Get the free Tax Form 990

Get, Create, Make and Sign tax form 990

How to edit tax form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax form 990

How to fill out tax form 990

Who needs tax form 990?

Tax Form 990 Form: A Comprehensive Guide

Understanding tax form 990

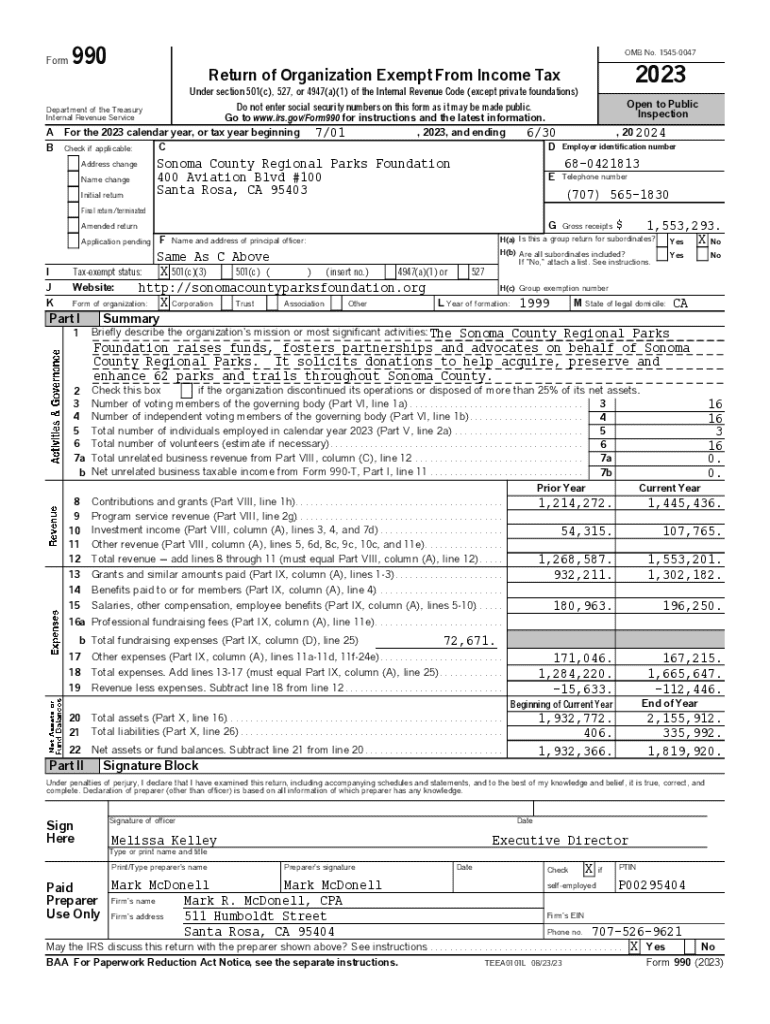

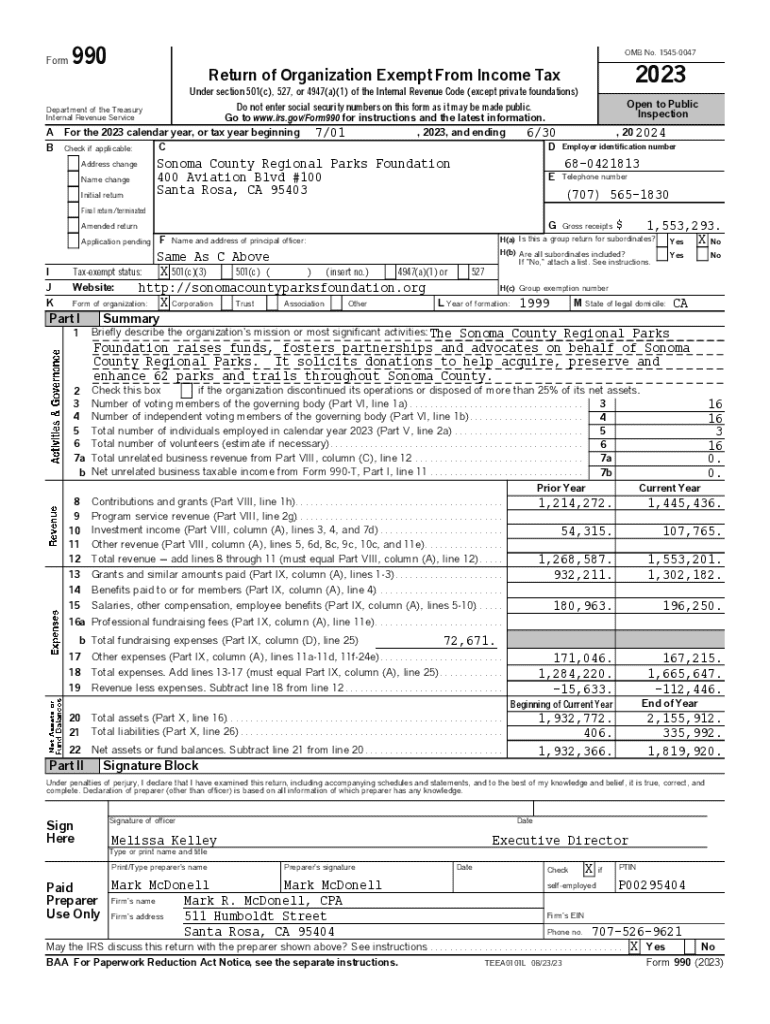

Tax Form 990 is a crucial document that nonprofits, charities, and other tax-exempt organizations in the United States are required to file annually with the Internal Revenue Service (IRS). This form serves both as a tax return and a public disclosure document, aimed at ensuring transparency in the financial activities of organizations that benefit from tax-exempt status. Form 990 provides the IRS, along with the general public, essential insights into an organization’s revenues, expenditures, governance, and overall financial health.

