Get the free Cdtfa-65-tg

Get, Create, Make and Sign cdtfa-65-tg

How to edit cdtfa-65-tg online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cdtfa-65-tg

How to fill out cdtfa-65-tg

Who needs cdtfa-65-tg?

A Comprehensive Guide to the CDTFA-65-TG Form

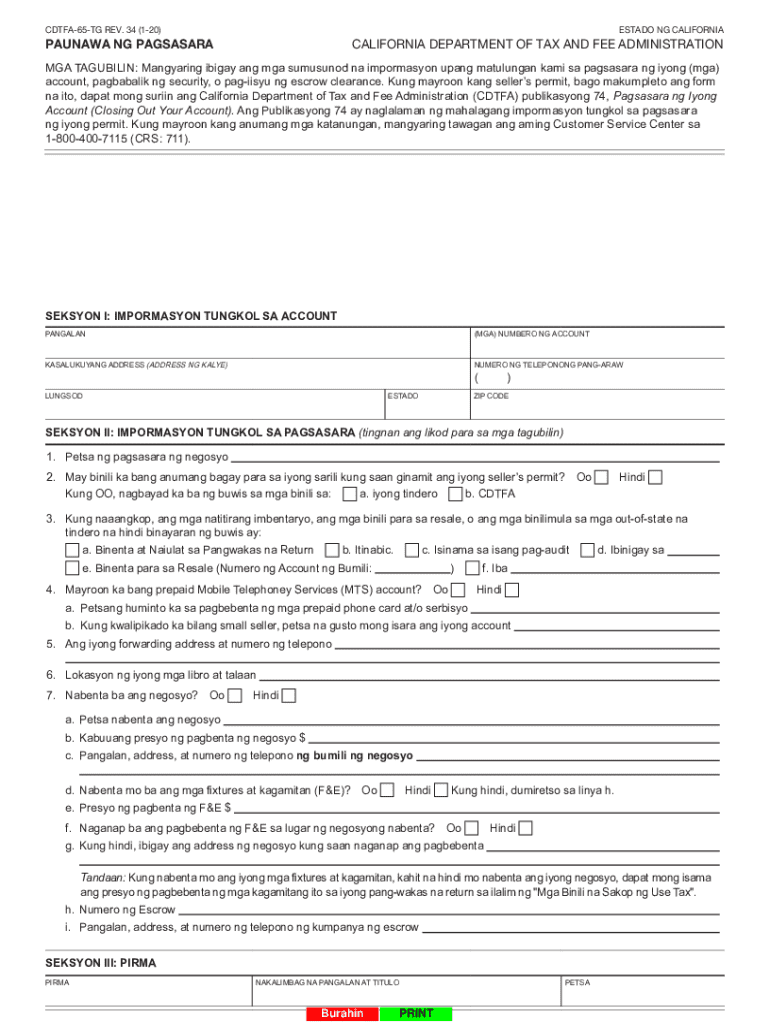

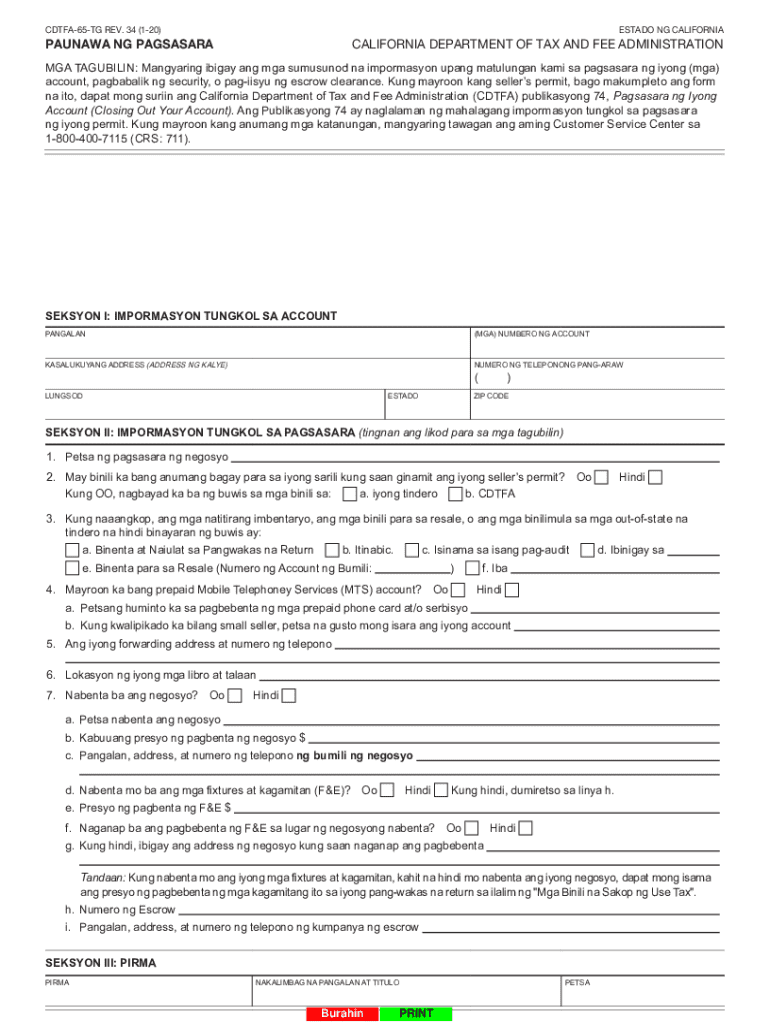

Overview of the CDTFA-65-TG Form

The CDTFA-65-TG Form is an essential document used for reporting tax-related information, specifically in the context of California's tax regulations. This form plays a pivotal role in ensuring that taxpayers comply with the fee administration requirements set by the California Department of Tax and Fee Administration (CDTFA). It is crucial for maintaining transparent and accurate tax records.

