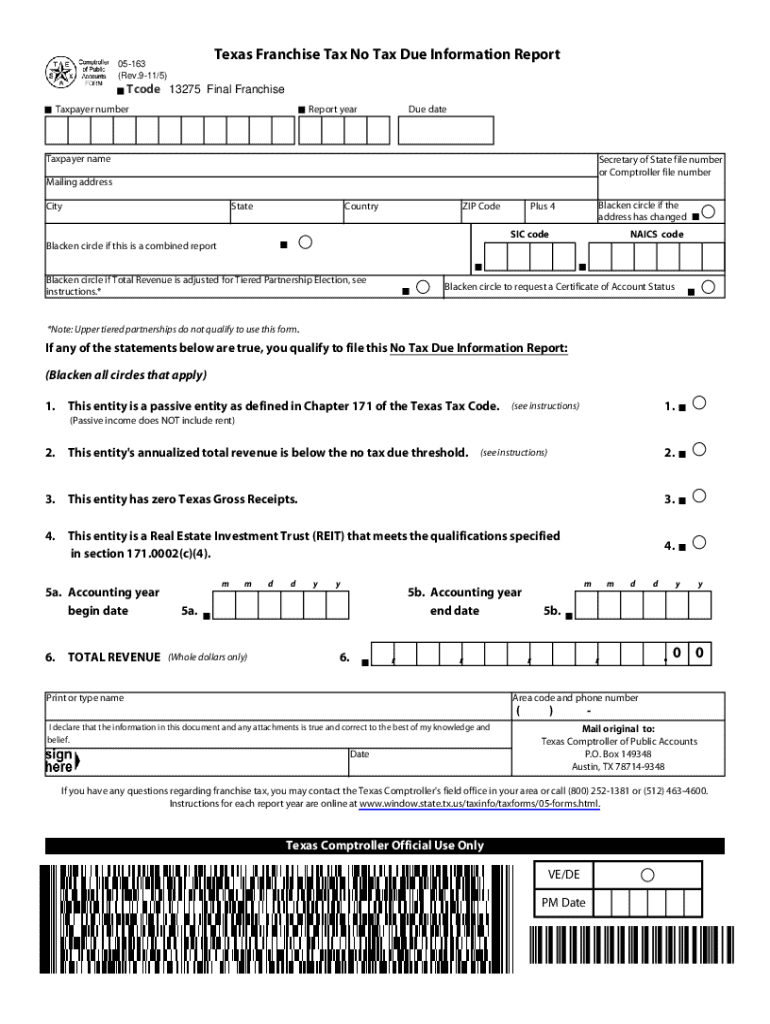

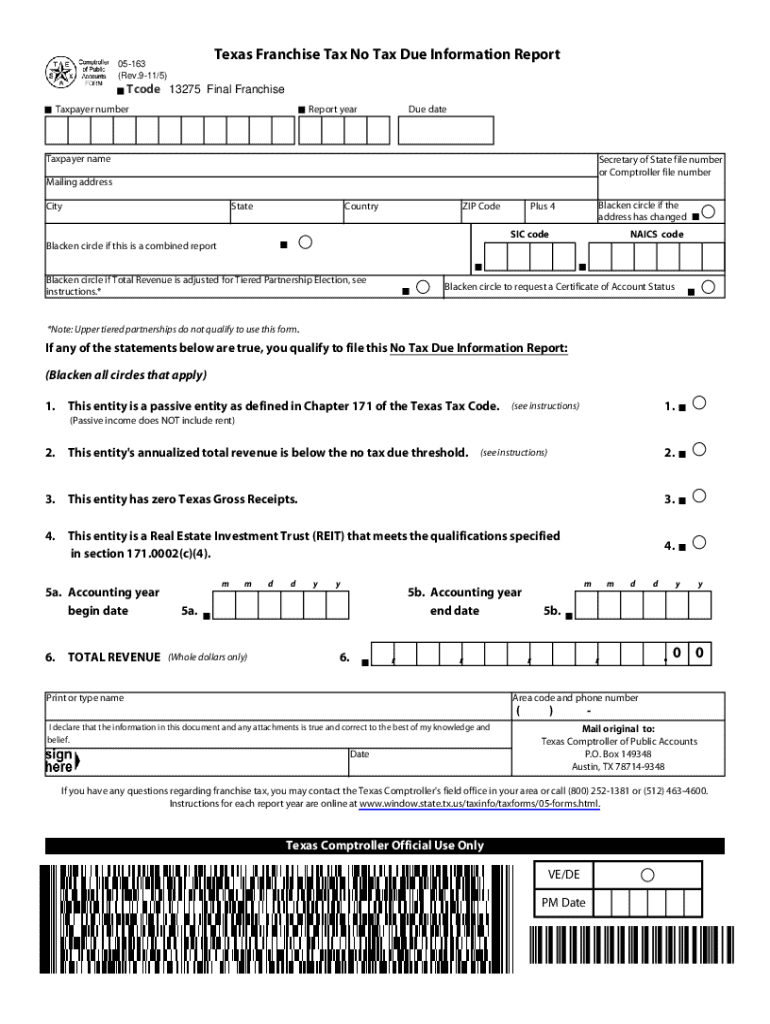

Get the free Texas Franchise Tax No Tax Due Information Report

Get, Create, Make and Sign texas franchise tax no

How to edit texas franchise tax no online

Uncompromising security for your PDF editing and eSignature needs

How to fill out texas franchise tax no

How to fill out texas franchise tax no

Who needs texas franchise tax no?

