Get the free Ncf Savings Bank Switch Kit

Get, Create, Make and Sign ncf savings bank switch

Editing ncf savings bank switch online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ncf savings bank switch

How to fill out ncf savings bank switch

Who needs ncf savings bank switch?

Guide to Completing the NCF Savings Bank Switch Form

Understanding the NCF Savings Bank Switch Form

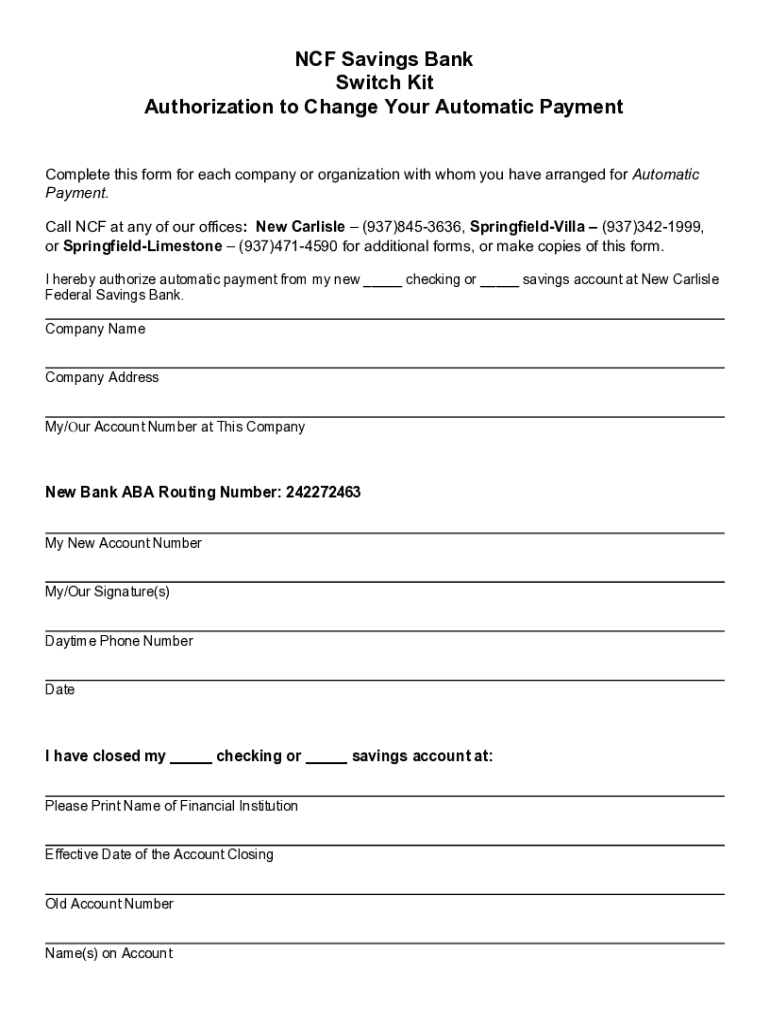

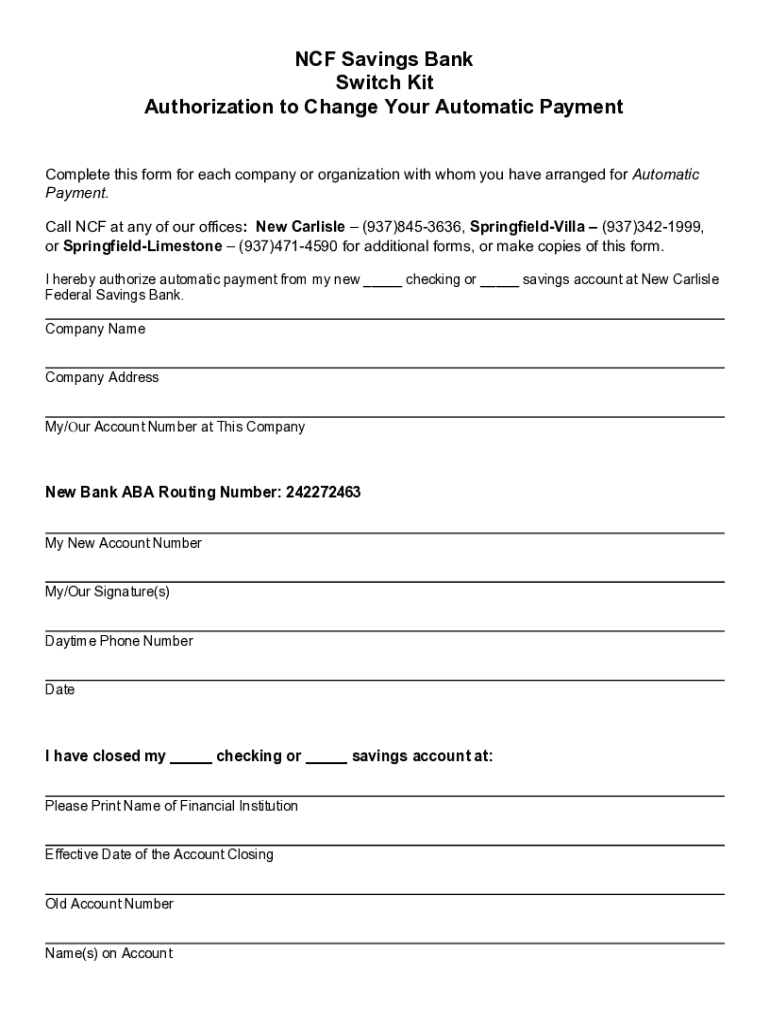

The NCF Savings Bank Switch Form is a vital document designed for individuals wishing to transition their banking relationship from one institution to another. This form serves as an official request to close your current account and initiate the opening of a new account, streamlining the process of switching banks. This switch is not just about moving your money; it is an opportunity to reassess your banking needs and seek out services that better fit your financial situation.

