Get the free Case 11-23138

Get, Create, Make and Sign case 11-23138

How to edit case 11-23138 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out case 11-23138

How to fill out case 11-23138

Who needs case 11-23138?

Comprehensive Guide to the Case 11-23138 Form

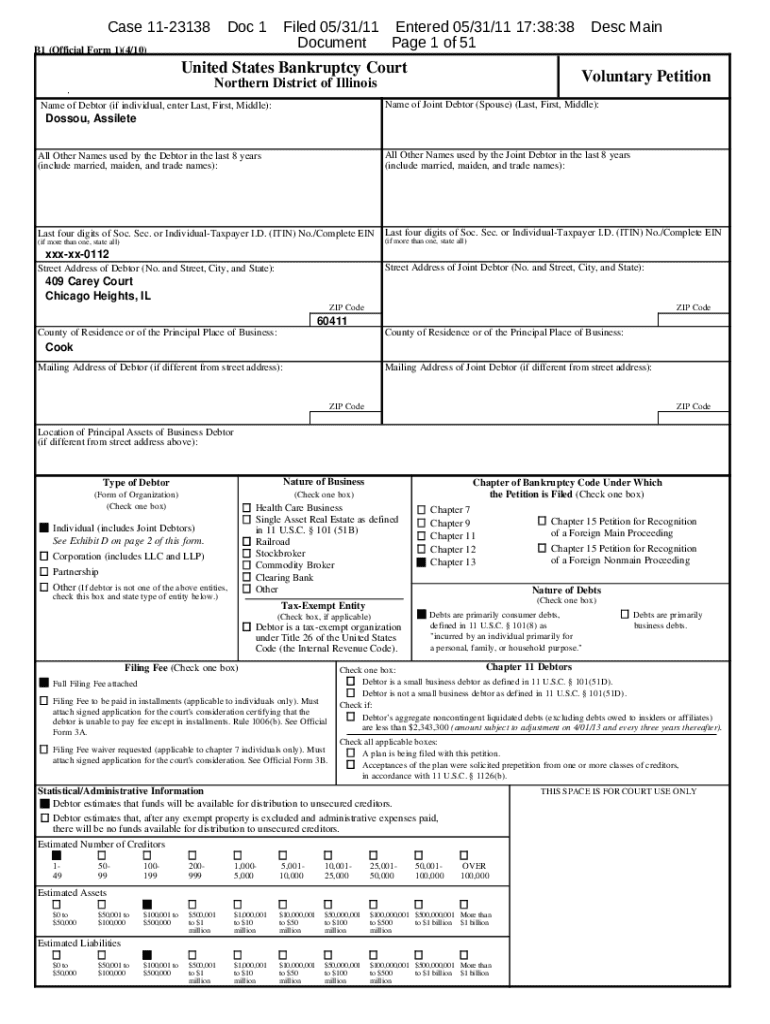

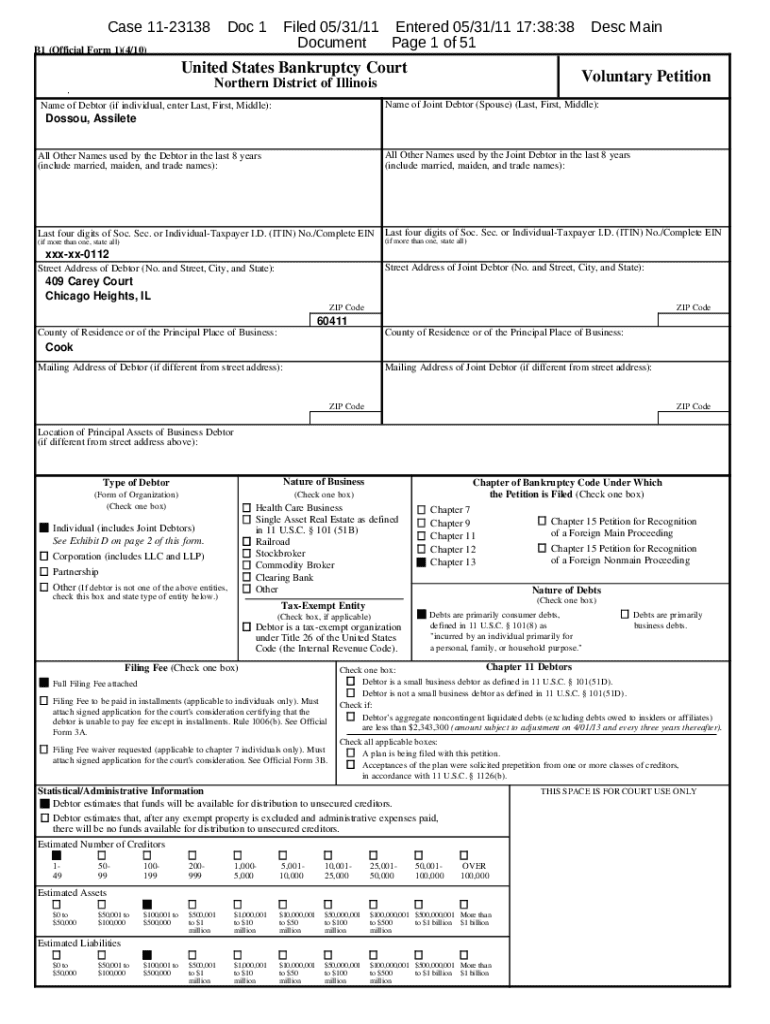

Overview of Case 11-23138 Form

The Case 11-23138 Form is a critical document used primarily in property tax appeals, specifically directed at the property tax appeal board. This form serves as an official means for appellants to contest property tax assessments they believe to be inaccurate or unfair. The importance of this form cannot be overstated, as it often represents the first step in addressing potentially significant financial discrepancies. For those seeking to navigate property tax disputes, understanding this form is essential.

Key stakeholders involved in the use of the Case 11-23138 Form typically include property owners seeking relief from perceived unfair tax assessments, legal representatives advocating on behalf of those owners, and officials from the property tax appeal board who review submitted cases. Their collaborative efforts can lead to resolutions that both respect property rights and uphold legal standards.

Sections of the Case 11-23138 Form

A complete understanding of the sections within the Case 11-23138 Form is essential for accurate completion and submission. Each section plays a crucial role in detailing the pertinent information regarding the appeal.

Step-by-step instructions for completing the Case 11-23138 Form

Completing the Case 11-23138 Form correctly involves a few critical steps that ensure all necessary information is accurately captured. With organized preparation, filling out the form can become a streamlined process.

Editing and modifying the Case 11-23138 Form

