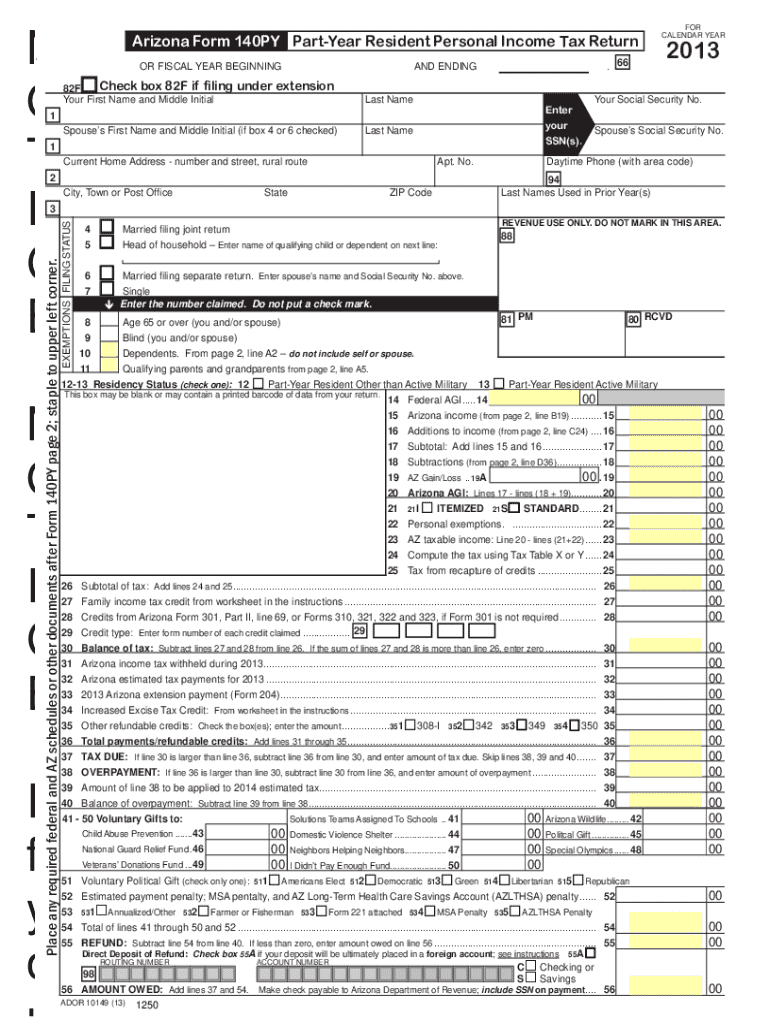

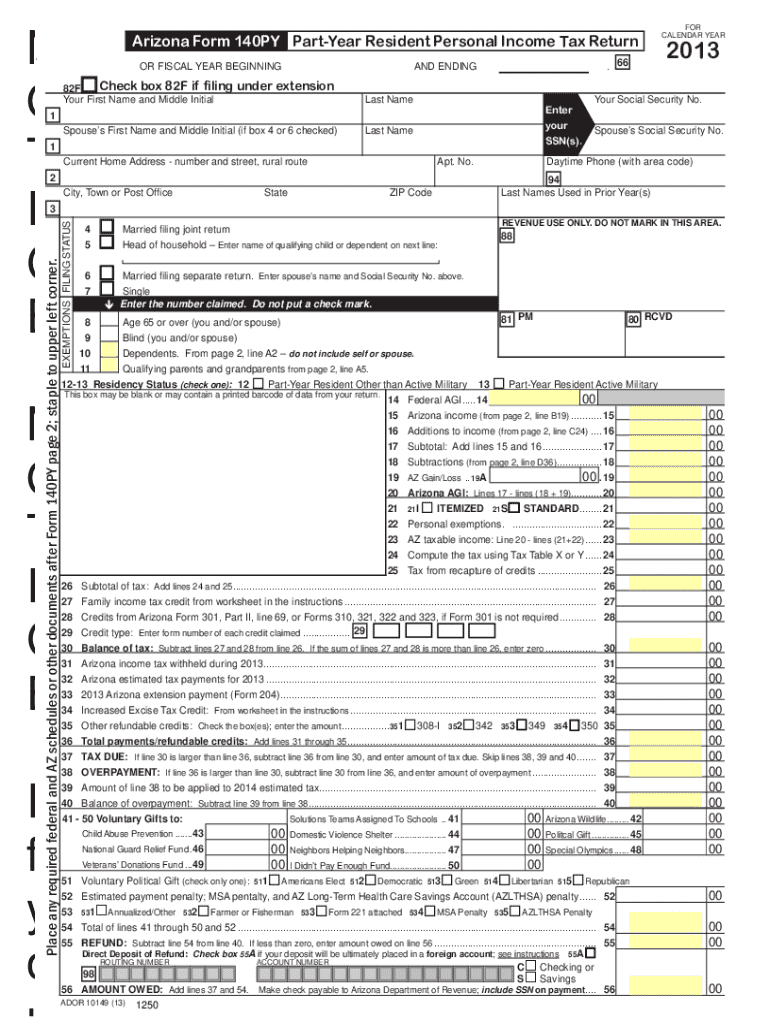

Get the free Arizona Form 140py Part-year Resident Personal Income Tax Return

Get, Create, Make and Sign arizona form 140py part-year

How to edit arizona form 140py part-year online

Uncompromising security for your PDF editing and eSignature needs

How to fill out arizona form 140py part-year

How to fill out arizona form 140py part-year

Who needs arizona form 140py part-year?

A Comprehensive Guide to Arizona Form 140PY for Part-Year Residents

Understanding Arizona Form 140PY: Purpose and Importance

Arizona Form 140PY is specifically designed for individuals who are considered part-year residents of Arizona. This form allows these residents to accurately report their income, deductions, and tax credits for the period they lived in the state. Given that a standard tax form does not cater to individuals with varying residency status, the 140PY ensures that part-year residents are taxed only on income earned during the time they resided in Arizona.

Filing the 140PY is crucial for anyone who meets the definition of a part-year resident. It not only helps in compliance with Arizona tax laws but also enables filers to claim any possible deductions and credits available specifically for their situation, thus potentially maximizing their tax return. Ensuring accuracy on this form can lead to a tax refund rather than an unexpected tax bill.

Eligibility criteria for part-year residents

A part-year resident in Arizona is an individual who lived in the state for a portion of the tax year. To be eligible to file Form 140PY, you need to provide proof of residency within the state during the year. This can include documentation, such as a driver's license or rental agreements that indicate your residency period. Additionally, such individuals must report income earned while living in Arizona, which can come from various sources including wages, freelance work, or business income.

