CA WG-022 2025 free printable template

Get, Create, Make and Sign wg-022 - courts ca

Editing wg-022 - courts ca online

Uncompromising security for your PDF editing and eSignature needs

CA WG-022 Form Versions

How to fill out wg-022 - courts ca

How to fill out wg-022 earnings withholding order

Who needs wg-022 earnings withholding order?

Comprehensive Guide to the WG-022 Earnings Withholding Order Form

Understanding the WG-022 earnings withholding order

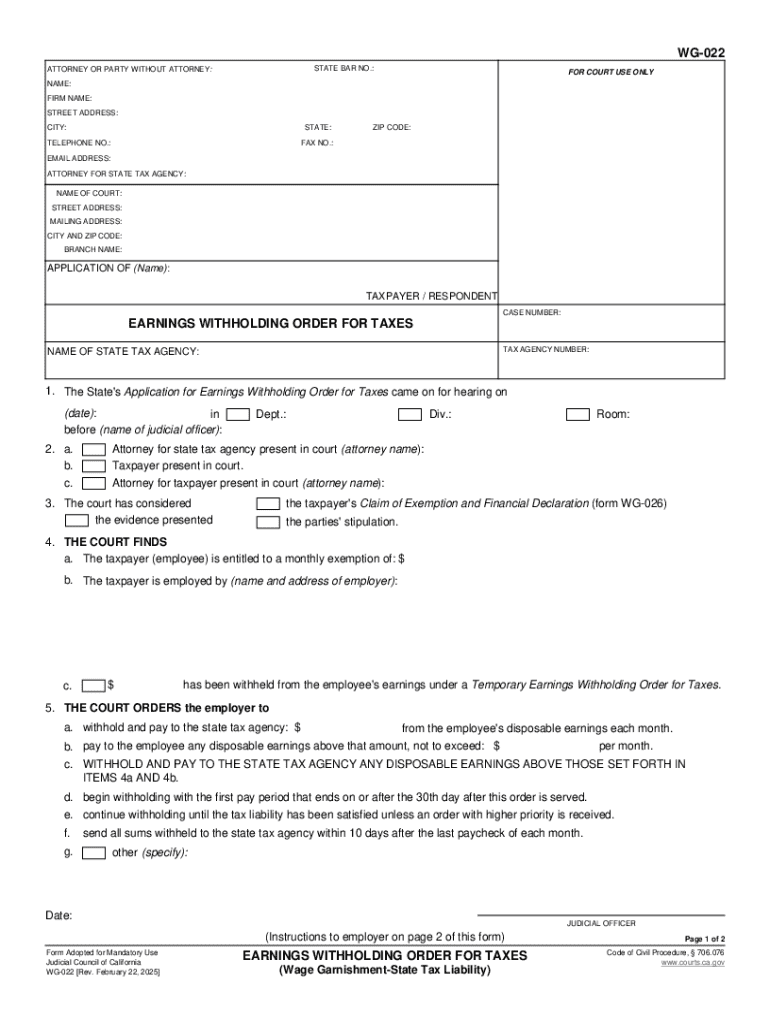

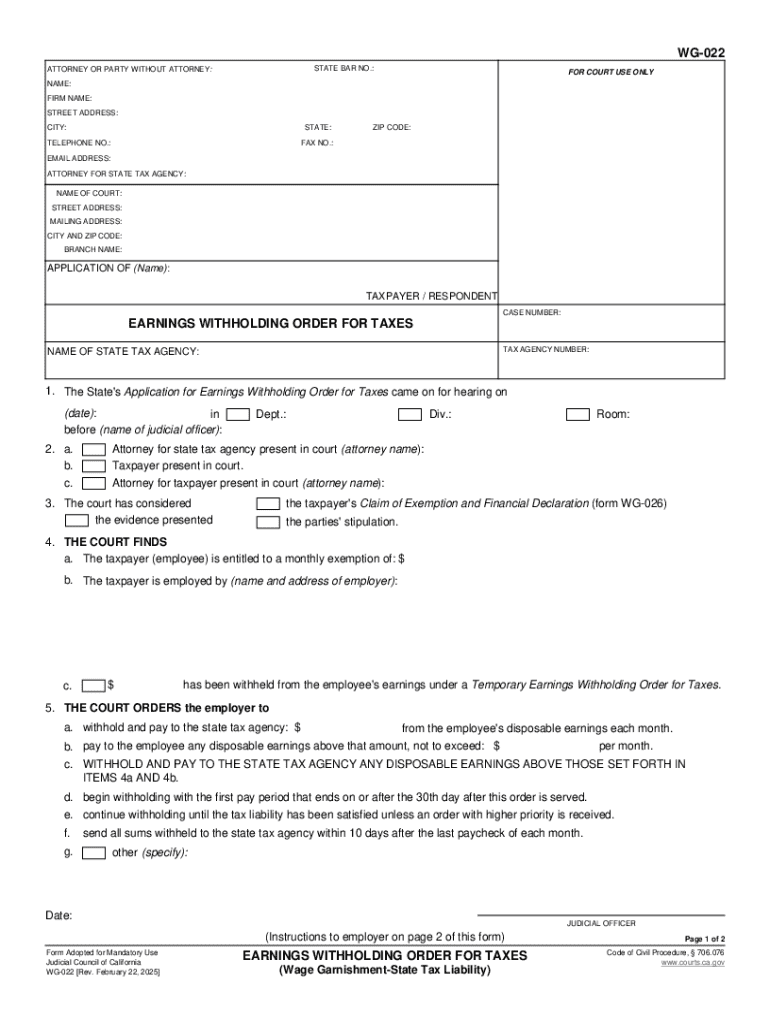

The WG-022 form is a legal document specifically designed for earnings withholding orders. It serves a pivotal role in wage garnishment procedures, enabling creditors to collect debts directly from an employee’s wages. Often utilized in both family law and commercial debt cases, the proper execution of the WG-022 ensures compliance with various state and federal regulations governing garnishments.

The importance of the WG-022 cannot be overstated; it protects the rights of both creditors and employees. The form delineates how much money may be withheld from an employee’s paycheck, ensuring that workers retain a portion of their income for personal use, which is critical in maintaining financial stability. Additionally, the legal framework surrounding wage garnishment stipulates strict adherence to guidelines set forth by local courts, making the WG-022 an essential document for businesses and legal entities.

Key features of the WG-022 earnings withholding order form

