Get the free Sec Form 424b5

Get, Create, Make and Sign sec form 424b5

Editing sec form 424b5 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 424b5

How to fill out sec form 424b5

Who needs sec form 424b5?

SEC Form 424B5 Form: Comprehensive Guide

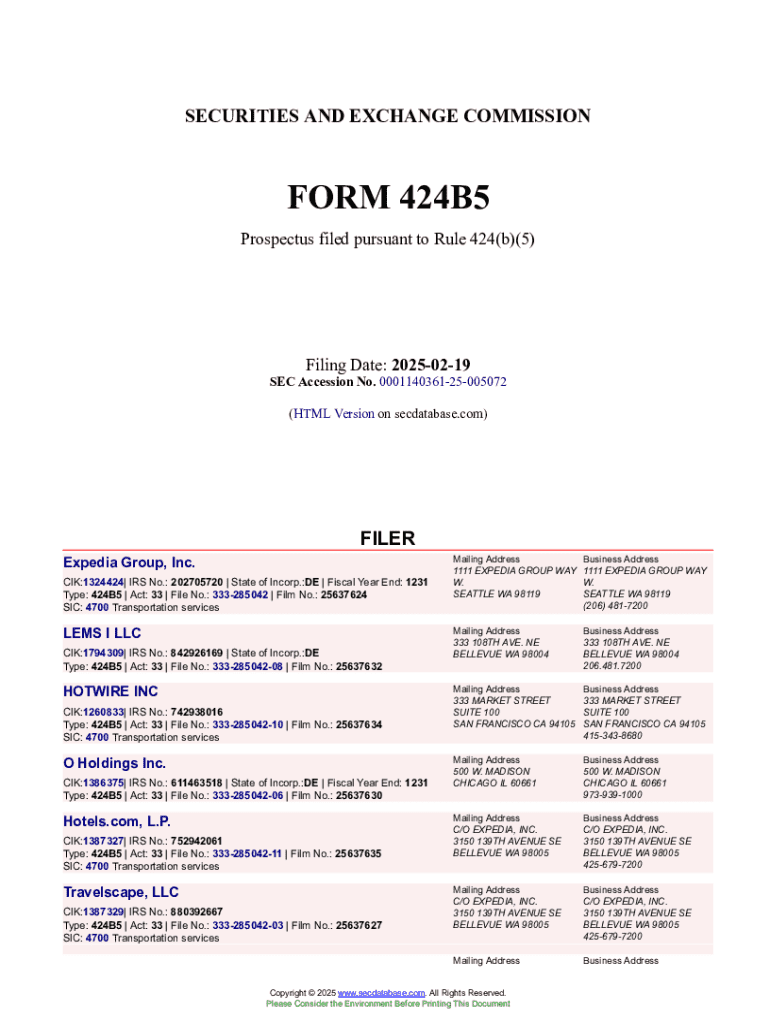

Understanding SEC Form 424B5

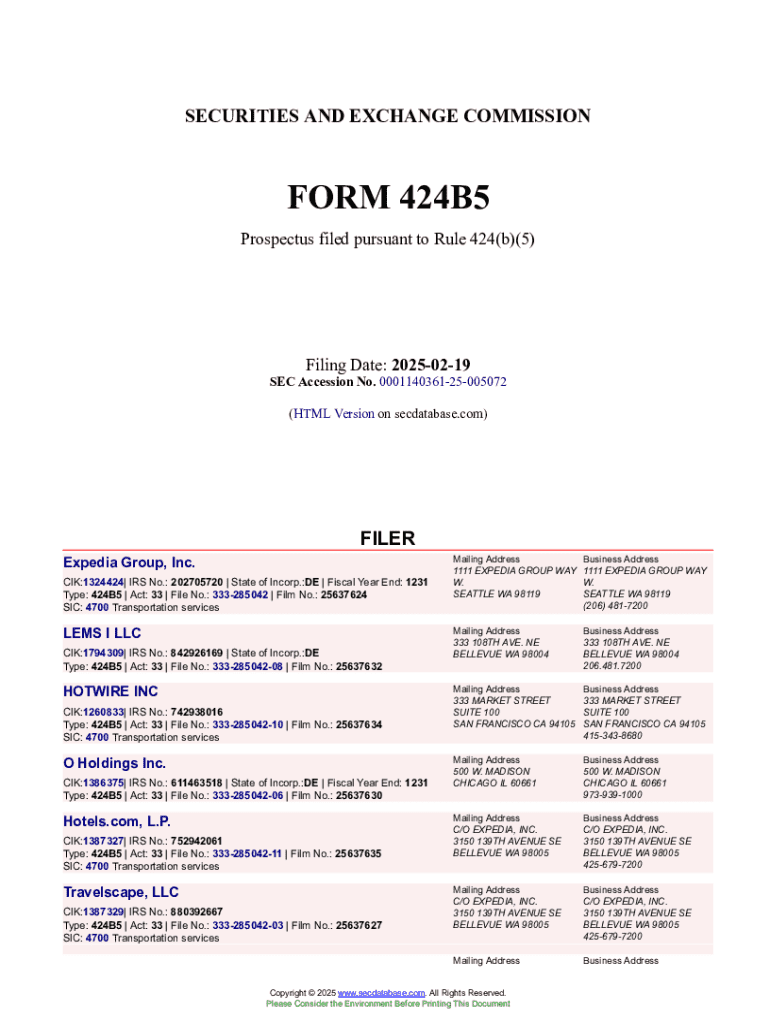

SEC Form 424B5 is a crucial regulatory document used by companies engaged in public offerings. It serves as a prospectus supplement that provides updated information for investors following the filing of an initial registration statement. This form is essential in the securities registration process, allowing companies to communicate material data that can impact their stock offerings and overall market perception.

