Get the free Direct Debit Authority Form

Get, Create, Make and Sign direct debit authority form

How to edit direct debit authority form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct debit authority form

How to fill out direct debit authority form

Who needs direct debit authority form?

Your Comprehensive Guide to Direct Debit Authority Forms

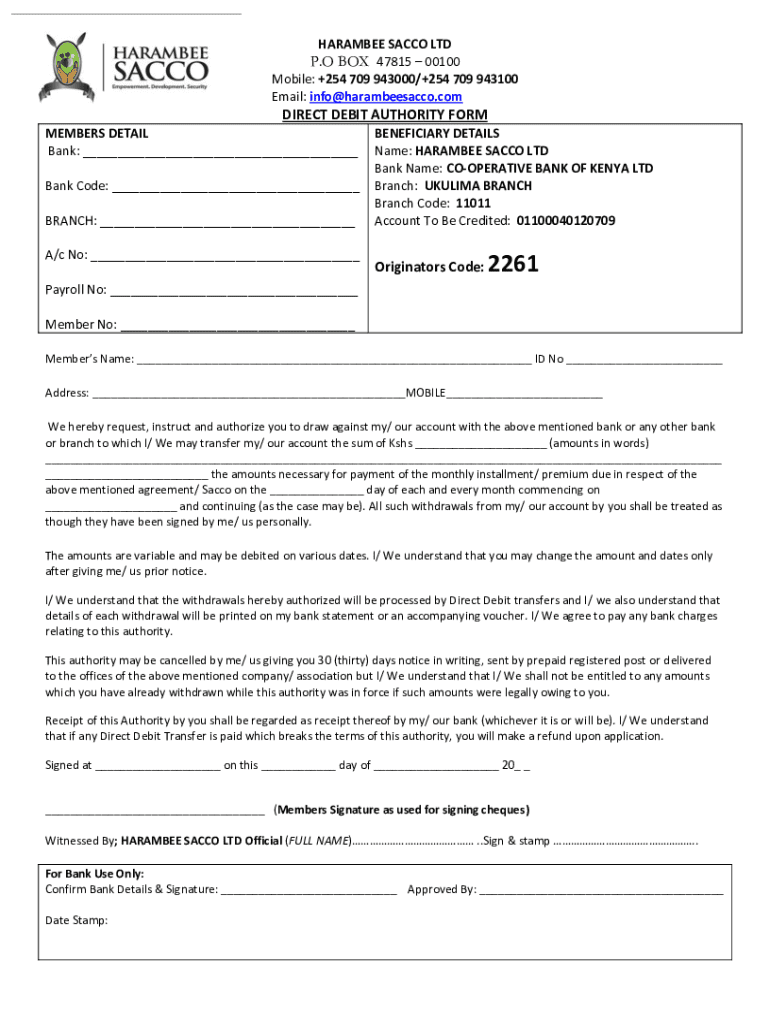

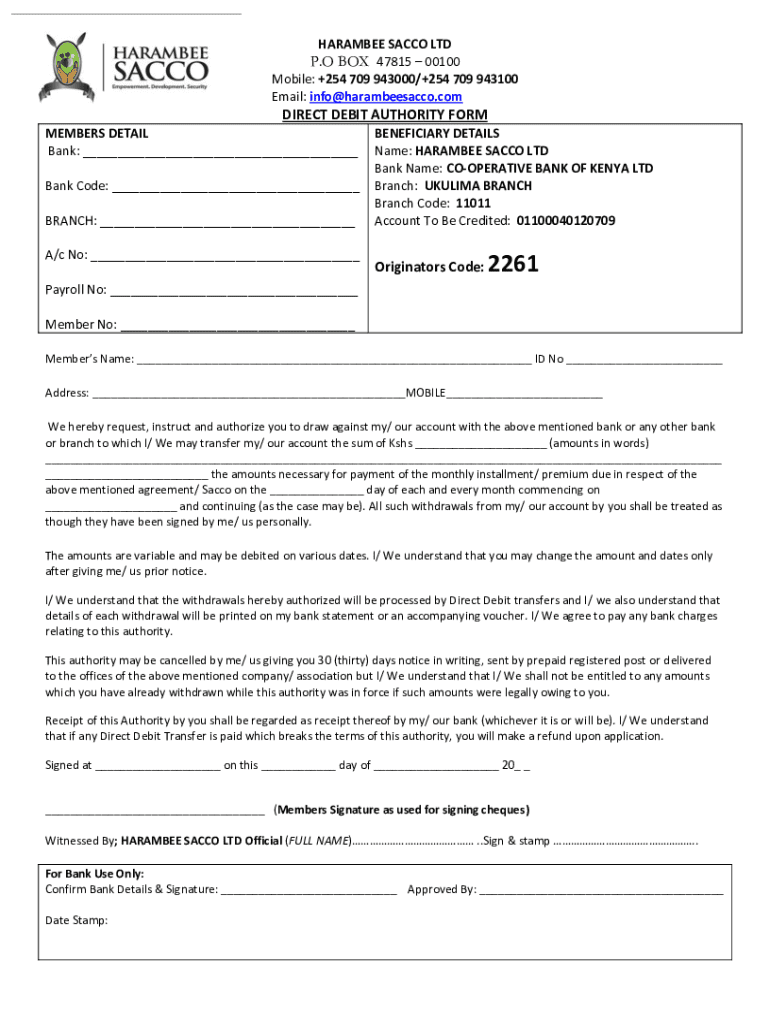

Understanding the direct debit authority form

A direct debit authority form is a document that allows an organization to take payments directly from an individual’s or business’s bank account on an agreed schedule. The primary purpose of this form is to streamline payments for services such as utilities, subscriptions, or loan repayments. This method of payment is crucial in maintaining efficiency in financial transactions, enabling individuals and businesses to manage their cash flow without the hassle of manual payments.

The importance of the direct debit authority form cannot be overstated; it is foundational to automated payment systems. Not only does it enhance convenience, but it also reduces the risk of late payments, ensuring that service providers receive their dues promptly. Individuals commonly use direct debits for regular bills, while businesses leverage them for recurring customer payments, ensuring operational stability.

People and businesses that use the form

Various entities utilize direct debit authority forms, including utility companies, subscription services, educational institutions, and even healthcare providers. Individuals tend to use this form predominantly for their household bills, such as electricity and internet services, enabling automatic deductions that help avoid missed payments.

For businesses, the advantages of direct debits are significant. Companies often use them for membership dues, customers’ loan repayments, or regular service fees. Automation through direct debit fosters reliable cash flow and improves customer satisfaction through streamlined operations. It allows businesses to reduce administrative overhead while enhancing customer loyalty.

