Get the free 2020 Ohio It 1040

Get, Create, Make and Sign 2020 ohio it 1040

How to edit 2020 ohio it 1040 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2020 ohio it 1040

How to fill out 2020 ohio it 1040

Who needs 2020 ohio it 1040?

How to Fill Out the 2020 Ohio IT 1040 Form

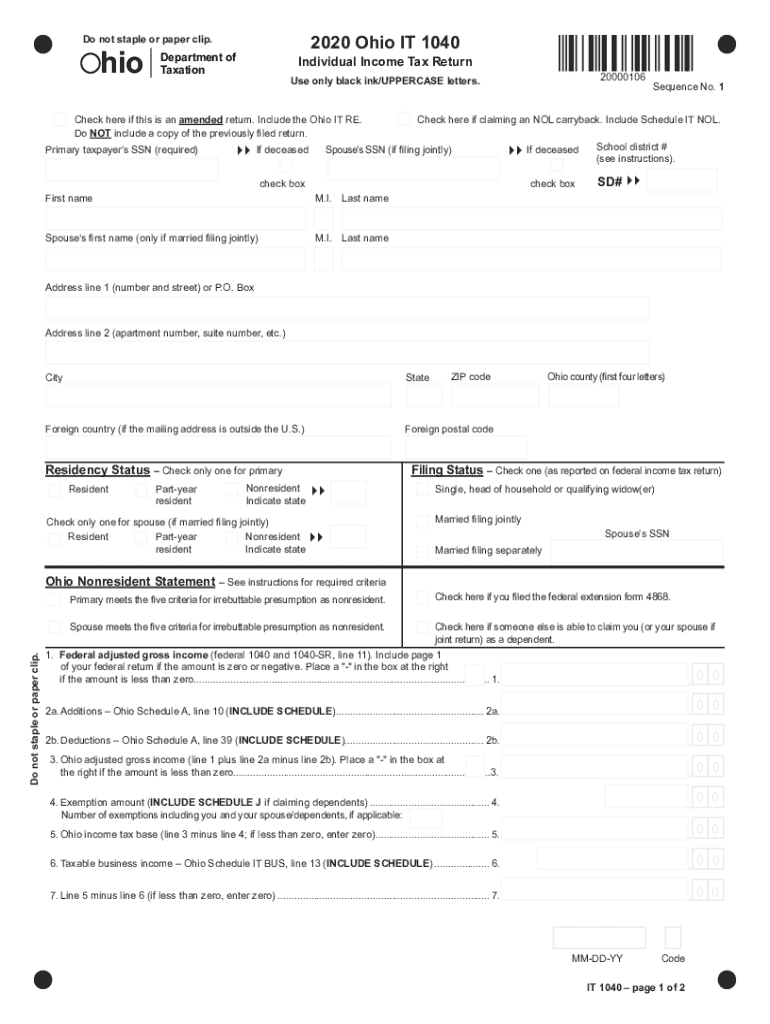

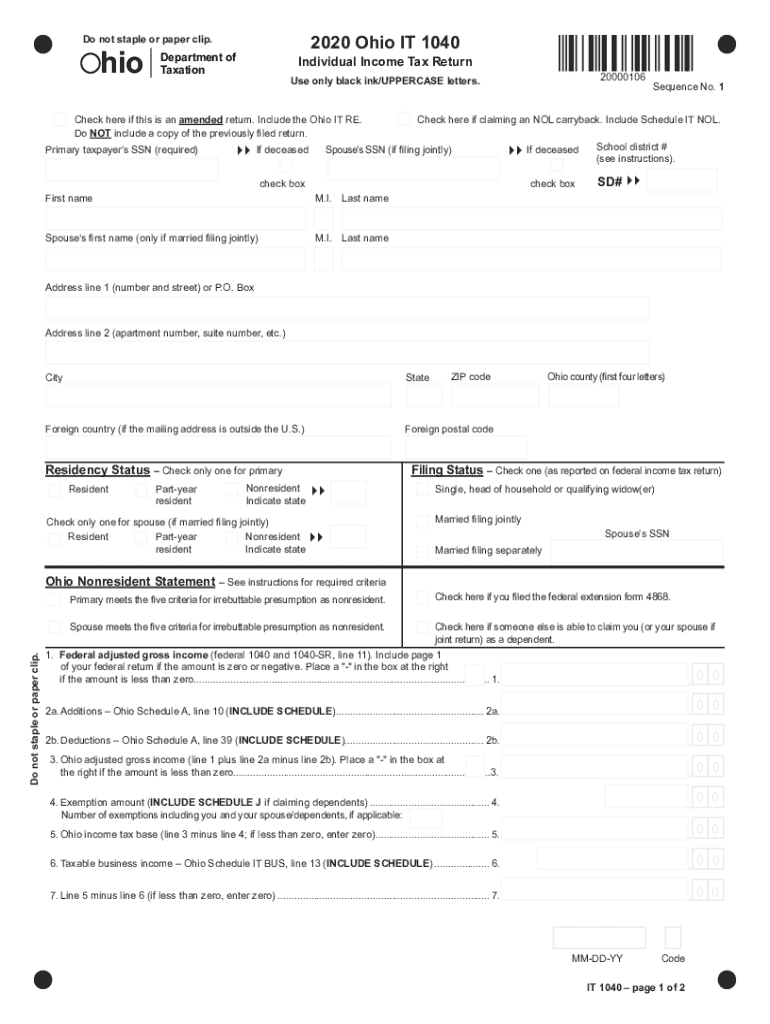

Overview of the 2020 Ohio IT 1040 form

The 2020 Ohio IT 1040 form is the state income tax return used by Ohio residents to report their income, calculate tax liability, and determine the amount of any refund or owed taxes to the state. This form is a vital part of the tax filing process for individuals living in Ohio, ensuring that they comply with state tax laws.

Anyone earning income in Ohio, whether from employment, self-employment, or other sources, needs to file this form. It is especially crucial for those who are Ohio residents or have income sourced from the state.

Key deadlines for the 2020 tax year include the filing deadline, which typically falls on April 15, 2021. However, for 2020, this was extended due to the COVID-19 pandemic, allowing taxpayers additional time to file.

Preparing to fill out the 2020 Ohio IT 1040 form

Before diving into the 2020 Ohio IT 1040 form, gather all necessary documents that can substantiate your income, deductions, and credits. Accuracy in reporting is pivotal for a smooth filing.

Understanding your residency status is also critical when completing your Ohio IT 1040 form. Ohio distinguishes among three classifications: residents, non-residents, and part-year residents.

Considerations for tax filing in 2020 were compounded by the COVID-19 pandemic, which led to changes in filing procedures and extensions. Adjustments in tax laws during this year also necessitated greater diligence to ensure compliance.

Step-by-step guide to completing the 2020 Ohio IT 1040 form

Filling out the Ohio IT 1040 form can seem daunting, but following a structured approach can simplify the process.

Tips for an efficient filing process

To streamline the filing process, leverage digital tools designed to simplify tax filing. Utilizing platforms like pdfFiller can make completing forms easier.

