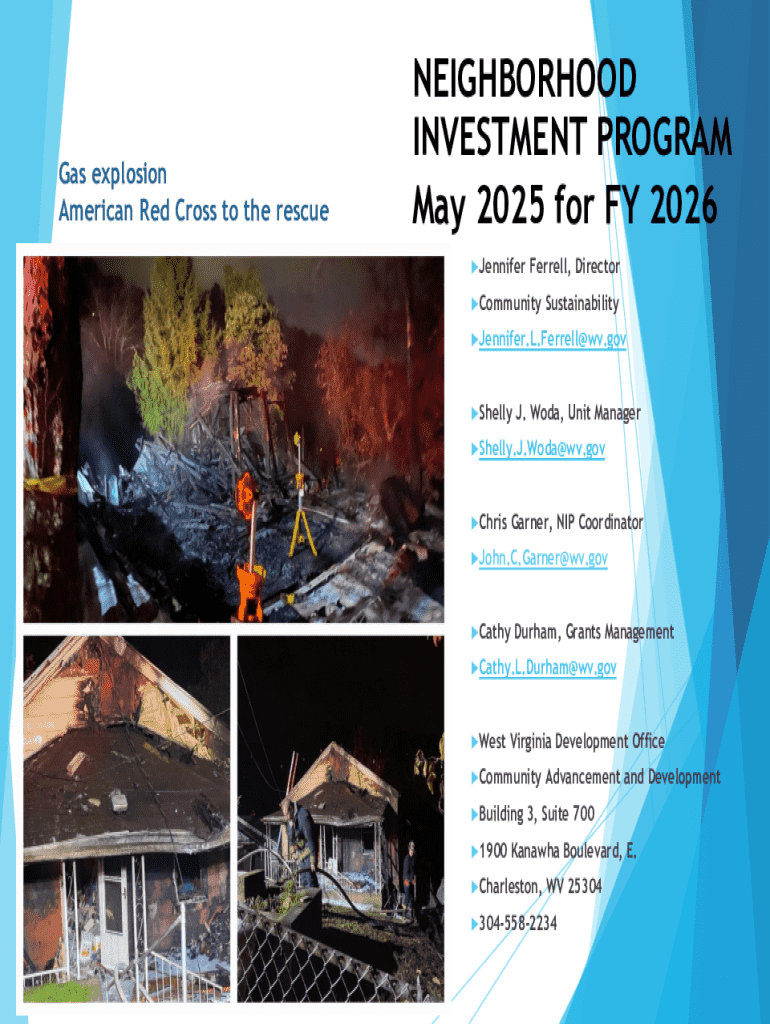

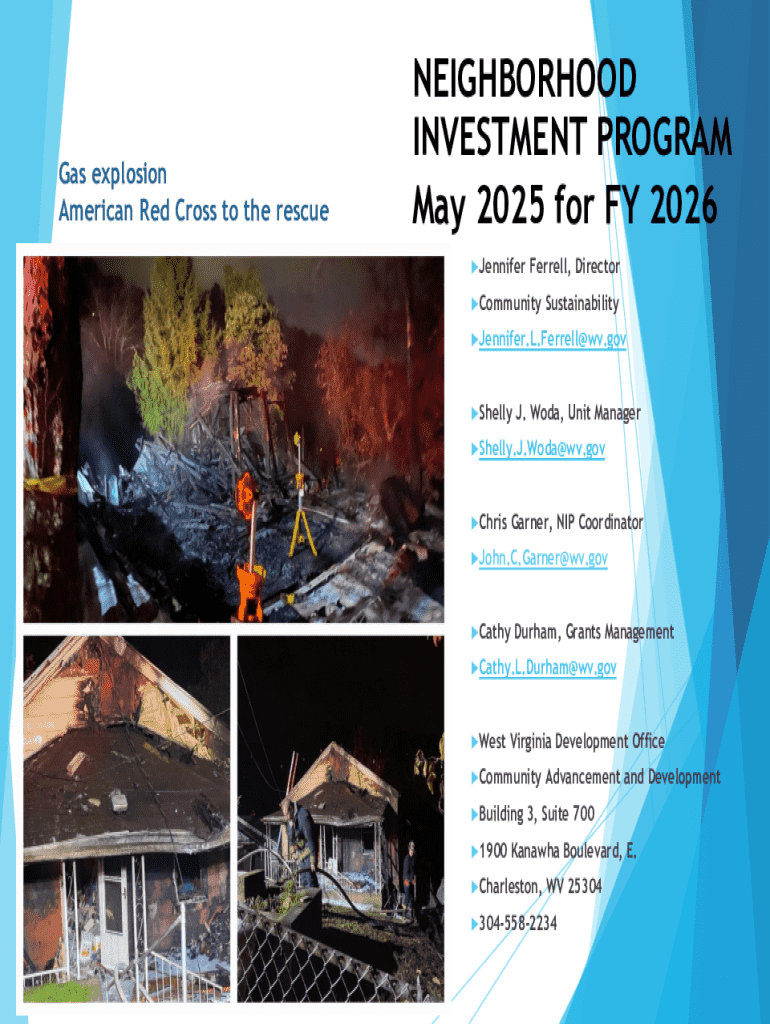

NIP Tax Credits, short for Neighborhood Investment Program Tax Credits, are financial incentives designed to promote investment in the revitalization of neighborhoods across the United States. These credits allow individuals and businesses to reduce their state tax obligations when they contribute to designated community development projects.

The importance of NIP Tax Credits cannot be overstated. For individuals, they provide a straightforward method to support local initiatives while simultaneously benefiting from tax reductions. For businesses, these credits can offset costs associated with community engagement and development, enhancing their corporate social responsibility profiles. This alignment benefits not only the local economy but also improves community relations and public perception.

The Neighborhood Investment Program (NIP) serves as the foundation for these credits, encouraging investments that drive positive change and restore vitality in economically distressed areas. By offering tax breaks, the program motivates contributions to projects that might otherwise struggle to secure funding and resources, fostering a healthier community overall.

Eligibility criteria for NIP tax credits

To qualify for NIP Tax Credits, both individuals and businesses must meet specific eligibility requirements. For individuals, anyone can claim NIP Tax Credits as long as they make a qualifying contribution to projects aligned with the NIP objectives. This includes donations to qualified non-profits or community enhancement programs targeting impoverished areas.

