Get the free Maryland Form 502s

Get, Create, Make and Sign maryland form 502s

How to edit maryland form 502s online

Uncompromising security for your PDF editing and eSignature needs

How to fill out maryland form 502s

How to fill out maryland form 502s

Who needs maryland form 502s?

Complete Guide to Maryland Form 502S: Your Essential How-to Resource

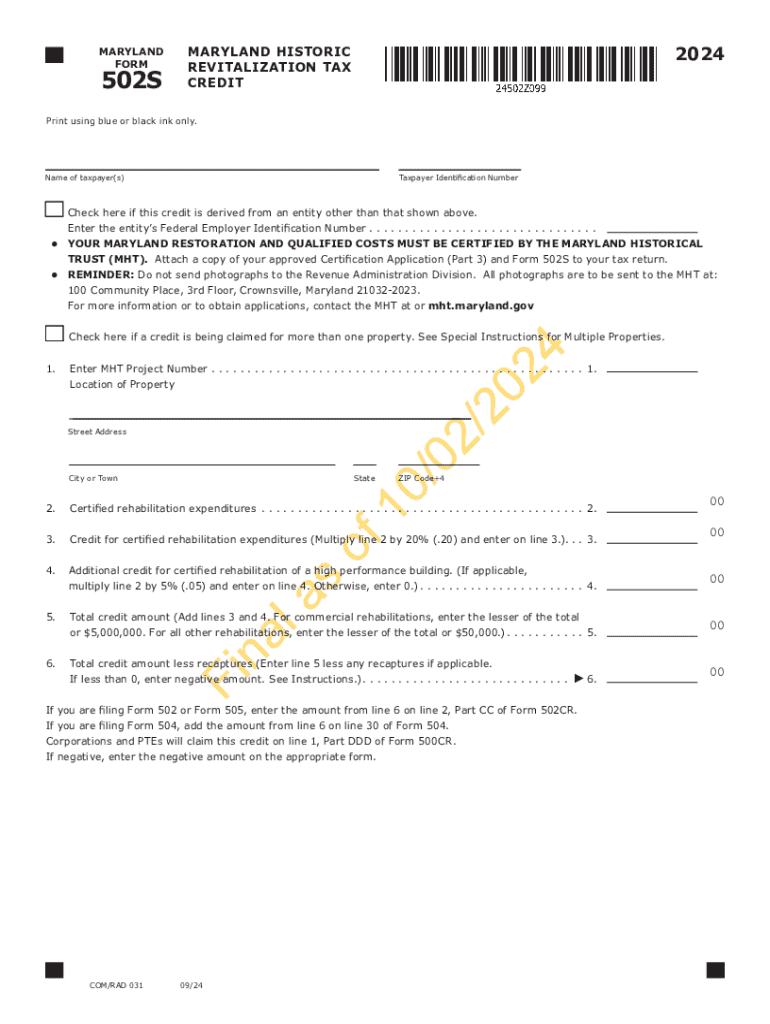

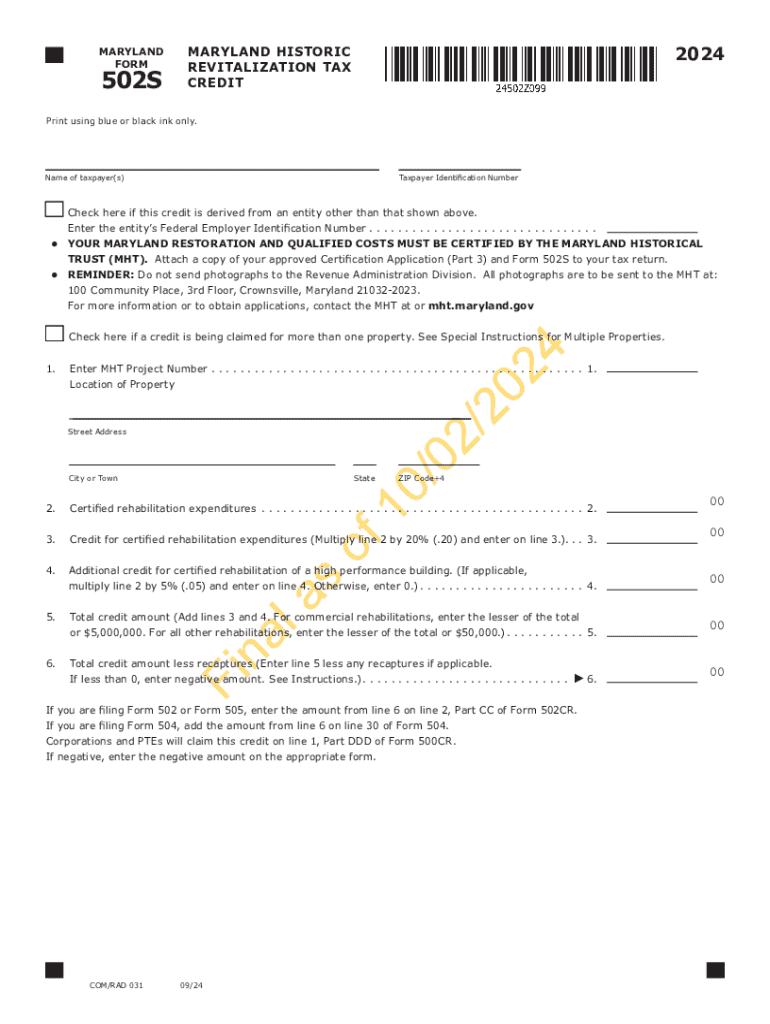

Overview of Maryland Form 502S

Maryland Form 502S is a crucial tax document used by individuals residing in Maryland to report income. Specifically, it caters to those who have income from sources within the state, allowing taxpayers to determine their tax liability or potential refund. It’s significant as it ensures residents meet local tax obligations, contributing to state funding and public services.

Form 502S contains several key sections that require attention and understanding. Notably, these sections cover various aspects of income, deductions, and tax credits that are pertinent to Maryland taxpayers. Important deadlines for submission typically align with the federal tax deadlines, reinforcing the need for timely filing to avoid penalties.

Preparing to fill out Maryland Form 502S

To effectively complete the Maryland Form 502S, it is essential to gather appropriate documentation. Key documents include W-2 forms from your employer, 1099s for freelance or contract work, and any other income statements. Additionally, understanding the deductions and credits specific to Maryland, such as the earned income tax credit and various subtraction modifications, will aid in accurately calculating your tax obligations.

Filing requirements also differ based on income thresholds and eligibility criteria. Individuals should review their income levels to ascertain whether they need to file Form 502S. For instance, those who have taxable income exceeding Maryland's minimum filing requirements for the year must complete this form promptly to meet state obligations.

Step-by-step guide to completing Maryland Form 502S

Completing the Maryland Form 502S entails a thorough walkthrough of various sections. Begin with the header information, ensuring your personal details such as name, address, and Social Security number are accurate. This information establishes your identity with the tax authorities and is essential for processing your return.

In the income section, clearly report different sources of income to avoid misreporting. Important notes include not just primary wages, but also income from secondary jobs, investments, and rental properties. Finally, when claiming deductions, be aware of common options available to Maryland taxpayers such as charitable contributions and state-specific credits that can significantly lower your taxable income.

Common mistakes to avoid when filing Maryland Form 502S

Filing errors can lead to significant complications, including delays in refunds or potential audits. A few frequent mistakes include misreporting income due to overly simplified calculations or neglecting to claim valid deductions and credits. Understanding these pitfalls can save taxpayers a considerable amount of stress and money.

