Get the free Form P – Verification of Practicum for Licensure as a Clinical Addiction Counselor (...

Get, Create, Make and Sign form p verification of

How to edit form p verification of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form p verification of

How to fill out form p verification of

Who needs form p verification of?

Form P Verification of Form: A Comprehensive How-to Guide

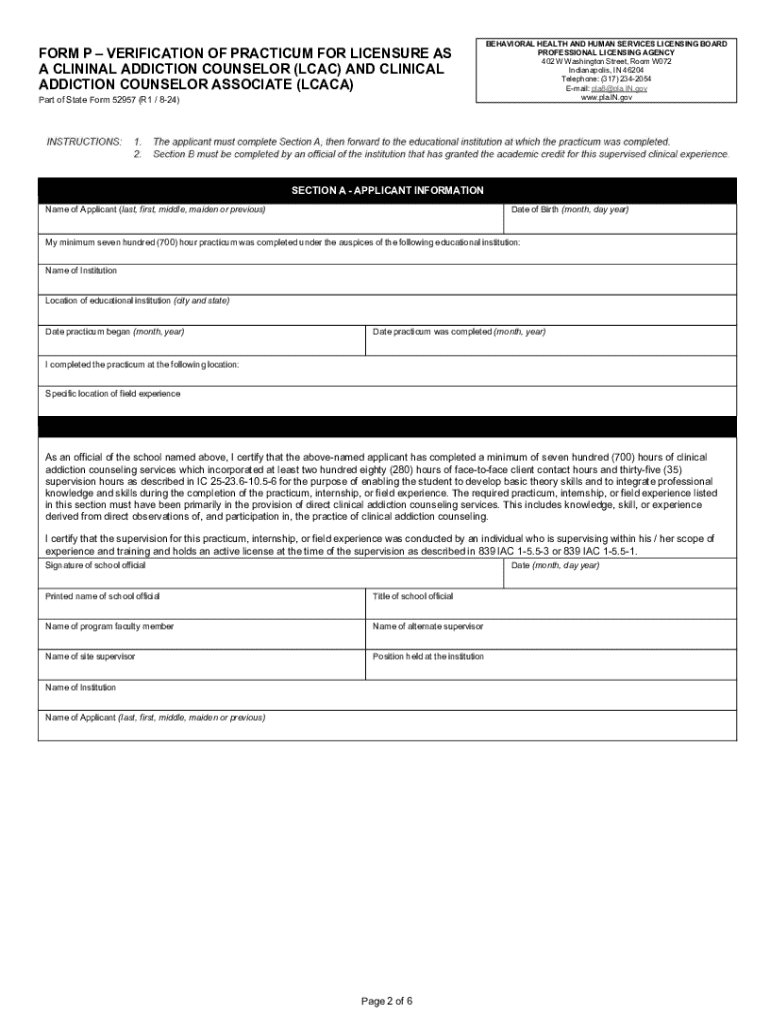

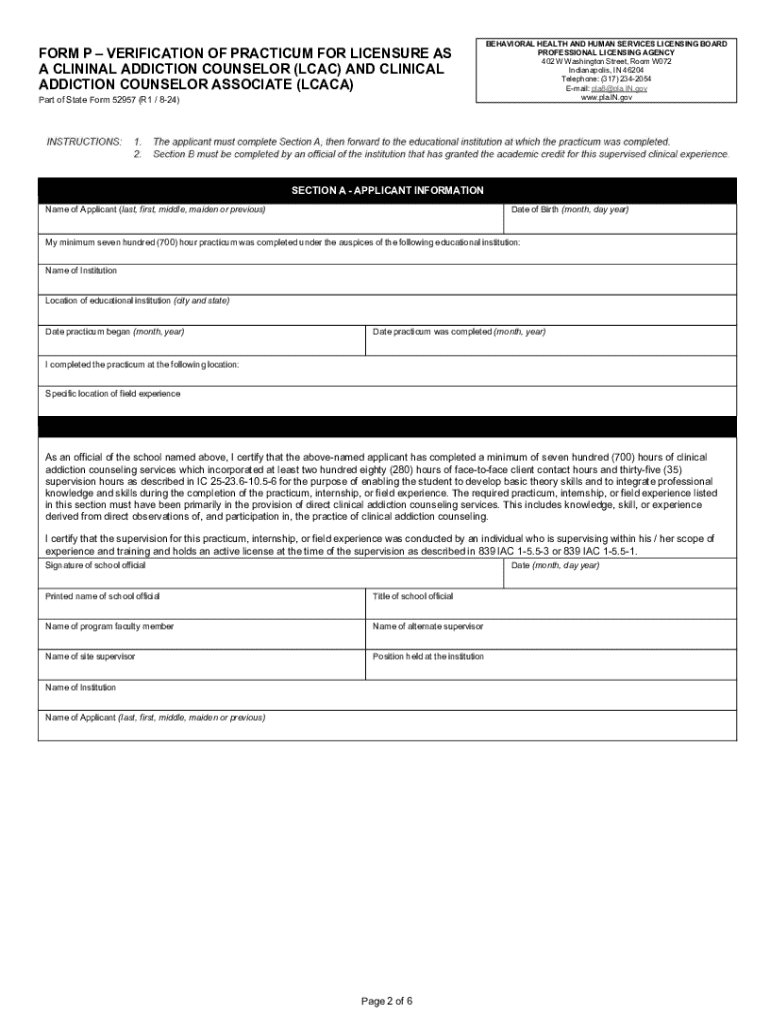

Understanding Form P Verification

Form P is a crucial document often required in various processes, notably in the financial and administrative sectors. This form typically provides a structured way to gather essential personal and financial information, facilitating various types of verification, including identity, income, and eligibility checks. The importance of Form P verification lies in ensuring that the provided information is accurate and complies with regulatory standards. This verification process is common in applications for loans, grants, or any situation requiring officially registered data.