For businesses, the criteria include contributing financial resources or making in-kind donations to eligible community projects. However, to qualify, businesses must ensure that their contributions align with NIP standards, typically involving collaborative efforts with community-based organizations. Exclusions do exist, and contributions made to non-approved organizations or unrelated projects will not qualify for the tax credits.

Types of contributions eligible for NIP tax credits

Several types of contributions qualify for NIP Tax Credits, making it easier for both individuals and businesses to participate. First, monetary contributions are the most straightforward. Donations made to designated NIP projects can directly qualify for tax credits proportional to the amount given.

In-kind contributions, which refer to donations of goods or services rather than cash, are also eligible under certain conditions. For example, donating equipment, materials, or even service hours to community improvement projects can yield tax credits. Moreover, volunteer hours, while not always counted directly, can factor into the total value of contributions, provided they are quantified and reported correctly.

Step-by-step guide to filling out the NIP tax credits form

Filling out the NIP Tax Credits Form is a straightforward process when you approach it methodically. The first step is to gather required documents, which may include receipts for financial contributions, donation records, letters from organizations confirming contributions, and any relevant volunteer hour documentation.

Next, access the NIP Tax Credits Form online, usually found on state government websites or directly through affiliated NIP organizations. Once you have the form, complete it carefully, ensuring that you follow detailed instructions for each section. Common mistakes like incorrect tax identification numbers not only delay processing but can also lead to denied credits.

