Get the free New Jersey Multi-member Llc Operating Agreement

Get, Create, Make and Sign new jersey multi-member llc

Editing new jersey multi-member llc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new jersey multi-member llc

How to fill out new jersey multi-member llc

Who needs new jersey multi-member llc?

New Jersey Multi-Member Form: A Comprehensive Guide

Understanding the multi-member structure in New Jersey

A Multi-Member LLC is a limited liability company that comprises two or more owners, known as members, who share ownership of the business. This structure offers unique advantages tailored for small to medium-sized enterprises in New Jersey. Understanding these benefits can be crucial for anyone considering forming such an entity.

One of the primary benefits of forming a Multi-Member LLC in New Jersey is the flexibility in management. Unlike corporations, which have a stricter governance structure, LLC members can decide how they want to manage the company. Members can participate actively in operations or delegate these responsibilities to one or more designated LLC managers.

Additionally, the pass-through taxation feature of Multi-Member LLCs means that income is only taxed at the member’s personal income tax rate, avoiding the double taxation often associated with corporations. This feature makes it a financially appealing option for many entrepreneurs.

The limited liability protection that an LLC offers is another critical factor. This structure separates personal and business liabilities, protecting members' personal assets from business-related debts and lawsuits. Multi-Member LLCs are often ideal for groups of entrepreneurs teaming up to launch a new business venture, as well as for families who want to run a business together.