Sometimes, adjustments to the Case 11-23138 Form are necessary. Utilizing tools like pdfFiller makes this process seamless, allowing users to edit forms with minimal hassle.

eSigning the Case 11-23138 Form

Digital signatures are increasingly accepted in legal contexts, allowing individuals to sign documents electronically. The eSigning process via pdfFiller not only simplifies signing but ensures your submission is both secure and recognized.

Collaboration features

Collaboration is an integral part of preparing your Case 11-23138 Form, especially if you are working with legal representation or team members. Utilizing pdfFiller's collaboration features can enhance the experience.

Managing submitted Case 11-23138 forms

After submission, managing your Case 11-23138 Form properly is essential. A well-organized approach helps keep everything on track and easily retrievable.

Legal guidelines and best practices

Navigating the legal landscape surrounding the Case 11-23138 Form requires familiarity with relevant terminologies and practices. Understanding the nuances can significantly benefit anyone involved in property tax appeals.

Case studies and examples

Real-life applications of the Case 11-23138 Form illustrate its significance in property tax relief cases. These narratives often provide insight into effective strategies for successful submissions.

Frequently asked questions (FAQs)

Navigating the nuances of the Case 11-23138 Form generates several common queries that are worth addressing to aid in clarity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit case 11-23138 online?

Can I create an eSignature for the case 11-23138 in Gmail?

How can I fill out case 11-23138 on an iOS device?

What is case 11-23138?

Who is required to file case 11-23138?

How to fill out case 11-23138?

What is the purpose of case 11-23138?

What information must be reported on case 11-23138?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.