Get the free Credit Card Payment Authorization

Get, Create, Make and Sign credit card payment authorization

Editing credit card payment authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card payment authorization

How to fill out credit card payment authorization

Who needs credit card payment authorization?

Understanding the Credit Card Payment Authorization Form

Understanding the credit card payment authorization form

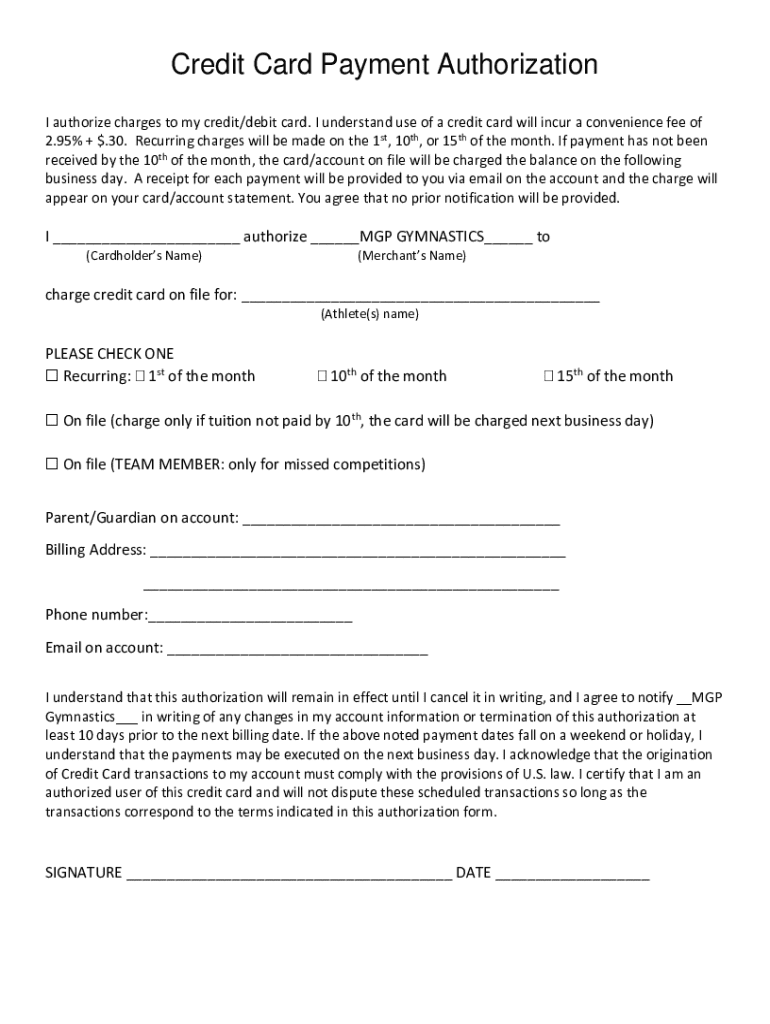

A credit card payment authorization form is a vital document used by businesses to obtain consent from customers before processing a payment with a credit card. This form provides a structured way for cardholders to formally authorize a transaction, ensuring that both parties—businesses and customers—are protected. Proper authorization is key in implementing secure payment practices and helps maintain trust in economic exchanges.

For businesses, this form mitigates the risk of chargebacks, which can severely impact their bottom line and reputation. On the customer side, it reinforces their rights by providing clear evidence of their consent to the transaction. Thus, the importance of this form cannot be overstated; it serves as a protective measure for both parties involved in the payment process.

Key components of the form

A well-structured credit card payment authorization form typically includes several key components crucial for its functionality. These include:

The role of credit card authorization forms in preventing chargeback abuse

Chargebacks occur when a customer disputes a charge, often leading to a reversal of the payment. Common reasons for chargebacks include unauthorized transactions, goods not received, or dissatisfaction with services rendered. The financial impact of chargebacks can be significant, particularly for small businesses that may struggle to absorb such losses.

By implementing credit card payment authorization forms, businesses can significantly reduce the risk of chargeback abuse. When a customer completes this form, they are explicitly agreeing to the transaction, which serves as a strong defense against potential disputes. It's important to understand that having solid documentation—such as this form—can help businesses provide necessary evidence to payment processors when disputing a chargeback.

