Get the free Application for Interbank Giro

Get, Create, Make and Sign application for interbank giro

How to edit application for interbank giro online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for interbank giro

How to fill out application for interbank giro

Who needs application for interbank giro?

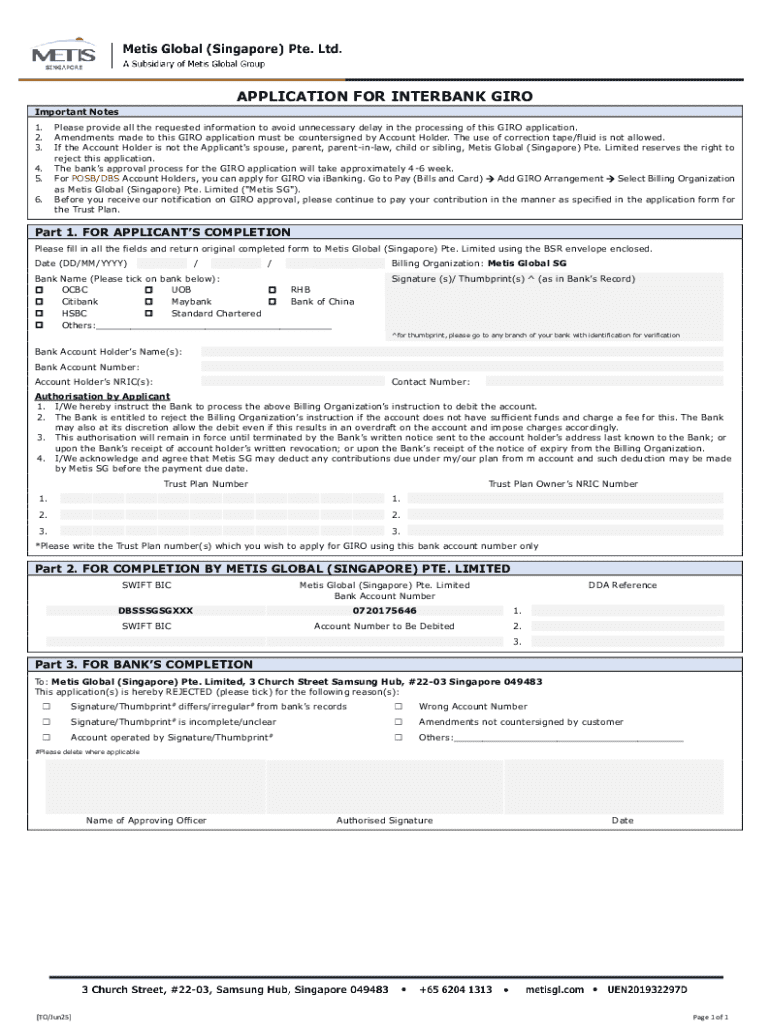

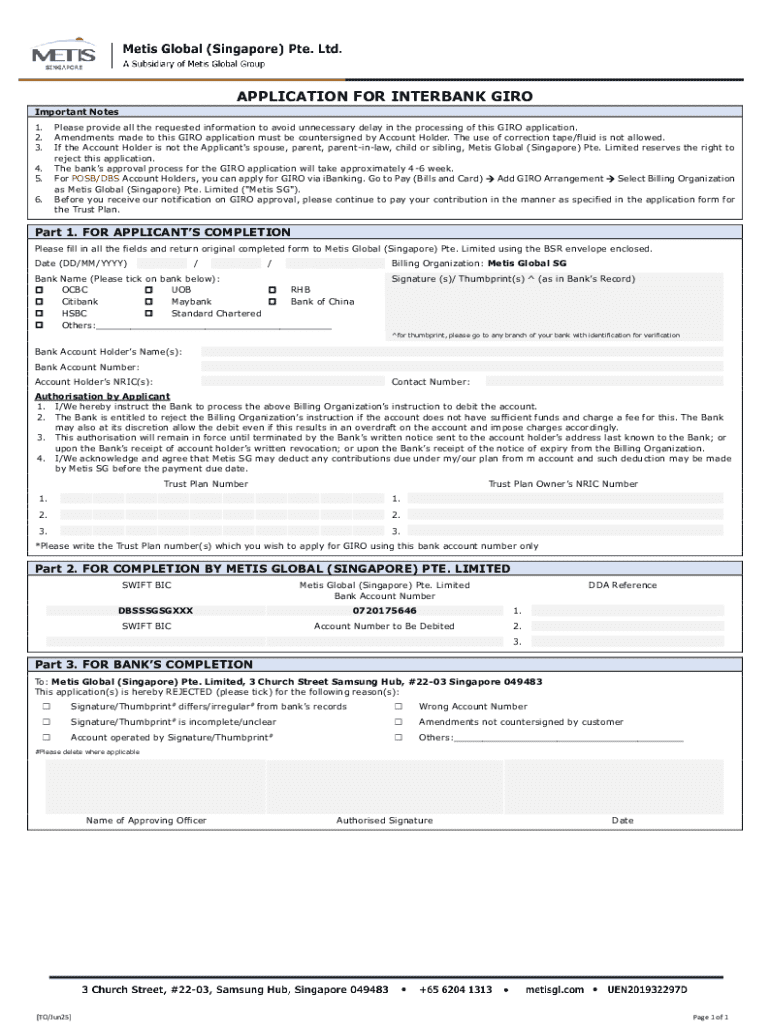

Application for Interbank Giro Form: A Complete Guide

Understanding interbank giro payments

An interbank giro form is a crucial document that facilitates the transfer of money between different banks. This form is typically used to authorize automatic transfers, such as recurring payments for utility bills or loan repayments. It streamlines the payment process, making it easier for both businesses and individuals to manage their financial transactions efficiently.

The significance of the interbank giro form spans multiple facets of finance. By allowing seamless transactions across various banking institutions, it enhances liquidity and ensures that payments are processed swiftly. In today's fast-paced economy, the ability to transfer funds securely and reliably is paramount.

The importance of properly filling out the interbank giro form

Filling out the interbank giro form correctly is critical to ensure smooth transactions. Mistakes, even minor ones, can lead to transaction failures or delays, affecting cash flow and incurring potential fees. Invalid account details and incorrect payment amounts are the most prevalent mistakes that can disrupt the transaction process.

Errors in the interbank giro form can result in serious financial consequences. For instance, a wrong account number could lead to funds being sent to the incorrect recipient. These errors might necessitate formal processes for correction, resulting in wasted time and additional fees. Understanding the implications of these mistakes emphasizes the need for careful attention when completing the form.

Step-by-step guide to filling out the interbank giro form

Before you begin filling out the interbank giro form, gather all necessary information. This includes your personal identification details and the payment receiver's bank account information. Having everything on hand aids in avoiding mistakes and ensures a smoother process.

After completing the form, you can submit your application either online through your bank's portal or offline by visiting a branch. Always review the form for accuracy before submission to ensure a hassle-free transaction.

Editing and customizing your interbank giro form

Utilizing pdfFiller provides an easy way to edit your interbank giro form. You can upload a blank or previously filled form and access various editing tools that allow you to correct errors or make any necessary adjustments effortlessly.

Adding a digital signature is another crucial feature in pdfFiller. An eSignature secures your documents and enhances the authentication process. To add an eSignature, you simply need to click on the designated area, create your signature using the mouse or touchscreen, and save it to apply it to the form.

