Get the free Notification Certificate of Taxable Fuel Registrant

Get, Create, Make and Sign notification certificate of taxable

Editing notification certificate of taxable online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notification certificate of taxable

How to fill out notification certificate of taxable

Who needs notification certificate of taxable?

Notification Certificate of Taxable Form: A Comprehensive Guide

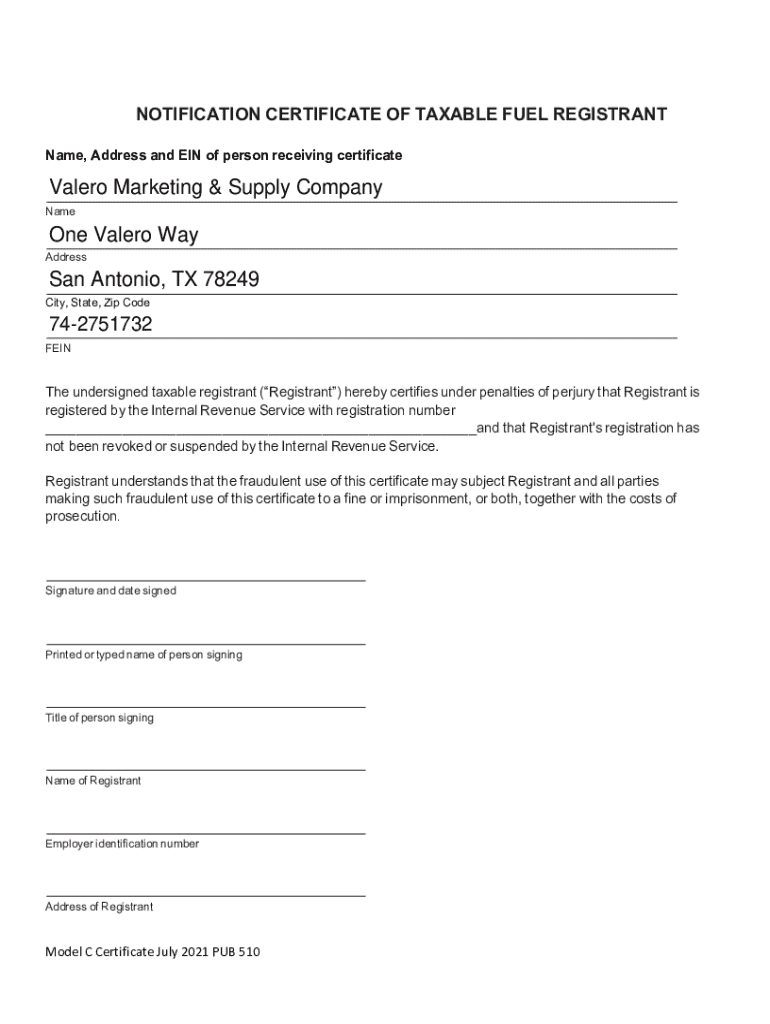

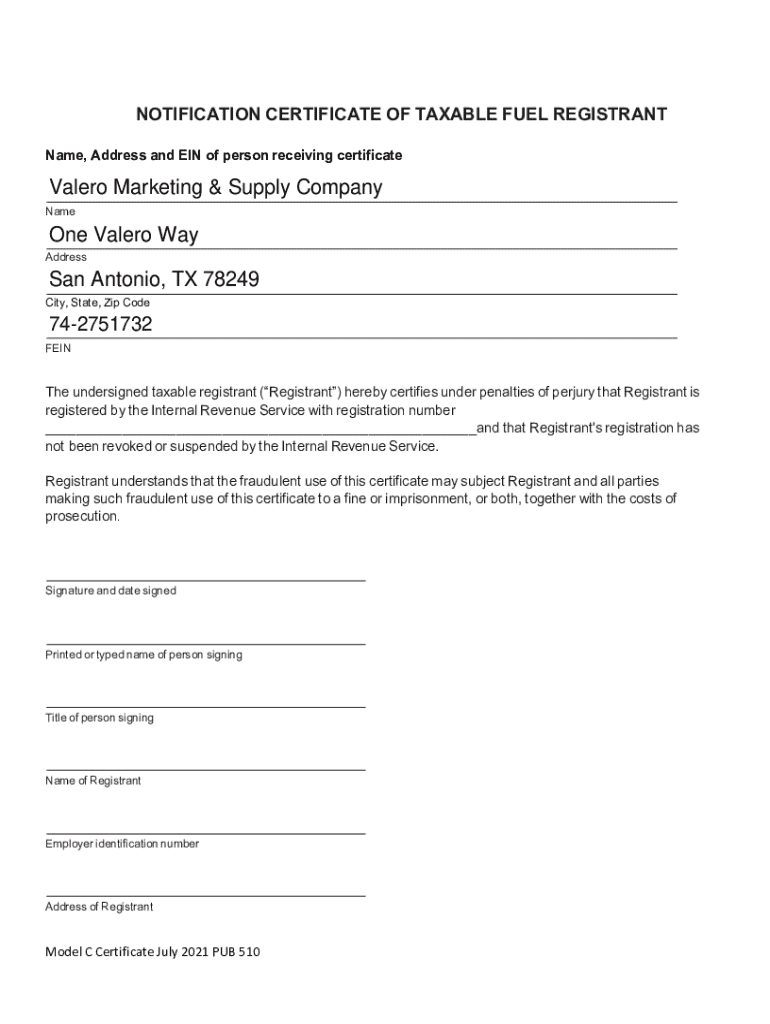

Understanding the Notification Certificate of Taxable Form

A Notification Certificate of Taxable Form is an official document that provides taxpayers with critical information about their taxable income, deductions, and credits. This form serves as a basis for individual and business tax filings, ensuring compliance with local, state, and federal tax laws. The importance of the notification certificate cannot be overstated, as it lays the groundwork for accurate reporting and prevents potential legal complications arising from tax discrepancies.