Facilitating an efficient filing process increases accuracy and reduces stress during tax time.

What to do after filing your 2020 Ohio IT 1040 form

After submitting the 2020 Ohio IT 1040 form, it's essential to understand the post-filing process. The tax authorities will review your submission for accuracy and compliance with tax laws.

Handling issues or audits related to your filing

Should you receive an audit notice from Ohio tax authorities, it’s crucial to respond appropriately to ensure your case is handled efficiently.

Preparation and clarity are vital components for navigating any issues that arise post-filing.

FAQs about the 2020 Ohio IT 1040 form

Many taxpayers have similar queries when it comes to the Ohio IT 1040 form. Addressing common questions can aid in clarifying processes.

Accessing resources for further information helps ensure that taxpayers are equipped to address their unique situations.

Leveraging pdfFiller for document management

Utilizing a cloud-based solution like pdfFiller for tax forms offers numerous advantages, including organizing and managing tax documents seamlessly.

Integrating these management tools can significantly reduce stress during tax season while maintaining organization.

Conclusion: Mastering your 2020 Ohio IT 1040 filing

In conclusion, filling out the 2020 Ohio IT 1040 form is a vital task for Ohio residents that requires careful attention to detail. Following the outlined steps can streamline the process.

By leveraging tools like pdfFiller, maintaining organization, and understanding the nuances of state tax law, taxpayers can foster a more efficient and successful filing experience. Equip yourself with the knowledge to master your tax filings today and in the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2020 ohio it 1040 in Gmail?

How do I complete 2020 ohio it 1040 online?

Can I create an electronic signature for the 2020 ohio it 1040 in Chrome?

What is ohio it 1040?

Who is required to file ohio it 1040?

How to fill out ohio it 1040?

What is the purpose of ohio it 1040?

What information must be reported on ohio it 1040?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.