Get the free Case 23-10935-kbo

Get, Create, Make and Sign case 23-10935-kbo

How to edit case 23-10935-kbo online

Uncompromising security for your PDF editing and eSignature needs

How to fill out case 23-10935-kbo

How to fill out case 23-10935-kbo

Who needs case 23-10935-kbo?

Understanding the Case 23-10935-KBO Form: A Comprehensive Guide

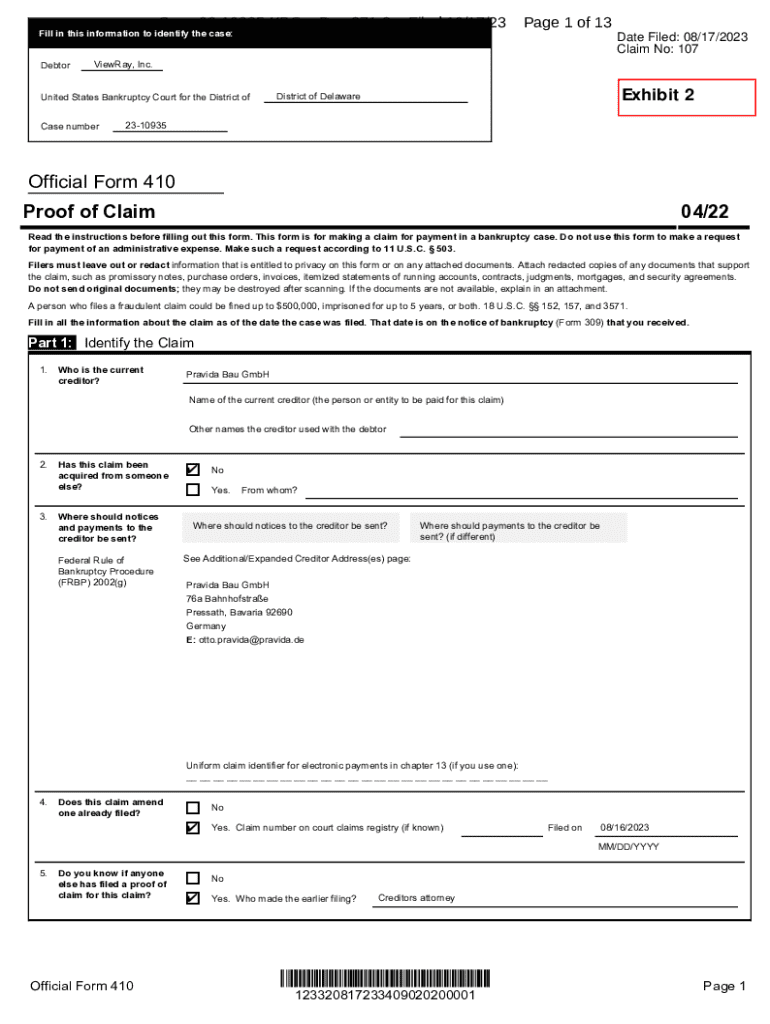

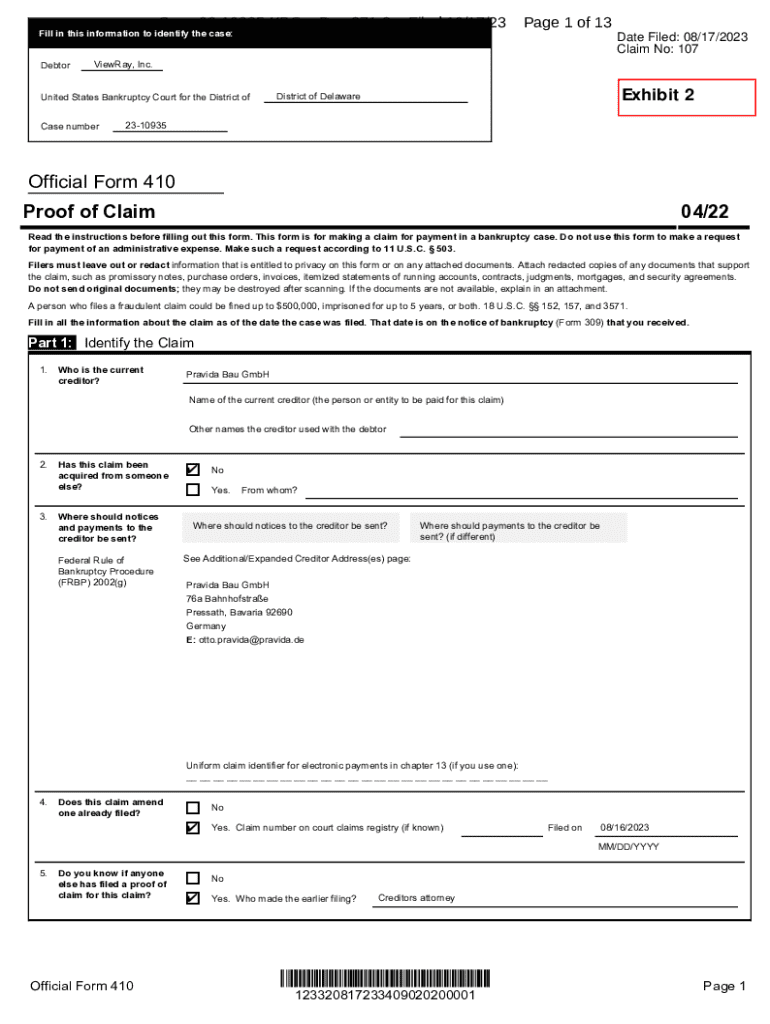

Overview of the Case 23-10935-KBO Form

The Case 23-10935-KBO Form plays a critical role in the bankruptcy proceedings occurring within the Delaware District Bankruptcy Court. This document facilitates the structured reporting of debtor information, assets, liabilities, and additional relevant financial information necessary for a comprehensive understanding of an entity's financial standing. It is essential for individuals and businesses undergoing bankruptcy to accurately and promptly complete this form to streamline the process of relief and financial restructuring.

