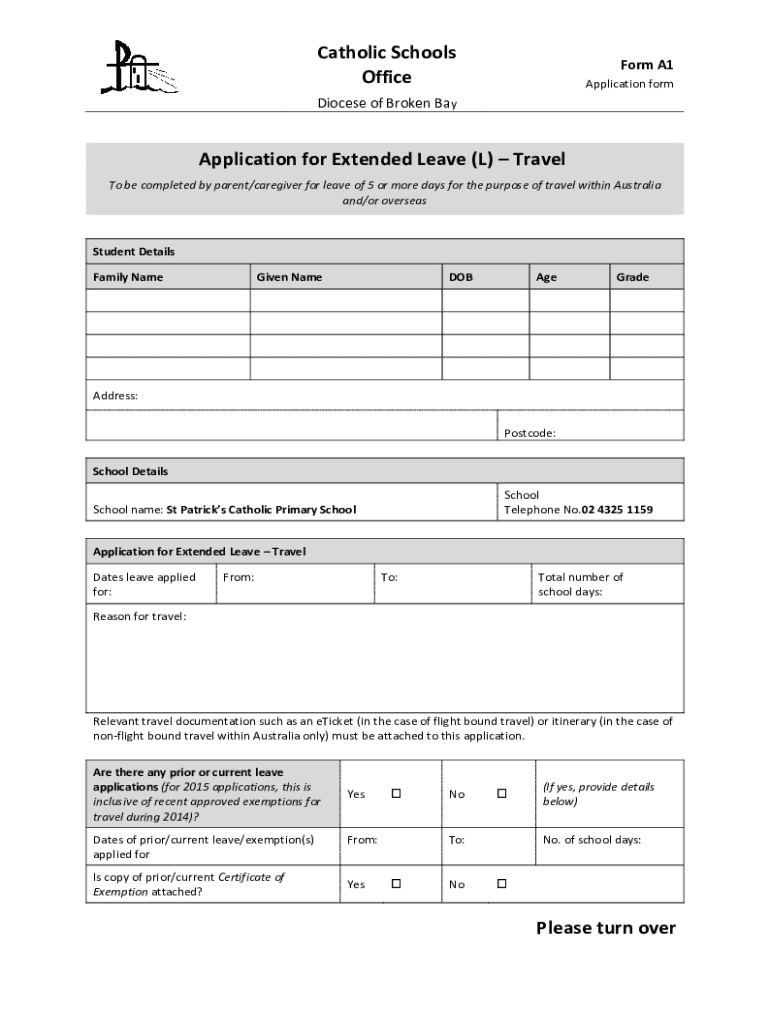

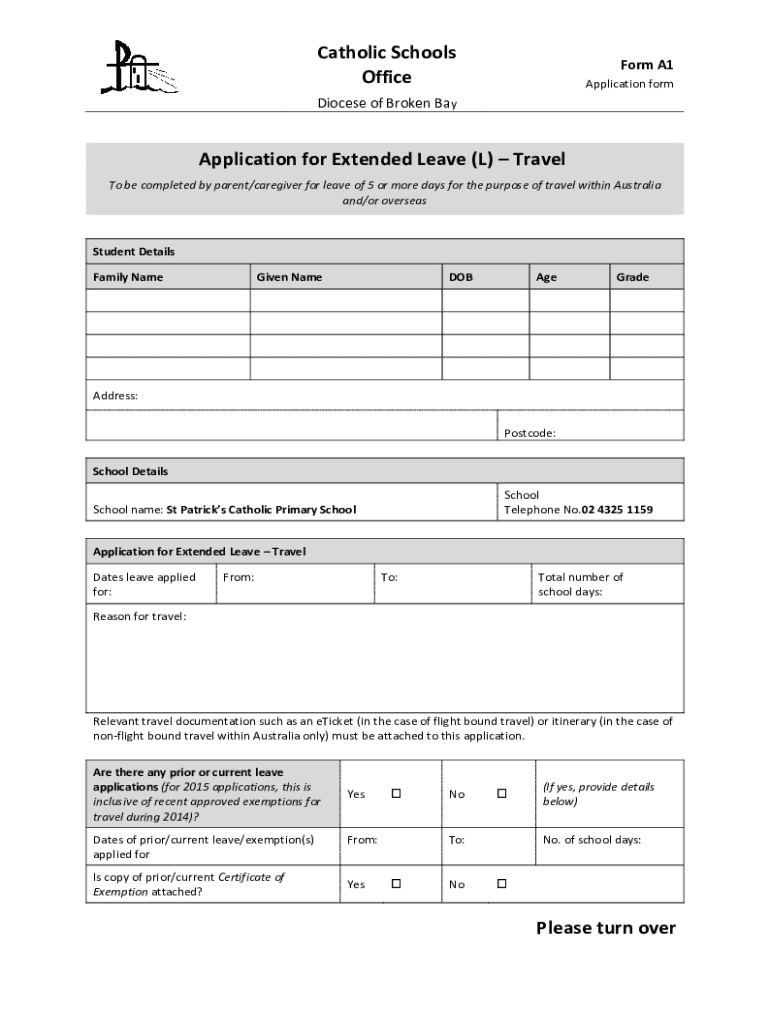

Get the free Form A1

Get, Create, Make and Sign form a1

How to edit form a1 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form a1

How to fill out form a1

Who needs form a1?

