Get the free Mi-1040-v

Get, Create, Make and Sign mi-1040-v

How to edit mi-1040-v online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mi-1040-v

How to fill out mi-1040-v

Who needs mi-1040-v?

A Comprehensive Guide to the -1040- Form: Everything You Need to Know

Understanding the -1040- form

The MI-1040-V form is a critical component of the tax process for residents of Michigan. This payment voucher is used by taxpayers to submit their estimated state income tax payments and is particularly important for individuals and businesses that may not have taxes withheld from their income. Understanding the MI-1040-V is essential for accurate tax filing and avoiding unnecessary penalties.

Its role in the tax filing system cannot be overstated; it helps ensure that taxpayers make timely payments towards their estimated tax liabilities, thereby facilitating better planning for tax obligations. Using the MI-1040-V form correctly can significantly aid in efficient tax management.

Who needs to use the -1040- form?

The MI-1040-V form is primarily meant for individuals and businesses in Michigan who anticipate owing tax due to substantial income not covered by withholding, such as freelance income or investment income. If your expected tax liability is more than $500 for the year, you must file this form to ensure compliance with state taxation rules.

Common scenarios include self-employed individuals, owners of small businesses, and those with additional income streams like investments or rental properties. Taxpayers should calculate their estimated tax obligations carefully and determine if filing the MI-1040-V is necessary.

