Get the free Notice of Estate Administration

Get, Create, Make and Sign notice of estate administration

How to edit notice of estate administration online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of estate administration

How to fill out notice of estate administration

Who needs notice of estate administration?

Notice of Estate Administration Form: A Comprehensive Guide

Overview of the notice of estate administration form

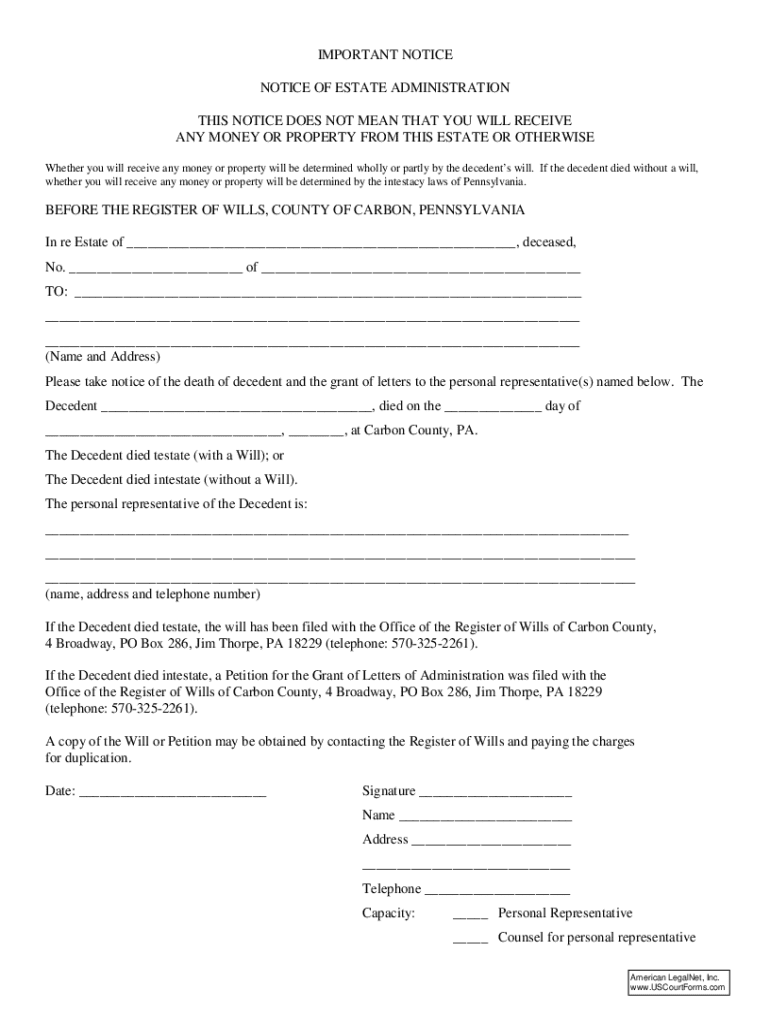

The notice of estate administration form is a crucial document in the probate process, serving as an official notification of a decedent's death and the initiation of the estate's administration. Its primary purpose is to inform interested parties, including beneficiaries and heirs, of the proceedings concerning the deceased person's affairs. By filing this form, executors or administrators establish their role in managing the estate, which may include gathering assets, settling debts, and ultimately distributing property.

The importance of this form cannot be overstated. It acts as a formal invitation for potential claimants and beneficiaries to participate in or monitor the probate process. Legal requirements for filing vary by jurisdiction, but generally, it should be filed in the probate court where the deceased resided. Understanding these legal nuances is central to ensuring that the estate is administrated in compliance with local laws.

Who needs to file the notice of estate administration?

Filing the notice of estate administration form is typically the responsibility of executors or administrators appointed by a court. These individuals obtain their authority through the probate process and act as representatives of the estate. However, beneficiaries and heirs may need to be aware of this filing to understand their rights and claims over the estate's assets.

There are distinct considerations for estates with wills (testate estates) versus those without (intestate estates). Testate estates provide a clear directive for asset distribution, often simplifying the administration process. In contrast, intestate estates follow state laws to determine heirs, which can complicate things, especially in cases with multiple potential claimants. Both scenarios require the notice of estate administration to keep all parties informed.

Key information included in the form

The notice of estate administration form should contain essential information to serve its purpose. Basic details include the decedent’s name, date of death, and last known address. Additionally, the details of the executor or administrator, including their contact information, must be clearly stated to facilitate communication among parties involved in the estate administration.

A comprehensive description of estate assets is also vital. This may encompass real property, personal belongings, financial accounts, and other valuable items. Relevant dates and deadlines, such as anticipated hearing dates and timelines for claims filing, should be included to ensure that all interested parties are adequately informed and can act within specified timeframes.

Step-by-step instructions for completing the notice of estate administration form

Completing the notice of estate administration form requires careful attention to detail. Here’s a breakdown of the steps involved:

Managing the notice of estate administration form

Once the notice of estate administration form has been filed, managing its status is important for smooth estate administration. Tracking your filing status helps ensure that all parties are aware of their rights and any ongoing proceedings. Maintaining accurate records of all submitted documents and communications with the court can facilitate this process.

Updating information post-filing may be necessary if new claims arise or if there are changes in estate details. Understanding how and when to amend the form is crucial for remaining compliant and transparent with all interested parties—especially since any significant changes might affect the probate process.

Common questions and answers (FAQs)

Navigating the intricacies of estate administration can lead to several questions. Here are some of the most common inquiries:

Interactive features and tools available on pdfFiller

pdfFiller offers a range of interactive tools designed to simplify the completion and management of the notice of estate administration form. Document editing tools are available for users to make necessary changes quickly. With collaborative features, executors and beneficiaries can work together efficiently, ensuring all stakeholders are kept in the loop.

Additionally, templates for related documents, such as probate claims or inventories of estate assets, are easily accessible. This means users can create and manage all required documentation from a single platform, streamlining the entire estate administration process.

Real-life scenarios: Navigating estate administration

Real-world examples can illuminate the complexities surrounding estate administration. Consider a case study of intestate succession where the deceased left no will, resulting in family disputes over asset distribution. Here, the notice of estate administration form becomes critical in outlining the proceedings and ensuring all potential heirs are notified.

In another instance, managing disputes among heirs can complicate things. Clear communication, facilitated by the notice of estate administration, helps to mediate conflicts that may arise regarding asset division. Through these scenarios, it becomes evident that errors in filing can lead to significant delays and conflict—underscoring the importance of diligence when completing the form.

Conclusion and next steps for executors and administrators

Successfully navigating the probate process begins with understanding the importance of the notice of estate administration form. Executors and administrators should prepare for subsequent phases of estate administration by gathering documents, maintaining accurate records, and seeking legal advice where necessary. Consulting with an estate attorney can be invaluable in ensuring compliance with local laws and smooth administration of the estate.

As you move forward, familiarize yourself with the resources at your disposal, such as those offered by pdfFiller. By leveraging cloud-based document management solutions, you can efficiently manage forms, gather signatures, and collaborate with all parties involved, streamlining the entire estate administration process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit notice of estate administration from Google Drive?

How do I execute notice of estate administration online?

How do I edit notice of estate administration on an iOS device?

What is notice of estate administration?

Who is required to file notice of estate administration?

How to fill out notice of estate administration?

What is the purpose of notice of estate administration?

What information must be reported on notice of estate administration?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.