Key components of the New Jersey multi-member form

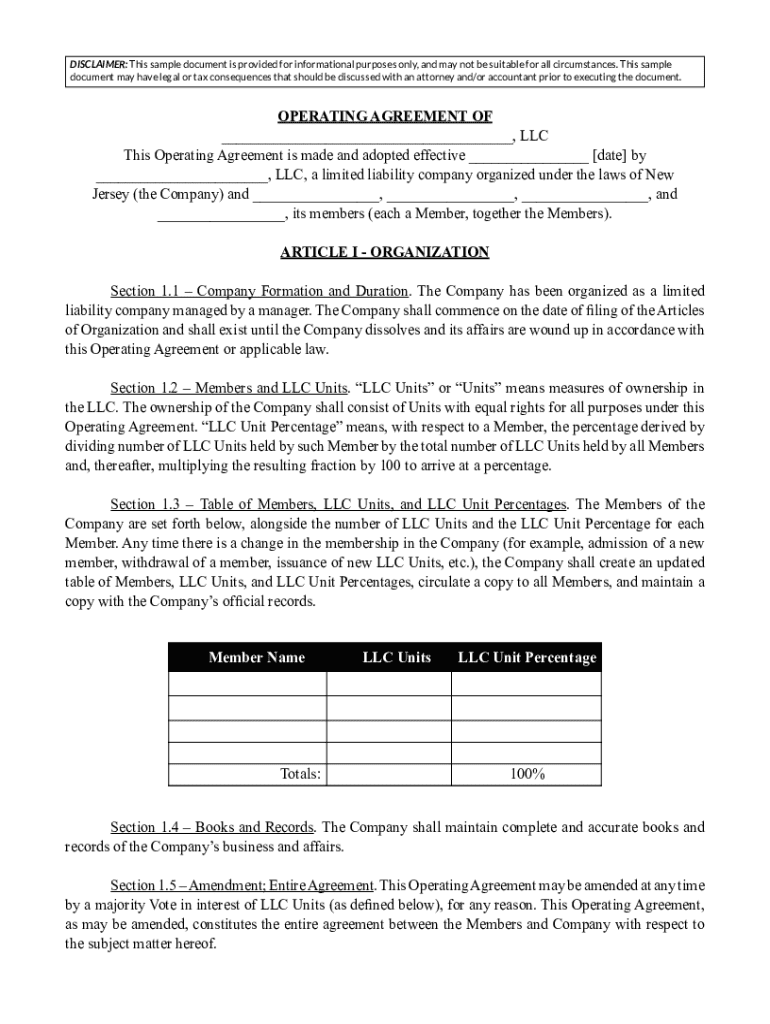

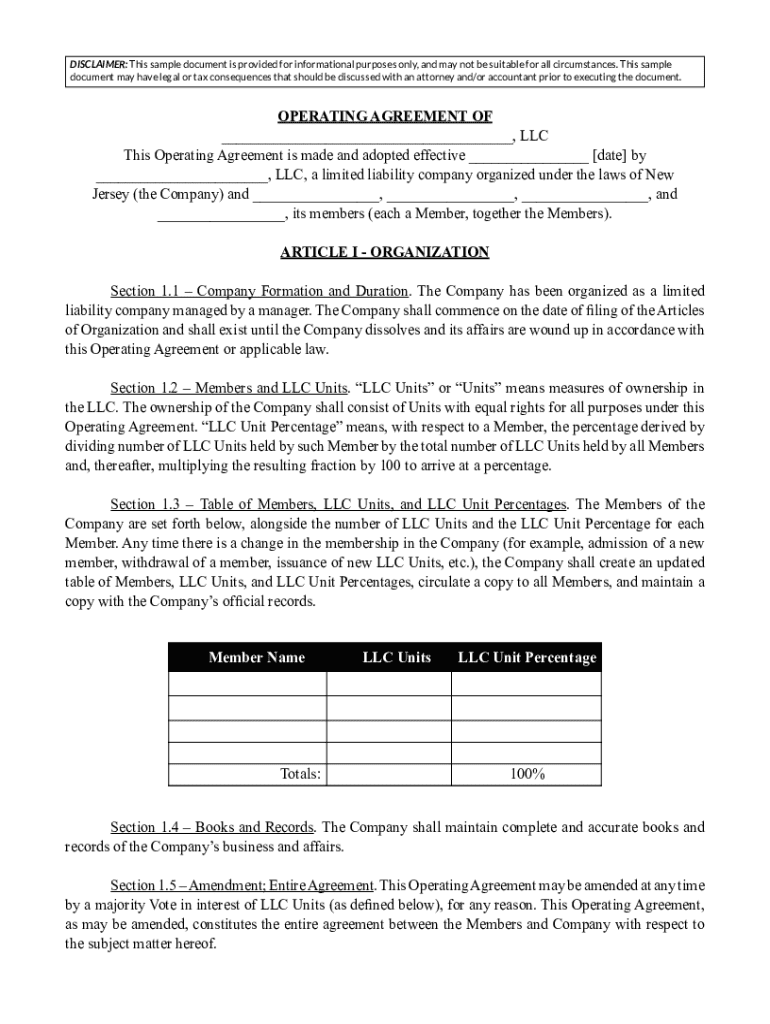

Completing the New Jersey Multi-Member LLC form involves several steps and requires specific information. The formation process allows members to legally establish their LLC, ensuring compliance with New Jersey state regulations. The core components necessary for filling out the form include details relating to the members, the business specifics, and the designated registered agent.

Each section of the form plays a vital role in establishing your LLC's identity and ensuring that all members' rights and responsibilities are articulated correctly. Thus, understanding the importance of accuracy while filling out this form is essential for smooth functioning post-formation.

Step-by-step guide to filling out the New Jersey multi-member form

Ready to establish your Multi-Member LLC? Follow this step-by-step guide to ensure you complete the New Jersey Multi-Member LLC form accurately and efficiently.

Carefully following these steps will facilitate a smoother formation process, ensuring that your Multi-Member LLC is correctly established under New Jersey law.

Submission process for the New Jersey multi-member form

After completing the New Jersey Multi-Member LLC form, knowing how and where to submit it is crucial. You have several options for submission, aimed at providing convenience to all members.

Expect to pay a filing fee upon submission, which covers administrative costs. Processing times can vary, but online submissions tend to be processed faster than those sent by mail. Always check for the most current fee amounts and processing times through the official New Jersey government website.

Post-submission steps for multi-member LLCs

Once your New Jersey Multi-Member LLC is officially registered, specific post-submission steps are essential for your ongoing compliance and business operations.

Establishing an operating agreement is especially crucial for a Multi-Member LLC since it helps outline expectations and reduces potential conflicts among members. Remember, maintaining good standing involves not just filing reports but also paying the associated fees promptly.

Effective management and operation of a multi-member

Effective management of a Multi-Member LLC hinges on clear communication and collaborative decision-making. Establishing regular meetings and open channels for discussions among members can aid in this endeavor. Since each member has a vested interest in the company, leveraging their unique strengths can enhance overall operational efficiencies.

Using tools like pdfFiller can significantly streamline collaboration among LLC members. This versatile platform allows you to edit and share documents in real-time, making it easier to draft agreements and other important business documents. Additionally, pdfFiller includes functionalities for electronic signing, which saves time and enhances the overall efficiency of your document handling process.

It’s equally important to remain aware of tax considerations and responsibilities that come with running a Multi-Member LLC. Members should understand how profit-sharing impacts their personal tax obligations and ensure they maintain accurate financial records to navigate this aspect effectively.

Common questions and concerns about New Jersey multi-member LLCs

Navigating the intricacies of a Multi-Member LLC can raise various questions and concerns. Some of the most commonly asked questions include those about changing members and the implications of a member’s departure from the company.

For any further assistance or legal consultation, consider reaching out to local resources or legal professionals specializing in business law in New Jersey.

Leveraging pdfFiller to streamline your formation process

pdfFiller provides robust tools tailored for LLC formation and management, making it easier for users to handle all related documentation. The platform's cloud-based access allows users to manage multitasking from any location, ensuring that crucial documents are available whenever needed.

Testimonials from users highlight the effectiveness of pdfFiller in smoothing out the sometimes arduous process of form completion and management, facilitating a more straightforward journey toward establishing a Multi-Member LLC.

Success stories: multi-member LLCs thriving in New Jersey

Numerous success stories of Multi-Member LLCs in New Jersey illustrate how this business structure can lead to thriving ventures. Case studies show founders leveraging their collective skills, unique resources, and diverse backgrounds to create innovative solutions and capture market share.

One example includes a group involved in the tech industry who pooled their expertise to launch a successful software development firm. By forming an LLC, they not only protected their assets but also created a collaborative environment fostering creativity and accountability among shareholders.

Lessons learned from these success stories often emphasize the value of clear communication and a well-structured operating agreement, providing future Multi-Member LLCs with a roadmap to success.

Additional tips for future business success with a multi-member

To ensure your Multi-Member LLC thrives in the competitive New Jersey business landscape, networking and partnership opportunities play a pivotal role. Building relationships with other businesses and engaging with local entrepreneurship communities can foster growth and provide invaluable insights.

By committing to ongoing education and fostering personal relationships within the business community, Multi-Member LLCs can position themselves for long-term success and sustainability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new jersey multi-member llc to be eSigned by others?

Can I create an electronic signature for signing my new jersey multi-member llc in Gmail?

How can I fill out new jersey multi-member llc on an iOS device?

What is new jersey multi-member llc?

Who is required to file new jersey multi-member llc?

How to fill out new jersey multi-member llc?

What is the purpose of new jersey multi-member llc?

What information must be reported on new jersey multi-member llc?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.