Get the free Form 8-k

Get, Create, Make and Sign form 8-k

Editing form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Form 8-K: A Comprehensive Guide to Corporate Reporting

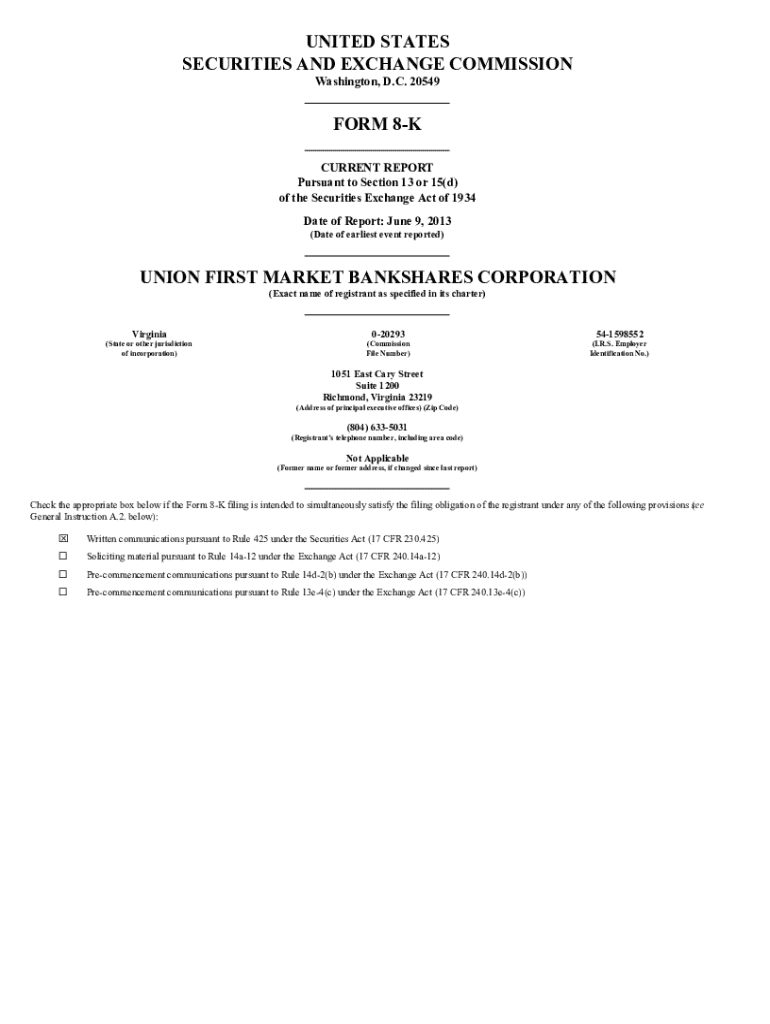

Understanding Form 8-K

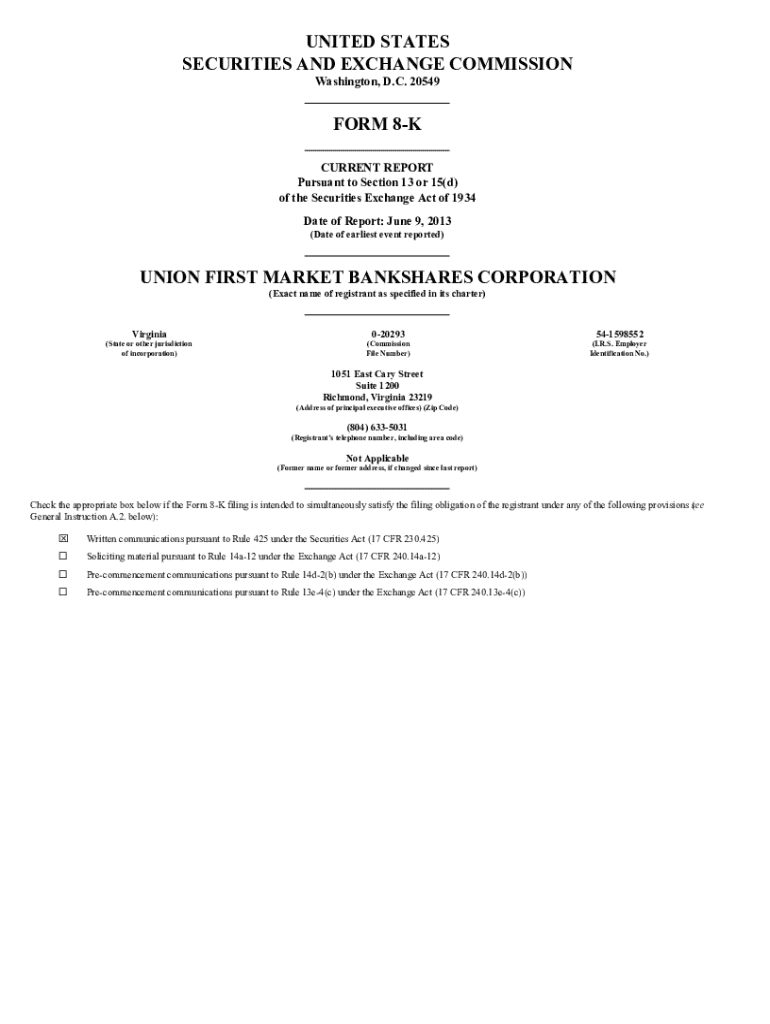

Form 8-K is a crucial document that publicly traded companies must file with the Securities and Exchange Commission (SEC) to report major events impacting their business. Often termed the 'current report,' Form 8-K serves as a mechanism for promoting transparency within the financial markets. This document allows companies to disclose significant changes that might affect their stakeholders and investors, ensuring timely and relevant information dissemination.