The primary purpose of the NCF Savings Bank Switch Form is to facilitate a smooth transition, reducing the likelihood of service interruptions during the switch. Users benefit from a simplified workflow, as the form consolidates necessary information in one location while ensuring that all critical details are addressed. One significant advantage of using this switch form is transparency; it clearly outlines what your responsibilities are, and what to expect from both your old and new bank during the process.

Preparing to complete the NCF Savings Bank Switch Form

Before diving into the NCF Savings Bank Switch Form, it’s crucial to prepare essential information to ensure you fill it out accurately. This information typically includes your personal identification details, current account information, and options for your new account preferences. Gather your identification documents, such as a government-issued ID, and have your current bank account details ready as they will be necessary for your application.

When preparing to switch banks, it’s advisable to evaluate the terms and features offered by your new account options. Take note of fees associated with your current account that may not exist with your new bank, and consider any features such as online banking availability, customer service quality, and additional services like mobile deposit. Understanding these factors can prevent you from unexpected surprises during and after the switch.

Step-by-step guide to filling out the NCF Savings Bank Switch Form

Completing the NCF Savings Bank Switch Form can seem daunting, but it can be straightforward if you follow these steps. Start by accessing the form through pdfFiller, where it is available for easy downloading. Once you have the form, you’ll begin by filling in your personal details, ensuring you input your information accurately.

In the subsequent sections of the form, provide your current account information, including account numbers and other banking details. Next, as you select your new account options, think about what features you require and make those choices clear. Once all sections are filled out, take the time to review your completed form carefully, ensuring that all details are accurate to avoid delays in processing your request.

Editing and customizing your switch form with pdfFiller

One of the standout features of pdfFiller is its editing capabilities, enabling users to customize the NCF Savings Bank Switch Form efficiently. If you need to make changes after initial completion, pdfFiller offers robust tools that allow you to modify and adjust your document as needed. This flexibility ensures that your form reflects your accurate financial preferences and details.

Utilize interactive tools within the pdfFiller platform to enhance your experience while using the switch form. For instance, you can take advantage of text fields, checkboxes, and drop-down menus that make the process easier. Don’t forget to save your edits periodically to maintain document integrity and avoid losing any changes.

Signing the NCF Savings Bank Switch Form

After completing the NCF Savings Bank Switch Form, the next step is to sign it. pdfFiller provides multiple options for eSigning your form, offering security and convenience as you finalize your document. eSignatures are legally recognized, which means you can confidently submit your form without the need for physical signatures.

Understanding the implications of your eSignature is crucial; it binds you to the agreement outlined in the switch form. Moreover, ensure your document's security when signing. With pdfFiller, you can easily navigate through the signing process while protecting your information and guaranteeing a seamless transaction.

Submitting the NCF Savings Bank Switch Form

Once your NCF Savings Bank Switch Form is complete and signed, it's time to submit it. You have several options for submission; you can opt for online submission via your new bank’s portal or deliver the form in-person at a branch. Each method has its advantages, with online submissions often being quicker while in-person submissions may provide an added sense of assurance.

After submitting your completed form, it’s essential to track your application status. Stay in touch with both your old and new banks to ensure the transition is proceeding smoothly and that any outstanding balances are transferred correctly without discrepancies. Being proactive helps avoid delays.

Common questions about the NCF savings bank switch process

The switch process can raise several questions, particularly for users unfamiliar with how banking transitions work. One common inquiry is regarding the duration of the switch process; typically, it can take anywhere from a few days to a couple of weeks depending on the banks involved and their processing times. Remaining aware of your new bank’s communication practices can help clarify this timeline.

Another question pertains to the ability to switch back to your previous bank. Generally, you can reopen a closed account, but this may involve an additional process that could depend on your previous account's terms. During the transition, your current balance will be securely managed to ensure it follows through to your new account without missing funds. Be proactive in addressing common issues that may arise by staying informed.

Additional financial tools for better banking management

To further aid in document organization and banking management, utilizing tools like pdfFiller is invaluable. This platform allows you to manage all your banking documents, including forms, contracts, and financial statements, from a single cloud-based solution. Leveraging pdfFiller for document creation and management streamlines your banking experience while ensuring all your paperwork is organized and accessible.

In addition to the NCF Savings Bank Switch Form, pdfFiller offers other relevant forms and templates that can assist you in various financial transactions. Consider using tools for tracking expenses, creating budgets, or organizing important banking documents, enhancing your overall financial management.

Important notices and disclaimers

When switching banks, understanding the implications of your actions is vital. While this guide provides detailed steps for completing the NCF Savings Bank Switch Form, always refer to your specific bank for the most accurate and up-to-date information regarding account switching. Be aware that external links and resources are meant to assist your switching process, but they may present additional risks. Each bank's policies can differ radically; thus, it's imperative to review the terms of service before making any final decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ncf savings bank switch from Google Drive?

How do I edit ncf savings bank switch on an iOS device?

How do I complete ncf savings bank switch on an iOS device?

What is ncf savings bank switch?

Who is required to file ncf savings bank switch?

How to fill out ncf savings bank switch?

What is the purpose of ncf savings bank switch?

What information must be reported on ncf savings bank switch?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.