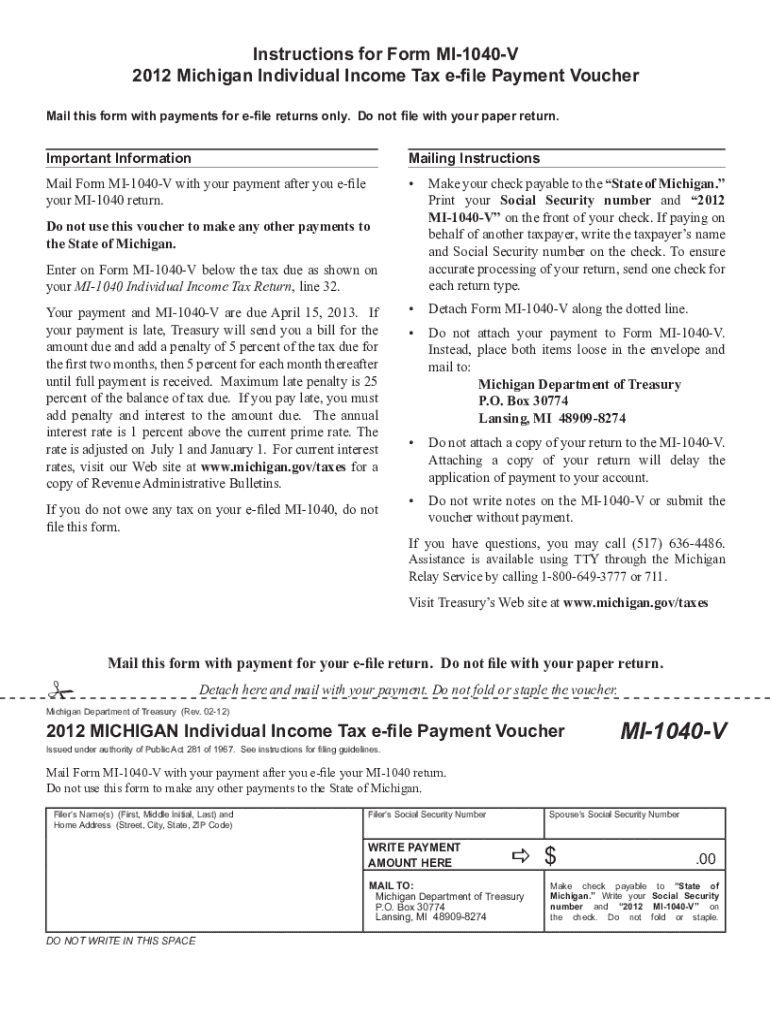

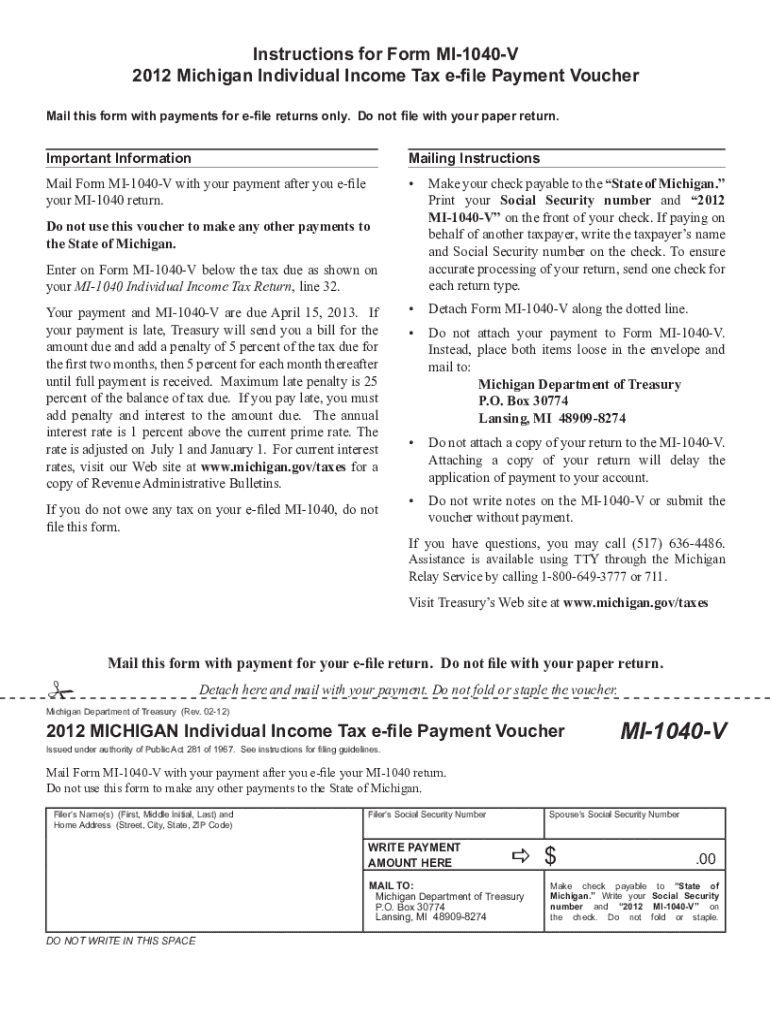

Detailed instructions for filling out form -1040-

Filling out the MI-1040-V form is straightforward if you follow these step-by-step instructions. To begin, provide your personal information, such as your name, address, and Social Security number (SSN). This information is essential for the Michigan Department of Treasury to accurately associate your payment with your tax account.

Next, indicate the payment amount you are submitting. It's crucial to provide an accurate figure that reflects your estimated tax liability for the year. Finally, sign and date the form. A signature is necessary to validate your intent and ensure that you are responsible for the payment.

To avoid common pitfalls, double-check your entries and ensure everything is legible. Mistakes can lead to processing delays or even incorrect penalties.

How to submit payment with form -1040-

Submitting the MI-1040-V form correctly is key to ensuring your payments are processed efficiently. If you opt for the traditional method, mail the completed form along with your payment to the address specified at the bottom of the voucher. Be sure to send it well ahead of the deadline to avoid any late fees or penalties.

Alternatively, you can explore electronic submission options offered by the Michigan Department of Treasury. This can streamline the payment process and ensure that your submission is time-stamped to prevent any late payment issues.

Do need to submit the -1040- form if e-file my return?

There is often confusion regarding whether the MI-1040-V form is necessary when e-filing your tax return. The answer is that it largely depends on your payment preferences and tax situation. If you are e-filing and your tax return includes a balance due, submitting the MI-1040-V helps ensure your payments are tracked correctly by the Michigan Department of Treasury.

In some cases, if you choose to pay your tax liability electronically via your e-filing software, you may not need to submit the MI-1040-V since the payment can be made directly through the software. However, it's crucial to verify the protocol followed by your specific software provider to ensure compliance.

Can pay electronically instead of mailing a check?

Yes, electronic payments are not just an option but are actively encouraged by the Michigan Department of Treasury. Utilizing the online payment system allows you to pay your taxes conveniently without the need for physical checks. This method is secure, quick, and provides you with a confirmation record of your payment, which is invaluable for tax records.

Moreover, electronic payment can help you avoid potential postal delays or payment misplacement issues associated with mailing checks. This approach can lead to better tax management, allowing you to focus more on the financial aspects of your business rather than worry about payments.

What happens if miss the filing deadline or make a late payment?

Missing deadlines when filing your MI-1040-V form or making a late payment can lead to serious repercussions, including penalties and interest charges imposed by the state. The Michigan Department of Treasury applies a standard penalty rate for late payments, which can substantially increase your overall tax liability.

If you miss a due date, promptly addressing the situation is vital. Contacting the Michigan Department of Treasury can provide guidance on resolving issues, including potential payment plans or penalties. Staying proactive in these scenarios is essential to limit financial repercussions.

Where can download the -1040- form?

Downloading the MI-1040-V form is a simple process. You can access it directly from the Michigan Department of Treasury's official website. There, you will find the latest versions of the form, ensuring compliance with any updates made in tax regulations.

Additionally, if you're looking to streamline filling out the form digitally, you can utilize services such as pdfFiller. This platform provides tools for filling out PDF forms online, making it easier than ever to manage your tax documents efficiently.

Interactive tools for managing your -1040- form

To enhance your experience with the MI-1040-V form, utilizing tools such as pdfFiller can be incredibly beneficial. This platform allows users to edit documents, eSign, and collaborate with others on tax-related papers without needing to print anything out.

pdfFiller's cloud storage feature means you can access your forms from anywhere, ensuring you’re always prepared, no matter where tax season takes you. Whether you’re working individually or as part of a larger team, these tools facilitate an efficient approach to managing tax documentation.

Tips for a smooth tax filing experience

To ensure a seamless tax filing process, it's advisable to stay organized. Keeping all relevant documents, receipts, and vouchers like the MI-1040-V in one place can minimize the stress that often accompanies tax season. Setting aside dedicated time to review your finances and prepare your documentation well in advance can significantly reduce last-minute scrambling.

Utilizing services like pdfFiller can also simplify the tax preparation process. By leveraging their e-signature features, collaborative tools, and document management capabilities, you can optimize your experience and ensure that no detail is overlooked as you prepare for your tax filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my mi-1040-v in Gmail?

How can I send mi-1040-v for eSignature?

How do I make edits in mi-1040-v without leaving Chrome?

What is mi-1040-v?

Who is required to file mi-1040-v?

How to fill out mi-1040-v?

What is the purpose of mi-1040-v?

What information must be reported on mi-1040-v?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.