Get the free Nyc-uxp

Get, Create, Make and Sign nyc-uxp

How to edit nyc-uxp online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nyc-uxp

How to fill out nyc-uxp

Who needs nyc-uxp?

NYC-UXP Form: Comprehensive Guide to Understanding and Completing the Form

Understanding the NYC-UXP Form: Key elements and purpose

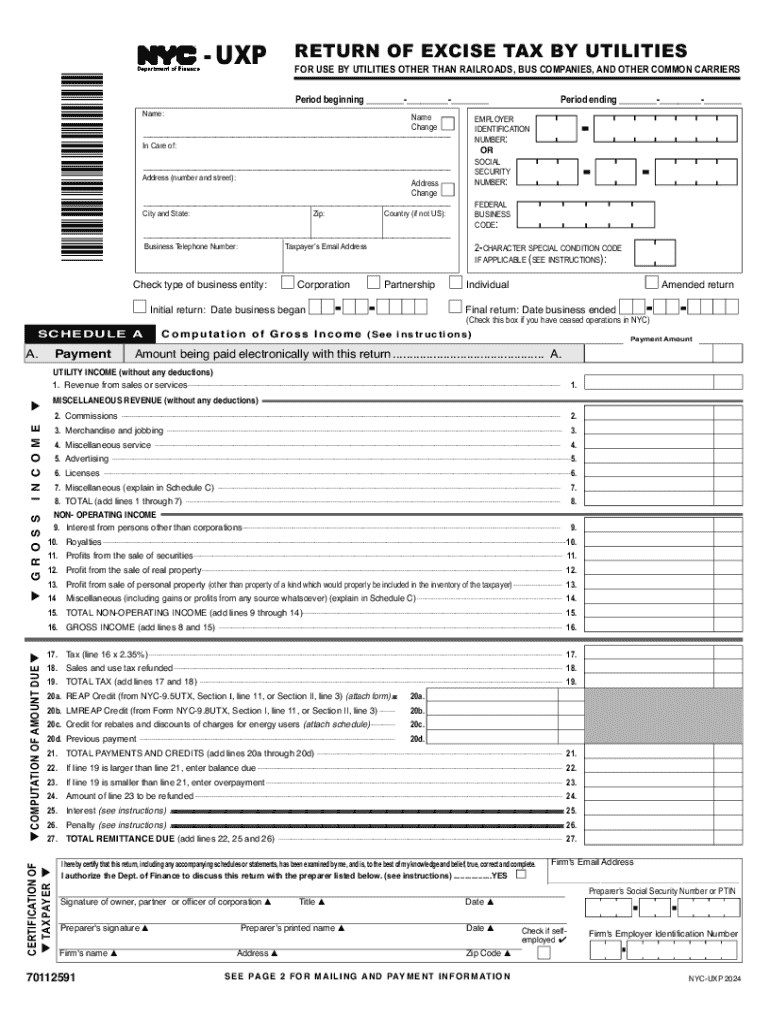

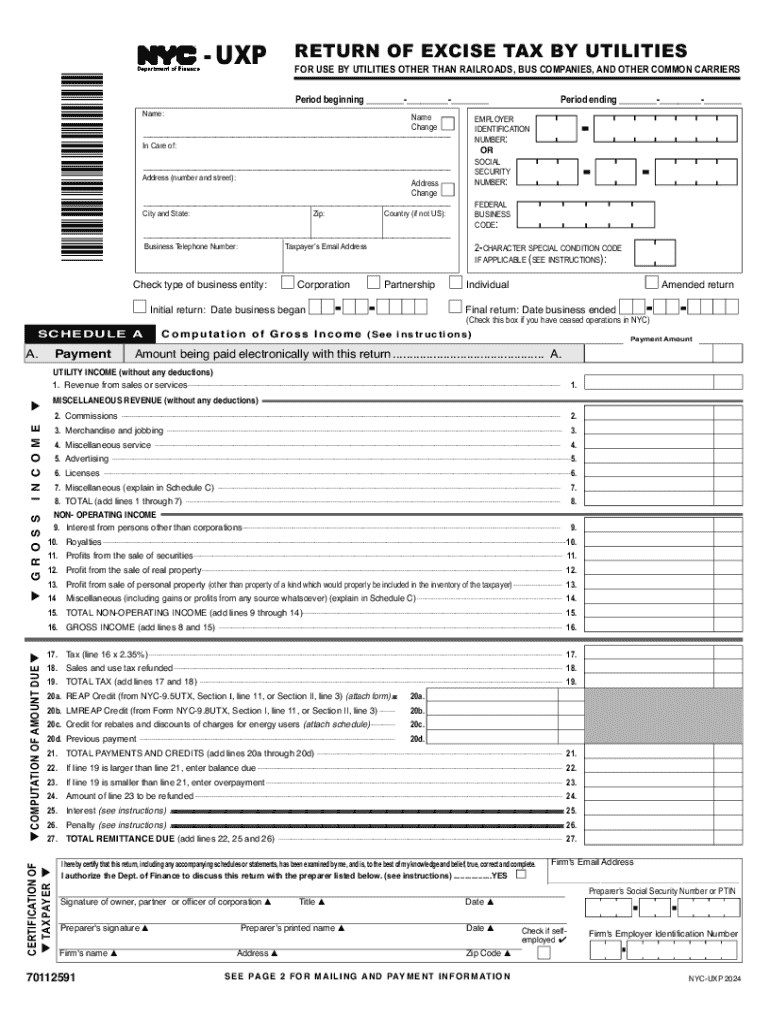

The NYC-UXP form is an essential document aimed at ensuring utilities in New York City comply with the excise tax regulations set forth by the city. Specifically designed for utilities, excluding railroads, bus companies, and common carriers, this form plays a critical role in the calculation and reporting of taxable amounts, helping to streamline urban financial management.