The WG-022 form comprises several vital components that facilitate accurate garnishment calculations and transpose necessary information. Understanding these features is crucial for both employees and employers. The Employee Information Section captures essential details such as the employee's name, social security number, and the total amount owed, while the Employer Information Section records the employer's details and responsibilities regarding the garnishment.

Another significant component is the Payment Instruction field. It outlines how employers should remit the withheld wages to the appropriate creditor or agency, ensuring clarity and compliance throughout the garnishment process. Understanding essential terms is key, including:

Who needs the WG-022 form?

The WG-022 form is predominantly required in cases where an individual is subject to wage garnishment due to unpaid debts. This may include child support, alimony, taxes owed, or unsecured debts. Courts issue the WG-022 to ensure that employers comply with the wage withholding order as stipulated. Hence, employers hold a significant responsibility once the form is issued.

Employers must accurately fill out the WG-022 form, ensuring that the information is up-to-date and correctly reflects the amounts to be withheld. Situations that commonly require the use of the WG-022 include:

Detailed steps to fill out the WG-022 form

Successfully filling out the WG-022 form requires careful attention to detail. Here’s a step-by-step process to ensure proper completion:

For accuracy and compliance, here are a few tips to ensure the WG-022 is filled out correctly:

Common mistakes to avoid include failing to include an employee's correct details or neglecting to sign the form, both of which can delay garnishment processing.

