Get the free Cc 15:5.1

Get, Create, Make and Sign cc 1551

Editing cc 1551 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cc 1551

How to fill out cc 1551

Who needs cc 1551?

1551 Form: A Comprehensive How-to Guide

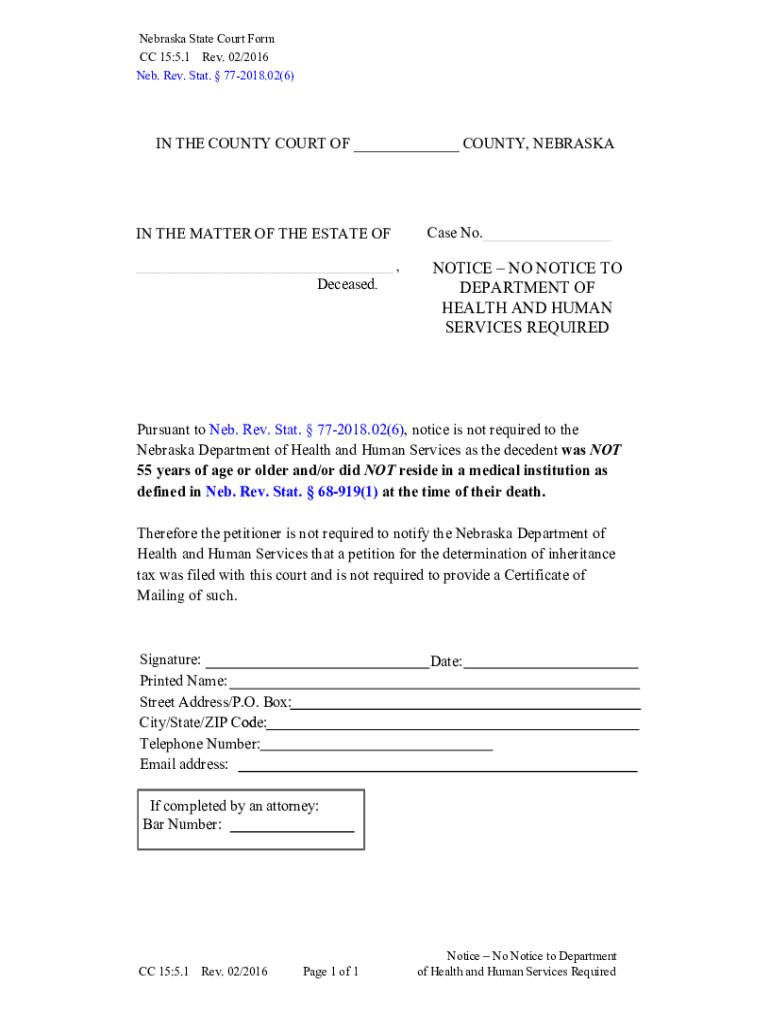

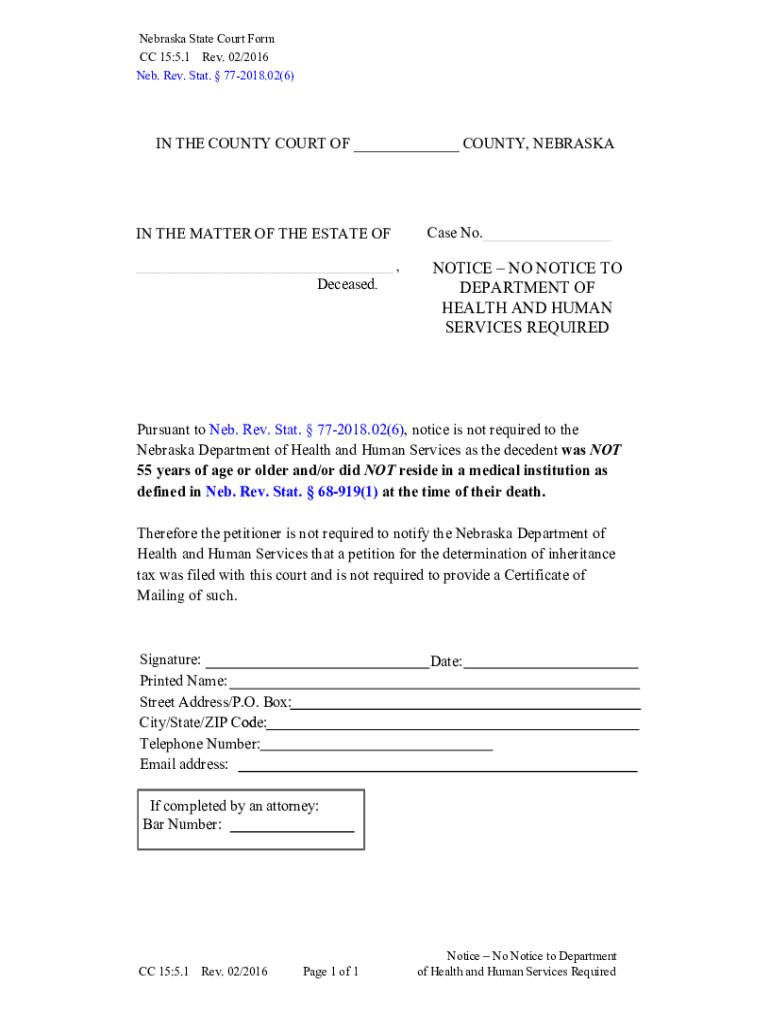

Overview of 1551 Form

The CC 1551 form serves as a crucial document in various legal and administrative processes. It is primarily used to convey essential information regarding certain duties or conditions related to property, donation, or transfers of ownership. By using this form, parties involved can ensure that all necessary details are clearly shared and legally recognized, streamlining processes that could otherwise be cumbersome and complex.

In legal and social contexts, the CC 1551 form holds significant importance. When properly completed, it can serve as incontrovertible evidence of agreement and compliance with applicable laws, protecting the rights of all parties involved. Its correct usage can lead to enhanced operational efficiency in transactions and prevent misunderstandings or disputes over ownership and acceptance of benefits.

Who uses the 1551 form?

The CC 1551 form is vital for a variety of users, including individuals, families, and legal representatives. It is especially relevant for those involved in the transfer of property or assets, as well as individuals who seek to make donations or provide benefits under legal arrangements. Scenarios where the CC 1551 form comes into play include estate planning, property donations, and any transactions involving the transfer of rights or obligations.

Key elements of the 1551 form

Understanding the structure of the CC 1551 form is key to effective completion. The form is segmented into distinct sections, each designed to capture specific information that contributes to the overall purpose of the document. Additionally, by organizing the form in an approachable manner, users can ensure that they provide all required details without overlooking crucial elements.

The key elements of the CC 1551 form include the following sections:

Step-by-step guide to completing the 1551 form

Completing the CC 1551 form accurately is essential for its acceptance. To ensure a smooth process, follow these steps carefully.

Preparation

Start by gathering all required information and documents, which may include identification cards, legal documents regarding the property or donation, and any prior agreements. Understanding the legal obligations associated with the form is crucial to ensure compliance without ambiguities.

Filling out the form

The following outlines section-by-section instructions for completing the CC 1551 form:

Common mistakes include missing signatures, incorrect dates, and not providing necessary documentation. Double-check the final version of the form before submission to avoid these pitfalls.

Review and finalization