Understanding Texas Franchise Tax Without Form Submission

Understanding Texas Franchise Tax

Texas Franchise Tax is a business tax imposed on businesses operating in Texas, primarily based on revenue. This tax serves as a significant revenue source for the state, contributing to educational programs and infrastructure. Unlike income tax, franchise tax is applied to businesses rather than individuals, thereby impacting corporations, LLCs, and several other entities operating within the state.

The importance of the franchise tax for Texas businesses cannot be overstated. It provides funding for essential state services and helps maintain public infrastructure that benefits all Texans. For entrepreneurs, understanding the obligations linked to franchise tax is crucial for compliance and strategic financial planning.

Who is subject to Texas Franchise Tax?

In Texas, several types of entities are subject to franchise tax. Primarily, corporations and limited liability companies (LLCs) must pay this tax based on their total revenue earned within the state. Partnerships also fall under this tax umbrella, albeit with specific distinctions regarding thresholds and their tax obligations.

Exemptions can apply to organizations such as non-profits or entities with revenues below a certain threshold. Additionally, small businesses—defined often by their total revenue levels—may find they have no filing requirements at all. This makes it essential for business owners to stay informed about their specific obligations.

The no form requirement explained

The term 'no form' regarding Texas Franchise Tax indicates that certain eligible entities may not need to submit a traditional franchise tax report if their revenue is below the established threshold. This typically means that businesses whose total revenue is less than $1.23 million (as of the current legislative year) do not need to file a report.

Circumstances that allow for no form submission include being categorized as a small business or being inactive. The benefit of this exemption means less administrative work, reduced compliance costs, and fewer worries about potential filing errors. All of this contributes to more streamlined operations for small business owners in Texas.

Filing and reporting obligations

Understanding the revenue thresholds for Texas Franchise Tax is crucial for compliance. Businesses with revenues over $1.23 million must file a report and remit the calculated tax. This tiered system accommodates businesses of various sizes, with clear delineations between different revenue brackets to ensure fair taxation.

Timely tax management is integral to maintaining compliance and avoiding penalties. Keeping track of deadlines, which are typically aligned with the business's fiscal year, ensures that businesses can plan their finances and avoid unexpected liabilities. Regularly reviewing revenue updates and thresholds can help businesses adapt quickly.

How to manage your franchise tax responsibilities

Setting up an effective tax management system is crucial for Texas businesses, particularly those navigating the complexities of the franchise tax. Utilizing tools like pdfFiller can enhance document management by enabling easy editing, storage, and sharing of important financial documents. This helps ensure that all relevant employee information systems are updated and compliant.

Keeping track of revenue changes is also vital. Businesses should regularly assess their financial position and revenue streams to anticipate any changes in tax obligations. Thorough record-keeping practices, such as documenting all revenue sources and maintaining clear files of tax-related correspondence, are essential to mitigating risks and ensuring readiness for any inquiries.

Leveraging pdfFiller for franchise tax processes

pdfFiller stands out as a powerful platform for streamlining tax processes. By enabling users to edit and create vital tax documents effortlessly, businesses can tailor their franchise tax reporting forms or documentation directly within the platform. Utilizing e-signatures allows for fast, secure submissions without the need for physical documentation, which is especially beneficial in today’s fast-paced business environment.

Additionally, collaboration features within pdfFiller allow team members to work together on tax responsibilities, ensuring that all relevant employees are informed and involved in the tax filing process. This fosters accountability and enhances the overall quality of submissions, reducing the margin for error.

Common errors to avoid

One of the most frequent errors made by businesses concerning Texas Franchise Tax involves misreporting revenue. This can lead to either overpayment or penalties for underreporting, both of which can significantly impact the financial health of a business. It's crucial to meticulously track all income and ensure accurate reporting to avoid these complications.

Strategizing to avoid these common pitfalls can save businesses time, money, and stress. Proactively managing records and maintaining open lines of communication with tax professionals is a best practice.

Frequently asked questions (FAQ)

Business owners often have questions regarding their Texas Franchise Tax obligations. One key inquiry is what to do if revenue exceeds the threshold. Businesses should promptly update their financial strategies and prepare to file the necessary tax reports accordingly. It’s advisable to consult with a tax professional to ensure compliance.

Interactive tools & resources

Utilizing interactive tools can simplify franchise tax calculations and filings significantly. The Texas Franchise Tax Calculator helps businesses estimate their potential liabilities based on various revenue scenarios. Furthermore, pdfFiller offers templates for tax documents that can be easily filled out and customized as needed.

Visual aids, such as tax status reports, can also provide valuable insights and assist businesses in tracking their compliance status, making these tools essential for long-term financial planning.

Future updates and changes

Staying informed about upcoming legislative changes is vital for Texas businesses. Regular updates to franchise tax laws can affect compliance and financial obligations. Business owners should actively monitor developments from the Texas Comptroller’s office to ensure they are prepared for any changes that might impact their tax responsibilities.

Tracking these changes in tax laws and regulations enables businesses to anticipate necessary adjustments to their financial strategies, ensuring continued compliance and fiscal health.

Additional notes and considerations

For specific inquiries regarding Texas Franchise Tax, including detailed personal assistance, it is advisable to reach out directly to the Texas Comptroller’s office. Their dedicated lines provide resources and support to facilitate compliance and answer any pressing questions you might have.

Being proactive in this manner is essential to ensuring that your business fulfills all necessary obligations and avoids complications down the line.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit texas franchise tax no from Google Drive?

Where do I find texas franchise tax no?

How do I fill out the texas franchise tax no form on my smartphone?

What is texas franchise tax no?

Who is required to file texas franchise tax no?

How to fill out texas franchise tax no?

What is the purpose of texas franchise tax no?

What information must be reported on texas franchise tax no?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.