Get the free Trust Business Account Application Form

Get, Create, Make and Sign trust business account application

Editing trust business account application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out trust business account application

How to fill out trust business account application

Who needs trust business account application?

A Comprehensive Guide to Trust Business Account Application Forms

Understanding trust business accounts

Trust business accounts play a vital role in the effective management of assets within a trust framework. A trust business account is a specialized account that allows legal entities, such as trustees and businesses, to manage funds held in trust for beneficiaries. These accounts are designed to meet the unique needs of entities managing multiple assets and ensuring compliance with fiduciary responsibilities.

There are various types of trusts, including revocable living trusts, irrevocable trusts, and charitable trusts, each serving different purposes. For instance, revocable living trusts can be altered during the grantor's lifetime, while irrevocable trusts cannot be modified once established. Understanding the type of trust you are working with is crucial, as it impacts the management and distribution of funds.

Who needs a trust business account?

Trust business accounts are essential for various individuals and entities involved in trust management. Primarily, trustees who are responsible for managing and distributing trust assets should have a trust business account to handle funds appropriately. Additionally, professional fiduciaries, such as financial advisors and attorneys managing estates, can also benefit from such accounts.

Business entities that utilize trust accounts are often those engaged in estate planning or asset management. For example, family businesses may establish trust accounts to protect their company’s assets for future generations. Situations such as managing estate distributions, setting up educational funds for beneficiaries, or charitable contributions typically prompt the opening of a trust business account.

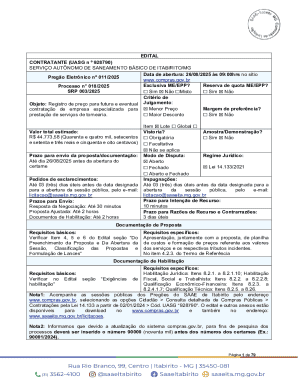

Pre-application checklist for trust business account

Before diving into the trust business account application process, it’s essential to assemble all necessary documents and ensure eligibility. A Trust Deed is a fundamental document that outlines the trust's terms, specifying the asset distribution and management guidelines. Additionally, identification documents for all trustees, like driver's licenses or passports, will be required to verify their identity. Along with identification, you will need a Tax Identification Number (TIN) for tax reporting purposes.

Understanding the eligibility criteria for a trust business account is also vital. Not all trusts qualify; for instance, a valid trust deed must be provided to validate the trust's existence. Furthermore, financial institutions might require proof of sufficient initial deposits or asset documentation to assess the financial health of the trust.

Step-by-step application process

The trust business account application process can seem daunting at first, but breaking it down into clear, manageable steps can simplify the experience significantly. Start the process by gathering all required documentation thoroughly. An organized list makes it easy to ensure you have everything necessary before proceeding.

Once documents are at hand, you'll need to complete the trust business account application form. Pay particular attention to the various sections of the form, which typically includes personal information about trustees, trust details, and any other relevant information the financial institution may require. Common errors to avoid include typos, missing information, and inaccuracies in the trust details.

Lastly, submission of your application can be done online, in person, or via mail, depending on the institution's options. It’s important to follow up and track the application status, as processing times may vary.

Editing and managing the application form

Once you have assessed and prepared your trust business account application form, leveraging tools like pdfFiller can significantly enhance your efficiency. pdfFiller provides a cloud-based platform where users can easily edit the trust business account application form, making necessary adjustments without starting from scratch.

The platform's eSigning features enable users to add signatures electronically, thereby speeding up the approval process. Furthermore, if you're working alongside co-trustees or legal advisors, collaborating on document revisions and approvals becomes seamless, eliminating the need for multiple physical meetings.

Common challenges and solutions

Throughout the application process for a trust business account, several obstacles may arise. Documentation issues often surface, whether it be incorrect data or missing components. It's crucial to meticulously review all materials prior to submission to mitigate these errors.

Communication with banks or financial institutions is another area where many applicants struggle. To overcome this, it is advisable to maintain open lines of communication, ask clarifying questions, and ensure you understand all requirements. In the unfortunate event that your application is denied, reviewing the feedback provided by the institution can help address any concerns and craft a stronger re-application.

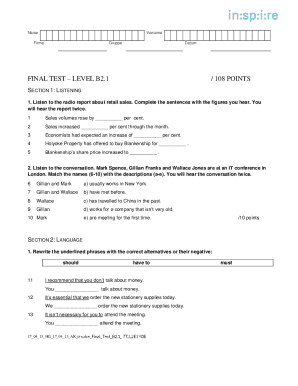

Frequently asked questions (FAQs)

A common question regarding trust business accounts is what distinguishes them from personal accounts. Trust business accounts are specifically designed to manage assets on behalf of beneficiaries, thereby maintaining a clear separation of personal and trustee assets. Furthermore, trust accounts often have distinct reporting requirements and tax implications, requiring greater scrutiny and management than personal accounts.

Another frequent inquiry relates to interest earnings on these accounts. Many trust business accounts do have options for earning interest based on the trust's financial structure. Approximately those revenues may be categorized differently for tax purposes, so consultation with a tax professional can provide clarity.

Real-world examples

To illustrate the practical application of trust business accounts, consider a case study involving a family-owned business. They established a revocable living trust to ensure a smooth transition of their business assets to the next generation. The trust business account facilitated streamlined management, making it easier for the appointed trustee to oversee day-to-day operations while ensuring compliance with legal requirements.

Another example features a non-profit organization managing donations through a charitable trust business account. The ability to maintain rigorous oversight of funds helped them demonstrate transparency and build trust with their donors, ultimately leading to increased contributions and community support.

Conclusion: the importance of proper account management

Establishing and managing a trust business account effectively offers lifelong benefits not only for the trustees but also for the beneficiaries involved. From ensuring compliance with fiduciary duties to optimizing tax benefits, the advantages are numerous. This management is made simpler by leveraging digital tools like pdfFiller, which streamline the application process, document collaboration, and eSigning.

Encouraging individuals and teams to utilize these resources can pave the way for a more accessible and efficient method of managing trust-related documents. By staying organized and informed, applicants can navigate the trust business account application process with confidence, setting themselves up for long-term success.

Interactive tools and resources

For those interested in pursuing a trust business account, pdfFiller offers easy access to the trust business account application form, allowing users to fill out, edit, and manage their documents from anywhere. By providing an interactive checklist specifically tailored for trust business applications, pdfFiller enhances the user experience and ensures nothing essential is overlooked.

Additionally, support is available through simple contact forms on the pdfFiller platform, further facilitating assistance with any inquiries relating to trust business accounts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the trust business account application in Gmail?

How do I edit trust business account application straight from my smartphone?

Can I edit trust business account application on an iOS device?

What is trust business account application?

Who is required to file trust business account application?

How to fill out trust business account application?

What is the purpose of trust business account application?

What information must be reported on trust business account application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.