Get the free Payroll Change Form

Get, Create, Make and Sign payroll change form

How to edit payroll change form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out payroll change form

How to fill out payroll change form

Who needs payroll change form?

Comprehensive Guide to Payroll Change Form Management

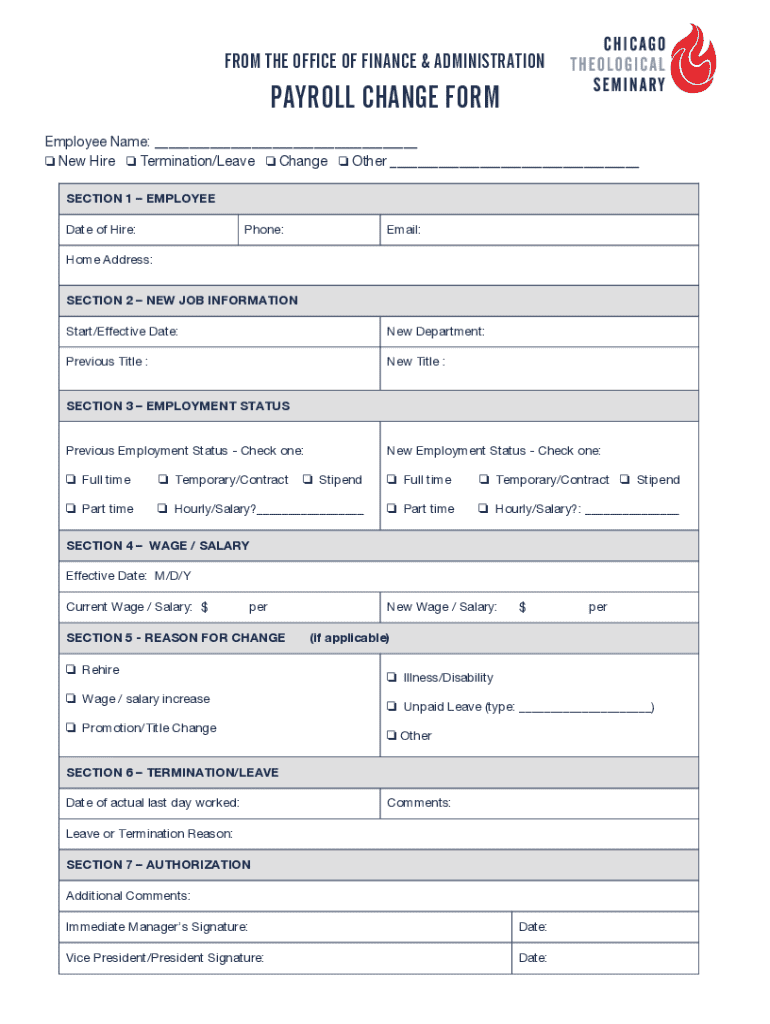

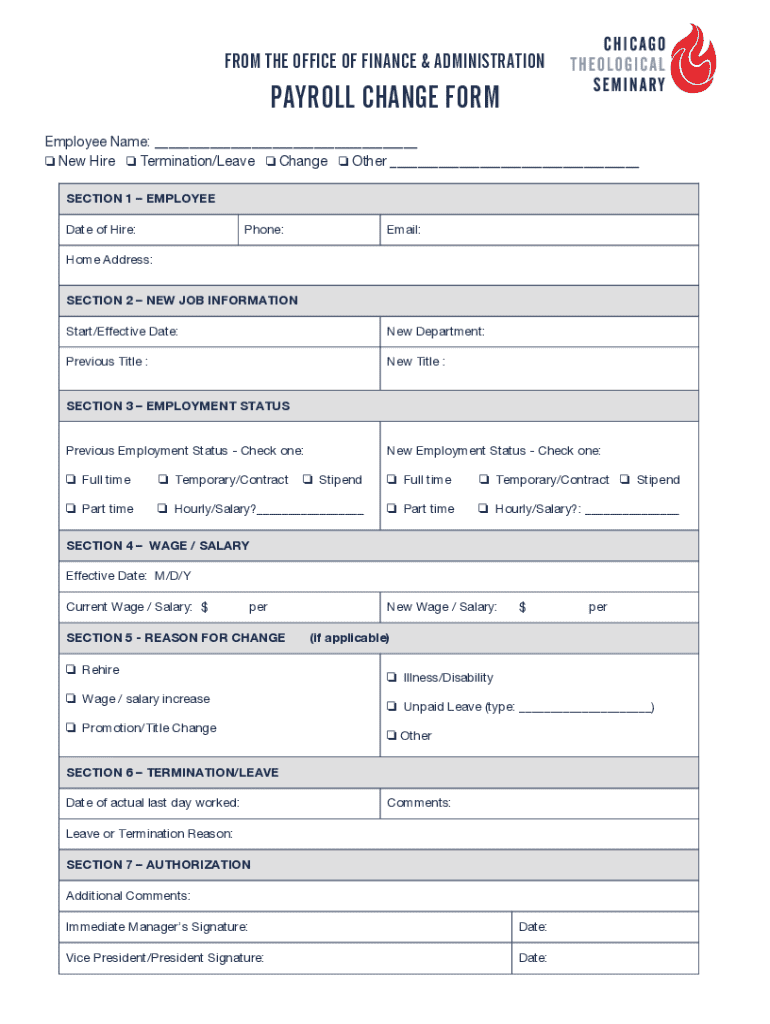

Understanding the payroll change form

A payroll change form is a critical document used in organizations to capture any modifications related to an employee's salary, job classification, or employment status. The primary purpose of this form is to ensure that all changes are documented accurately, facilitating the smooth processing of payroll adjustments. By maintaining a structured approach to payroll changes, companies can prevent errors, ensure compliance with labor laws, and uphold employee satisfaction.

Accurate payroll change management contributes to overall organizational health, allowing for clear communication between departments, minimizing discrepancies, and assisting in budget forecasting. This form plays a pivotal role in managing payroll adjustments, particularly in dynamic work environments where changes frequently occur.

Key components of a payroll change form

A well-structured payroll change form includes various essential components that ensure comprehensive data capture. These components generally include detailed employee information, specifics about the intended changes, and an authorization section for necessary approvals.

Types of changes managed through the payroll change form

Payroll change forms efficiently handle various types of changes that can occur throughout an employee's lifecycle in the organization. Common changes include salary adjustments, job classification changes, and shifts in employment status. Each of these modifications has distinct implications that are worth understanding.

How to complete a payroll change form

Completing a payroll change form accurately is vital for preventing payroll delays and ensuring employee satisfaction. Follow these step-by-step instructions to navigate the process effectively.

Common mistakes to avoid when filling out the payroll change form

