Get the free Property Loss or Damage Report - gacc nifc

Get, Create, Make and Sign property loss or damage

How to edit property loss or damage online

Uncompromising security for your PDF editing and eSignature needs

How to fill out property loss or damage

How to fill out property loss or damage

Who needs property loss or damage?

Property Loss or Damage Form: A How-to Guide

Understanding the importance of a property loss or damage form

Documenting property loss or damage is a critical step in the claims process for both individuals and businesses. A property loss or damage form serves as formal notification to your insurance provider, outlining the specifics of your situation, enabling timely processing of claims. The insurance company relies heavily on this documentation to assess the validity of the claim and to determine compensation.

Filing a property loss or damage report has legal implications as well; it creates an official record that may be needed in future disputes or investigations. Whether it’s caused by vandalism, natural disasters, or accidents, certain scenarios necessitate the completion of this form to protect your interests.

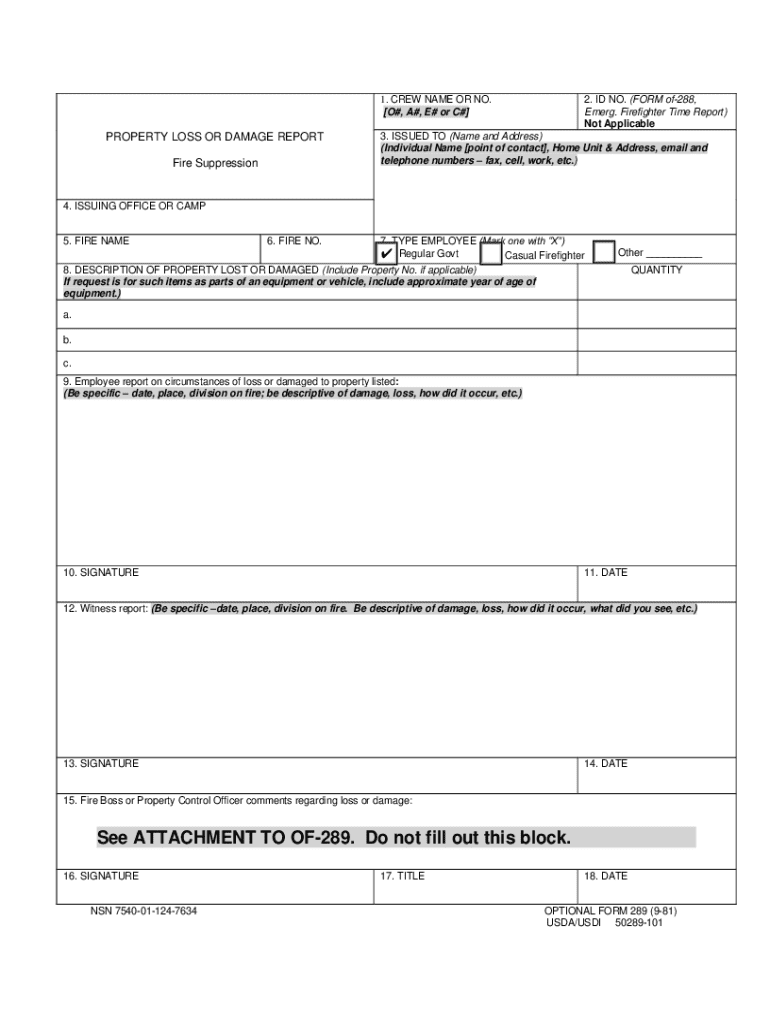

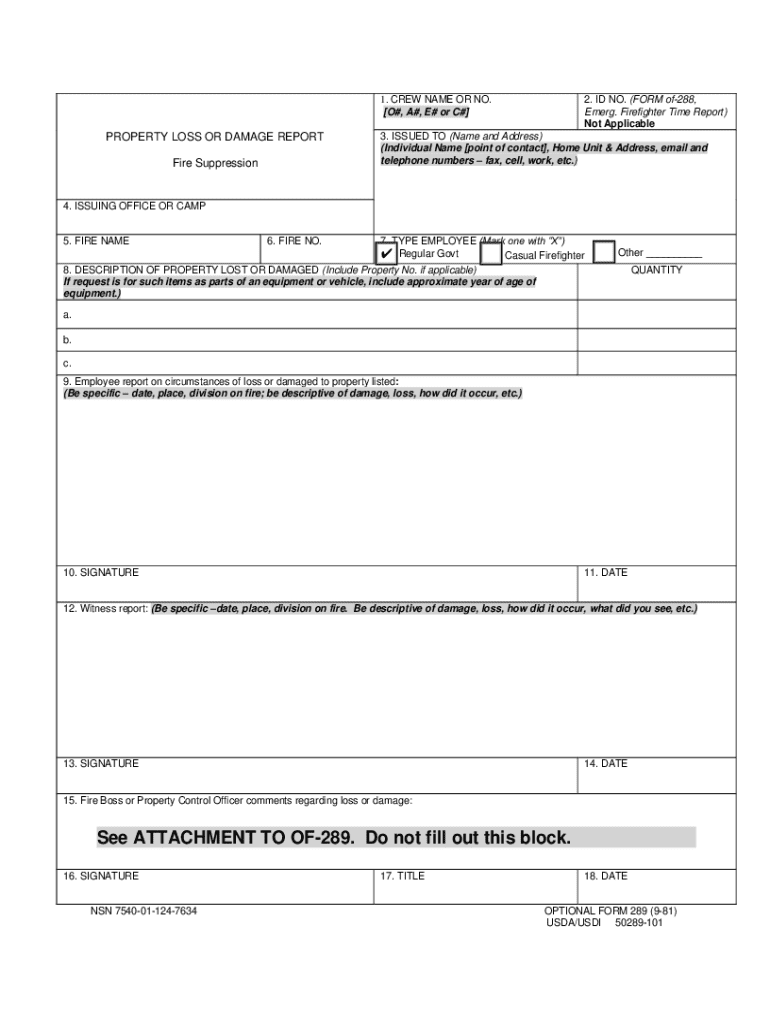

Overview of the property loss or damage form

A property loss or damage form is a structured document that individuals and organizations fill out to report incidents of loss or damage. This official form is a requirement for processing insurance claims and soliciting appropriate compensation from your insurer. Understanding its key components empowers you to effectively communicate your issue and expedite the claims process.

