Comprehensive Guide to Your Brokerage Agreement Template Form

Understanding a brokerage agreement

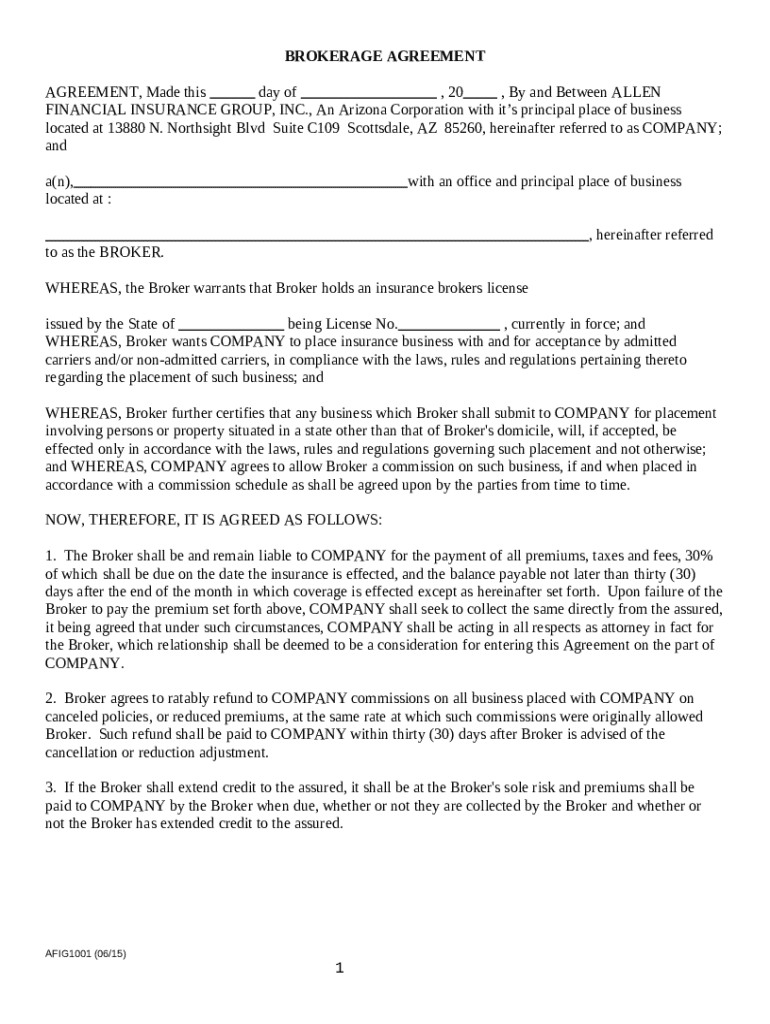

A brokerage agreement serves as a critical legal document that outlines the relationship between a broker and their client. By defining the responsibilities and expectations of both parties, it provides a framework for transactions in various sectors, including real estate, finance, and insurance. Having a formal brokerage agreement is not merely a legal formality; it's essential in protecting the interests of all parties involved. Without such an agreement, misunderstandings can arise, potentially leading to disputes.

The significance of having a brokerage agreement lies in its ability to clarify roles and establish clear expectations. For example, in real estate, a brokerage agreement will outline the broker's duty to market the property effectively while ensuring that the seller understands their obligations during the sale process. By formalizing this relationship, both parties can operate with the assurance that their interests are legally protected.

Key components

Every brokerage agreement should include essential elements that address the scope of the services offered, the commission structure, and the duration of the agreement. Furthermore, variations may exist depending on the context—real estate brokers might focus on property sales, while financial brokers could emphasize investment strategies. Common components include:

Identification of all parties signing the agreement.

Details regarding the services the broker will provide.

Structure and timing of payments from the client to the broker.

Time limits placed on the agreement and conditions for ending it.

Protection of sensitive information exchanged during the agreement.

Importance of using a template

Using a brokerage agreement template form streamlines the process of drafting a legally binding document. One of the significant benefits is the time saved, as standardized templates can reduce the effort required to create a new agreement from scratch. This aspect is particularly beneficial for busy professionals who need to focus their attention elsewhere.

Moreover, utilizing a template helps ensure compliance with legal standards. Templates often include necessary clauses and provisions to comply with local regulations, significantly reducing the risk of errors or omissions that could jeopardize the agreement's validity. This feature is especially important in industries where legal conditions frequently change.

Features of a quality template

A well-crafted brokerage agreement template form should have multiple key features. Firstly, a user-friendly design allows for easy navigation and understanding of the terms involved. Customizable sections enable users to tailor the agreement to their specific needs, whether they're in real estate, finance, or insurance.

Additionally, incorporating interactive elements like responsive fields and drop-down menus transforms the template into an engaging experience. Features that support seamless editing and signing expand its usability, making it suitable for diverse client scenarios.

Navigating the brokerage agreement template

Navigating a brokerage agreement template becomes an effortless task, especially with a well-structured layout. Typically, the document is divided into sections, such as introductory clauses, party identification, and service scope, making it user-friendly. With platforms like pdfFiller, users benefit from an intuitive user interface that guides them through each step.