Filling out a payroll change form can be prone to errors, which may delay processing or lead to employee dissatisfaction. Being aware of common mistakes can prevent such issues.

Utilizing interactive tools for payroll change management

In today's fast-paced work environment, leveraging technology can significantly enhance payroll change management. Tools like pdfFiller offer innovative features that simplify this process.

By utilizing cloud-based management solutions like pdfFiller, organizations benefit from flexibility, allowing access from any device and smooth integration with existing HR systems.

Best practices for managing payroll changes

Creating a robust payroll change management system requires adherence to best practices. By doing so, organizations can enhance efficiency and accuracy.

Use cases for the payroll change form

Understanding practical use cases for payroll change forms can bring to light their importance in the organizational structure.

Ensuring flexibility in document management helps adjust to organizational changes swiftly, reducing frustration and fostering a positive work environment.

Feedback and continuous improvement

Gathering employee feedback regarding payroll changes fosters a culture of transparency and continuous improvement. It provides insights that can refine how these changes are managed in the future.

Utilizing platforms like pdfFiller to collect and analyze employee feedback enables organizations to adapt their processes and address potential pain points, leading to more effective and satisfactory outcomes. Encouraging open communication regarding payroll changes can transform challenges into opportunities for enhancement and alignment with employee needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my payroll change form in Gmail?

How do I edit payroll change form in Chrome?

How can I edit payroll change form on a smartphone?

What is payroll change form?

Who is required to file payroll change form?

How to fill out payroll change form?

What is the purpose of payroll change form?

What information must be reported on payroll change form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.