Get the free pdffiller

Get, Create, Make and Sign form 8804

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out 8804 annual return for

Who needs 8804 annual return for?

8804 Annual Return for Form: A Comprehensive Guide

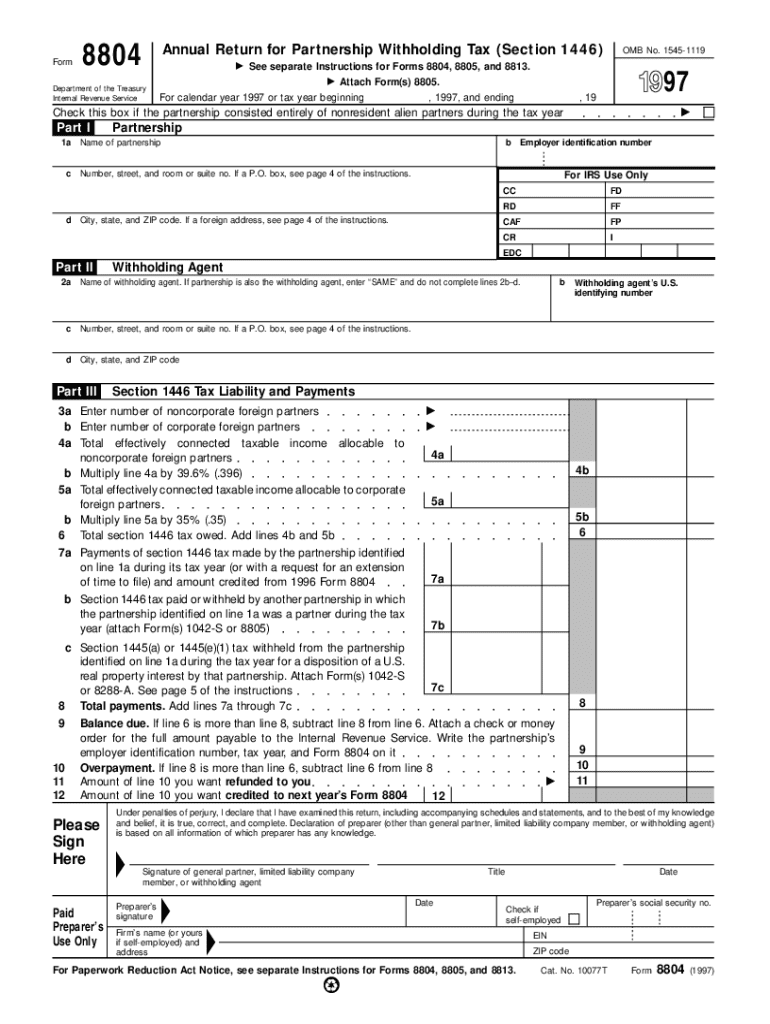

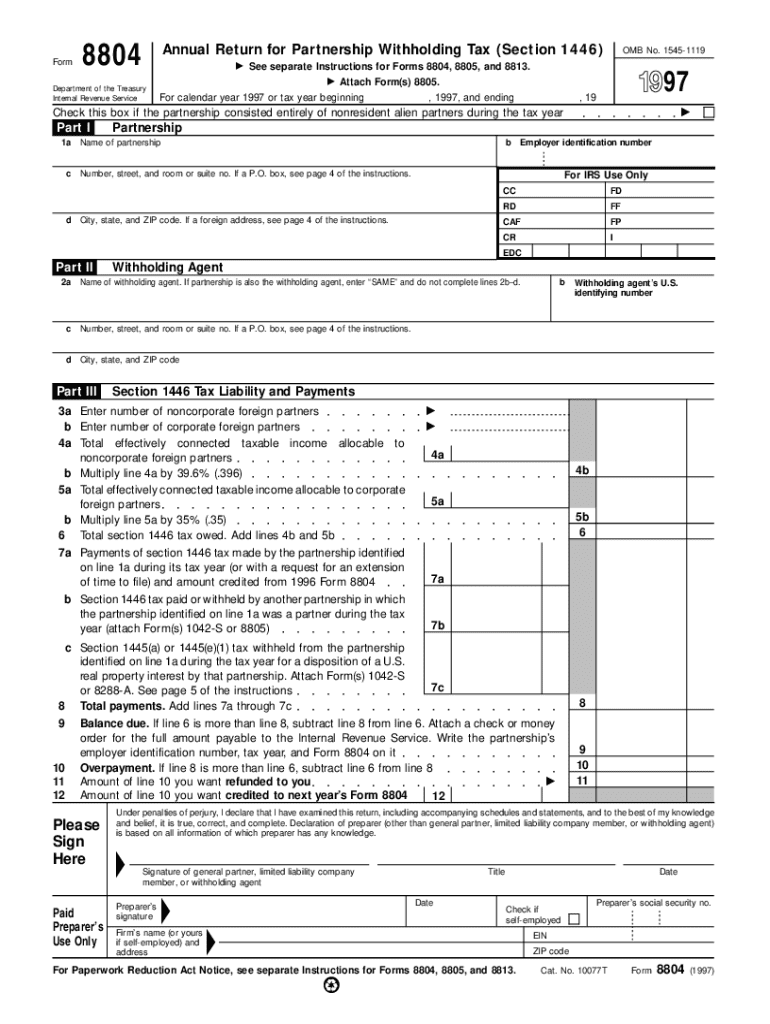

Understanding Form 8804

Form 8804 is a crucial document used to report the partnership withholding tax for foreign partners in U.S. partnerships. This form specifically ensures compliance with the U.S. tax obligations imposed on these partnerships, making it essential for any partnership involving foreign investors. It facilitates the partnership withholding tax system, which mandates that partnerships withhold taxes on effectively connected taxable income allocated to foreign partners.