Thoroughly reviewing the CC 1551 form is important. Utilize a checklist to confirm that all required fields are completed and that any included documentation matches the information on the form. Proper submission is also key; understanding your options for submitting the form—be it online, by mail, or in-person—is vital, especially regarding any deadlines relevant to your circumstances.

Interactions and follow-up actions

After you submit the CC 1551 form, it enters a review process that may involve compliance checks. Depending on your specific case or jurisdiction, there may be additional actions required from you or notifications sent.

Possible outcomes include approvals or requests for further information. In cases where the form is incomplete or inaccurate, expect to receive notifications prompting corrections. It’s crucial to keep copies of submissions for your records during this period.

Editing and managing your 1551 form

Managing your CC 1551 form effectively involves using resources that facilitate document management, especially considering the need for future edits or updates. Platforms like pdfFiller provide the capability to upload, alter, and securely store the CC 1551 form.

Using pdfFiller also enables collaboration with teams or legal advisors. With eSign capabilities, you can easily gather required signatures electronically, which can streamline the approval process considerably and enhance convenience.

Frequently asked questions (FAQs) about 1551 form

Below are answers to some common queries regarding the CC 1551 form:

Additional considerations regarding 1551 form

Understanding the legal implications of submitting incorrect or incomplete forms is crucial. Failure to comply with mandatory requirements can lead to legal challenges, including disputes over rights and ownership. Those acting in fiduciary or representative roles must exercise diligence to uphold the interests of the individuals they represent.

For further guidance, it may be beneficial to consult legal professionals or relevant support organizations. They can clarify specific rights and obligations associated with using the CC 1551 form, providing more refined advice to navigate the complexities involved.

Tips for successful document management

Effective document management can significantly reduce the risks of errors and improve efficiency. Leveraging digital tools like pdfFiller can enhance the creation and management of your CC 1551 form. Security measures should be in place to protect sensitive information while maintaining easy access for authorized parties.

Consider establishing habits such as consistent organization, timely updates, and regular reviews. These practices can bolster operational integrity and ensure that all necessary documents are always available when needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find cc 1551?

Can I create an electronic signature for the cc 1551 in Chrome?

How do I edit cc 1551 on an iOS device?

What is cc 1551?

Who is required to file cc 1551?

How to fill out cc 1551?

What is the purpose of cc 1551?

What information must be reported on cc 1551?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.