Key components of the direct debit authority form

The direct debit authority form comprises several key components that must be accurately completed. Essential information includes personal or business details such as the name, address, and contact information of both parties involved — the debtor (the payer) and the creditor (the payee). Additionally, bank account information is required, including the account number and sort code, which enable the financial institution to process the payments seamlessly.

Understanding the terminology associated with direct debits is crucial for effective completion of the form. Terms like 'debtor,' which refers to the individual or entity authorizing the payment, and 'payment schedule,' describing how often payments will be deducted, are common. Another term to be familiar with is 'mandate,' which is the authorization given to the creditor to collect payments.

How to complete a direct debit authority form

Filling out a direct debit authority form is straightforward if you follow a step-by-step approach. Start by gathering all necessary documentation that includes personal identification, bank details, and any agreements regarding payment amounts and schedule. This preparation will ensure you have all relevant information at your fingertips.

Next, accurately enter your personal details, including your name and address, alongside your bank account information. When specifying payment details, be clear about the amount, how often payments will be made (weekly, monthly), and the length of time the direct debit will be in effect. Carefully reviewing terms and conditions is equally important, as it stipulates the responsibilities of both parties.

To avoid common mistakes, double-check the accuracy of your bank details to ensure no errors in the account numbers, which can result in payment failures. It’s also crucial to confirm that all required signatures are present to validate the authorization.

