Get the free Cash Plan Claim Form

Get, Create, Make and Sign cash plan claim form

Editing cash plan claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cash plan claim form

How to fill out cash plan claim form

Who needs cash plan claim form?

Your comprehensive guide to the cash plan claim form

Overview of cash plan claims

Cash plans offer a valuable safety net for individuals and teams by covering a range of health costs upfront, rather than waiting for reimbursement from insurance. They typically include expenses such as dental check-ups, optical treatments, and other necessary health services. Submitting a cash plan claim form is crucial to ensure you can access these funds promptly.

Understanding the importance of the cash plan claim form includes recognizing how it simplifies the claim process. It allows policyholders to reclaim their out-of-pocket expenses efficiently. Utilizing cash plans provides significant benefits, including financial relief during unexpected medical expenses and the peace of mind knowing that you have a fallback for routine health costs.

Understanding the cash plan claim form

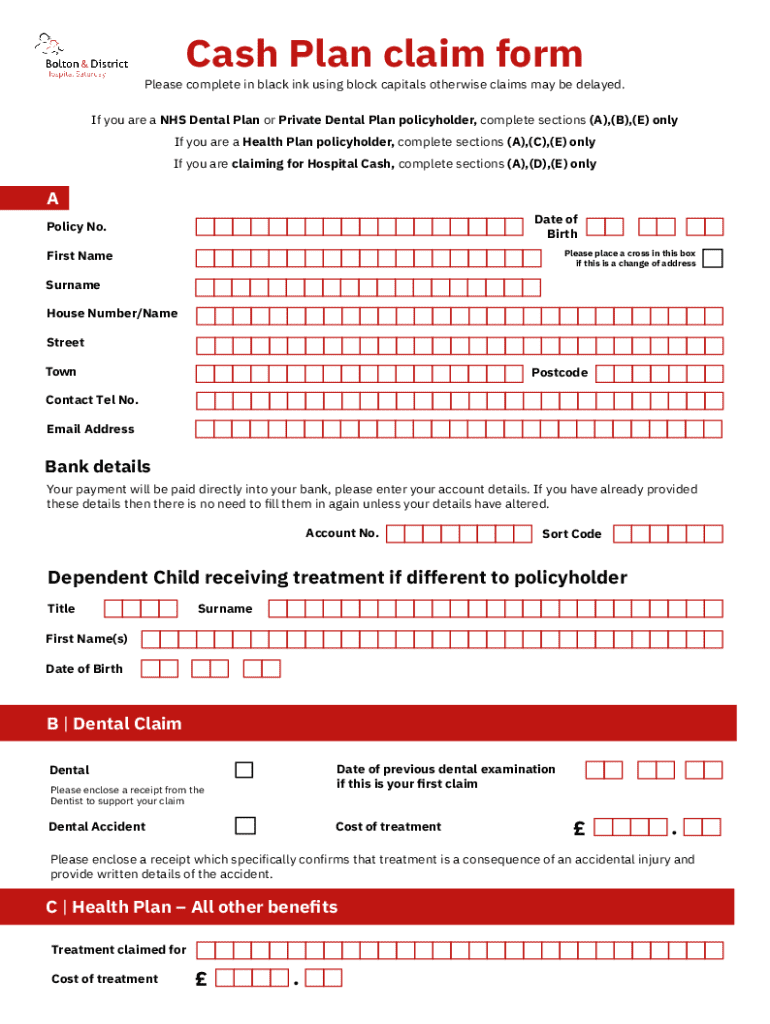

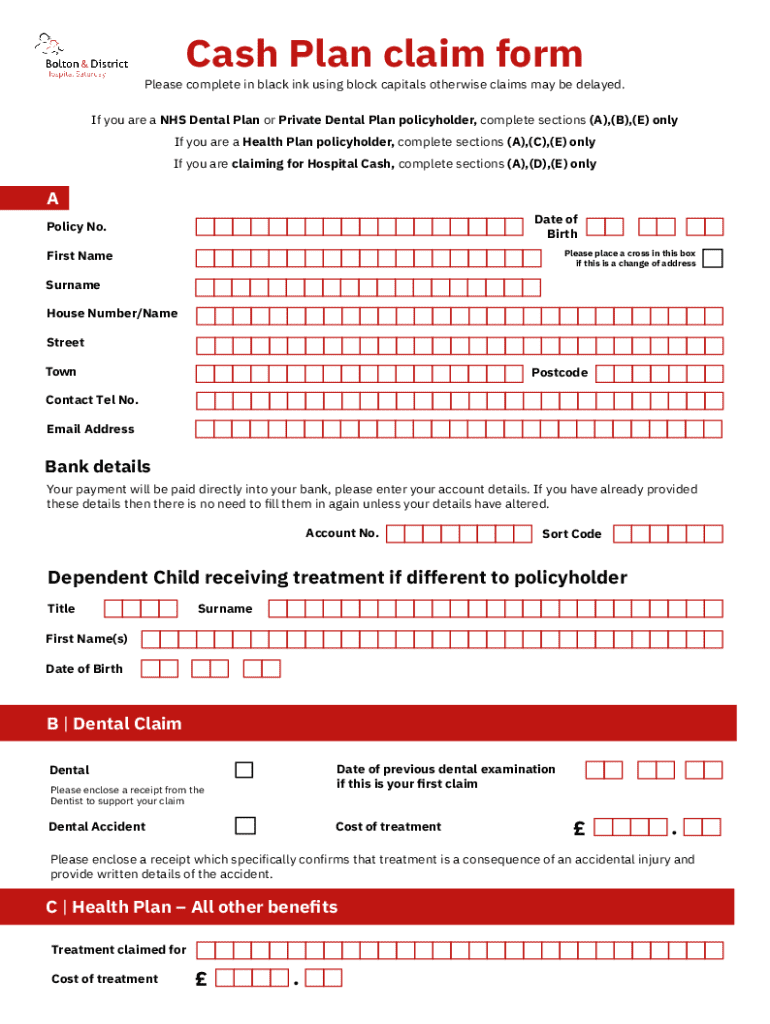

The cash plan claim form is a structured document that facilitates the reimbursement process from health plans. It encompasses an array of necessary information that both the claimant and the insurance provider require to process the claim effectively. Filling it out correctly is vital to avoid delays.

Key components of the form typically include personal information, your health plan number, service provider details, and the nature of your claim. Each of these sections must be completed accurately to ensure a smooth claims process. Notably, including correct details about medical services is essential for categorization and approval.

Preparing to fill out your cash plan claim form

Before you begin filling out your cash plan claim form, gathering essential documents is crucial. You will need proof of service, which may include receipts or invoices from the healthcare provider. Additionally, valid identification documents and any previous correspondences about your claims will streamline the process.

Consider using a useful checklist for completing your form effectively. Ensure that your personal information is accurate and up-to-date. Also, confirm the format of your receipts, as official receipts are usually required by cash plans to validate your claims.

Step-by-step guide to filling out the cash plan claim form

Completing the cash plan claim form can be accomplished in a few systematic steps that simplify the process for users. Start by gathering all necessary information related to yourself, your health plan, and the services rendered.

Begin with Step 1: Gather Necessary Information. Collect details like your full name, address, and health plan number. Furthermore, it’s important to have information about your healthcare provider, including their name and contact details.

Step 2: Complete the Personal Details Section. Enter information such as your name, address, and policy number accurately, as missing or incorrect details may cause delays.

Step 3: Specify the Nature of Your Claim. Clearly identify the nature of your claim—whether it's medical treatment, dental services, or optical expenses—as each claim could be subjected to different processing criteria.

Step 4: Attach All Supporting Documents is next. Organizing and attaching all relevant documents securely will enhance the chances of claim approval. Ensure each document is clear and placed in the correct order.

Finally, Step 5: Review Your Application Before Submission is crucial. Go through your entire claim form to double-check for missing information. This checking step can save you time and prevent future headaches.

Common mistakes to avoid

