Get the free Tax Preparer’s Registration Application

Get, Create, Make and Sign tax preparers registration application

Editing tax preparers registration application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax preparers registration application

How to fill out tax preparers registration application

Who needs tax preparers registration application?

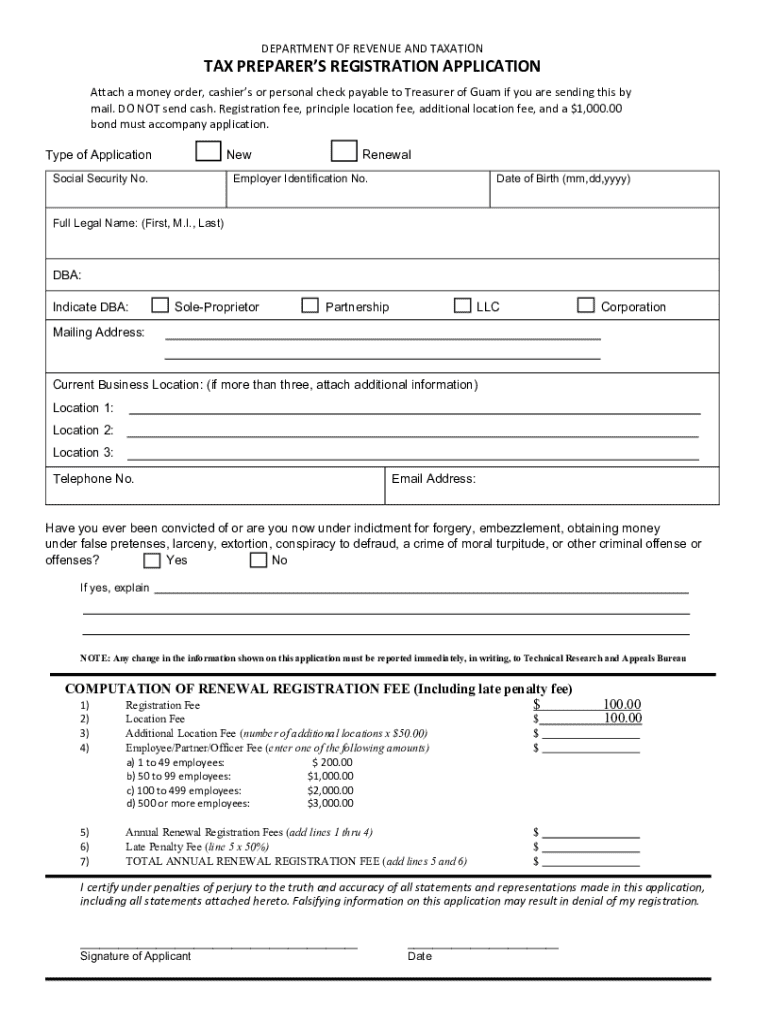

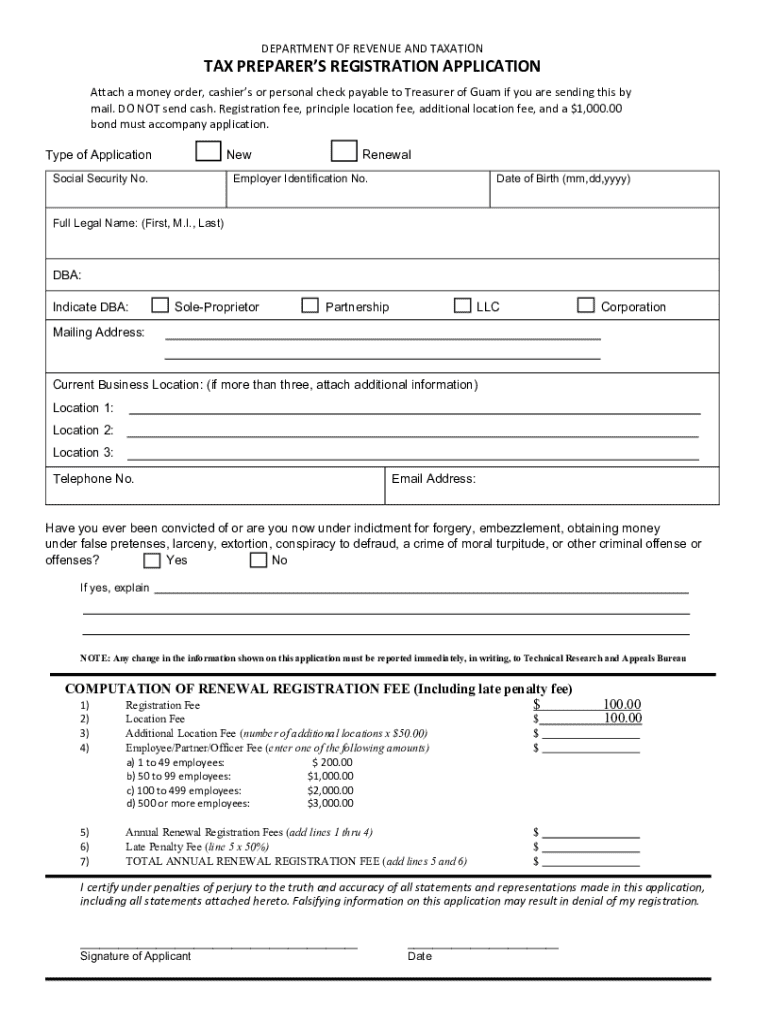

Understanding the Tax Preparers Registration Application Form

Understanding tax preparers registration

A tax preparer is a professional who assists individuals and businesses in preparing and filing tax returns. This role is crucial in the tax system, where accuracy and compliance with government regulations are paramount. By ensuring that clients take advantage of all eligible deductions and credits, tax preparers not only help clients reduce their tax obligations but also maintain the integrity of the tax code.