To enhance accuracy, consider utilizing tools like pdfFiller, which provide error-checking features and templates specifically for Maryland Form 502S. Furthermore, previewing the form after completion but before submission can highlight possible discrepancies and ensure the readiness of your application.

How to submit Maryland Form 502S

When it comes to submitting Maryland Form 502S, you have a few options. E-filing is one of the most efficient methods, allowing for quicker processing and immediate confirmation of submission. Alternatively, you can choose to mail your forms, but be aware that this could introduce delays.

For electronic filing, services like pdfFiller not only streamline the submission process but also ensure compliance with Maryland state regulations. By following the specific e-filing instructions, taxpayers can avoid digital headaches and focus on ensuring their documents are error-free and complete.

Managing your Maryland Form 502S with pdfFiller

pdfFiller truly transforms how you manage your Maryland Form 502S. The platform allows users to edit, save, and share their forms in a cloud-based environment, thereby enhancing accessibility and functionality. With a wealth of collaboration tools, individuals and teams can work seamlessly together, making tax season less overwhelming.

Post-filing, staying organized is critical. pdfFiller aids users in tracking submissions and responses, which is essential for maintaining clarity about your tax obligations and any potential future amendments or inquiries from tax authorities.

Frequently asked questions about Maryland Form 502S

It’s common to have questions regarding Maryland Form 502S, especially about amendments and deadlines. If you need to amend your Form 502S, it’s vital to follow the proper procedure for corrections. Additionally, staying on top of filing deadlines is essential; missing these can lead to penalties and accrued interest on any owed taxes.

For further assistance, resources are available through Maryland State tax support, where you can find detailed guides and FAQs to help mitigate any confusion or uncertainty surrounding your tax filings.

Tips for future tax filings

Preparation is key for future Maryland tax filings. Keeping tax documents organized year-round can significantly simplify the completion of Maryland Form 502S each tax season. Consider utilizing a dedicated folder for relevant documents, which can include receipts, income statements, and past tax returns.

By making use of pdfFiller for all your tax-related documentation, you can streamline the entire process, not just for the Maryland Form 502S but for all forms required by Maryland State. This comprehensive approach leads to better organization and reduced stress when tax season arrives.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send maryland form 502s to be eSigned by others?

How do I execute maryland form 502s online?

How can I edit maryland form 502s on a smartphone?

What is maryland form 502s?

Who is required to file maryland form 502s?

How to fill out maryland form 502s?

What is the purpose of maryland form 502s?

What information must be reported on maryland form 502s?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.