Get the free Cf-1040

Get, Create, Make and Sign cf-1040

Editing cf-1040 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cf-1040

How to fill out cf-1040

Who needs cf-1040?

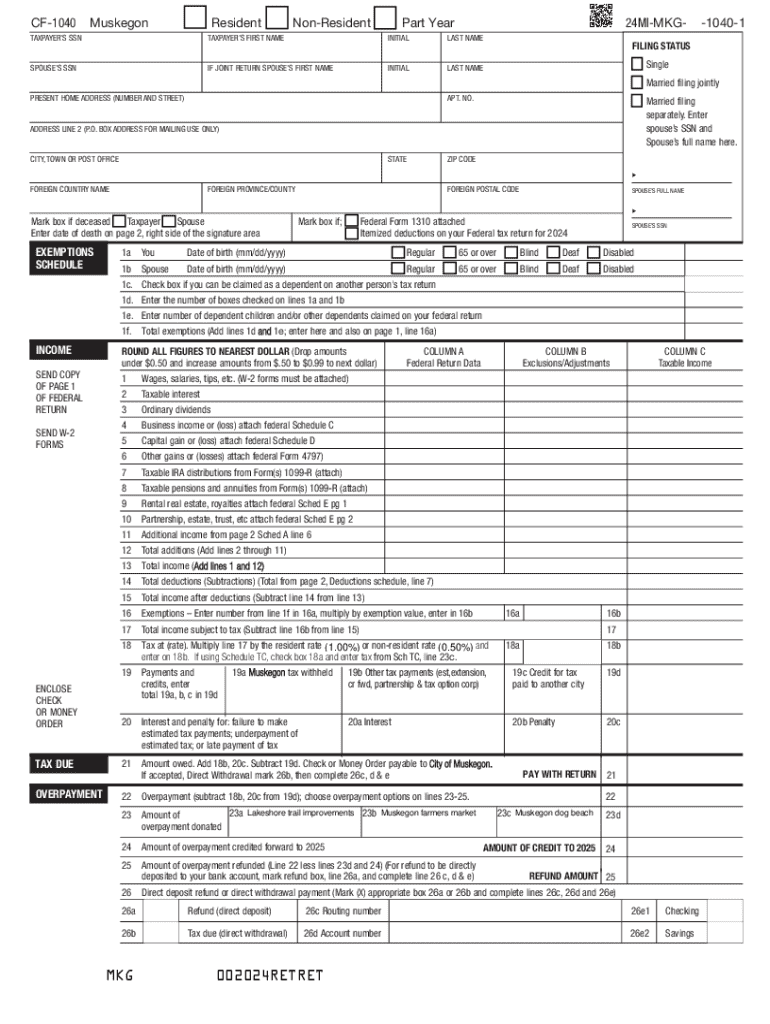

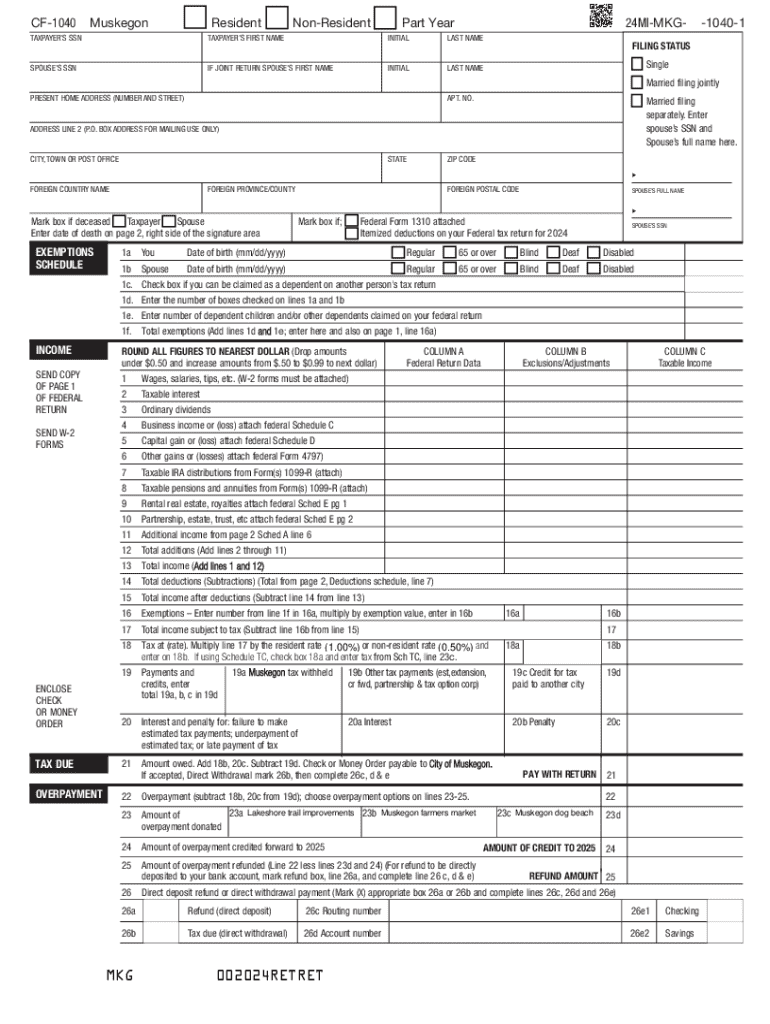

Comprehensive Guide to the CF-1040 Form

Understanding the CF-1040 Form

The CF-1040 form is a pivotal document in the landscape of income tax forms, designed specifically for individuals looking to report their annual income to the income tax department. This form serves as a comprehensive statement of your earnings, allowing the tax authorities to assess your tax obligations accurately. Its primary purpose is to ensure that all individuals meet their civic duty of paying taxes based on the income they receive throughout the year.

