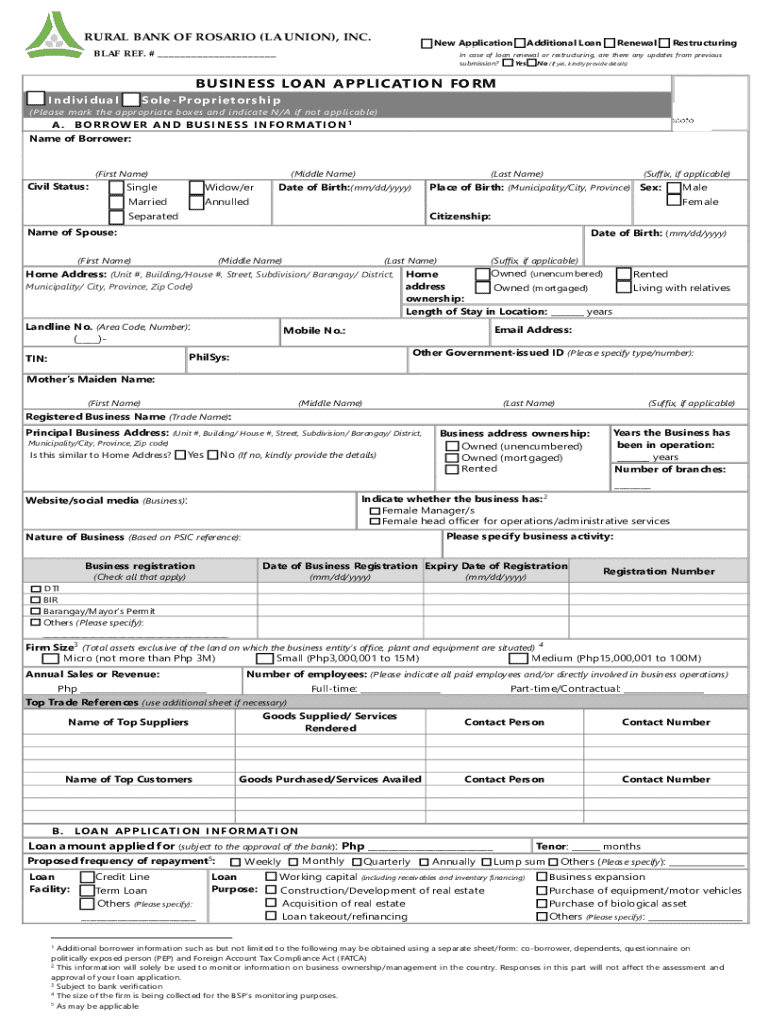

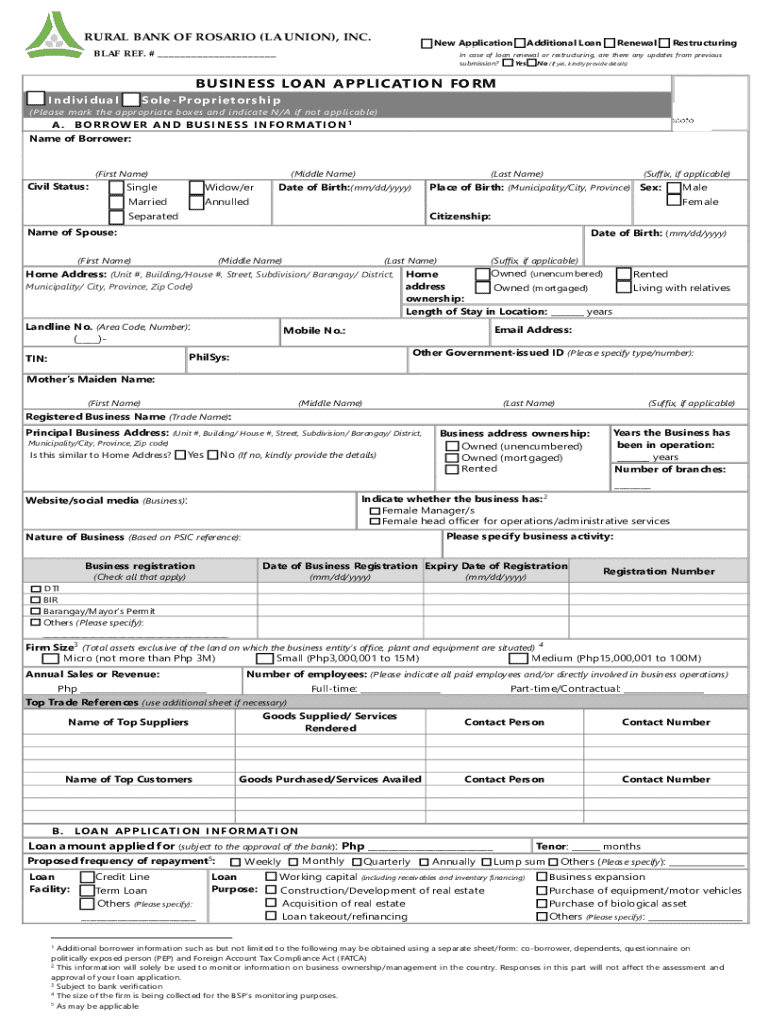

Get the free Business Loan Application Form

Get, Create, Make and Sign business loan application form

How to edit business loan application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business loan application form

How to fill out business loan application form

Who needs business loan application form?

Comprehensive Guide to the Business Loan Application Form

Understanding business loans

A business loan is a sum of money borrowed by entrepreneurs to fund their business operations. This financial support is essential for growth, expansion, or even day-to-day activities. Understanding various types of business loans can help you determine which option is best suited for your needs.

Navigating the business loan application process is crucial as it sets the foundation for obtaining the necessary financial support. A well-prepared application can significantly enhance your chances of loan approval.

Essential information to prepare before filling out the form

Before you complete the business loan application form, gathering the necessary documentation and personal information is essential. This preparation will make the process smoother and bolster your case for loan approval.

In addition, you'll need to provide personal information, including your credit history and details about business ownership. Understanding how much you want to borrow and the terms of repayment is equally important to articulate your request clearly.

Step-by-step guide to completing the business loan application form

Filling out a business loan application form can seem daunting, but following a systematic, step-by-step approach can alleviate some stress.

Interactive tools available on pdfFiller to enhance your application

pdfFiller provides an array of interactive tools that can significantly enhance your business loan application process. These features not only streamline document creation but also ensure that your submissions are professional and comprehensive.

Frequently asked questions about business loan applications

As you navigate the business loan application process, questions may arise. Let's address some common concerns that might help ease your journey.

Managing your business loan post-application

After submitting your business loan application, understanding what comes next is vital for successful management. The anticipation can be intense, but knowing the process can reduce anxiety.

Get started with your business loan application today using pdfFiller’s user-friendly tools to simplify the process and ensure your documents are complete and professional.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify business loan application form without leaving Google Drive?

How do I complete business loan application form online?

How do I make changes in business loan application form?

What is business loan application form?

Who is required to file business loan application form?

How to fill out business loan application form?

What is the purpose of business loan application form?

What information must be reported on business loan application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.