Get the free where to mail 1120s

Get, Create, Make and Sign 1120s mailing address form

How to edit where to mail 1120s tax return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out where to mail 1120s

How to fill out instructions for form 1120s

Who needs instructions for form 1120s?

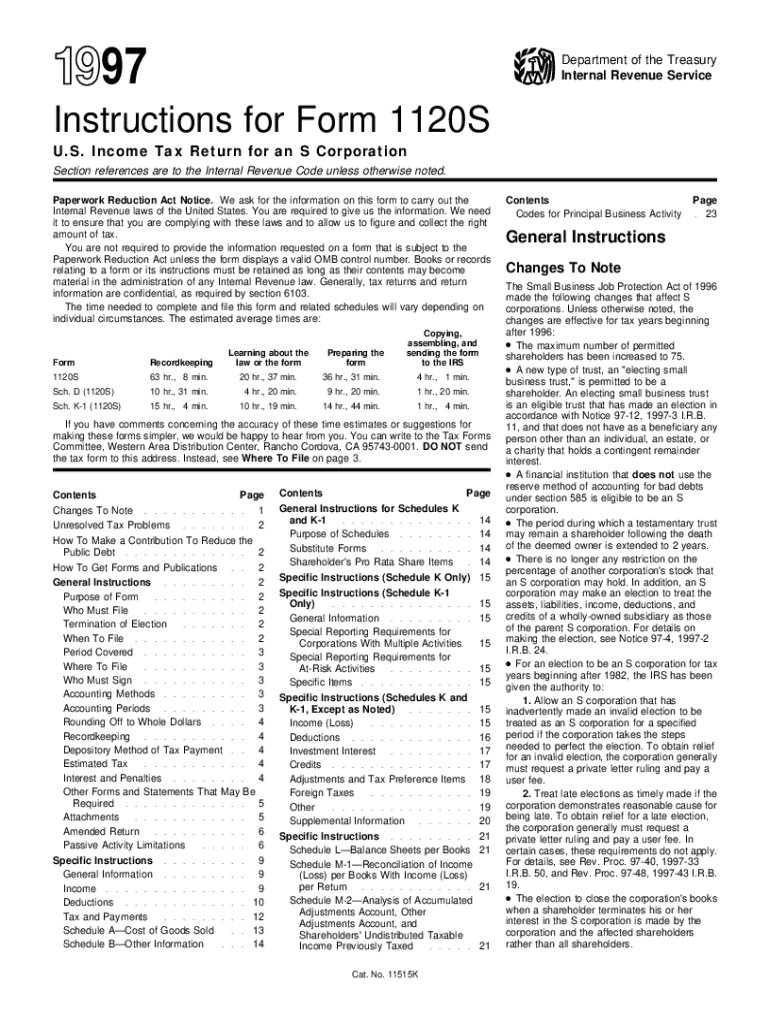

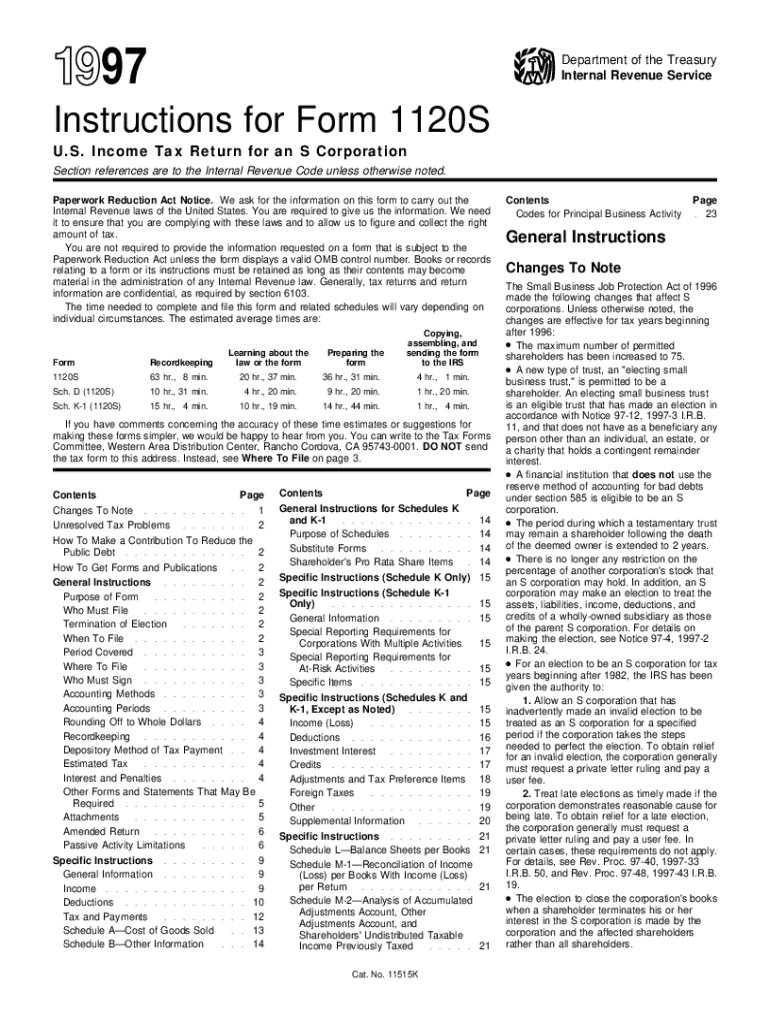

Instructions for Form 1120-S: Your Complete Guide

Understanding Form 1120-S

Form 1120-S is the designated income tax return for S corporations, an essential document in the realm of business taxation. It allows S corps to report income, deductions, gains, and losses to the Internal Revenue Service (IRS). Unlike traditional corporations (C corporations), S corps are unique in that their income is passed through to shareholders, thereby avoiding the double taxation commonly associated with corporate profits.

S corporations must file Form 1120-S annually to maintain their S status and inform the IRS of their financial activity. Failure to file can lead to loss of S corp status and a host of tax complications, making understanding this form vital for small business owners.

Key components of Form 1120-S

Form 1120-S is structured into several components that are critical for accurately reporting business activity. Understanding these sections helps streamline the filing process and ensures compliance with IRS regulations.

Common terms used in Form 1120-S include 'pass-through taxation,' 'deductible expenses,' and 'distributions,' each of which plays a pivotal role in accurately completing the document.

Step-by-step instructions for filling out Form 1120-S

Before filling out Form 1120-S, thorough preparation is essential. Gathering necessary documentation, such as financial statements, previous tax returns, and records of income sources, can facilitate a smooth filing process. It's equally crucial to confirm your eligibility for S corporation status; typically, this means your corporation must have no more than 100 shareholders, all of whom must be U.S. citizens or residents.

Don’t forget the final sections, which may require additional forms such as Schedule K-1, crucial for reporting individual shareholder income, deductions, and credits.

Common mistakes to avoid when filing Form 1120-S

Filing Form 1120-S accurately is paramount, yet many small business owners make notable mistakes. One common issue is misreporting income or deductions, whether through oversight or misunderstanding tax regulations. This misstep can lead to IRS audits or penalties.

Example of a completed Form 1120-S

To further illustrate the completion of Form 1120-S, consider a hypothetical S corporation, ABC Corp. With a clear layout and sample data, you can visualize how to fill it out accurately. For instance, in Part I, ABC Corp reports total income of $200,000 from various services rendered, while in Part II, $50,000 in allowable deductions is recorded.

