Get the free Coordination of Benefits Information

Get, Create, Make and Sign coordination of benefits information

Editing coordination of benefits information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out coordination of benefits information

How to fill out coordination of benefits information

Who needs coordination of benefits information?

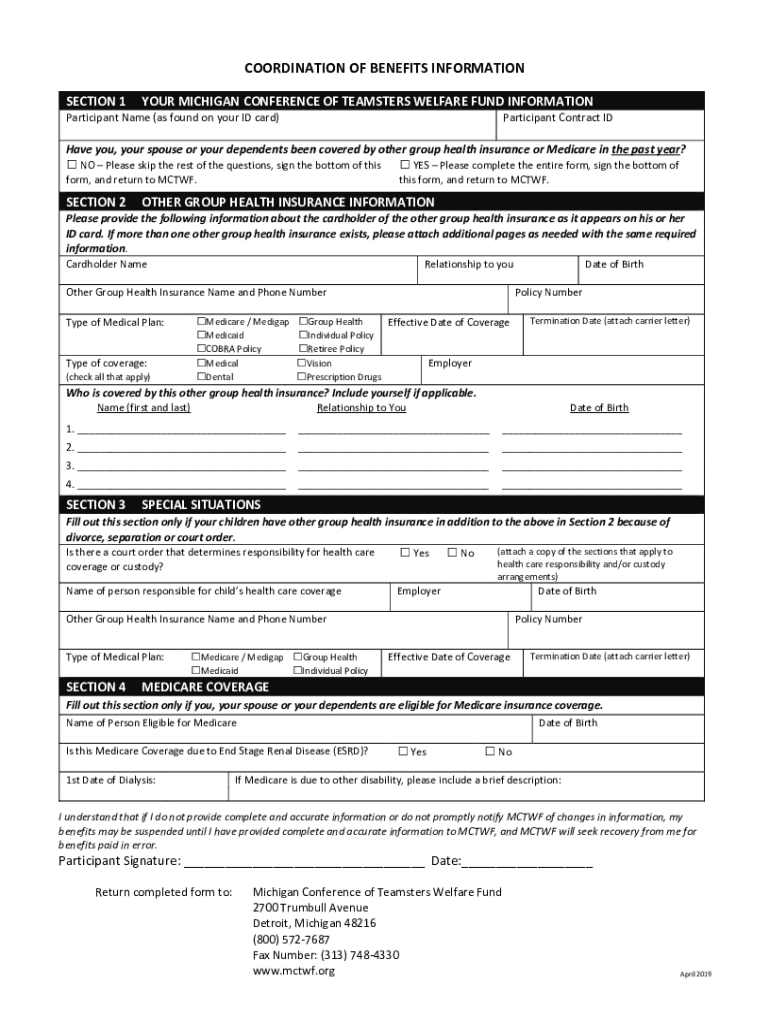

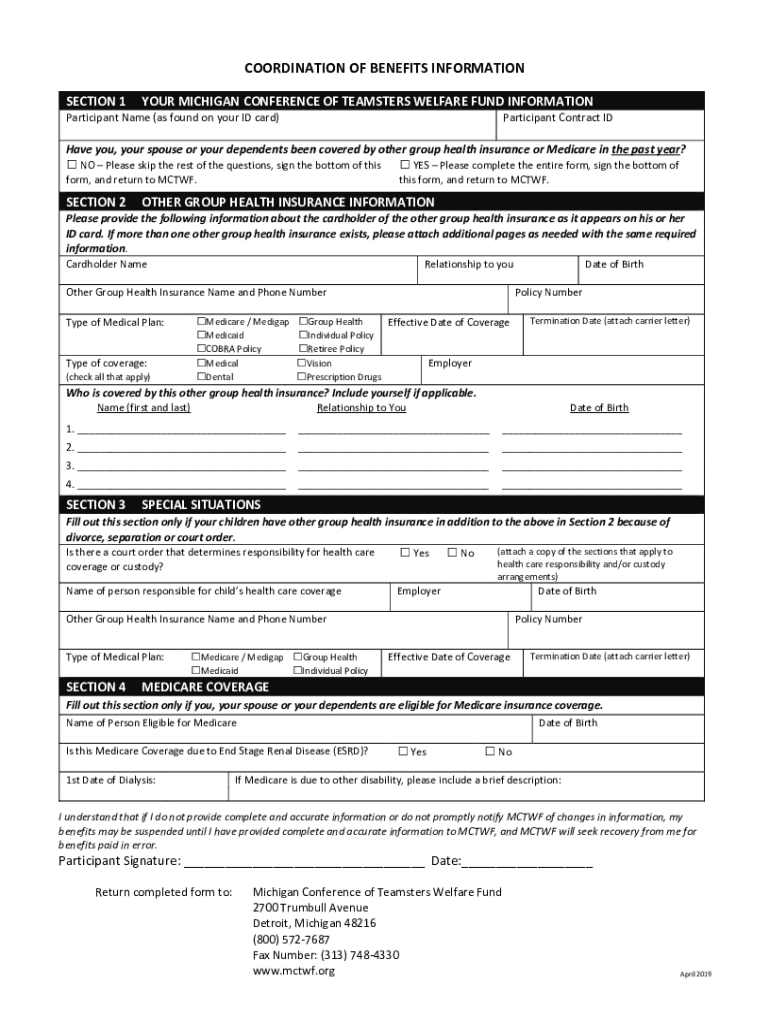

Understanding and Completing the Coordination of Benefits Information Form

Understanding the coordination of benefits (COB)

Coordination of Benefits (COB) is a crucial insurance process that ensures individuals covered by multiple health insurance plans do not receive more in benefits than the actual cost of their medical expenses. It allows insurers to share the financial responsibility for medical care. The importance of COB lies in its ability to help manage healthcare costs effectively, ensuring that patients receive the maximum allowable benefits without the risk of overpayment.

