Get the free Form 1098-t

Get, Create, Make and Sign form 1098-t

Editing form 1098-t online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1098-t

How to fill out form 1098-t

Who needs form 1098-t?

Form 1098-T Form: A Comprehensive How-to Guide

Understanding Form 1098-T: What You Need to Know

Form 1098-T is a crucial document used by educational institutions to report qualified tuition and related expenses to the Internal Revenue Service (IRS) and students. It is essential for students pursuing higher education to understand this form, as it influences tax credits and deductions they may be eligible for, notably the American Opportunity Tax Credit and the Lifetime Learning Tax Credit.

The importance of Form 1098-T lies in its role as a key resource for students in managing their educational expenses. By providing clear records of tuition paid and financial aid received, this form helps students effectively plan their finances and understand potential tax implications.

Generally, students enrolled in higher education institutions, including colleges and universities, who pay tuition and fees are eligible to receive a 1098-T form. Educational institutions are obligated to prepare and send this form if the student is enrolled and has made qualifying payments towards their education.

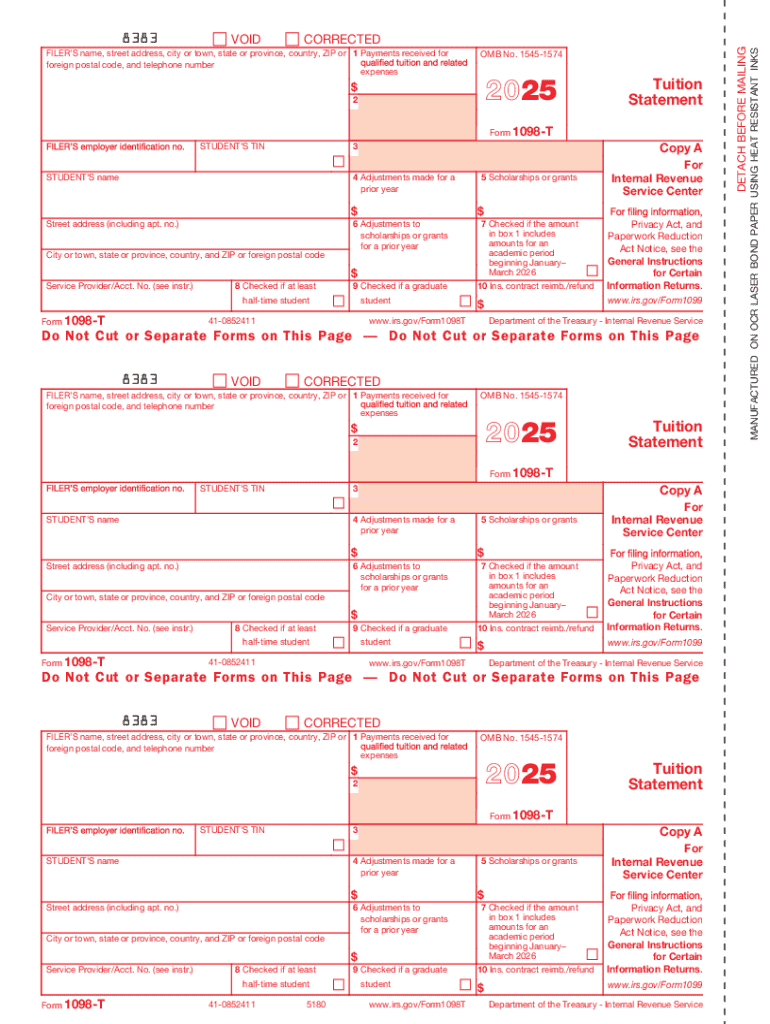

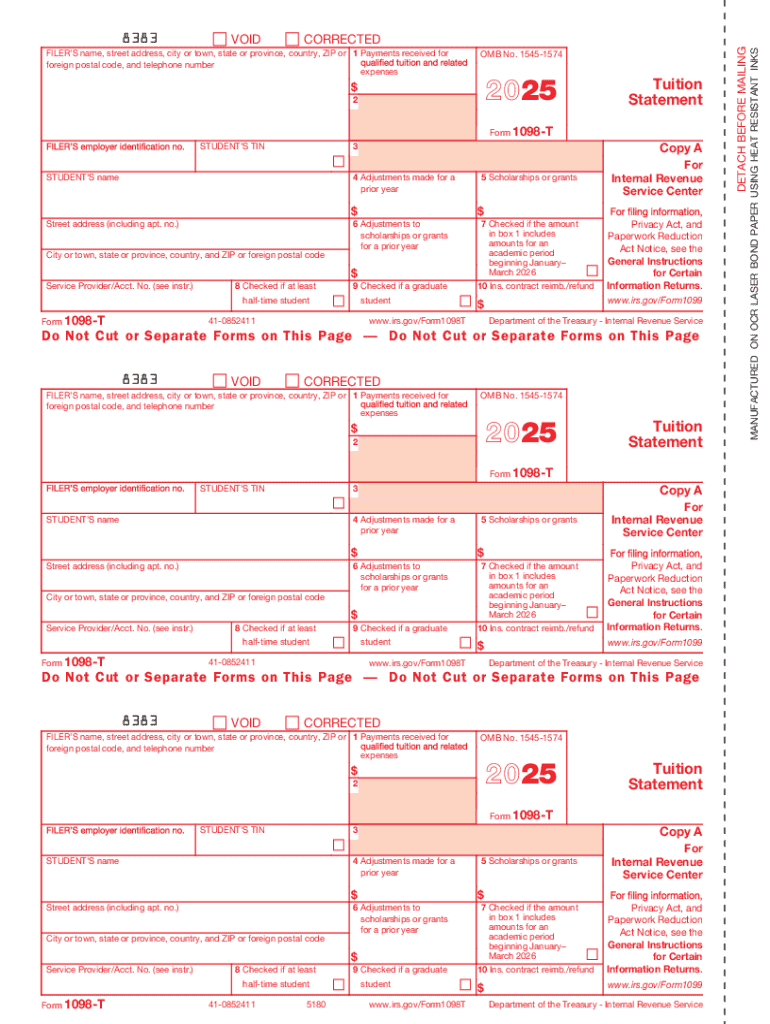

Detailed Breakdown of Form 1098-T Components

A comprehensive understanding of Form 1098-T starts with a detailed breakdown of its key components. The form includes important sections such as the reporting institution's name, address, and Employer Identification Number (EIN), providing assurance of the institution's legitimacy.

Student information is also vital. It typically includes the student’s name, address, and Tax Identification Number (TIN), ensuring accurate records. The form presents box reporting for qualified tuition and fees, with Box 1 indicating amounts billed for the tax year and Box 2 representing retroactive billing. Box 5 reports any scholarships or grants received by the student, which can affect overall tuition liability and potential refunds.

Step-by-step instructions for filling out Form 1098-T

Filling out Form 1098-T accurately is essential for both students and their educational institutions. To get started, you’ll need several documents, including tuition payment receipts, scholarship notifications, and any statements regarding other educational expenses. Having these documents on hand simplifies the process and ensures accurate entries.

When completing the form, start with the institution information. Fill in the name, address, and EIN in the designated spaces. Next, proceed to the student information section—make sure to provide accurate details to prevent complications. For Boxes 1 and 2, report only qualified expenses. Typically, you’ll indicate the total amount billed for tuition in Box 1; if your institution uses Box 2, report changes in the revenue for the previous year if relevant.

Finally, in Box 5, be transparent about any scholarships or grants received that reduce the amount of tuition owed. This transparency ensures that the reported data reflects true expenses, leading to potential benefits during tax filing.

Handling your 1098-T form: What to do next

After receiving your Form 1098-T, it’s crucial to review it thoroughly for accuracy. Common mistakes include incorrect student identification numbers or amounts reported in error, which can lead to complications when filing your taxes. If you find discrepancies, address them promptly with your educational institution to correct errors before filing your taxes.

The 1098-T form also plays a significant role in your tax return process. It helps determine eligibility for various deductions and credits related to education expenses. Understanding the benefits associated with this form enables better financial planning, ensuring you can maximize your tax return. Common tax credits associated with Form 1098-T include the American Opportunity Tax Credit and the Lifetime Learning Tax Credit, both of which can significantly reduce your tax liability.