The form typically includes vital details such as the owner’s information, a thorough description of the property in question, specifics regarding the loss or damage, and prompts for any supporting documentation required to substantiate your claim.

Step-by-step instructions for completing the form

Completing your property loss or damage form effectively is essential for a smooth claims process. Follow this step-by-step guide to ensure that your submission is thorough and accurate.

Step 1: Gathering necessary information

Start by gathering all relevant documents, including your insurance policy, photographs of the damage, and any previous correspondence with your insurer. Collecting robust evidence of your loss or damage can significantly bolster your claim.

To support your submission, consider listing detailed notes about the incident, including dates, times, and conditions surrounding the loss.

Step 2: Filling out personal and property details

Accurate completion of personal and property details is crucial. Ensure your contact information and the property location are correct, as discrepancies can lead to processing delays. Pay special attention to property descriptions—include brand, model, and condition.

Common areas that confuse claimants include valuation and description fields. Be as precise as possible to minimize back-and-forth communication with your insurer.

Step 3: Detailing the incident

Elaborate on the circumstances that led to the loss or damage while ensuring every detail is accurate and comprehensive. Mention how the incident occurred and the immediate implications of the damage. The clarity of your narrative will assist the insurer in understanding your situation better.

Step 4: Including supporting documentation

Supplement your property loss or damage form with all relevant documentation. Potential supporting evidence includes photographs, purchase receipts, police reports, or repair estimates. Present the evidence clearly, and arrange them in the order they relate to your claim.

Ensure that attachments are legible and appropriately sized, as this makes it simpler for your insurer to digest the information.

Editing and customizing your property loss or damage form

Once you've filled out the form, pdfFiller offers easy-to-use editing tools to fine-tune your document. Changing pre-filled details is seamless, allowing you to correct any errors swiftly.

Additionally, you can add annotations or notes for clarification. Customizing your form to meet specific requirements, whether for personal housing or commercial property, ensures it's tailored to the unique points of your situation.

eSigning your property loss or damage form

eSigning your property loss or damage form is a crucial step before submission. By adding your electronic signature using pdfFiller, you’re verifying the authenticity of the document. This modern approach not only speeds up the process but also provides a safe and secure method for submitting your claims.

If multiple parties need to sign, pdfFiller allows you to send the document to them easily, ensuring everyone involved verifies their acknowledgment without unnecessary delays.

Submitting the property loss or damage form

With your form complete and signed, it’s time to submit it to your insurance company. There are various submission methods available, from online uploads to traditional mail or in-person submissions. Confirm the preferred route of your specific insurer to avoid complications.

Before submission, double-check the completeness of your form and all attached documents. After submission, keep copies and note confirmation receipts, if provided. Being proactive ensures you stay informed about the status of your claim.

Managing your submitted property loss or damage form

Post-submission, managing your property loss or damage form effectively is crucial. Utilize pdfFiller’s features to track the current status of your submission efficiently. Keeping records of communications and any updates from your insurer ensures you're prepared should you need to follow up.

Creating backups of your form and related documents is also necessary for your peace of mind, ensuring that important documents are secure and retrievable whenever needed.

Common mistakes to avoid when filling out the form

When completing the property loss or damage form, errors can lead to unnecessary delays. Frequent mistakes include omitting critical information, inaccurate descriptions, or submitting insufficient supporting documents. Always verify that you've entered all required details clearly.

In addition, failing to double-check your submission can result in overlooking these errors. Utilizing resources for assistance and templates can provide additional clarity, enhancing the chances of your claim process running smoothly.

Frequently asked questions (FAQs)

Clarifying eligibility and timelines concerning property claims is critical. Most insurers elaborate on the specifics in their documentation; however, seeking further guidance is advisable if uncertain. For disputes with your insurer regarding the submission, document exchanges can help solidify your case.

If you need further assistance with your property loss or damage form, consider reaching out to customer support available on pdfFiller or your insurance provider, who are well-equipped to answer your specific queries.

Conclusion: The advantage of using a comprehensive document solution

Utilizing pdfFiller to navigate the property loss or damage form process streamlines the workflow, making your experience less stressful. Its centralized platform for document management equips users with the tools they need to create, edit, eSign, and manage forms easily.

The benefits of having a cloud-based platform for managing important forms lead to increased efficiency and peace of mind. Embracing a solution like pdfFiller ensures that you can manage significant documents with confidence, knowing that you are well-prepared for any eventuality that might emerge.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the property loss or damage in Chrome?

How can I fill out property loss or damage on an iOS device?

How do I edit property loss or damage on an Android device?

What is property loss or damage?

Who is required to file property loss or damage?

How to fill out property loss or damage?

What is the purpose of property loss or damage?

What information must be reported on property loss or damage?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.