Its primary purpose revolves around the accurate reporting of excise tax owed, which significantly contributes to the city's revenues. By meticulously tracking utility taxes, the city can allocate resources more effectively, ensuring the continuous provision of public services that directly benefit residents and businesses alike.

Who should use the NYC-UXP form?

The NYC-UXP form is targeted towards utilities operating within New York City that are subject to excise taxes. Excluded are specific entities like railroads and common carriers. Essentially, any utility, including those managing electricity, gas, or water services, should be knowledgeable about and utilize this form to maintain compliance with local tax laws.

For individuals and organizations, completing the NYC-UXP form is proactive compliance. It not only aids in fulfilling legal obligations but also ensures transparency in operations. This form provides utilities with a clear structure for tracking owed taxes, making it easier to forecast future liabilities and budget appropriately. Thus, by using the NYC-UXP form, organizations foster better financial practices while supporting the city’s financial health.

Preparing to complete the NYC-UXP form

Before filling out the NYC-UXP form, it's crucial to gather all necessary documentation and information to ensure a smooth and accurate filing process. Required records generally include prior excise tax returns, operational receipts, and any correspondence with the issuing department. Having these documents on hand allows utilities to compile accurate data points for reporting.

Despite its structured format, several challenges can arise during preparation. Common issues include discrepancies in reporting taxable amounts or miscalculations, which can potentially lead to underreporting or overreporting liabilities. To overcome these challenges, utilities should maintain meticulous records and review their previous filings during the preparation of the NYC-UXP form to ensure the data accurately reflects their current situation.

Step-by-step guide to filling out the NYC-UXP form

Filling out the NYC-UXP form involves several distinct sections, each requiring specific information. The process begins with Section 1: Identification of Utility, where utilities must provide their name, address, and related identification details, ensuring the issuing department can accurately recognize the entity.

In Section 2, the Calculation of Taxable Amounts must be detailed, where entities will calculate total taxable revenues based on their operations. Maintaining accurate entries here is essential, as errors can lead to tax complications. Lastly, Section 3 involves Reporting Previous Payments and Adjustments, where utilities confirm payments made in prior periods, which helps in tracking any overpayments or underpayments.

Editing, signing, and submitting the NYC-UXP form

Once the NYC-UXP form is filled out, the next step involves careful editing to ensure accuracy. pdfFiller provides comprehensive tools to edit the form easily, allowing users to modify fields, adjust data, and review input effectively. This ease of use is critical in avoiding errors that could lead to complications during submission.

Digital signatures are also an option for the NYC-UXP form, leveraging eSignature technologies that not only ensure the validity of the submission but also streamline the process significantly. Utilities should submit the completed form directly to the designated city department through the appropriate submission channels, being mindful of deadlines to avoid penalties for late filings.

Managing your NYC-UXP document post submission

After submission, it's crucial to effectively manage your NYC-UXP document to ensure compliance and track the status of your filing. pdfFiller offers cloud-based document management, which allows users to store and easily access their submitted forms. This feature is invaluable for reviewing filed documents and preparing for future taxes.

If there’s a need to amend a submitted NYC-UXP form to correct errors or update information, utilities can follow a standardized process to file corrections. Typically, this involves submitting an amendment along with a letter explaining the changes to the issuing department, ensuring that all records are updated accordingly.

Frequently asked questions (FAQs) about the NYC-UXP form

Individuals often have various questions regarding the NYC-UXP form. For instance, what happens if the form gets submitted late? Typically, late submissions can incur penalties, emphasizing the importance of timely filing. Additionally, many wonder if the form can be filed electronically, which, as facilitated by pdfFiller, offers a streamlined alternative to paper submissions, significantly saving time.

For further assistance, resources from the NYC Department of Finance provide valuable support and information regarding the NYC-UXP form. It’s advisable for utilities to utilize these resources to better understand their obligations and maintain compliance.

Related forms and documents

In addition to the NYC-UXP form, utilities may encounter a variety of related documents required for comprehensive compliance within the NYC tax system. These may include other excise tax documents that detail specific aspects of utility revenue or forms similar in structure but tailored for different utilities. Understanding these related documents is vital for accurate reporting and ensuring that all financial obligations are met.

By comparing the NYC-UXP form with similar forms, utilities can identify unique requirements and deadlines pertinent to their services. This knowledge ensures that there is no overlap or confusion when filing, ultimately fostering a more efficient tax reporting practice.

Leveraging pdfFiller for a seamless document experience

The use of pdfFiller significantly enhances the experience of filling out and managing the NYC-UXP form. This all-in-one document platform enables utilities to seamlessly edit, eSign, and collaborate on documents from any location. With its user-friendly interface, utilities can streamline their documentation processes, ultimately saving time and reducing the likelihood of errors.

Many users have shared positive feedback regarding how pdfFiller has transformed their filing processes. From simplifying data entries to facilitating quick access to templates and interactive calculators, the platform has proven effective in ensuring compliance and efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the nyc-uxp electronically in Chrome?

How can I edit nyc-uxp on a smartphone?

How can I fill out nyc-uxp on an iOS device?

What is nyc-uxp?

Who is required to file nyc-uxp?

How to fill out nyc-uxp?

What is the purpose of nyc-uxp?

What information must be reported on nyc-uxp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.