Understanding the A1 Form: A Comprehensive Guide

Understanding the A1 Form

The A1 Form is a critical document within the European Union (EU) and the European Free Trade Association (EFTA) that certifies an individual's social security coverage. Established under European regulations, particularly EU Regulation 883/2004, the A1 form is vital for workers moving within the EU or EFTA countries. By providing proof of ongoing social security contributions in one country while working in another, this form ensures that expatriates and remote workers do not face dual social security obligations.

The importance of the A1 Form cannot be overstated. It facilitates international employment by simplifying the process for workers who are temporarily assigned to work in another country, enabling them to access social security rights without penalties. This document acts as a bridge, allowing businesses to deploy talent effectively across borders while ensuring legal compliance and protection for employees.

What is the purpose of the A1 form?

The primary purpose of the A1 Form is to clarify an individual’s social security status when they work in a country different from where they are insured. For employers, the A1 form streamlines cross-border operations, mitigating the risk of non-compliance with national labor laws. For employees, it ensures access to social security benefits, such as health care and pensions, without the burden of paying contributions in multiple countries.

In essence, the A1 form serves as a passport for social security rights, making it an indispensable tool in today's interconnected workforce. As remote work and international assignments become increasingly common, the A1 form plays a critical role in facilitating employee mobility and cost management for businesses.

Who needs an A1 form?

The A1 Form is especially relevant for expatriates, remote workers, and professionals who frequently travel across borders for work. This includes various demographics such as:

Significance of the A1 Form today

The A1 Form has gained significant importance in light of recent changes in international labor laws, especially as economies become more interconnected. The rise of remote work has transformed traditional employment models, making it essential for workers to navigate different social security systems. The A1 Form ensures compliance and protects both employees and employers from potential legal complications arising from misclassification of employment status in foreign jurisdictions.

Additionally, misconceptions about the A1 Form abound. Many assume it is only necessary for long-term relocations, but even short-term assignments require this documentation to avoid potential fines or double taxation of contributions. Understanding the scope and necessity of the A1 form is critical for workers and businesses alike.

Application process for the A1 form

The application for an A1 Form can be completed by both individuals and businesses. Eligibility criteria often include being a national of an EU or EFTA country and being covered by the social security system of the sending country. To ensure a smooth application process, follow these steps:

After submission, applicants can expect a processing timeline that varies by country but generally ranges from a few days to several weeks. Knowing the potential outcomes and subsequent steps will help clarify what to anticipate after the submission.

Managing your A1 form

An A1 Form is typically valid for up to 24 months, after which it will need to be renewed. This renewal process involves re-submitting updated documentation to the appropriate authority. Importantly, individuals do not need a new A1 Form for every trip, as long as their assignments remain within the defined validity period.

However, if a worker fails to obtain an A1 Form when required, the consequences can be dire. Employers may be subject to significant penalties, and the employee could end up dealing with unexpected taxation impacts. Therefore, it's crucial for both workers and employers to understand when the A1 Form is necessary in order to avoid long-term implications.

Best practices for employers

To ensure compliance and efficiency when applying for an A1 Form, UK employers should adhere to specific best practices. First, employers must be aware of their obligations to their employees regarding cross-border social security. Understanding the employee’s home country’s social security agreements is crucial.

These practices not only help streamline the process but also mitigate potential risks associated with compliance failures.

Interactive tools for A1 form management

With the help of advanced document management tools like pdfFiller, filling out an A1 Form can be straightforward. Users can utilize pdfFiller's features to easily edit, sign, and share documents from a cloud-based platform.

A step-by-step guide to using pdfFiller for A1 forms includes:

This approach not only accelerates the application process but also enhances collaboration for teams working with multiple A1 Forms.

FAQs about A1 forms

Addressing common queries can further demystify the A1 Form for workers and employers alike. For example, what happens if an A1 Form is denied?

Enhancing your document experience with pdfFiller

pdfFiller sets itself apart by providing seamless document editing and eSigning features tailored to the needs of users handling A1 Forms. Its functionalities include real-time collaboration, making it easier for teams to manage and track multiple documents.

Choosing pdfFiller for managing A1 Forms not only enhances user experience but also boosts productivity. With testimonials highlighting improved efficiency, it’s clear that using pdfFiller is a sound investment for both individuals and team-oriented workflows.

Troubleshooting common issues

Navigating the A1 Form application can come with challenges. Common mistakes include failing to provide complete personal details or submitting incorrect documentation, which can delay the approval process significantly.

By taking proactive steps to troubleshoot, individuals can simplify the process significantly, ensuring a smoother experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form a1 without leaving Google Drive?

How do I complete form a1 online?

How do I make changes in form a1?

What is form a1?

Who is required to file form a1?

How to fill out form a1?

What is the purpose of form a1?

What information must be reported on form a1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.