Organizations that are typically mandated to file Form 990 include charitable foundations, educational institutions, religious organizations, and various nonprofit service organizations. By making financial information publicly accessible, Form 990 plays a pivotal role in upholding accountability and fostering trust between nonprofits and their donors, stakeholders, and the general public.

Importance of filing form 990

Filing Form 990 is not just a regulatory requirement; it is vital for maintaining the tax-exempt status of nonprofits. Organizations must comply with IRS regulations to ensure they continue to qualify for federal tax exemptions under Section 501(c)(3) and similar sections. This compliance helps nonprofits operate without the burden of taxation, allowing more revenue to be allocated towards their charitable missions. Additionally, presenting accurate and thorough financial data helps build donor trust and maintains the confidence of stakeholders and the public.

Neglecting to file Form 990 can have serious ramifications for nonprofits. Organizations that fail to file may face penalties, which can include fines or even the automatic revocation of tax-exempt status. This not only impacts an organization’s financial resources but also severely tarnishes its public image and trustworthiness, making it difficult to secure funding or support from donors in the future.

Preparing to file form 990

Preparation for filing Form 990 involves gathering necessary documentation to provide accurate and detailed information about the organization’s financial performance. Key documents include the organization’s financial statements, balance sheets, prior year Form 990s, and any reports related to fundraising activities. Additionally, a thorough gathering of data concerning revenue sources, total expenditures, and assets is essential for constructing a comprehensive picture of the organization’s financial health.

Establishing a dedicated team to handle the filing can streamline the process. Clearly assigning roles – such as a treasurer to manage finances, an accountant for technical input, and a compliance officer to ensure regulations are met – will facilitate collaboration and organization. Investing in tools such as cloud-based document management systems can also enhance team productivity, allowing for remote collaboration in drafting and reviewing the Form 990.

How to complete form 990 in 5 steps

Completing Form 990 can be achieved by following a structured process. Here’s how to tackle it in five easy steps:

Frequently asked questions about form 990

Many organizations find themselves navigating questions regarding Form 990. Here are some common queries:

Tools and resources to simplify the filing process

Utilizing the right tools can significantly simplify the Form 990 filing process. Platforms like pdfFiller offer interactive features that streamline document management, allowing users to edit, sign, and collaborate on Form 990 remotely. This capability promotes efficiency by accommodating the needs of teams working from different locations, ultimately leading to a more accurate submission.

Additional nonprofit accounting software can provide tailored reporting features, helping organizations keep track of their finances throughout the year. Many of these tools include templates and guidance, ensuring comprehensive compliance and minimizing mistakes during the filing process. Engaging with resources that specialize in nonprofit compliance can further enhance an organization's understanding of the requirements and best practices for accurate filing.

Best practices for managing your form 990

Maintaining a well-organized system throughout the year is critical for ensuring a smooth Form 990 filing process. Keeping detailed financial records and continuously logging income and expenditures can make data collection for Form 990 much easier. Utilize software solutions that allow easy tracking of financial data and document management, ensuring you can quickly access necessary documentation when it’s time to prepare Form 990.

Additionally, staying informed about changes to tax regulations or IRS guidelines is indispensable. Regularly reviewing IRS updates or seeking out continuing education opportunities related to nonprofit compliance can save organizations from foreseeable challenges during the filing process. Implementing these best practices fosters an overall stronger relationship with stakeholders and upholds a nonprofit’s commitment to transparency.

Case studies: successful form 990 filings

Examining the practices of organizations that successfully navigate the complexities of filing Form 990 can provide valuable insights. For instance, a local nonprofit focused on community service regularly employs a collaborative approach to data gathering, involving multiple departments in the preparation process. This has led to more thorough documentation and clear accountability, resulting in consistently accurate filings and positive feedback from stakeholders regarding financial disclosures.

Moreover, introducing technology solutions like pdfFiller has transformed their filing process. By transitioning from paper-based to digital formats, this organization not only improved its efficiency but also enhanced collaboration among team members. Such case studies underline the importance of strategic planning, the effective use of tools, and ongoing commitment to transparency, collectively contributing to an organization’s operational success.

The future of form 990: insights and trends

As the landscape of nonprofit compliance evolves, Form 990 is likely to see changes aimed at increasing transparency and accountability. Emerging trends indicate that organizations are moving toward stricter reporting requirements and enhanced scrutiny from the IRS. Technological advancements are also paving the way for more efficient filing processes, with digital tools simplifying data collection and submission efforts.

Looking ahead, nonprofits will need to stay agile in adapting to these changes while continuing to uphold their commitment to transparency. Increasingly, organizations may leverage technology to automate their compliance processes, ensuring a more streamlined approach to Form 990 filings while also bolstering their public image with clear financial reporting strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in tax form 990 without leaving Chrome?

How do I edit tax form 990 on an iOS device?

Can I edit tax form 990 on an Android device?

What is tax form 990?

Who is required to file tax form 990?

How to fill out tax form 990?

What is the purpose of tax form 990?

What information must be reported on tax form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.