Get the free Mdufa Small Business Request

Get, Create, Make and Sign mdufa small business request

How to edit mdufa small business request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mdufa small business request

How to fill out mdufa small business request

Who needs mdufa small business request?

Understanding the MDUFA Small Business Request Form

Understanding the MDUFA small business request form

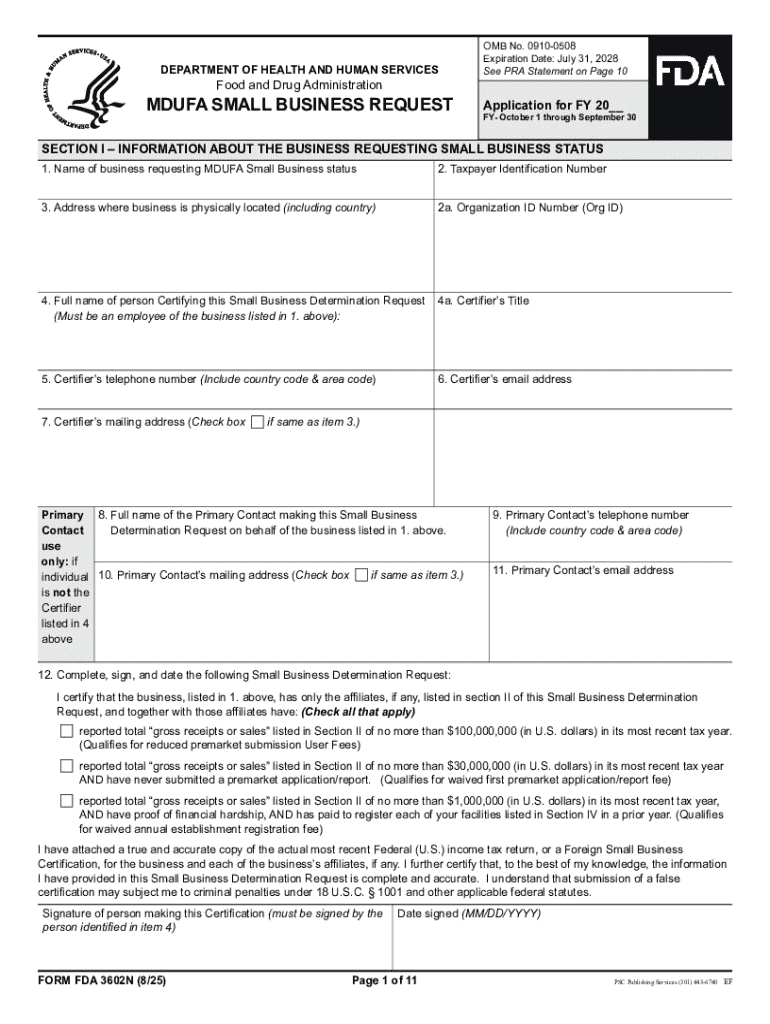

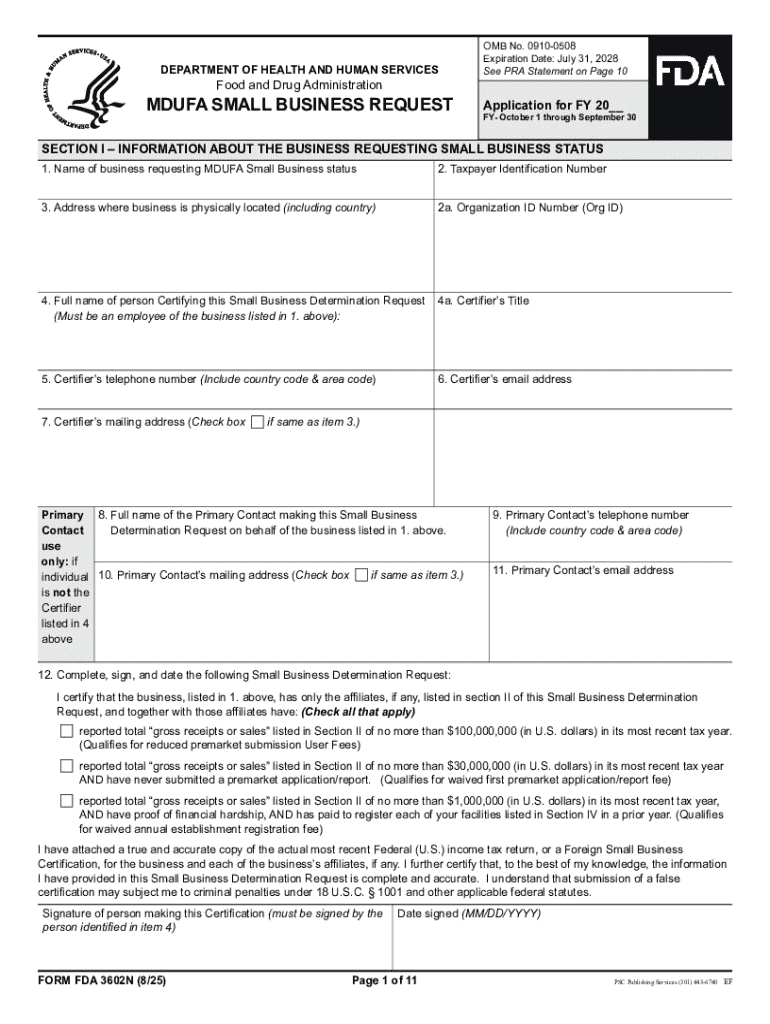

The MDUFA Small Business Request Form is an essential document for small businesses engaged in the development of medical devices. This form caters to the needs of small entities seeking qualification for a reduced user fee structure under the Medical Device User Fee Amendment (MDUFA). Its importance cannot be understated, as it enables small businesses to gain access to funding and support necessary for innovation and product development.