Filing Form 8-K is vital for robust corporate governance, providing a necessary means to keep investors informed about crucial corporate changes. Unlike other SEC forms, such as the Form 10-K or 10-Q, which provide periodic updates on a company's performance, Form 8-K is filed in response to specific triggering events, making it a unique instrument in corporate reporting.

What triggers an 8-K filing?

Numerous triggering events require a company to file a Form 8-K, each indicating a significant change in the company's status or operations. Some of the primary scenarios include:

The timeline for reporting these events is typically within four business days of the triggering event, emphasizing the need for timely disclosure to maintain investor trust.

Legal obligations and compliance

The SEC has established specific rules and regulations governing the filing of Form 8-K. Companies are legally obligated to report significant events promptly; failure to do so can result in penalties, including fines and sanctions. Compliance is not only a regulatory requirement but also crucial for maintaining investor confidence and corporate integrity.

Non-compliance can lead to severe repercussions, such as market penalties and severe reputational damage. Best practices for ensuring accuracy in reporting include maintaining clear internal processes for identifying and acting on events that require disclosure, conducting regular audits of disclosed information, and adopting robust communication strategies to address stakeholders' questions.

Elements of a complete Form 8-K

A complete Form 8-K requires specific information and follows established formatting guidelines. Key elements include:

Careful adherence to formatting guidelines is crucial to ensure that the filing meets SEC standards, avoiding delays and compliance issues. Companies should consider using templates to assist in maintaining consistency.

Benefits of filing Form 8-K

Filing Form 8-K offers several advantages that extend beyond legal compliance. For instance, by enhancing transparency and trust with investors, companies can foster a more robust and favorable investor relations environment. This proactive approach to communication ensures that stakeholders are kept informed about significant changes affecting the company.

Moreover, a timely Form 8-K filing helps protect corporate reputation and credibility, particularly in sensitive situations such as executive departures or financial difficulties. Clear and well-timed communication minimizes misinformation and helps maintain a company's image in the eyes of the public and the markets. Additionally, it streamlines communication with stakeholders, leading to improved relationships and potentially even boosting stock prices in response to positive news.

Step-by-step guide to filing Form 8-K

Filing Form 8-K involves several important steps to ensure completeness and accuracy. Here’s a step-by-step guide:

By following these steps carefully, companies can enhance their efficiency during the filing process and ensure compliance with SEC regulations.

Real-world examples of Form 8-K filings

Several high-profile 8-K filings have made headlines and resulted in considerable market impacts. For example, companies like Tesla and Boeing have had to file Form 8-K to disclose critical information regarding executive changes and major financial milestones.

Case studies analyzing successful and failed filings demonstrate the stakes of accurate reporting. In one instance, a delay in reporting a significant acquisition led to shareholder panic and a subsequent stock price plunge, while timely disclosures in positive developments often correlate with favorable market reactions.

Tools for managing Form 8-K and other SEC filings

Companies can utilize tools like pdfFiller for a seamless experience in managing their Form 8-K filings and other SEC-related documents. The platform offers powerful features for editing and filing forms, enabling companies to customize their disclosures without hassle.

Additionally, pdfFiller integrates with eSignature solutions, allowing for quick approvals, and provides collaborative tools so teams can work together efficiently on disclosures. These features help streamline the filing process, ensuring accuracy and compliance.

Ongoing management post-filing

After filing Form 8-K, it’s important for companies to monitor investor feedback and media coverage closely. This proactive engagement creates an open line of communication, enabling companies to gauge public sentiment and respond to any concerns that arise.

Furthermore, addressing issues raised post-disclosure is critical. This includes releasing supplemental information or amendments when new developments occur. Companies must be prepared to revise and update their filings as required to maintain transparency and build investor confidence.

Future changes and trends in Form 8-K filings

The landscape surrounding Form 8-K filings is continuously evolving. Anticipated regulatory changes may focus on enhancing the transparency and timeliness of disclosures, while the increasing impact of technology is pushing companies toward more digital-first reporting strategies.

As technology continues to shape corporate reporting, companies should prepare for structural adjustments in how they manage disclosures. Digitizing documentation processes, embracing real-time reporting, and implementing automated systems for compliance will be critical in the coming years.

FAQs about Form 8-K

Certain common inquiries arise concerning Form 8-K, including the implications of missing the filing deadline. Companies that fail to file on time may face enforcement actions from the SEC. If a Form 8-K needs a revision, companies can file an amended version to correct any inaccuracies or update previous disclosures.

The frequency of filings also varies. Companies may file Form 8-K multiple times a year, depending on the number of triggering events impacting their business operations. Staying proactive in monitoring these events is essential.

Resources and interactive tools on pdfFiller

pdfFiller provides numerous resources for simplifying the management of Form 8-K and other SEC filings. Users can access interactive forms and templates specifically designed for efficient disclosure management. Additionally, video tutorials guide users through the platform, ensuring they can navigate the filing process smoothly.

The support community available through pdfFiller offers assistance to users as they navigate Form 8-K, providing insights and shared experiences to enhance understanding and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 8-k in Gmail?

Can I edit form 8-k on an iOS device?

How do I edit form 8-k on an Android device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.