It’s essential for filers to note key deadlines. Arizona typically follows a tax filing deadline of April 15th each year, but if you have a specific residency period, it's crucial to keep track of those dates closely to prevent late penalties. Understanding your timeline will help ensure a smoother submission process.

Gathering necessary documents

To successfully complete Arizona Form 140PY, you will need several documents. These documents include proof of residency and income statements, which may include IRS forms like W-2s for wages and 1099s for freelance work. Here’s a comprehensive list of what you’ll need:

Organize these documents in a manner that enables you to quickly reference them as you fill out the form. This will help streamline the process and reduce any anxiety associated with tax filing.

Step-by-step instructions for completing the Arizona Form 140PY

Completing the Arizona Form 140PY involves several sections, each requiring careful attention. Below is a breakdown of each section:

Section 1: Personal information

In this section, fill out your basic personal details including name, address, and social security number. Make sure the information is accurate to avoid delays.

Section 2: Income reporting

Report all income sources you earned while a resident of Arizona. This may include wages, self-employment income, and any investment income. Ensure that the sums reported correspond with the income documents you’ve collected.

Section 3: Deductions and credits

In this section, detail deductions available specifically for part-year residents. Common deductions may include unreimbursed business expenses or specific educational expenses. Be sure to also list any tax credits for which you may qualify.