The registration of tax preparers is a regulatory process that guarantees the competency and reliability of these professionals. It is necessary to register with appropriate state or federal authorities to provide tax preparation services legally. One of the primary benefits of being a registered tax preparer is the ability to represent clients before the IRS, enhancing their professional credibility.

Who must register as a tax preparer?

Individuals who prepare tax returns for compensation generally need to register as tax preparers. This includes professional tax preparers and tax facilitation entities like firms that employ multiple preparers. In many states, any entity engaging in tax preparation for a fee requires registration, highlighting the responsibility these professionals bear.

However, not everyone is obligated to register. Exemptions typically apply to individuals who prepare taxes for family members, volunteers participating in free tax preparation clinics, or those who prepare very few returns for compensation. Understanding the criteria for exemption is crucial for anyone considering entering this profession.

Detailed registration requirements

To register as a tax preparer, specific eligibility criteria must be met. This often includes having a minimum level of education, such as a high school diploma or equivalent, and a clean background check. Tax preparers should demonstrate an understanding of tax laws and the filing process, which is sometimes verified by completing a preparer education program.

The documentation required for registration generally includes proof of identity, educational credentials, and sometimes a tax compliance certificate. It's essential to gather these documents in advance. To ensure everything is in order, organizing them logically can simplify the registration process significantly.

How to complete your tax preparers registration application form

Completing your tax preparers registration application form requires careful attention to detail. Start by carefully reading every section of the form to understand what is needed. Each section usually demands specific information about your qualifications and experiences, such as your educational background, work history, and any continuing education you've undergone.

One common mistake is submitting incomplete or incorrect information, which can delay processing. To avoid this, double-check all entries and take the time to re-read the application. Utilizing platforms like pdfFiller can streamline this process by allowing you to fill out forms easily and ensuring everything is laid out clearly. Their interactive features help prevent errors.

Registration fees and payment procedures

The registration process often involves fees that cover application processing, which may vary significantly by state or jurisdiction. Prospective tax preparers should be aware of these costs upfront. Typically, the fees can range from $100 to several hundred dollars depending on various factors, including any additional accreditation you may be pursuing.

Payment methods for registration can include online payments via credit card, electronic checks, or sometimes paper checks. Familiarizing yourself with these options early on is essential to avoid complications when submitting your registration application.

After registration: What you need to know

Upon submission of your tax preparers registration application, you will receive confirmation indicating that your application is under review. The processing timeline can vary from a few days to several weeks depending on how busy the regulatory office is and the completeness of your application.

After your application is approved, you will receive your registration credentials. Being registered not only legitimizes your practice but enables you to assist clients fully. Next steps may involve obtaining liability insurance, if not already acquired, and preparing to market your tax preparation services to potential clients.

Continuing education requirements for tax preparers

Registered tax preparers are required to pursue continuing education (CPE) to stay updated on changes in tax laws and regulations. Ongoing education is vital to ensure that preparers remain competent and knowledgeable in their field. The minimum education requirement typically includes a set number of hours per year, often around 15 to 20 hours depending on state requirements.

To fulfill these requirements, tax preparers can enrol in accredited programs that offer courses relevant to current tax laws, preparation techniques, and ethical considerations. Many professional organizations provide resources and courses to facilitate learning and development in this area.

Managing your registration status

Tax preparers must ensure that their registration information remains current. This includes updating personal details such as contact information and address whenever changes occur. Being proactive about maintaining registration status is crucial as failure to do so could result in lapses in your ability to legally prepare taxes.

Renewing your registration is also an important aspect of management. Many jurisdictions require renewal every one to three years, often requiring proof of continuing education and payment of a renewal fee. Being aware of these timelines will prevent penalties or revocation of registration.

Penalties and consequences of failing to register

Operating as a tax preparer without the necessary registration can lead to severe legal implications. Individuals caught preparing tax returns without registering may face penalties, including fines. In some cases, repeat offenders could even face criminal charges depending on the extent of non-compliance and the amount of compensation earned during unregistered operations.

The financial penalties can be steep, as many states impose fines that significantly exceed the original registration fee. Timely registration is essential not only to avoid these financial repercussions but also to ensure that your practice is credible and trustworthy in the eyes of potential clients.

Resources and tools for tax preparers

Registered tax preparers should leverage essential resources to thrive in their practice. Educational materials, networking opportunities, and tools that aid in tax preparation and management are invaluable. Organizations that provide certifications and training often offer resources that help preparers stay abreast of best practices and changes in tax law.

Additionally, using document management solutions like pdfFiller can make the preparation process more efficient. With tools for editing, signing, and collaborating on tax forms, tax preparers can manage their documents seamlessly and enhance their productivity.

FAQs about tax preparers registration

As the registration process can be complex, many prospective tax preparers have questions. Common inquiries include how long the registration process takes, specific documentation requirements, and the procedures for resolving issues with applications. It is essential for tax preparers to be well-informed about the entire registration journey to avoid delays and difficulties.

If you encounter issues with your application, knowing whom to contact for assistance can expedite the resolution process. Each state typically has designated contact points in their tax preparation offices, and many online resources, including pdfFiller, can provide guidance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tax preparers registration application directly from Gmail?

How can I modify tax preparers registration application without leaving Google Drive?

How do I fill out tax preparers registration application on an Android device?

What is tax preparers registration application?

Who is required to file tax preparers registration application?

How to fill out tax preparers registration application?

What is the purpose of tax preparers registration application?

What information must be reported on tax preparers registration application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.