Navigating the tax credit reporting process

Once you have successfully completed and submitted the NIP Tax Credits Form, reporting these credits on your annual tax return is the next crucial step. Typically, you will need to document the credits on your state tax return rather than federal forms, as these credits primarily affect state tax obligations.

In addition to the NIP Tax Credits information, ensure any supplementary documents are attached, such as the original form submitted and proof of contributions. Familiarize yourself with the specific IRS forms and schedules applicable to your situation. This might vary based on your state, so checking with a tax professional can be invaluable to ensure that you've covered all necessary aspects.

Comparisons: NIP tax credits vs. tax deductions

Understanding the distinction between NIP Tax Credits and tax deductions is essential for maximizing tax efficiency. Tax credits directly reduce the amount of tax owed, while tax deductions lower taxable income. This difference can significantly impact your overall tax strategy; for instance, opting for a tax credit can lead to greater savings.

When deciding whether to pursue a tax credit over a deduction, consider your specific financial situation. If your tax liability is high, credits like those offered through the NIP may provide larger financial relief. Conversely, if your tax liability is low, deductions might suffice to lessen your taxable income.

Addressing common questions about NIP tax credits

Many individuals have questions regarding the implications of participating in the NIP Tax Program on their federal tax deductions. Generally, the effects on deductions depend on how the contribution was recorded and whether you’ve claimed them elsewhere. Efficient documentation is vital to navigate potential overlaps.

For more information or assistance, individuals can reach out to local NIP offices or consult tax professionals specializing in state credits. Additionally, specific resources are available for non-profits and larger organizations navigating the NIP process. Connecting with knowledgeable resources can alleviate confusion and ensure compliance with all requirements.

Tools and interactive resources for NIP tax credits

Utilizing tools and interactive resources can significantly streamline the process of managing NIP Tax Credits. For instance, document management and editing tools available on pdfFiller enhance your ability to manage PDFs associated with NIP contributions. These tools allow users to efficiently create, edit, eSign, and collaborate on documents, ensuring that all contributions are properly documented.

Moreover, interactive calculators exist to help estimate potential tax credits derived from contributions, providing insight into how much can be saved. Features like collaboration tools also enable teams to work together more efficiently, simplifying the form-filling process and ensuring that everyone involved is on the same page throughout.

Best practices for managing your NIP tax credits

Proper management of NIP Tax Credits begins with diligent record-keeping. Maintaining an organized log of all contributions, whether monetary, in-kind, or through volunteer hours, is crucial. Documentation not only substantiates tax claims but also provides transparency for audits or inquiries.

Setting annual reminders can also aid in staying on top of reviews and updates for tax credits. This proactive approach ensures that eligible contributions are tracked and celebrated properly and can improve future reporting accuracy. Leveraging pdfFiller for continuous document management facilitates easy access and modification of records, which is particularly advantageous during tax season.

Quick links to key resources

To maximize your experience with NIP Tax Credits, having access to the right resources is essential. Direct links to the NIP Tax Credits Form can usually be found on your local state tax authority’s website, making it readily accessible.

Additionally, informative guides and webinars that cover the specifics of NIP Tax Credits can be found through various platforms, including nonprofit organizations and tax advisory services. Should you have further inquiries or require support, having contact information for local NIP offices and assistance through services like pdfFiller can enhance your experience with the NIP Tax Credits Form.

Connect with us

For any questions related to the NIP Tax Credits Form or general tax credit inquiries, you can reach pdfFiller's dedicated support team. Our platform is designed to provide users with seamless access to editing and managing tax-related documents efficiently. Connect with us today and let us assist you in maximizing your tax benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my nip tax credits in Gmail?

How can I get nip tax credits?

How do I fill out nip tax credits using my mobile device?

What is nip tax credits?

Who is required to file nip tax credits?

How to fill out nip tax credits?

What is the purpose of nip tax credits?

What information must be reported on nip tax credits?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.