Managing your interbank giro form in the cloud

Cloud-based document management brings numerous benefits. With pdfFiller, you can access your interbank giro form from anywhere and at any time, ensuring that important documents are always at your fingertips. Automatic backups safeguard your forms from loss or corruption, while secure storage keeps your personal information safe.

Additionally, collaboration with team members becomes effortless when managing your interbank giro form in the cloud. You can share documents for review, track changes made by others, and maintain a version history to ensure all parties are aligned.

Frequently asked questions (FAQs) about interbank giro forms

What should you do if your interbank giro form is rejected? This common issue usually arises from inaccuracies or incomplete sections. Review your submission carefully to identify and rectify any errors before reapplying.

How long does it take for transactions to process? This varies by bank; however, many transactions within the same banking network can often be completed within hours, while those involving different banks may take several business days.

Can you cancel or modify a submitted interbank giro? Generally, this depends on the stage of the transaction process. If the transaction is still pending, some banks may allow you to cancel or amend it, but once processed, changes are impossible.

Additional tips for successful interbank transactions

Understanding processing fees associated with interbank transfers is essential to avoid unexpected costs. Different banks charge varying fees for transactions, so it's advisable to confirm these charges before transferring funds.

To ensure secure transactions, adopt best practices that include using strong passwords and always verifying recipient details before authorizing a payment. Keeping track of your payments can be effectively managed with various online tools and applications that provide real-time updates on transaction statuses.

Leveraging pdfFiller for other financial document needs

PdfFiller is not just about filling out the interbank giro form; it also provides access to a suite of related documents, such as authorization forms and invoices, that are essential for various financial transactions. Using pdfFiller can greatly enhance the efficiency of your financial workflows.

By integrating pdfFiller into your financial document management, you can create a streamlined process where all necessary forms are easily accessible and editable within a single platform, significantly reducing the time and effort required to manage multiple documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send application for interbank giro to be eSigned by others?

How do I execute application for interbank giro online?

How do I edit application for interbank giro on an Android device?

What is application for interbank giro?

Who is required to file application for interbank giro?

How to fill out application for interbank giro?

What is the purpose of application for interbank giro?

What information must be reported on application for interbank giro?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.