When submitting your cash plan claim form, being aware of common mistakes can significantly impact the likelihood of claim approval. Frequent errors include missing essential information, providing unreadable receipts, or failing to attach proper documentation.

Another typical mistake is neglecting to follow specific submission guidelines set by the cash plan provider. It's crucial to understand that all mandatory information must be filled out to avoid any unnecessary delays or rejection of your claim.

What happens after submission?

After submitting your cash plan claim form, it’s essential to be aware of the processing timeline, which can vary depending on the provider. Generally, you should expect to wait between 5 to 10 business days for processing, after which you will receive communication about the status of your claim.

To track the status of your claim, most providers offer a tracking system either through their website or customer service. It’s beneficial to keep your reference number handy for inquiries.

For questions or clarifications, it's advisable to reach out to the dedicated contact points listed on your provider’s site. This can include customer service numbers, email support, or even an online chat function for immediate assistance.

Tips for efficient claims management

Using a cloud-based platform like pdfFiller for document management can enhance your claims management experience significantly. With robust features allowing users to edit PDFs, eSign, and manage documents seamlessly, it ensures that your cash plan claim form is processed without hiccups.

Additionally, employing pdfFiller’s editing and signing features can facilitate smoother interactions with your documents. You can easily correct any mistakes on the form or append your signature without the hassle of printing and scanning physical documents.

Moreover, if you're part of a team, pdfFiller's collaborative features enable multiple members to contribute to the claims process. This ensures that every piece of information is accounted for, leading to a more streamlined submission.

Frequently asked questions (FAQs)

Common inquiries regarding the cash plan claim form often revolve around issues like processing times and what to do if a claim is denied. Most claims typically take 5 to 10 business days to process, although some may take longer.

In case your claim is denied, the best course of action is to review the denial notice carefully. This document usually outlines the reasons for denial and provides you with guidance on how to rectify the issues. Additionally, understanding the submission methods available, such as online versus paper submissions, can also aid in expediting your claims.

Recap of the cash plan claim process

To summarize the key steps involved in the cash plan claim process: start by collecting all necessary documentation and filling out the claim form meticulously. Always ensure that you provide accurate information and include all relevant documents to avoid unnecessary delays.

Lastly, double-check your submission before sending it off to ensure all details are correct. Keeping a record of your claims submission can also be highly beneficial for quick reference in the future.

Contact information for further assistance

For any additional support regarding your cash plan claim form, it’s essential to know where to turn. At pdfFiller, you can easily reach customer support by visiting their website, where options for live chat and email assistance are available. Quick access to help ensures that you can navigate any part of the claims process efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my cash plan claim form directly from Gmail?

How can I send cash plan claim form to be eSigned by others?

How can I edit cash plan claim form on a smartphone?

What is cash plan claim form?

Who is required to file cash plan claim form?

How to fill out cash plan claim form?

What is the purpose of cash plan claim form?

What information must be reported on cash plan claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.