Individuals, businesses, and tax professionals all play unique roles in the process of obtaining and using this certificate. Individuals often need to verify their personal income details, while businesses may require comprehensive information about rental payments or sales revenue. Tax professionals utilize these certificates to facilitate the accurate preparation of income tax forms, ensuring their clients meet all regulatory requirements.

Key components of the notification certificate

The notification certificate includes several essential components, starting with personal details such as names, addresses, and Social Security numbers. Each taxpayer receives a unique tax identification number (TIN) to streamline processing and tracking within the IRS. Accurate income details are crucial, encompassing wages, dividends, interest income, and other sources of taxable revenue. Common terminology like taxable income versus non-taxable income, as well as deductions and credits available to taxpayers, should be clearly understood and defined.

Step-by-step guide to filling out the notification certificate

Preparing to fill out your notification certificate involves gathering all necessary documents, such as W-2s and 1099s. Understanding your financial situation comprehensively is key to ensuring accuracy in your tax reporting. Each section of the certificate requires specific information, so having your financial records readily accessible will facilitate a smoother process.

When filling out the certificate, start with the Personal Information Section. Double-check for spelling errors in names or inaccuracies in addresses as these can lead to processing delays or rejections. Then, move on to the Income Reporting Section where you report various types of income, including self-employment earnings or investment returns. In the Deductions & Credits Section, be sure to account for all relevant deductions that may apply to your situation, such as mortgage interest or charitable contributions.

Finally, make sure to review your completed form; it’s best practice to have a checklist that confirms every section is filled out correctly. This verification step is vital because it can save you from costly errors and delays in processing.

Editing and customizing the notification certificate

Editing your notification certificate is easily accomplished using tools like pdfFiller, which allows you to upload and modify your form effortlessly. The editing tools available enable users to adjust text, add images, or even draw directly on the document. This is particularly useful if you notice mistakes after you've initially filled out the form.

If you need to make corrections after submitting your form, it’s essential to know the steps to amend your filing. Early corrections are crucial, as errors can create complications during audits or lead to additional taxes owed down the line.

E-signing the notification certificate

E-signatures provide significant benefits, notably in speed and convenience. Using pdfFiller, you can easily apply your signature with just a few clicks, reducing the time spent on paperwork. Added security features—like authentication methods—ensure that your signature is legally binding and protects your sensitive information.

The process of e-signing with pdfFiller is straightforward: simply navigate to the signature section of your document, select your preferred signing method, and follow the prompts. Be prepared to resolve any issues that might arise, such as verification delays or technical errors, by consulting pdfFiller’s help resources.

Collaborating on the notification certificate

When working on your notification certificate with colleagues or tax professionals, pdfFiller provides an array of sharing options. You can give specific permissions and access settings to control who can view or edit your document. This collaborative approach enhances the accuracy of your submissions, as feedback can be readily incorporated.

Utilizing comments and annotations helps streamline communication regarding tax matters. By allowing other contributors to provide input, you can ensure that every angle is addressed, which contributes to a more precise and effective filing process.

Managing your notification certificate

Once you’ve completed your notification certificate, safe storage is the next essential step. Using cloud storage solutions offers the benefit of accessibility from any device, allowing you to stay organized and prepared, especially as tax deadlines approach. pdfFiller makes this easy, providing a centralized location for all your tax-related documents.

Accessing your form anytime, anywhere enables you to manage your documents efficiently, especially during peak tax season when timing is crucial. The cross-device accessibility provided by pdfFiller ensures that you’re never left scrambling for documents when they are most needed.

Common FAQs about the notification certificate of taxable form

A frequent query centers around what to do if a Notification Certificate is lost or misplaced. It’s essential to contact your tax authority for reissuance. Discrepancies in reported income also cause concern; ensure to gather documentation supporting your claims to facilitate corrections. Another common question is whether you can file taxes without this form. While it is technically possible, it is not advisable as this can lead to complications and increased scrutiny on your return.

Insight from tax professionals suggests maintaining organized records of all forms related to income tax and utilizing dedicated systems for tracking filings, ensuring compliance with tax laws. Utilizing comprehensive tools like pdfFiller can simplify this process and empower users to manage their documents effectively.

Preparing for tax season with pdfFiller

As tax season approaches, using pdfFiller for your Notification Certificate of Taxable Form becomes increasingly beneficial. With an all-in-one document solution available at your fingertips, you can easily create, edit, and sign forms without the hassle of cluttered paperwork. The platform's efficient collaboration features allow multiple users to contribute seamlessly, promoting accuracy and ensuring timely submissions.

Being aware of upcoming deadlines and important dates is crucial for tax compliance. Organizing your timeline with pdfFiller allows you to manage submissions effectively, ensuring that no deadlines are missed, which can ultimately lead to penalties or missed deductions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my notification certificate of taxable in Gmail?

Can I create an electronic signature for the notification certificate of taxable in Chrome?

Can I create an electronic signature for signing my notification certificate of taxable in Gmail?

What is notification certificate of taxable?

Who is required to file notification certificate of taxable?

How to fill out notification certificate of taxable?

What is the purpose of notification certificate of taxable?

What information must be reported on notification certificate of taxable?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.