How to edit and sign the WG-022 earnings withholding order form

Editing and signing a WG-022 form involves using reliable tools to ensure compliance and security. pdfFiller simplifies the document editing process, enabling users to efficiently modify the form as needed. With pdfFiller's intuitive interface, users can easily input or change information within the PDF format without compromising the document's integrity.

One of the standout features of pdfFiller is the ability to digitally sign documents. Digital signatures are legally recognized and can expedite the processing of the WK-022. This feature not only saves time but also enhances document security by keeping sensitive information safe while ensuring compliance with state laws.

Managing the WG-022 form: Best practices

Proper management of the WG-022 form is essential for maintaining accurate payroll records and adhering to legal requirements. After filling out the form, it's critical to store it securely. Electronic filing through platforms like pdfFiller allows easy access and reduces the risk of lost documents. Cloud-based storage can offer additional peace of mind, given its reliability and security.

In addition, keeping track of any changes or updates to the form is vital. As legal requirements change, businesses must remain compliant. Utilizing collaboration tools available on pdfFiller can facilitate easy sharing and reviewing of documents among team members, ensuring that everyone involved in handling the form is aware of any updates or modifications.

Related forms and templates

In handling wage garnishments, several forms relate to the WG-022. These may include state-specific earnings withholding orders and forms for disputing garnishments. Understanding the differences between these forms is essential, as each may pertain to varying legal circumstances and requirements. For instance, while the WG-022 is specifically for earnings withholding, other forms may address asset seizures or property liens.

Furthermore, accessing related forms is simplified through pdfFiller, where users can find templates for various states that adhere to local regulations. This ensures users have the correct version of forms suited to their geographical and legal contexts.

Frequently asked questions (FAQs)

After submitting the WG-022 form, a common question arises: what happens next? Generally, the employer is required to begin withholding the specified amounts from the employee’s paycheck and submit them to the designated creditor. It's also important to note that garnishments remain in effect until the debt is paid or modified by court order.

Another frequent inquiry pertains to modifying the earnings withholding order. Yes, the WG-022 can be altered. If circumstances change, including the amount owed or the employee's financial status, a new form may be necessary. Legal implications may arise from incorrectly completing the form, leading to potential penalties or prolonged legal proceedings, underscoring the importance of accuracy.

Additional support and resources

For those navigating the complexities of wage garnishments and the WG-022, seeking legal advice can be invaluable. Many attorneys specialize in debt collection and wage garnishment and can provide critical guidance. Helpful links to governmental resources or court systems often clarify wage garnishment laws, further aiding understanding and compliance. Additionally, pdfFiller offers tutorials on using their platform, enabling users to enhance their document management skills.

Form preview and interactive tools

A sample WG-022 form is available for users to preview, illustrating how to appropriately fill it out. Moreover, an interactive guide on pdfFiller allows users to fill out their WG-022 form online, benefiting from features like auto-filling and form validation, ensuring correct information is captured. These interactive tools exemplify how pdfFiller enhances document management by removing the guesswork from form completion.

Using pdfFiller for form management provides definitive advantages, from document security to ease of access. Users can store, edit, and sign documents seamlessly, all in one platform.

Conclusion and final thoughts

Accurate submission of the WG-022 earnings withholding order form is not merely procedural; it’s a legal obligation that can significantly impact an employee’s financial situation. Businesses must understand the process deeply to protect both their interests and those of their employees. Using platforms like pdfFiller can streamline this process, making it easier to manage, edit, and sign the WG-022 form efficiently.

Ultimately, equipping oneself with the right tools and knowledge in handling wage garnishments not only helps in compliance with legal standards but also aids in fostering better employer-employee relations through transparency and diligence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in wg-022 - courts ca?

Can I create an electronic signature for signing my wg-022 - courts ca in Gmail?

Can I edit wg-022 - courts ca on an Android device?

What is wg-022 earnings withholding order?

Who is required to file wg-022 earnings withholding order?

How to fill out wg-022 earnings withholding order?

What is the purpose of wg-022 earnings withholding order?

What information must be reported on wg-022 earnings withholding order?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.