Get the free Non-profit Corporation Annual Report

Get, Create, Make and Sign non-profit corporation annual report

How to edit non-profit corporation annual report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-profit corporation annual report

How to fill out non-profit corporation annual report

Who needs non-profit corporation annual report?

Comprehensive Guide to Non-Profit Corporation Annual Report Form

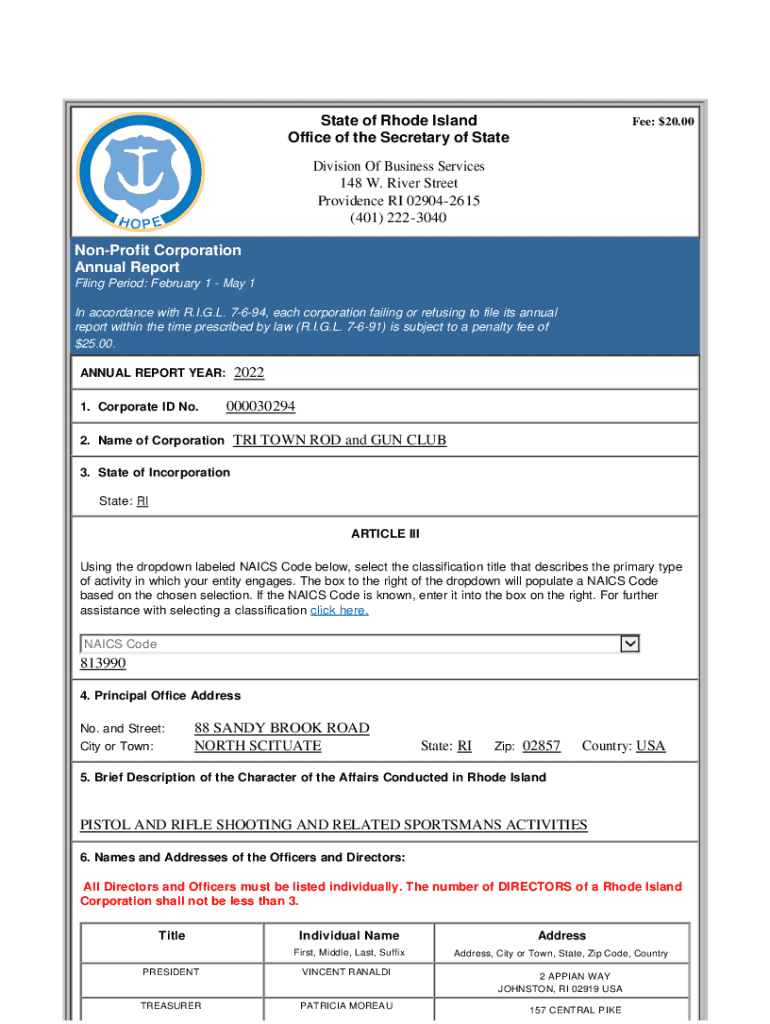

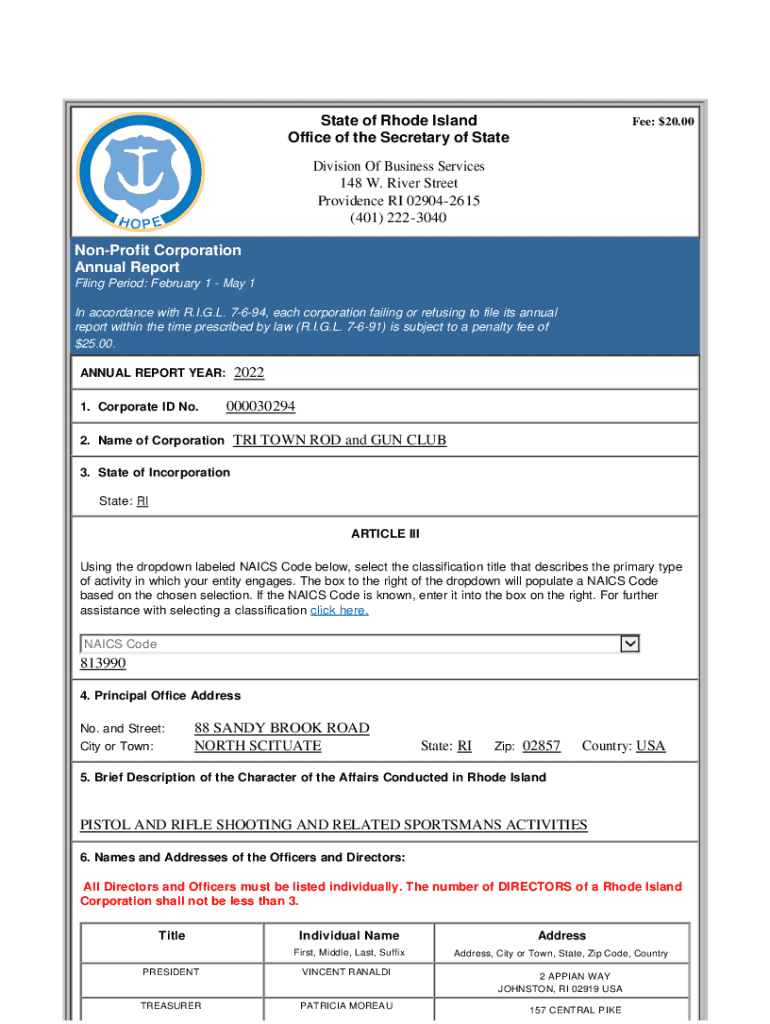

Understanding the non-profit corporation annual report form

The non-profit corporation annual report form serves a vital function in maintaining organizational transparency and compliance. This document is required by states to articulate the operational status of non-profits, ensuring they fulfill their mission and adhere to statutory obligations. The primary purpose of this report is to provide state authorities with updated information about the organization's activities, finances, and governance, ensuring accountability in the non-profit sector.