Historically, Delaware has emerged as a pivotal hub for corporate bankruptcy filings, with trends showing an increasing number of high-profile cases. This relevance is not just historical; the flourishing business laws in Delaware attract many companies to incorporate there, which subsequently leads to a unique environment for bankruptcy proceedings. Stakeholders, including legal teams, financial advisers, and creditors, must be well-informed about the dynamics related to the Case 23-10935-KBO Form.

Structure of the Case 23-10935-KBO Form

The Case 23-10935-KBO Form is organized into key sections that help delineate critical information needed by the bankruptcy court. Understanding each section is paramount to ensure accurate and thorough completion.

The language used in this form can be technical, making it vital to familiarize oneself with bankruptcy terminology. Terms such as 'debtor,' 'creditor,' and 'secured versus unsecured debts' are instrumental in ensuring clarity and correctness when filling out the form.

Step-by-step guide to filling out the Case 23-10935-KBO Form

Preparation is key when approaching the Case 23-10935-KBO Form. Before you begin the process of filling out the form, gather necessary documentation such as tax returns, bank statements, and statements from creditors. Having these documents at hand will facilitate a more accurate and efficient completion process.

Now, let’s break down how to fill out each section of the form.

Once you’ve filled out the portions of your Case 23-10935-KBO Form, it's crucial to verify each section meticulously. Create a checklist to track your progress and ensure nothing is overlooked. This can help avoid common pitfalls such as inaccuracies or missing information during the submission process.

Editing and managing the Case 23-10935-KBO Form

pdfFiller provides a sophisticated suite of tools for editing the Case 23-10935-KBO Form. Users can easily alter sections of the form to reflect the most accurate and current information, all while maintaining the integrity of the original document.

Collaboration is simplified on the pdfFiller platform as it allows team members to be invited for review and feedback on the document. This feature is crucial for legal teams and advisers managing multiple bankruptcy filings, ensuring every detail is meticulously scrutinized and finalized.

Signing the Case 23-10935-KBO Form

Signatures are a vital component of the Case 23-10935-KBO Form. They serve as a legal affirmation that the information provided is truthful and accurate. Unsanctioned signatures can lead to severe legal repercussions and complications in the bankruptcy process.

To eSign the form through pdfFiller, users can follow these steps: select the signature field, click to sign, and authenticate the signature through the secure platform. This not only saves time but also ensures that signatures are valid and securely stored.

Common pitfalls and how to avoid them

Filling out the Case 23-10935-KBO Form can be daunting, leading to mistakes that could jeopardize the filing. Common errors frequently encountered include omitting critical financial details, such as unpaid debts or misrepresented assets.

To achieve a smooth filing experience, develop a systematic approach that includes checklists for every part of the form and a second review by someone else, if possible. This collaborative effort can help spot errors that may be missed during the initial completed draft.

Frequently asked questions about the Case 23-10935-KBO Form

As users often navigate the complexities of the Case 23-10935-KBO Form, they frequently have questions that, when addressed, can ease the process. Here are some common queries and their answers.

Understanding these key aspects of the Case 23-10935-KBO Form can significantly ease the anxiety associated with bankruptcy filings. Engaging with the form consistently and seeking clarifications can lead to an improved filing experience.

Tips for managing bankruptcy documentation

Managing documentation efficiently is crucial to navigating bankruptcy successfully. pdfFiller helps streamline document management during this process, serving as an accessible cloud-based platform ideal for teams and individuals. Proper organization can alleviate some of the stress associated with concurrent filings.

Utilizing a cloud-based platform such as pdfFiller not only facilitates document management but also assures that records are secure and easily accessible from any location. This enhanced accessibility is especially beneficial for teams working collaboratively on bankruptcy cases, ensuring a seamless flow of communication and progress.

Conclusion: Elevating your bankruptcy filing experience with pdfFiller

The Case 23-10935-KBO Form is an essential component of the bankruptcy process, and understanding its intricacies can lead to a more efficient experience. By leveraging platforms like pdfFiller, users can enhance their document management capabilities, ensuring smooth collaboration, accurate submissions, and secure eSigning.

In summary, adopting a tech-forward approach to bankruptcy filings can be a game-changer. Harnessing the power of tools like pdfFiller allows users to focus on rebuilding their financial future rather than getting bogged down in complex paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in case 23-10935-kbo?

How can I edit case 23-10935-kbo on a smartphone?

How do I fill out case 23-10935-kbo using my mobile device?

What is case 23-10935-kbo?

Who is required to file case 23-10935-kbo?

How to fill out case 23-10935-kbo?

What is the purpose of case 23-10935-kbo?

What information must be reported on case 23-10935-kbo?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.