The purpose of SEC Form 424B5 extends beyond mere compliance; it plays a significant role in investor transparency and informed decision-making. By disclosing pertinent information, companies equip investors with insights necessary for evaluating the risks and benefits of their investments.

Key features of SEC Form 424B5

Understanding the structure of SEC Form 424B5 is key to comprehending its implications for regulatory compliance. The form typically contains updated details about the offering, such as the number of shares being sold, the pricing information, and any changes in the use of proceeds from the offering. It's essential to note that SEC Form 424B5 differs from other forms like 424B and S-1, primarily in its role as a supplemental document intended to refine disclosures rather than initiate the registration process.

Companies are required to file Form 424B5 to provide investors with the most current information regarding the offerings of their securities. This updated disclosure ensures that potential investors are not only aware of what was initially reported but also any developments or changes that could influence their investment decisions.

Types of filings associated with SEC Form 424B5

SEC Form 424B5 is commonly utilized in various scenarios within the capital markets. Typical scenarios include the following:

Purpose and importance of filing SEC Form 424B5

Filing SEC Form 424B5 is not merely a regulatory obligation but a critical component of maintaining investor confidence. It addresses the legal requirements set forth by the SEC and meets the regulatory expectations of transparency in the financial markets. For investors, this transparency is invaluable; it equips them with essential information needed to make informed decisions regarding their investments.

The role of transparency in market confidence cannot be overstated. It fosters trust between investors and companies, laying the groundwork for a more stable market environment. When companies disclose risks, uses of proceeds, and other significant changes, it helps mitigate uncertainties that investors might have, ultimately leading to a more informed investment landscape.

Detailed components of SEC Form 424B5

A well-structured SEC Form 424B5 includes several critical components. Risk factors must be articulated clearly, as they provide insights into potential challenges that may affect the investment's viability. Companies are encouraged to disclose relevant information succinctly and accurately, which can enhance investor confidence.

In addition to risk factors, the use of proceeds section is vital. Companies must detail how the funds raised will be utilized, whether for capital expenditures, debt repayment, or expansion initiatives. Comprehensive reporting in this area assures investors that their financial contributions will be managed responsibly.

Furthermore, the Management’s Discussion and Analysis (MD&A) is another essential component. This section allows companies to provide context to their financial data and operational insights. Effectively crafting this section that meets SEC standards can significantly impact how investors perceive a company’s future.

Filing requirements and timeline for SEC Form 424B5

Understanding who must file SEC Form 424B5 is crucial for compliance. Primarily, companies seeking to update existing securities registration statements must file this form. This encompasses both multinational companies conducting public offerings and smaller enterprises wishing to engage investors.

The filing timeline is equally important, as failures to adhere to SEC deadlines can lead to legal repercussions. Key dates often revolve around the timing of public offerings; thus, companies should develop a robust calendar to keep track of these critical moments in the filing process. The submission process typically involves electronic filing via the SEC’s EDGAR system, which streamlines the documentation process and ensures immediate access to submitted materials.

Common mistakes in filing SEC Form 424B5 and how to avoid them

Navigating the filing of SEC Form 424B5 can be challenging, and many companies make common errors that could jeopardize their compliance. Misreporting risk factors, failing to update the use of proceeds, or mislabeling supplementary documents are frequent pitfalls.

To avoid these errors, companies should implement best practices for thorough document review before submission. This includes routine checks for accuracy, clarity, and completeness of the information provided. Collaboration among team members can also enhance the quality of final filings by providing diverse perspectives during the review process.

Tools and resources for managing SEC Form 424B5

Leveraging digital tools can greatly enhance the management of SEC Form 424B5. Solutions like pdfFiller offer users streamlined options to edit and manage filings efficiently. The platform provides features that simplify document creation, allowing for easy updates to forms without the hassle of traditional editing.

Interactive features, such as real-time collaboration, enable teams to work on filings simultaneously, thus reducing the turnaround time for completing essential documents. Given the importance of accurate filings in the regulatory landscape, utilizing a cloud-based platform like pdfFiller can transform how organizations approach document management.

FAQs about SEC Form 424B5

Many questions arise surrounding the specifics of filing SEC Form 424B5. Common inquiries include the types of disclosures necessary, the implications of certain risk factors on investor decisions, and the legal obligations surrounding these filings.

Clarifications around investment implications play a significant role in understanding the broader context of these filings. It's essential for companies to be well-informed about the ramifications of their disclosures, particularly concerning how they could influence investor behavior and market dynamics.

Enhancing your document management experience

Utilizing pdfFiller enhances the experience of managing SEC Form 424B5. By providing seamless editing capabilities, signing options, and a collaborative environment, businesses ensure that their filings are not only accurate but also professionally presented.

The benefits of adopting a cloud-based platform extend beyond just efficiency; they include improved accessibility and security of sensitive documents. Users have reported enhanced satisfaction with their filing processes when using pdfFiller, emphasizing its role in simplifying complex documentation requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my sec form 424b5 directly from Gmail?

How can I edit sec form 424b5 from Google Drive?

How do I edit sec form 424b5 straight from my smartphone?

What is sec form 424b5?

Who is required to file sec form 424b5?

How to fill out sec form 424b5?

What is the purpose of sec form 424b5?

What information must be reported on sec form 424b5?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.