Section 4: Calculating your tax liability

Carefully calculate your tax owed by following the instructions on the form. Make use of provided tables to ensure that your calculations are accurate, leading either to a refund or a bill.

Section 5: Review and signature

As the final step, double-check all information for accuracy. Ensure that you sign and date the form, as unsigned documents can lead to rejection by the Arizona Department of Revenue.

Electronic filing vs. paper filing: Which one to choose?

When it comes to filing Arizona Form 140PY, individuals have the option to file electronically or via paper. E-filing can significantly speed up the processing of your return and is often considered more secure. That said, some individuals may prefer the traditional pen-and-paper method. Here’s a quick breakdown of both methods:

To e-file using pdfFiller’s platform, simply follow their user-friendly interface to fill and submit the 140PY form electronically. If opting to paper file, ensure you send your completed form to the correct address detailed in the filing instructions.

Common mistakes to avoid when filing Arizona Form 140PY

Filing your taxes can be complex, especially when detailing part-year residency. To help make the process smoother, here are some common mistakes filers often make:

Taking time to review your information and understand common issues can save you from costly penalties down the line.

Interactive tools and resources for part-year residents

pdfFiller offers various interactive tools that streamline the process of filling out the Arizona Form 140PY. These features can make tax filing more manageable, especially for part-year residents who need to quickly capture their unique tax situation. The platform allows users to easily edit the form, eSign documents, and collaborate with tax professionals if necessary.

Using templates can save time and ensure you’re filling the form accurately. Besides, you can collaborate with team members or tax professionals through the platform, making the process seamless and efficient.

FAQs about Arizona Form 140PY

Many filers have questions surrounding the Arizona Form 140PY. Here’s a roundup of some common queries:

Tax season management tips for part-year residents

For part-year residents navigating tax season, organization is key. Keeping all your documents, including proof of residency and income sources, in one easily accessible location can greatly simplify the filing process. Here are some additional tips:

Proactive attention to organization can yield a more efficient tax season overall.

Additional support options

pdfFiller is here to assist with your tax preparation and filing. Their support staff is readily available to answer questions and provide guidance as you navigate the complexities of Arizona tax forms. Whether you require assistance in filling out the 140PY form or need help with technical issues, pdfFiller’s customer support can help.

In addition to professional help, consider accessing community forums or groups where you can connect with fellow taxpayers. These resources can offer invaluable insights and shared experiences that may further clarify the filing process.

Next steps after filing Arizona Form 140PY

Following the successful submission of your Form 140PY, monitor the status of your return. Arizona’s Department of Revenue allows taxpayers to track their returns online, providing peace of mind during the waiting period. If further information is needed, be diligent in responding to any follow-up requests promptly.

Understanding the necessary steps post-filing is crucial for a hassle-free tax experience. Keep an eye on your bank account for any refunds and remember to save a copy of your completed return for your records.

Additional benefits of using pdfFiller for document management

pdfFiller provides a host of features aimed at simplifying the document management process. These include options for eSigning, editing documents, and collaborating in real-time with others. Users can easily access their tax documents from any device with an internet connection, ensuring that managing tax forms like Arizona Form 140PY is both convenient and efficient.

Additionally, many users have highlighted the platform's ease of use and the effective way it integrates tax document management into one seamless experience, reducing confusion and enhancing productivity.

Related Arizona income tax forms and resources

Beyond Form 140PY, Arizona has other income tax forms that may be relevant based on your residency status or type of income. It’s essential to familiarize yourself with these forms as they can provide additional opportunities to manage your tax liabilities. For further research, resources are available through the Arizona Department of Revenue's website and other tax-related resources to assist in successfully navigating your tax obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send arizona form 140py part-year for eSignature?

Can I sign the arizona form 140py part-year electronically in Chrome?

How do I fill out arizona form 140py part-year using my mobile device?

What is arizona form 140py part-year?

Who is required to file arizona form 140py part-year?

How to fill out arizona form 140py part-year?

What is the purpose of arizona form 140py part-year?

What information must be reported on arizona form 140py part-year?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.