Who should file Form 8804?

Partnerships that have foreign partners are required to file Form 8804. This includes various types of partnerships such as limited partnerships, limited liability companies (LLCs) treated as partnerships, and general partnerships with foreign investments. All partnerships with a foreign partner must ensure compliance with this form for the correct withholding tax calculations, regardless of how the involved partners classify their income.

In addition to the partnership's responsibility, foreign partners must understand their tax obligations under U.S. law. They are often subject to specific reporting requirements and can face penalties if the partnership fails to withhold income taxes correctly or file the appropriate forms on their behalf.

The purpose of the 8804 annual return

The necessity of Form 8804 cannot be overstated. It plays a significant role in ensuring compliance with U.S. tax laws regarding withholding tax. By correctly filing this form, partnerships fulfill their obligation to report income and taxes withheld from their foreign partners. Failure to file can lead to substantial consequences including penalties, interests, or increased scrutiny from tax authorities.

Form 8804 requires detailed information that is vital for accurate tax reporting. It mandates the disclosure of the partnership's name, address, tax identification number, and the details of every foreign partner. This is not merely a formality; this information is critical for the IRS to track the amounts withheld and ensure that all tax responsibilities are met appropriately.

Filling out Form 8804

Completing Form 8804 requires careful attention to detail. Here’s a step-by-step guide to help you fill it out effectively:

Common mistakes can easily derail the filing process. Ensure that all partner details match IRS records, and verify that the withholding amounts calculated align with current tax rates. Avoid missing deadlines as this can lead to additional penalties.

Understanding the withholding tax

The partnership withholding tax acts as a critical mechanism to ensure that tax obligations are met on behalf of foreign partners. Typically, partnerships must withhold a certain percentage of their income before distributing residual profits to foreign partners, calculated based on the withholding tax rate set forth by the IRS. This is pivotal for ensuring compliance, especially since foreign investments bring complex tax responsibilities.

For foreign partners, understanding their specific tax obligations is essential. They are typically liable for the taxes withheld, and the amount may vary depending on whether a tax treaty exists between the U.S. and their country of residence. Foreign partners might also have access to deductions or credits under these treaties, which can influence their taxable income substantially.

Deadlines and penalties

Timeliness is key when it comes to filing Form 8804. The fiscal deadline for submitting this form is typically the 15th day of the 4th month following the end of the partnership’s tax year. For partnerships on a calendar-year basis, this means April 15th. Partnerships that fail to meet this deadline may incur severe penalties, which can amount to thousands of dollars over time.

Local and state considerations can also impact filing, as some jurisdictions require additional forms or filings that accompany the federal Form 8804. Partners should be diligent in understanding local tax laws to avoid double penalties.

Practical considerations for filing Form 8804

To promote a smooth filing process, it is beneficial to establish a regular filing routine. Keeping track of necessary documentation and timelines simplifies the preparation for Form 8804. Utilizing cloud-based document management tools can greatly enhance this process—allowing for easy access and editing.

Year-end tax planning strategies are equally important for maximizing tax outcomes. Partnerships should consider the implications of distributions and deductions for each partner well in advance. A well-structured approach can mitigate tax liabilities and enhance overall partner satisfaction.

How pdfFiller enhances the Form 8804 experience

pdfFiller offers streamlined document management solutions that significantly enhance the experience of completing Form 8804. With its user-friendly interface and editing features, users can effectively create, edit, and manage their tax documents from a single cloud-based platform.

The ability to eSign, collaborate, and access forms from anywhere simplifies the tax filing process. pdfFiller provides interactive tools that reduce errors and help users stay organized, making it an invaluable resource for anyone navigating the complexities of tax documentation.

Frequently asked questions (FAQs) about Form 8804

Common inquiries regarding Form 8804 often revolve around who is responsible for filing it, what happens if the form is not filed on time, and how to handle discrepancies in reported income. Understanding these aspects can alleviate confusion and help ensure compliance with U.S. tax regulations.

Another frequent question concerns the responsibilities of foreign partners. Many are unsure about their tax obligations or how to take advantage of tax treaties. Being informed and aware can help avoid pitfalls that could lead to costly penalties.

Resources for further assistance

For more detailed guidelines regarding Form 8804 and relevant regulations, the IRS provides comprehensive resources on its website. Their documentation elucidates the specific requirements for various types of partnerships and can be invaluable during tax season.

Additionally, consulting with a tax professional specializing in partnership taxation can provide insights tailored to your specific situation and ensure that all obligations are met accurately, minimizing the risk of non-compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify pdffiller form without leaving Google Drive?

Where do I find pdffiller form?

Can I create an electronic signature for the pdffiller form in Chrome?

What is 8804 annual return for?

Who is required to file 8804 annual return for?

How to fill out 8804 annual return for?

What is the purpose of 8804 annual return for?

What information must be reported on 8804 annual return for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.