Essentially, the template’s layout is designed to lead users seamlessly from one section to another, promoting clarity throughout the completion process. For instance, a clear table of contents can direct users to the relevant parts of the agreement they need to fill out, which is particularly helpful in more extensive agreements.

Interactive tools within the template

In today’s digital environment, integrating interactive tools within the brokerage agreement template offers added flexibility and ease of use. The editing options allow users to customize text, insert images, and add annotations easily. Having these capabilities ensures that any specific details unique to the client or transaction can be incorporated effortlessly.

Additionally, platforms like pdfFiller offer eSignature features, ensuring that the signing process is not only secure but also efficient. Both parties can sign the agreement electronically, which accelerates the finalization of the document. Collaboration tools facilitate team input and feedback, enhancing productivity by streamlining the review and adjustment process.

Step-by-step guide to filling out the brokerage agreement template

Before filling out the brokerage agreement template form, it’s crucial to prepare properly. Gather all necessary information, such as the identities of the parties involved, specific services offered, and commission structures. This pre-work ensures that you can complete each section accurately and comprehensively.

When diving into filling the template, consider the following detailed sections and their descriptions:

Correctly entering names, roles, and contacts of all involved parties.

Clearly defining what services the broker will provide to the client.

Specifying the compensation structure, including how and when payments will be made.

Outlining time frames for the agreement and any termination conditions that may apply.

Embedding clauses that protect sensitive information during and after the business relationship.

Once you have completed filling each section, it’s essential to review the document thoroughly. Checking for clarity, grammar, and consistency ensures that all parties are on the same page. Moreover, obtaining consent from all parties before finalizing the document is paramount to its legal effectiveness.

Editing the brokerage agreement template

Using platforms like pdfFiller provides access to powerful editing features for the brokerage agreement template. This allows users to easily make adjustments to existing templates, making it simple to keep agreements up-to-date with current practices and legal standards. The ability to incorporate changes ensures that any alterations reflect the most accurate information for each transaction.

Best practices for document management involve organizing templates effectively for future reference. Save multiple versions of agreements to avoid confusion and ensure that you can revert to prior iterations if needed. This practice enhances the reliability of your documentation process, especially for businesses with a high volume of transactions.

Signing the brokerage agreement

Understanding electronic signatures is vital when finalizing brokerage agreements. In many jurisdictions, eSignatures hold the same legal weight as traditional signatures, making them a secure and efficient option for executing documents. Utilizing generous platforms like pdfFiller allows users to navigate the signing process without legal concerns.

To sign a document using pdfFiller, users can simply click on the designated eSign feature, follow prompts to complete their signature, and finalize the document. It's a straightforward process that encourages timely completion of agreements while maintaining security protocols.

Securing signed agreements

Once the brokerage agreement is signed, securing the document becomes paramount. Recommendations for securely storing signed agreements include using cloud-based systems that offer backup capabilities and access control features. By implementing robust security measures, users can safeguard sensitive information contained within these documents.

Additionally, employing sharing options responsibly ensures that only authorized individuals have access to the signed agreements, further protecting the integrity of the agreement.

Managing your brokerage agreements

Effective management of brokerage agreements can significantly enhance operational efficiency, particularly within teams. Utilizing collaborative tools enables sharing and editing among different team members, ensuring that everyone involved has the latest version. This aspect is crucial for maintaining clarity in transactions and fostering team communication.

Furthermore, keeping track of changes and revisions using pdfFiller's version history feature, companies can hold on to a comprehensive record of the evolution of their agreements, enabling easier access to historical data when necessary.

Ensuring compliance and record-keeping

Accurate record-keeping is not simply a best practice but a requirement in many business contexts. Organizations must be mindful of maintaining detailed records of all brokerage agreements, including any amendments or extensions. By using pdfFiller’s features for compliance documentation, users can easily keep their records organized and accessible, facilitating a smoother audit process.

Implementing a systematic approach to compliance ensures that all parties adhere to legal guidelines, thus protecting the business from potential liabilities. Employing technology aids in safeguarding documents and managing compliance requirements efficiently.

Frequently asked questions

When dealing with brokerage agreements, users often have a range of questions that pertain to the structure, legality, and functionalities of their templates. Common queries may include how long a brokerage agreement remains valid, whether all parties need to be present during signing, and which elements specifically make an agreement enforceable.

Addressing these inquiries ensures that individuals and teams are equipped with the knowledge needed to navigate the complexities of brokerage agreements effectively. The pdfFiller platform provides resources and support to clarify terms and features related to their templates.

Tips for success

When completing a brokerage agreement template form, it’s essential to be aware of common pitfalls. Common mistakes include not clearly defining the scope of services, ambiguous commission structures, and failing to clarify termination conditions.

Best practices involve verifying that all details are precise and unequivocal to avoid any disputes in the future. Moreover, consider having legal counsel review your agreements periodically to align with evolving regulations. This precaution offers additional assurance that your agreements are robust and well-founded.