For small businesses, navigating the FDA regulations can be daunting. The MDUFA Small Business Request Form streamlines this process, reducing the financial burden typically associated with device submissions and approvals. Ultimately, this form makes it significantly easier for startups and smaller enterprises to compete in the medical device market, ensuring they remain viable and innovative.

Submitting the MDUFA Small Business Request Form is a requirement for companies that seek to benefit from the associated fee reductions. It is not limited to established organizations; startups and small businesses venturing into medical device production must also be aware of the submission timeline and eligibility criteria.

Eligibility criteria for small business qualification

To qualify as a small business under MDUFA, a company must meet specific guidelines established by the FDA. According to the FDA's definition, a small business is generally one that is independently owned and operated and has fewer than 500 employees or a total annual revenue less than $100 million. This definition ensures that the benefits of reduced user fees are accessible to those businesses that typically face capital constraints.

Key factors influencing eligibility include:

To verify their status, applicants must submit documentation such as tax returns, ownership details, and financial statements. This necessary information will be reviewed by the FDA to confirm compliance with the small business definitions and criteria.

Step-by-step guide to completing the MDUFA small business request form

Completing the MDUFA Small Business Request Form requires a methodical approach. The form is divided into several key sections, each requesting specific information to determine eligibility. The primary sections include Business Information, Financial Information, and Ownership and Control Information. The accurate completion of these sections is crucial for a successful application.

For each section, here are detailed instructions:

Common mistakes to avoid while completing the form include misreporting revenue figures, failing to account for affiliations that might disqualify a business, or neglecting to include required documentation. Accuracy is vital, as errors can lead to delays or denial of the application.

Submitting your small business application

After completing the MDUFA Small Business Request Form, applicants have several submission pathways. The preferred method is online submission through the FDA's electronic submission system, which allows for quicker processing and confirmation. However, for those preferring paper submission, guidelines must be followed strictly.

Here’s how to ensure your submission is successful:

Once submitted, the processing time for the application varies. Typically, businesses can expect to be notified of their qualification status within 60 to 90 days, though variations do exist based on the volume of submissions and review schedules. Stay prepared to respond promptly to any inquiries from the FDA during this period.

Payment information for user fees

Understanding the payment structure for user fees under the MDUFA is critical for small businesses. These fees can represent a significant part of the financial commitments involved in medical device development, but the MDUFA allows for small business discounts to mitigate these costs.

Payment methods to consider include:

Additionally, understanding fee waivers and reductions is crucial. Small businesses may qualify for substantial reductions or even waivers based on their financial status, helping to alleviate pressures on emerging companies striving to introduce innovative medical devices to the market.

Common questions about small business qualification

As you navigate the MDUFA Small Business Request Form, you may find yourself with several questions. Having clarity on common queries can save time and streamline your application process.

Here are some frequently asked questions:

For further inquiries, refer to the FDA’s dedicated support team, available through their website. It's advisable to reach out for clarification on any specific concerns you might have regarding your application.

Additional information on FDA regulations and resources

Staying informed about FDA regulations is essential for small businesses engaged in device development. The FDA provides a range of resources specifically designed to assist entrepreneurs and small business owners in navigating their regulatory obligations.

Key resources include:

Utilizing these resources effectively can help refine your approach to navigating the complexities of medical device regulations and compliance.

Integrating pdfFiller for your document needs

The process of completing the MDUFA Small Business Request Form can be significantly enhanced through the use of pdfFiller. As a cloud-based document management platform, pdfFiller streamlines the form completion process, allowing for easy editing, signing, collaboration, and efficient document management.

Key advantages of using pdfFiller include:

Testimonials and success stories abound from users who have leveraged pdfFiller to simplify their documentation processes. From startups to established firms, the platform has transformed how businesses interact with regulatory paperwork.

About the author

With extensive experience in regulatory documentation and compliance, the author has dedicated their career to supporting small businesses through the complexities of FDA applications. Having worked closely with numerous companies in different stages of development, the author understands the nuanced challenges faced in obtaining necessary qualifications and approvals.

Their expertise is enriched by hands-on experience with small business applications, which positions them uniquely to guide others through the MDUFA process. Through their writing, the goal is to empower small businesses to leverage available resources effectively.

Interactive tools: Enhance your experience

To further assist users in navigating the MDUFA Small Business Request Form, interactive tools can provide enhanced support. Resources like an interactive checklist for application readiness or fillable PDF templates for MDUFA requests can make the process more straightforward.

Furthermore, utilizing live chat support for real-time assistance can help resolve queries and facilitate seamless interaction throughout the application process.

Community engagement: Share your experience

Engagement with the community of small business owners is critical in building shared knowledge and support. By leaving a reply to this post, you can share your thoughts, experiences, and feedback about the MDUFA Small Business Request Form.

Connecting with other small business owners facilitates the exchange of ideas and resources. Join discussions on FAQs and forums dedicated to common challenges faced by small businesses in the medical device sector and gain insights that can bolster your application strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute mdufa small business request online?

How do I fill out the mdufa small business request form on my smartphone?

How do I complete mdufa small business request on an iOS device?

What is mdufa small business request?

Who is required to file mdufa small business request?

How to fill out mdufa small business request?

What is the purpose of mdufa small business request?

What information must be reported on mdufa small business request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.