Editing and managing your form

Once a direct debit authority form is completed, there might be times when you need to edit or update it. Utilizing tools like pdfFiller allows for easy editing of the form, permitting you to add or remove signatories as circumstances change. Such flexibility is essential for adapting to your financial obligations accurately.

Additionally, collaboration is made simple within teams. pdfFiller allows users to invite team members to review the form, leave comments, and track changes in real time. This collaborative feature ensures everyone involved remains informed and can contribute to any necessary amendments, which significantly minimizes communication gaps.

Signing the direct debit authority form

Signing your direct debit authority form marks the formalization of your request. You have the option to sign digitally using platforms like pdfFiller, simplifying the process by avoiding physical paperwork. Alternatively, you can print the form and provide a handwritten signature. This choice often depends on the preferences of the parties involved, as well as the specific requirements of the creditor.

Understanding the legality of electronic signatures is vital, especially in financial transactions. Most jurisdictions recognize electronic signatures as valid under specific conditions. Therefore, ensuring compliance with local regulations will put you on solid ground should any discrepancies arise.

Submitting your direct debit authority form

After completion and signing, the next step is to submit your direct debit authority form. Depending on the creditor, you may be required to send your completed form electronically, via email, or physically through postal mail. Knowing the exact submission method and timeframe is essential to ensure that your payment setup begins on time.

It's also important to confirm the submission of your direct debit authority form. Follow up with the creditor to verify that the setup has been processed correctly and that the first payment will be deducted as scheduled. This proactive approach helps avoid potential issues down the line.

Monitoring and managing your direct debits

Managing your direct debits requires vigilance to ensure that all payments are processed correctly and on time. Utilizing pdfFiller tools can help you track payments and make necessary changes efficiently. Regularly reviewing your direct debit authorizations is a good practice to ensure they align with your current financial situation.

Should issues arise, such as payment failures or disputes, it’s crucial to know whom to contact. Reaching out to your bank or the creditor promptly can rectify the situation. Keeping a detailed record of communications and transactions facilitates resolution and ensures all parties remain accountable.

Keeping your direct debit authority form secure

Document security is paramount when handling a direct debit authority form, as it contains sensitive financial information. Implementing best practices, such as safeguarding documentation and using secure password protections on digital files, will help in mitigating risks. pdfFiller enhances security by providing features that protect your documents against unauthorized access.

Regularly updating your direct debit authority form and maintaining accurate records is essential. Setting reminders for periodic reviews of your direct debits ensures you’re informed about your financial commitments and allows for timely adjustments if needed.

Benefits of using pdfFiller for your direct debit authority form

Using pdfFiller for your direct debit authority form presents several key advantages. As a cloud-based document solution, pdfFiller allows you to access, edit, and manage your forms from any device with internet capability. This facilitates convenience and accessibility for users who require flexibility in managing their documentation, especially for individuals and teams collaborating from diverse locations.

The platform's real-time collaboration capabilities empower users to work together seamlessly, reducing the chances of miscommunication. User testimonials highlight increased efficiency and satisfaction when using pdfFiller, showcasing how it simplifies document-related tasks and enhances user productivity.

Frequently asked questions (FAQs)

When dealing with direct debit authority forms, it’s not uncommon to have questions. One common query is related to the cancellation of direct debits. Typically, either the debtor or the creditor can cancel a direct debit, but it’s crucial to be aware of the procedures required by each financial institution.

Another frequently asked question revolves around making changes to payments, such as altering amounts or payment dates. This can often be done by contacting the creditor directly; however, it’s advised to keep a record of any adjustments made to avoid confusion later.

For troubleshooting, if a payment fails, contacting your bank immediately can help identify the reason. Whether it's due to insufficient funds or incorrect account details, knowing how to respond promptly can mitigate complications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my direct debit authority form directly from Gmail?

How do I edit direct debit authority form straight from my smartphone?

How do I edit direct debit authority form on an Android device?

What is direct debit authority form?

Who is required to file direct debit authority form?

How to fill out direct debit authority form?

What is the purpose of direct debit authority form?

What information must be reported on direct debit authority form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.