This annotated example demonstrates what to include in each section, providing clarity. Each completed section offers insights into how to structure your responses based on corporate operations and income flows.

FAQs about Form 1120-S

Navigating the nuances of Form 1120-S can lead to several questions. Below are common inquiries: What if my S corporation has no income? In such cases, you still need to file Form 1120-S to maintain your S status, indicating a loss or zero income. How are distributions to shareholders taxed? Generally, distributions are not considered taxable to shareholders, as the corporation's income has already been taxed before distribution.

Next steps after filing Form 1120-S

Once you have submitted Form 1120-S, it’s critical to understand what comes next. The IRS acknowledges receipt of your filing, and you should keep this acknowledgment for your records. This filing and the records that support it form the foundation for accurate tax compliance in the future.

Using pdfFiller for Form 1120-S management

Managing your documents efficiently is key to the success of your S corporation, and pdfFiller can be an invaluable tool in this regard. This platform enables users to edit, eSign, and manage PDFs from anywhere, providing the flexibility needed for busy small business owners.

When you’re ready to file

After completing Form 1120-S, the next step is submission. Be aware of your options: electronic filing can often expedite the process and improve accuracy, while physical filing may be preferable for those who prefer traditional methods. Utilizing pdfFiller can streamline this process, providing templates that meet IRS guidelines.

Summary of key takeaways

Form 1120-S is vital for S corporations to accurately report their income and maintain compliance with the IRS. Understanding how to fill it out, common pitfalls to avoid, and the importance of accurate record-keeping can significantly impact your business. Utilizing a platform like pdfFiller can enhance efficiency and reduce errors in document management.

As you embark on this journey, remember that staying informed and utilizing the right tools can empower you to approach your tax responsibilities with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in where to mail 1120s without leaving Chrome?

Can I create an electronic signature for the where to mail 1120s in Chrome?

How do I edit where to mail 1120s on an iOS device?

What is instructions for form 1120s?

Who is required to file instructions for form 1120s?

How to fill out instructions for form 1120s?

What is the purpose of instructions for form 1120s?

What information must be reported on instructions for form 1120s?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.