Get the free Business Bank Account Switch Kit

Get, Create, Make and Sign business bank account switch

Editing business bank account switch online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business bank account switch

How to fill out business bank account switch

Who needs business bank account switch?

Comprehensive Guide on Business Bank Account Switch Form

Understanding the business bank account switch form

A Business Bank Account Switch Form is a vital tool for business owners looking to change their banking institution. This form simplifies the process of transferring account details, ensuring a seamless transition from one bank to another. Often, businesses require a shift due to better rates, improved services, or simply to find a bank that meets their evolving needs.

Switching accounts can stem from various motivations, including excessive fees, unsatisfactory customer service, or the need for specific financial tools that a current bank does not provide. A dedicated switch form assists in consolidating the necessary information required for this transition.

Preparing for the switch

Before utilizing the business bank account switch form, it is essential to assess your current bank account thoroughly. This involves analyzing the fees associated with your existing account and scrutinizing the services offered. Understanding what you require from a new bank can help delineate which options align with your business's goals.

In selecting the right bank, consider factors such as geographical proximity, online banking capabilities, and any fees that could impact your bottom line. An exhaustive comparison of different banks' services and offers can reveal the best fit for your business.

Once you’ve identified a suitable bank, gathering the necessary documentation is critical. Prepare a list of the documents required to open your new account and ensure all the pertinent business information is readily available.

Step-by-step guide to complete the business bank account switch form

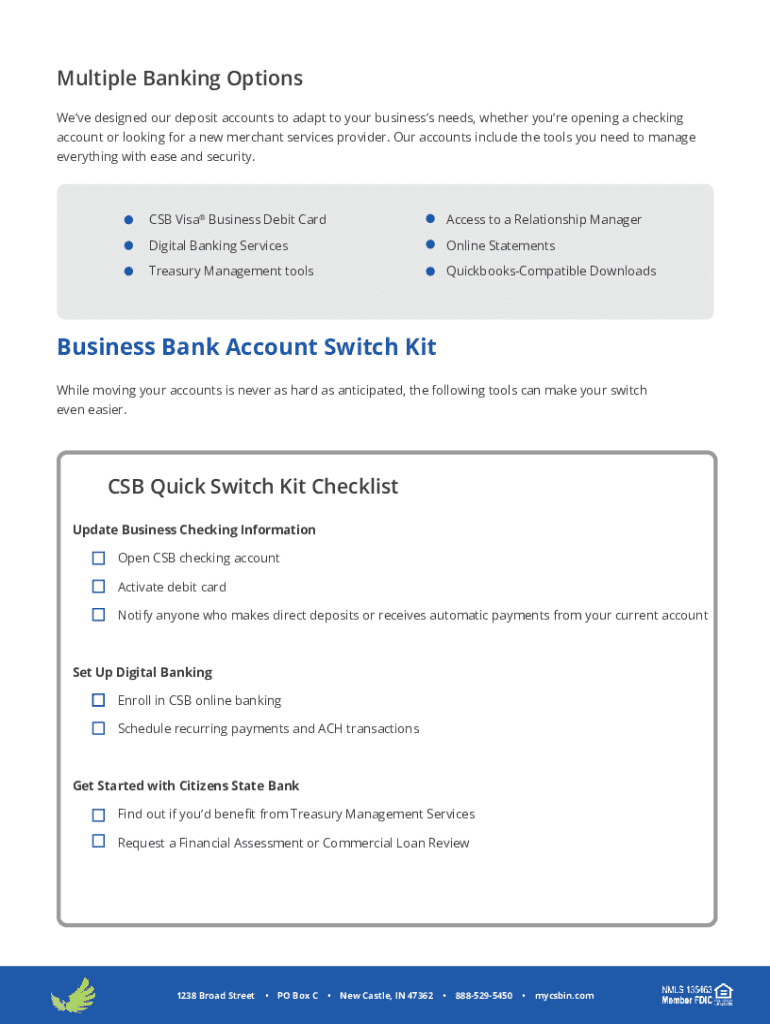

The first step in this transition is accessing the business bank account switch form, which can usually be found on pdfFiller or your prospective bank’s website. Depending on your preference, the form can often be downloaded for offline completion or filled out directly online.

Filling out the form requires specific business information, including your business name, contact details, and existing account numbers. Ensure accuracy while entering this data to prevent any delays in processing your account switch.

Once completed, the next crucial step is to authorize the account switch. This usually requires your signature—either physical or electronic through eSigning functionality—to expedite the process.

Organizing your financial affairs

After the form is submitted, the next steps include transferring your direct deposits and automated payments to the new account. Informing clients or payroll services about your new banking details ensures uninterrupted cash flow, which is critical for ongoing operations.

Additionally, you must review all automatic payments to ensure all billing parties have your updated account information. Setting up new schedules for payments where necessary can prevent overdue charges or service interruptions.

Communication with your old bank also plays a crucial role. Notify them about your intent to close the account, allowing for final statement processing and confirm remaining funds transfer.

Closing your old bank account

Finalizing the closure of your old account comes next. Make sure that all transactions—deposits, withdrawals, and payments—are completed to avoid any complications. Requesting written confirmation of closure ensures you have a formal record of your old banking relationship.

Safeguarding your account documents is equally important. Store statements from both banks securely to maintain a clear audit trail, which is particularly beneficial during tax season or if any discrepancies arise.

Navigating potential challenges

Switching business bank accounts can present challenges. For instance, there may be delays in payment processing during the transition, and overlapping charges from both accounts could occur. Thus, it is crucial to maintain clear records of all transactions during this period. Monitoring your account balances and transactions daily helps mitigate these risks.

To ensure a smooth transition, keep communication open with both banks and have contingency plans ready if issues arise. Involving key team members in these discussions can also minimize disruptions to business operations.

Conclusion: making the most of your new banking relationship

After successfully switching to your new bank through the business bank account switch form, it's essential to establish good banking practices. Regular financial check-ups will help evaluate your banking needs continuously, ensuring your services remain aligned with your business growth.

Utilizing digital tools and online resources provided by your new bank can enhance financial management. Familiarize yourself with their online banking features and integrate them into your operations, streamlining processes and improving overall cash flow.

Final thoughts on using pdfFiller for your documentation needs

pdfFiller stands out as an invaluable tool for managing your business documentation, including forms like the business bank account switch. The access-from-anywhere convenience allows teams to collaborate seamlessly, whether they are in the office or on the go.

The platform enables efficient editing, signing, and storing of documents, making it easier to manage your business needs. By utilizing pdfFiller, businesses can streamline their documentation processes, focusing more on growth and less on administrative tasks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit business bank account switch from Google Drive?

How can I send business bank account switch to be eSigned by others?

How do I edit business bank account switch online?

What is business bank account switch?

Who is required to file business bank account switch?

How to fill out business bank account switch?

What is the purpose of business bank account switch?

What information must be reported on business bank account switch?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.