In contexts where financial institutions or government agencies are involved, completing Form P accurately is imperative to avoid delays or rejections. For instance, submitting a loan application may hinge on the quality of the Form P verification process. This necessity underlines the importance of understanding what is required and how to correctly complete the form to meet verification criteria.

Key components of the Form P

Form P consists of several key sections that must be accurately filled out to ensure successful verification. Understanding these components is critical for avoiding common pitfalls. The major sections include personal information, financial details, and verification criteria.

In the personal information section, applicants need to provide details such as name, address, date of birth, and contact information. The financial information segment typically requires applicants to disclose their income, employment details, and any other marked financial commitments. Lastly, the verification criteria outline the standards against which the submitted data will be evaluated.

Common errors to avoid include misspellings in personal details, incorrect financial figures, and offering incomplete information which could lead to verification challenges down the line.

Step-by-step guide to completing Form P

Completing Form P efficiently requires a systematic approach. Begin with the preparation phase, where you will gather all necessary documentation such as identification, income proof, and previous financial statements. Understanding eligibility requirements related to your particular context will also streamline this process.

Filling out Form P can be tackled in distinct sections. Start with the personal information area: ensure all details are accurate. Next, move on to financial information. It's crucial to provide precise figures that reflect your current financial status.

Once you have filled out the form, it’s essential to review it thoroughly. This includes double-checking for typographical errors and ensuring all fields are completed. Failing to address these issues can result in unnecessary delays or outright rejection of your verification.

Interaction with pdfFiller: Streamlining your Form P verification

Leveraging pdfFiller can significantly enhance your experience with Form P verification. The platform allows users to upload the form directly, ensuring no loss in quality during edits. It provides various tools that allow for real-time editing which can be vital for ensuring accuracy.

Moreover, pdfFiller’s eSigning capabilities add an extra layer of convenience. Users can sign their documents securely, streamlining the verification process. Additionally, collaboration features allow team members to review and contribute to the form, ensuring comprehensive input prior to submission.

Finally, managing and storing your Form P via pdfFiller is straightforward, as the platform offers cloud-based solutions for document organization, version control, and change tracking. This ensures that you always have access to the most recent version of your documents.

Submitting your Form P

Once completed, timely submission of your Form P is essential. There are generally two methods: online submission through digital portals and mailing paper copies. Online submission tends to ensure quicker processing and immediate confirmation.

To confirm receipt of your submission, utilize tracking features provided by postal services, or confirmation emails from online submissions. Following up on the status of your verification should also be part of your process; many organizations provide a reference number or contact for inquiries, making it easier to check your application's progress.

Troubleshooting common issues with Form P verification

Despite meticulous preparation, challenges can arise during the Form P verification process. Common issues include denial due to discrepancies in provided information or delays in processing due to high volumes of submissions. Being aware of these potential problems can help in preemptively addressing them.

Solutions for addressing denied submissions typically involve reviewing communications from the verifying agency, which often outlines the reasons for denial. Addressing these issues may take additional documentation or corrections to your submitted form. Seek assistance from professionals if you encounter significant hurdles or if the form requires specialized knowledge.

Leveraging pdfFiller for future document needs

pdfFiller goes beyond just assisting with Form P. The platform offers access to a wealth of additional forms and templates, catering to various document management needs. Utilizing an all-in-one document solution significantly enhances productivity by simplifying the process of creating, editing, and storing essential documents.

Transitioning to pdfFiller means you have a consistent framework for all your documentation needs, ensuring that as new forms arise, the transition remains seamless and intuitive. This level of organization is critical for individuals and teams alike, fostering efficiency across various projects.

FAQs about Form P verification

Several questions routinely arise concerning Form P and its verification process. Common inquiries include the required timeframe for verification, acceptable forms of identification, and clarity on the data entry process. Addressing these frequently asked questions can significantly alleviate concerns and empower users as they navigate the completion of Form P.

Debunking misconceptions surrounding eligibility requirements and verification criteria also assists users in completing their Form P effectively.

User testimonials and success stories

User experiences provide valuable insights into the effectiveness of pdfFiller in streamlining the Form P verification process. Many users report time savings and enhanced ease of use, particularly in collaboratively completing the form with teams.

Success stories illustrate how individuals have successfully navigated their verification requirements utilizing pdfFiller, enhancing their understanding of the platform's capabilities and reinforcing the importance of accurate and timely submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form p verification of for eSignature?

How can I get form p verification of?

How do I make changes in form p verification of?

What is form p verification of?

Who is required to file form p verification of?

How to fill out form p verification of?

What is the purpose of form p verification of?

What information must be reported on form p verification of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.