For instance, a restaurant may have customers sign authorization forms for large catering orders. If a customer later claims they did not authorize the payment, the restaurant can refer back to the signed form, mitigating the chargeback risk. This connection illustrates how credit card authorization forms play a crucial role in defending against financial losses from chargebacks.

Detailed instructions for completing a credit card payment authorization form

Filling out a credit card payment authorization form accurately is essential for both parties. Here is a step-by-step guide to ensure the form is completed correctly.

Tips for editing and managing the form

Keeping track of multiple credit card authorization forms can be challenging. Utilizing pdfFiller's cloud-based platform, users can easily edit and manage their forms. Instead of starting from scratch, use quick edit tools to make necessary changes while maintaining the original content. This flexibility simplifies the documentation process and allows teams to collaborate seamlessly.

Editing and signing the form in a cloud-based platform

Editing a credit card payment authorization form from pdfFiller is a straightforward process. Users can access their forms online, make adjustments, and ensure accuracy before sending them off for signature. With collaborative editing features, team members can work together on the same document in real time, making it a convenient solution for businesses.

E-signing the authorization form

E-signing is a modern approach that allows for quick and legally binding signatures without printing the document. To e-sign a credit card payment authorization form on pdfFiller, simply select the 'e-sign' option, follow the prompts to add your signature, and submit the form. The benefits of e-signatures include faster processing times and reduced paper clutter.

Customizing your credit card payment authorization form

Customization is key when creating a credit card payment authorization form that aligns with your business's brand and needs. By adding logos and specific terms or clauses relevant to your agreements, you enhance the professionalism of the document. This not only aids in brand recognition but can also foster trust among your customers.

Utilizing templates available in pdfFiller allows for quicker set-up. These templates are designed to be adaptable, letting businesses easily modify them according to specific transaction needs or types of services provided.

Downloading and sharing your credit card authorization form

Once you have completed your credit card payment authorization form, downloading it in the appropriate format is essential. pdfFiller supports several formats, including PDF and Word, ensuring compatibility with various systems and documentation processes.

When it comes to sharing your form, pdfFiller offers secure options for sharing via email or through secure links. It's essential to follow best practices for data security when sharing sensitive financial information, ensuring that customer data remains protected.

Frequently asked questions about credit card payment authorization forms

Many businesses encounter common challenges and questions surrounding credit card payment authorization forms. One frequent concern is the differences between various types of authorization forms available. While standard forms are typically sufficient, specific industries may require more detailed information.

Another concern revolves around the duration for which these forms should be stored. Generally, it is advised to keep records of authorization forms for at least six months post-transaction. Understanding legal implications and compliance issues related to payment processing regulations is crucial. Reliable documentation can safeguard businesses against claims or potential legal disputes.

Resources for further assistance

For users needing help with credit card payment authorization forms, pdfFiller offers extensive support and tutorials on how to navigate the platform effectively. Engaging in community forums, sharing experiences, and accessing expert advice can provide valuable insights into optimizing document management practices.

Staying current with industry changes and regulations is crucial. Regular subscriptions to newsletters or updates from pdfFiller ensure users remain informed on best practices and new features that streamline document management.

Customer experiences and testimonials

Numerous businesses have shared positive experiences regarding the implementation of credit card payment authorization forms. Many report improved transaction security, faster payment processing times, and a significant reduction in chargebacks. These testimonials highlight how the use of authorization forms contributes to operational efficiency and customer satisfaction.

For example, a local restaurant noticed a drastic decrease in payment disputes after adopting a structured authorization form process. Their staff benefited from the initial setup of the forms through pdfFiller, showcasing effective document management that led to better financial control.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit credit card payment authorization online?

How do I edit credit card payment authorization on an Android device?

How do I complete credit card payment authorization on an Android device?

What is credit card payment authorization?

Who is required to file credit card payment authorization?

How to fill out credit card payment authorization?

What is the purpose of credit card payment authorization?

What information must be reported on credit card payment authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.