Digital solutions for managing your Form 1098-T

Managing Form 1098-T becomes efficient with digital solutions, especially through platforms like pdfFiller. This platform empowers users to edit PDFs seamlessly, eliminating the bottlenecks associated with traditional methods of completing forms. The ability to collaborate in real time means students and educational administrators can verify details without time delays, resulting in a streamlined documentation process.

Moreover, pdfFiller's electronic signing capabilities add convenience, making it easy to finalize documents without the need for printing. Users can access fillable PDF versions of Form 1098-T and even store these documents in the cloud for easy retrieval later. This ensures the 1098-T forms are always at hand when needed, whether for personal records or during tax filing periods.

Frequently asked questions (FAQs) about Form 1098-T

One common question regarding Form 1098-T is how one can obtain a copy if they didn't receive it. Students should reach out directly to the financial office of their educational institution, as they are responsible for issuing this form. In instances where students believe they should have received a form but did not, they can inquire about enrollment information, as sometimes administrative oversights occur.

Another frequent inquiry pertains to the impact of the 1098-T on future educational expenses. By understanding how their reported tuition and financial aid affect their tax situation, students can make informed decisions about managing future educational costs. Planning for upcoming tuition and financial aid becomes more transparent, assisting in budgeting for each term.

Additional support and resources

For those who need further assistance related to Form 1098-T, the IRS support hotline provides a valuable resource. Students can contact them with specific questions regarding the complexities of this form and its implications on their taxes. Additionally, reaching out to the financial office of one's educational institution can clarify individual circumstances related to tuition reporting.

Each educational institution might also have its own set of resources to assist students. It’s wise for students to explore their school's website or contact their financial aid department for personalized guidance. This support can often include access to institutional documents and detailed explanations surrounding the use of Form 1098-T, ensuring students have the right information at their disposal.

Specific resources per educational institution

Different educational institutions may offer tailored guides to help students navigate the 1098-T form. It's essential for students to familiarize themselves with the specific resources available at their own schools, as various institutions approach the reporting process differently. Many schools provide online tutorials, FAQs, or dedicated personnel to assist with financial aid questions.

Accessing these personalized resources can provide clarity on how to interpret the information on the 1098-T form and how it directly relates to tuition expenses. This knowledge empowers students to optimize their financial planning regarding education, ensuring they're making the most informed decisions possible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in form 1098-t without leaving Chrome?

Can I create an electronic signature for signing my form 1098-t in Gmail?

How do I edit form 1098-t on an Android device?

What is form 1098-t?

Who is required to file form 1098-t?

How to fill out form 1098-t?

What is the purpose of form 1098-t?

What information must be reported on form 1098-t?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.