Situations that typically require the filling out of the COB Information Form include instances where an individual is covered by both a primary and a secondary insurer, such as when one parent has their child covered under their plan while the other also includes them in their own coverage. Understanding the instances that necessitate filling out this form is vital to avoid complications in claims processes.

Overview of the coordination of benefits information form

The Coordination of Benefits Information Form serves the primary purpose of collecting vital information concerning all applicable health insurance coverage that an individual may have. This is essential for insurers to accurately determine which policy should be billed first, thereby avoiding duplicate payments for the same service.

Key features of the COB Information Form typically include sections for participant and dependent information, spousal coverage details, as well as fields to declare any additional insurance policies. Individuals covered under multiple plans must complete this form to ensure proper processing of claims. Anyone who has multiple healthcare covers should fill out the form.

Step-by-step guide to completing the coordination of benefits information form

Initial preparation

Before diving into the COB Information Form, initial preparation is key. Gather necessary documents such as your insurance cards, personal identification, and care provider details. Familiarizing yourself with commonly used insurance terms related to COB, such as 'primary insurance' and 'secondary insurance', will also facilitate a smoother completion process.

Filling out the form

Section 1: Participant information

The first section of the form requires personal details like your full name, address, and date of birth. Ensure that the information is accurate and matches your official documents to avoid discrepancies. Consistency is crucial, especially when confirming identities across multiple insurance providers.

Section 2: Dependent information & declaration of coverage

In this section, you will need to include any dependents on your insurance plan. Provide accurate information about their coverage, highlighting which insurance covers what, especially if they are also covered under another policy. Correctly declaring this information is vital to facilitate proper coverage coordination.

Section 3: Spousal information

If applicable, report coverage details for your spouse. Include their insurance details and be prepared to outline how their insurance policy interacts with yours. Common issues include incorrect reporting of coverage or policy numbers, which can lead to processing delays or denial of benefits.

Section 4: Multiple dependent information

If you have multiple dependents, the form allows up to seven entries. Ensure each dependent is listed clearly with their respective insurance details. Double-check to ensure that all required fields are filled to maintain completeness and accuracy; this can prevent issues when claims are submitted.

Reviewing your form

After completing the COB Information Form, it's essential to conduct a thorough review of all entered information. Focus on areas such as names, insurance policy numbers, and effective dates. A checklist of common errors to avoid includes mismatched names, incomplete sections, and incorrect coverage declarations.

Digital options for completing your COB information form

Using digital platforms like pdfFiller for your COB Information Form offer numerous benefits. First and foremost, it simplifies the completion process, enabling you to input your information electronically and ensuring error reduction. The platform features robust capabilities such as cloud storage that allows you to access your documents from anywhere, eSigning for quick approvals, and collaboration tools for teams needing to review documents together.

Start by accessing pdfFiller, where you can conveniently upload and edit your COB Information Form. The platform provides step-by-step instructions on how to edit fields, add necessary information, and integrate interactive tools to enhance your experience. This ensures you are well-prepared with a completed and accurate form ready for submission.

Coordinating with your insurers

After completing your COB Information Form, understanding how to submit it to your insurers is crucial. Ensure that you follow any specific submission requirements outlined by your insurers, which may include mailing the form to a specific address or submitting it electronically through their websites. Most insurers typically have specified timelines for processing such forms.

Following submission, monitor your insurance claims actively. Contacting your insurers to confirm receipt of your form and inquiring about the expected timeline for processing can prevent any unnecessary delays in your claims. Being proactive can significantly ease the subsequent claims process.

Common questions and troubleshooting tips

As individuals navigate the COB Information Form, questions may arise. One common query is how to handle multiple insurance plans. In such cases, be transparent about all coverages when filling out the form, providing specific details for each plan held. If discrepancies in coverage information occur, reach out to the respective insurance providers immediately to rectify any potential mistakes.

Additionally, if issues arise while filling out the form, user support options are often available through your insurance providers or platforms like pdfFiller, which can provide technical assistance. Taking advantage of these resources can help you avoid delays and ensure your document is completed accurately.

The importance of keeping your COB information updated

Maintaining up-to-date information on your COB Information Form is crucial, particularly as life circumstances change. Regularly revisit the form, especially following significant life events such as a new job that affects health insurance, marriage, or the birth of a child. These changes can bring new insurance policies into play, necessitating revisions to your COB details.

Remaining diligent in updating your form not only assists in accurate claim processing but also enforces the terms of your various health plans. Keeping your insurers informed prevents billing complications and ensures coverage remains intact.

Maximizing your benefits through proper coordination

Effective coordination of benefits can significantly reduce out-of-pocket expenses for medical services. By ensuring that the primary and secondary insurers are correctly listed and utilized, you can take full advantage of both plans. This often leads to reduced co-pays and deductibles, maximizing the overall benefits you receive.

Strategies such as double-checking your form, understanding your plans' terms, and knowing the best order of claims can enhance the benefits received. It's essential to regularly evaluate your coverage and seek assistance to understand your rights and the benefits available through coordination effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in coordination of benefits information without leaving Chrome?

How do I edit coordination of benefits information on an Android device?

How do I complete coordination of benefits information on an Android device?

What is coordination of benefits information?

Who is required to file coordination of benefits information?

How to fill out coordination of benefits information?

What is the purpose of coordination of benefits information?

What information must be reported on coordination of benefits information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.