Timely filing of the annual report is crucial; delays can lead to penalties or loss of non-profit status. Each state has specific deadlines, demanding diligent attention. Understanding local requirements fosters compliance and supports the integrity of your organization.

Who needs to file an annual report?

All registered non-profit corporations within the United States need to file an annual report unless explicitly exempted by state law. Different states have variations on the type and frequency of reports required. For example, some states may only require larger organizations to submit detailed financial statements, while smaller organizations are permitted to file simplified versions.

Common types of non-profits that must file this report include charities, arts organizations, membership organizations, and social service agencies. States may also impose stricter guidelines and different filing requirements depending on an organization’s activities, fundraising levels, and total revenues.

Key components of the non-profit corporation annual report form

When filling out the non-profit corporation annual report form, several key components must be accurately provided to ensure a comprehensive overview of your organization. This includes essential organizational information such as your name, address, and the purpose of the corporation, which helps state officials verify and assess your legitimacy.

The financial information section requires a detailed breakdown of revenue and expenditures over the past fiscal year. It’s essential to provide a clear overview of your organization’s assets and liabilities to illustrate financial stability and performance. Additionally, board of directors' information must be included to reflect any changes in leadership and the current structure of governance, which is critical for compliance and transparency.

Step-by-step guide to filling out the form

Filling out the non-profit corporation annual report form may seem daunting, but breaking it down into manageable steps simplifies the process. Begin by gathering all necessary documentation, including financial statements and the previous year’s report. This foundational information will streamline data entry and provide continuity in your reporting.

Next, navigate to your state's document portal. Most state websites provide an outline of required forms and offer a step-by-step guide specific to your type of organization. When completing each section of the form, accuracy is paramount, as inconsistencies can lead to delays or rejections. It’s beneficial to keep your audience aware of common pitfalls, such as omitting required signatures or misreporting financial data.

Common challenges and how to overcome them

Filing your non-profit corporation annual report form can present several challenges. A common issue is missing information, which often arises from inadequate data collection processes. To mitigate this, implement strategies like creating a checklist of required data points and designating responsibilities among team members to ensure comprehensive data gathering.

Another struggle organizations face is understanding legal language included in the reporting forms. Simplifying complex terminology by creating internal glossaries or consulting resources from experts can help demystify the contents. Lastly, if last-minute changes occur, maintaining flexibility in your report preparation and staying organized with version control will streamline making any necessary amendments.

Utilizing interactive tools for efficient reporting

Digital solutions such as pdfFiller provide interactive tools to optimize document management and enhance the annual reporting process. With features like eSignature capabilities and collaborative tools, team members can seamlessly input and revise reports together. This instantaneous feedback promotes accuracy and efficiency while diminishing the likelihood of errors.

Furthermore, pdfFiller enables users to track submission status and deadlines, ensuring compliance in real time. Using these innovative features not only streamlines your annual reporting but also helps foster a culture of teamwork, critical for any non-profit focused on mission-driven success.

Post-filing considerations

After submitting the non-profit corporation annual report form, proper document storage practices become essential. Keep a central repository of all reports, financial statements, and communications related to the filing. This organized approach will assist in preparing for next year’s filing and ensure vital information remains accessible.

Moreover, utilize the annual report as a strategic tool for future funding discussions. By showcasing accomplishments and clear goals, your organization can engage stakeholders and potential funders, enhancing prospects for contributions and support. A well-prepared report not only reflects accountability but also highlights the impact and importance of your mission in the community.

Frequently asked questions on annual reporting

Many non-profits harbor similar queries regarding their reporting obligations. A key question revolves around the frequency of filings; generally, most states require annual reports once a year, although some states may establish shorter or longer intervals depending on specific organizational criteria or revenue thresholds.

Another common concern involves amending reports post-submission; this is possible but typically involves a formal adjustment process through your state’s office. Late submissions can incur penalties or, in severe cases, jeopardize your non-profit status, necessitating proactive planning to meet all filing deadlines.

Additional support and resources

Organizations filing their non-profit corporation annual report form may benefit from additional resources. Access customer support and detailed help from pdfFiller to navigate any challenges you encounter. If your organization is experiencing financial or legal uncertainties, consider connecting with professional accountants or legal advisors. Their expertise can assist in ensuring compliance and effective management of your report.

Additionally, seeking online workshops and webinars on non-profit compliance can provide valuable insights and essential tips to enhance your understanding of regulatory requirements. These resources aid your organization in staying informed and effective in its reporting practices.

Engaging with your community post-report

After filing the non-profit corporation annual report form, engaging with your community can yield significant benefits. Share your achievements transparently with donors and stakeholders, leveraging social media as a powerful tool to communicate your impact and ongoing initiatives. This not only holds your organization accountable but also fosters trust and encourages further contributions.

Consider planning follow-up meetings with stakeholders to discuss the contents of the report in detail. This open line of communication cultivates a collaborative environment and enhances community involvement. By establishing a narrative surrounding your report, you can paint a comprehensive picture of your non-profit's contributions, goals, and future aspirations, aligning efforts towards a more significant mission-driven impact.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get non-profit corporation annual report?

How do I make edits in non-profit corporation annual report without leaving Chrome?

How can I fill out non-profit corporation annual report on an iOS device?

What is non-profit corporation annual report?

Who is required to file non-profit corporation annual report?

How to fill out non-profit corporation annual report?

What is the purpose of non-profit corporation annual report?

What information must be reported on non-profit corporation annual report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.