Typically, anyone earning an income is required to file the CF-1040 form, whether you're a freelancer, a corporate employee, or a small business owner. You must submit this form if your income surpasses the minimal threshold established by your city or state regulations. Additionally, partnerships and corporations may have specific filing requirements related to this form, incorporating various income tax documents as needed.

The CF-1040 form is laden with features and benefits that streamline the tax-filing process. It provides clarity on available deductions and credits, ensuring that taxpayers can maximize their refunds or minimize their tax liability. Furthermore, it allows room for adjustments and additional information through supporting documents, making it a flexible solution for various income sources.

Preparing to fill out the CF-1040 Form

Preparation is key when tackling the CF-1040 form. Before you dive into filling it out, gather all required information and documentation. Essential personal identification is needed, including your full name, address, and social security number. It's important to have details about various income sources, which could encompass wages, dividends, interest income, or self-employment earnings. Additionally, understanding the deductions and credits you may qualify for is crucial, as these can dramatically influence your tax obligation.

Setting up your pdfFiller account is a smart move for seamless access to the CF-1040 form. With pdfFiller, you can easily access, complete, and manage your tax forms from anywhere. By organizing your documents effectively — possibly by creating folders for different tax years or categories of income — you streamline your workflow and minimize the stress associated with tax season.

Step-by-step instructions for completing the CF-1040 Form

Completing the CF-1040 form can be straightforward if you follow a structured approach. Start with Section 1, which focuses on personal information. Here, you’ll fill out your name, address, and Social Security number. Accuracy in this section is crucial, as any discrepancies can lead to delays or issues with your tax submission.

The second section covers income reporting. Here, you need to detail various types of income, whether they are from employment, investments, or business activities. Using pdfFiller's tools, you can attach supporting documents, ensuring the income reported is verifiable.

Next, the deductions and adjustments section allows you to identify any common deductions. Knowing what you can claim can significantly reduce your tax burden. pdfFiller provides interactive tools to aid in calculating these deductions accurately, keeping your finances in check. Once you’ve claimed your deductions, don't forget to navigate to the tax credits section. Understanding eligibility for various tax credits can further optimize your tax return.

Finally, ensure you take the time to review and verify your completed CF-1040 form. Utilizing pdfFiller's review feature can help you double-check for errors before submission, ensuring a hassle-free experience.

Editing and signing the CF-1040 Form

Editing the CF-1040 form is easy with pdfFiller's suite of features. You can modify text, highlight important information, and even redact sensitive data if necessary. This capability is particularly useful if you've made errors during the filling process, allowing you to correct them quickly.

Once your form is complete, signing it is the next step. The electronic signature process is straightforward — just follow the guided steps within pdfFiller to eSign your CF-1040 form. The validity of eSignatures varies by jurisdiction, but most cities and states recognize them as legally binding, provided they’re executed correctly.

Submitting the CF-1040 Form

When it comes time to submit your CF-1040 form, you have two primary options: electronic filing or mail submission. Electronic filing is generally the preferred method as it is faster and often comes with immediate confirmation of receipt. On the other hand, traditional mail submission can take several weeks for processing, so be mindful of submission deadlines.

Be aware of critical submission deadlines, as these dates can vary by state and year. Utilizing pdfFiller, you can easily track your submission status to ensure everything is in order before tax season ends.

Managing your CF-1040 Form records

Once you’ve submitted your CF-1040 form, keeping organized records is essential. pdfFiller provides a user-friendly platform where you can store your CF-1040 form safely in the cloud. Organizing your forms online allows for easy retrieval when needed, aiding in any future tax obligations or audits.

Use these tools to stay on top of any evolving tax regulations that may affect your financial planning, making pdfFiller not just a tool for filing but a resource for managing your overall documentation.

Common errors to avoid when filing the CF-1040 Form

When it comes to the CF-1040 form, there are several common errors that can inadvertently derail your efforts. Simple oversights, such as mismatched Social Security numbers or incorrect calculations, can cause a ripple effect leading to delays or additional scrutiny.

Adopting best practices during the filing process can help you avoid these pitfalls. Regularly reviewing your form with a second pair of eyes or using pdfFiller's comprehensive review features can help ensure an error-free submission. Addressing FAQs related to common CF-1040 form issues can also give you added confidence.

Additional features of pdfFiller for CF-1040 users

For those utilizing the CF-1040 form, pdfFiller offers a range of features that enhance your overall experience. Collaboration tools allow for real-time work with team members or tax professionals, which is particularly beneficial if you're dealing with a complex return involving multiple income sources or deductions.

These capabilities not only streamline your filing experience but also offer ongoing support as your tax situations evolve and change over time.

How pdfFiller makes tax filing easier

Utilizing pdfFiller for your CF-1040 form can transform the taxing process into a straightforward endeavor. Its user-friendly interface is designed for efficiency, catering to individuals and teams alike, offering access from anywhere. This flexibility is invaluable for busy professionals juggling various commitments while trying to manage their taxes.

Customer testimonials emphasize the effectiveness of pdfFiller. Users appreciate the platform's intuitive tools that simplify tax filing, ultimately leading to significant time savings and reduced stress. These features contribute to a more positive overall experience, allowing taxpayers to focus on what truly matters.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send cf-1040 for eSignature?

Can I create an eSignature for the cf-1040 in Gmail?

How can I fill out cf-1040 on an iOS device?

What is cf-1040?

Who is required to file cf-1040?

How to fill out cf-1040?

What is the purpose of cf-1040?

What information must be reported on cf-1040?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.