Given the significance of the CDTFA-65-TG Form, it is critical for individuals and businesses engaged in taxable activities within California to understand its purpose. The form serves to report adjustments, amendments, and information that may alter tax liabilities, ultimately facilitating proper tax payments and compliance during tax periods.

Who needs to use the CDTFA-65-TG Form?

Individuals, businesses, and tax professionals who operate in California and are subject to state tax laws will generally need to utilize the CDTFA-65-TG Form. This includes anyone who must adjust previously submitted tax returns due to changes in income or tax liabilities. For businesses, keeping up with these forms is crucial for maintaining accurate records and ensuring compliance with state regulations.

In particular, those involved in industries impacted by disasters and requiring relief may find this form especially relevant. For example, businesses affected by natural disasters in California may need to file this form to report changes in their tax obligations resulting from the state of emergency tax relief measures.

Key features of the CDTFA-65-TG Form

The CDTFA-65-TG Form is structured into several essential sections that streamline tax reporting. Understanding these sections can help users effectively navigate the form and avoid common mistakes. Key components include header information, reporting periods, tax calculations, and necessary certifications and signatures. Each field must be filled out accurately to ensure proper processing of the tax information.

Common pitfalls occur often when users underestimate the importance of thoroughness when filling out the CDTFA-65-TG Form. For instance, inadequate documentation or inaccurate mathematical calculations can result in processing delays or rejected submissions. Ensuring accurate data entries, particularly in tax calculations, is vital to prevent complications.

Step-by-step instructions for filling out the CDTFA-65-TG Form

Before diving into the filling process, ensure you have all necessary documents ready. Important information includes previous tax returns, financial statements, and any documentation that supports the adjustments you seek to report on the CDTFA-65-TG Form. Gathering this data beforehand will streamline the submission process and help you avoid errors.

Follow these detailed steps to complete each section of the CDTFA-65-TG Form:

Double-check your entries for numerical accuracy and completeness before submission. Confirm that all support documentation aligns with the changes being reported to avoid complications during processing.

Editing and customizing the CDTFA-65-TG Form

Using pdfFiller, you can edit and customize the CDTFA-65-TG Form effortlessly. The platform provides robust tools to streamline this process, allowing you to make changes to the PDF easily. pdfFiller’s editing features let you modify text, adjust fields, and incorporate new information as needed.

Whether it’s adding or removing fields or incorporating digital signatures, pdfFiller allows seamless customization to meet your needs. Leveraging these capabilities can enhance your efficiency, especially during collaborative efforts or if you frequently need to update submission details.

Collaborating on the CDTFA-65-TG Form

Collaboration is key when multiple stakeholders are involved in the CDTFA-65-TG Form submission process. Using pdfFiller, you can easily share the form with team members or tax professionals, streamlining collaboration. The platform's features allow seamless interaction, enabling multiple users to edit, comment, and track changes.

The commenting and review functions ensure all collaborators can provide input, resulting in a well-rounded, accurate submission. Version management features also guarantee that everyone has access to the most current document, preventing confusion that may arise from using outdated forms.

Submitting the CDTFA-65-TG Form

After completing the CDTFA-65-TG Form, the next step is submission. You can submit the completed form electronically via the CDTFA's official website or by mailing it to your local field office. Ensure you confirm which submission methods are applicable during your reporting period.

Be vigilant about submission deadlines, as filing late can result in penalties or interest. Additionally, tracking your submission after it’s sent is crucial; keep documents relating to your submission secure for reference and tracking confirmation.

FAQs about the CDTFA-65-TG Form

Even with careful preparation, questions may arise during the CDTFA-65-TG Form process. It’s important to know what to do if you make a mistake after submission. Generally, it’s recommended to contact the CDTFA directly for guidance on how to amend your submission if necessary. They can assist with the exact steps to correct any issues.

Frequent questions often revolve around the tax implications of using the CDTFA-65-TG Form. It's advisable to consult with a tax professional who can offer insights specific to your situation and ensure that you understand any ramifications related to amendments or adjustments.

Conclusion and further assistance options

With a thorough understanding of the CDTFA-65-TG Form and how to efficiently utilize it through pdfFiller, individuals and businesses can navigate California’s tax ecosystem confidently. From editing and signing to collaborative efforts, pdfFiller enables users to manage their documents seamlessly. This helps you stay compliant while focusing on your core activities.

For further assistance, don’t hesitate to reach out to pdfFiller's support team. They are equipped to help you with any questions regarding the CDTFA-65-TG Form or any of your document needs. With modern tools and assistance at your fingertips, navigating the tax reporting landscape can become a smooth process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find cdtfa-65-tg?

How do I complete cdtfa-65-tg online?

Can I edit cdtfa-65-tg on an Android device?

What is cdtfa-65-tg?

Who is required to file cdtfa-65-tg?

How to fill out cdtfa-65-tg?

What is the purpose of cdtfa-65-tg?

What information must be reported on cdtfa-65-tg?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.