Get the free form 1099 patr

Get, Create, Make and Sign form 1099 patr

How to edit form 1099 patr online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1099 patr

How to fill out form 1099-patr

Who needs form 1099-patr?

A Comprehensive Guide to Form 1099-PATR

Understanding the 1099-PATR form

The Form 1099-PATR is a critical tax document used primarily by cooperatives and certain other organizations to report payments made to their members. Specifically, it outlines patronage dividends, which are distributions paid to members of cooperatives from the earnings derived from their transactions with the cooperative. This form is essential for accurate financial reporting and assists both the issuing organizations and the recipients in properly documenting income for tax purposes.

Its importance cannot be understated as it ensures compliance with IRS requirements while providing a clear overview of income generated from cooperative memberships. For members, understanding this form allows them to accurately assess their taxable income, thereby avoiding potential penalties or discrepancies during the tax filing process.

Key components of the 1099-PATR form

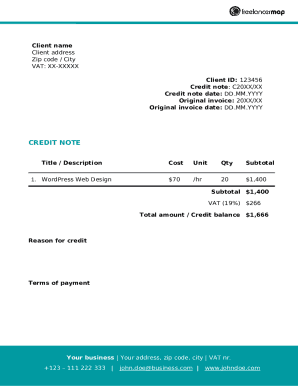

The 1099-PATR form consists of several key sections, each designed to capture specific information about the payments made to cooperative members. Completing each portion accurately is essential for compliance and to avoid confusion during tax time. The form typically includes boxes for the recipient's information, the amount of patronage dividends, and other relevant financial details.

Understanding the terminology found on the form is equally crucial. Familiarity with terms such as 'patronage dividend,' 'qualified distributions,' and 'taxable amount' directly impacts the accuracy of reporting and eventual tax obligations. This allows filers to provide the correct details and calculate their incomes correctly.

Step-by-step guide to filling out form 1099-PATR

Filling out the Form 1099-PATR can be straightforward, provided you gather all necessary information ahead of time. Begin by assembling related documents such as payment records and previous tax returns. This preparation will streamline the process and ensure that you have all the required details at your fingertips.

When it comes to completing the form, ensure to input your personal information accurately, including your name, address, and taxpayer identification number. Pay close attention while reporting distributions, particularly patronage dividends, making sure to differentiate between qualified and nonqualified distributions as they may have distinct tax implications.

Common mistakes while filling out the form include inaccurately reporting amounts and failing to include essential details like identification numbers. Always double-check entries to avoid discrepancies that could lead to penalties. Also, consider utilizing software or services that ensure compliance with the latest IRS guidelines.

Editing and managing your 1099-PATR form with pdfFiller

Using pdfFiller to manage your Form 1099-PATR delivers significant advantages. This cloud-based platform provides an easy way to edit PDFs, eSign documents, and collaborate, making the filing process much more efficient. With its intuitive interface, users can modify content directly and ensure that all provided information is accurate before submission.

The capability to upload your document, utilize editing tools, and securely sign and share forms without printing saves time and reduces paperwork. This streamlining is particularly valuable for those who handle multiple filings, as it can lead to faster turnaround times and fewer errors.

Frequently asked questions (FAQs) about 1099-PATR

Navigating the complexities of tax forms can bring about a slew of questions. One commonly asked question is what happens if you make an error on your Form 1099-PATR. The IRS allows you to correct errors by filing an amended form, which is imperative to avoid potential penalties or audits.

Additionally, many wonder if they can file multiple 1099-PATR forms. Yes, this is possible, especially if you are reporting payments to multiple members or clients. Each form should correspond to the appropriate recipient with accurate information. Lastly, remember that the deadline for submitting Form 1099-PATR about the IRS is typically January 31st following the end of the tax year.

Estimating your filing costs for 1099-PATR

When planning for the filing of Form 1099-PATR, it’s important to estimate potential costs associated with the process. The overall filing costs can vary depending on whether you choose to file online or use traditional methods like paper forms. Online filing tends to be more cost-effective and often includes tools that streamline the entire procedure.

Factors that influence filing costs encompass the number of forms being submitted, the complexity of the distributions, and any software fees associated with your chosen filing method. Understanding these variables upfront prepares you for the financial aspect of tax season, ensuring you allocate appropriate resources.

Real-world testimonials

Users of pdfFiller consistently express satisfaction with the platform, particularly emphasizing its user-friendly features for managing tax documents like the 1099-PATR. Testimonials reveal that the ease of accessing forms and the seamless editing capabilities significantly reduce stress during tax season. Many users appreciate that they can collaborate with team members on their filings directly through the platform.

Case studies highlight various businesses that have successfully navigated the complexities of filing the 1099-PATR using pdfFiller’s tools. These real-world applications illustrate how organizations have effectively streamlined their filing processes, ensuring both compliance and efficiency.

The future of document management with pdfFiller

pdfFiller continues to innovate in the document management space, offering cloud-based solutions that adapt to changing business needs. As more professionals seek efficient means to manage their paperwork, platforms like pdfFiller will play an integral role in the digital transformation landscape. Advancements in technology allow users to edit, sign, and store documents from any location, which means greater flexibility and accessibility.

By spearheading digital transformation, pdfFiller empowers users to handle their documentation efficiently and securely, ensuring that managing forms like the 1099-PATR becomes a seamless part of their workflow. This strategic direction aligns with the growing demand for solutions that enhance productivity and reduce physical paperwork.

Interactive tools for managing your 1099-PATR

To further assist users, pdfFiller provides interactive tools designed to make managing the Form 1099-PATR more accessible. Editable templates are available, allowing users to practice filling out the form in a safe environment without the fear of making costly errors. This practice can help demystify the process, leading to smoother filings come tax season.

Additionally, tools for estimating future filing needs based on prior filings can offer invaluable insights for both individuals and teams. These resources empower users to plan better, stay organized, and ultimately take control of their tax obligations with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 1099 patr in Gmail?

How do I execute form 1099 patr online?

How can I fill out form 1099 patr on an iOS device?

What is form 1099-patr?

Who is required to file form 1099-patr?

How to fill out form 1099-patr?

What is the purpose of form 1099-patr?

What information must be reported on form 1099-patr?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.