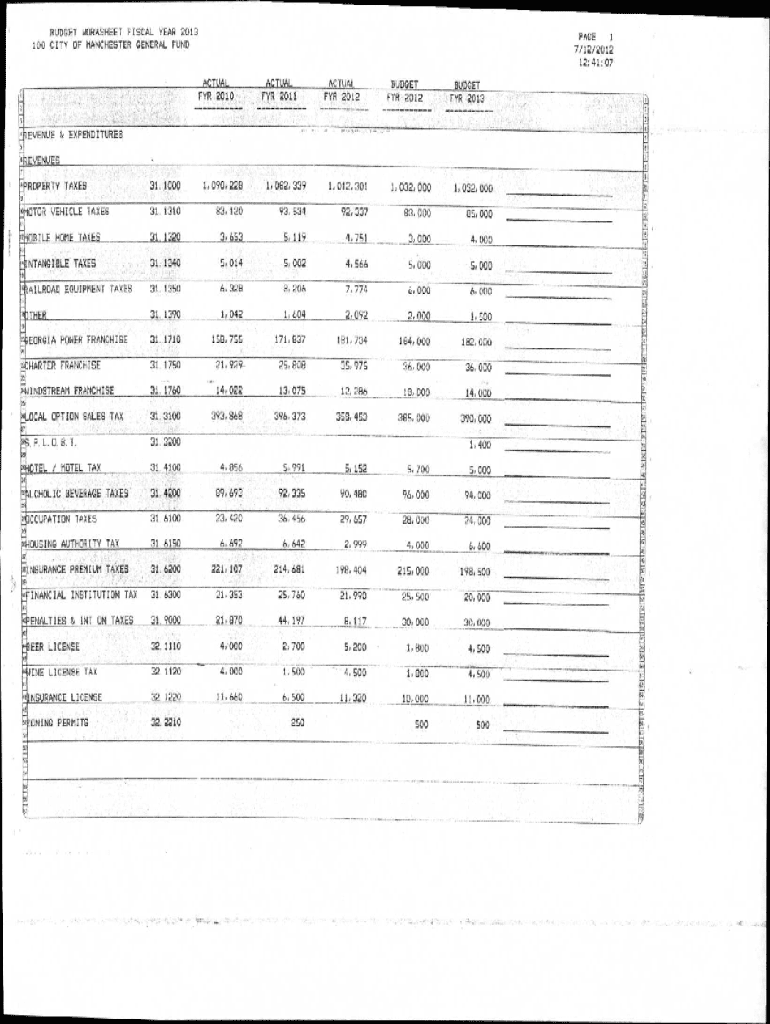

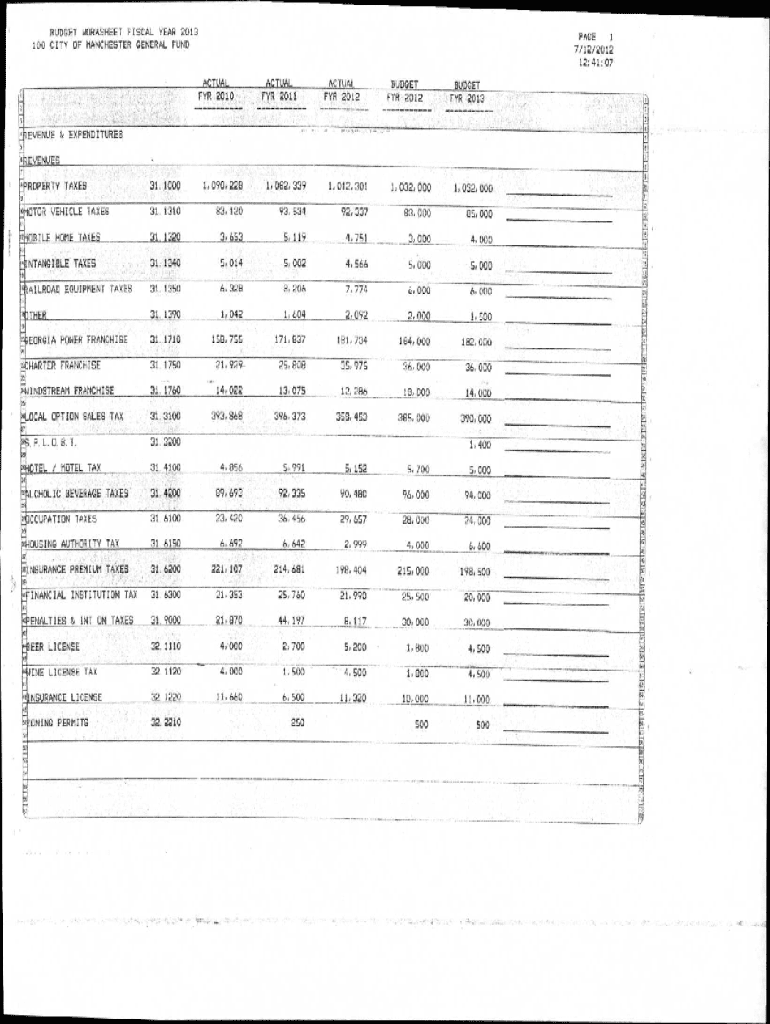

Get the free Budget Worksheet Fiscal Year 2013 - ted cviog uga

Get, Create, Make and Sign budget worksheet fiscal year

Editing budget worksheet fiscal year online

Uncompromising security for your PDF editing and eSignature needs

How to fill out budget worksheet fiscal year

How to fill out budget worksheet fiscal year

Who needs budget worksheet fiscal year?

A Comprehensive Guide to the Budget Worksheet Fiscal Year Form

Understanding the importance of a budget worksheet

A budget worksheet is an essential financial tool that enables individuals and teams to plan their spending, save effectively, and manage their financial resources efficiently. By tracking income and expenses, a budget worksheet provides clarity on where funds are allocated and highlights potential areas for savings. The necessity of a robust fiscal year form becomes even more evident as one considers the specific financial goals of a business or household for the upcoming year.

Using a budget worksheet brings numerous benefits. Firstly, it assists in preventing overspending by setting clear spending limits. Secondly, it promotes accountability by tracking financial behaviors and patterns over time. Lastly, it enables users to prepare for future expenses and allocate funds for savings and investments. Key considerations when creating a fiscal year budget involve understanding the cyclical nature of income and expenses and shifting financial priorities based on life changes.

Types of budget worksheets

There are different types of budget worksheets available, each catering to various needs and preferences. One common format is the Excel budget template, which offers flexibility and customizability for users comfortable with spreadsheet software. On the other hand, online budgeting tools provide a more interactive experience, allowing for real-time updates and collaboration.

When choosing the right type of budget worksheet, consider factors such as ease of use, the ability to share with others, and your personal or team's specific budgeting needs. Whether you prefer a monthly budget template that organizes financial data month by month or a comprehensive fiscal year template that encompasses the entire year's financial landscape, selecting the right tool is critical.

Getting started with the fiscal year budget worksheet

Before diving into filling out your budget worksheet, it’s essential to prepare your financial data. Start by gathering all your income sources, such as salaries, freelance work, and any passive income streams. This will form the foundation of your budget and provide clarity on your financial standing.

Next, identify your fixed and variable expenses. Fixed expenses include rent, mortgage, or loan payments that remain constant, while variable expenses can fluctuate each month, such as groceries, entertainment, and discretionary spending. After collecting this data, setting up your budget worksheet can be done easily using a platform like pdfFiller, which offers various templates that can be customized to your needs.

Step-by-step guide to filling out the budget worksheet

Filling out the budget worksheet involves several key sections. The first is the income section. Begin by entering all your income sources, whether it’s from a job or side hustles. It's important to calculate your total monthly income to establish a solid financial foundation.

Next, move to the fixed expenses section. Here, list obligations that remain constant monthly, such as rents or subscriptions. Employing strategies to lower fixed costs, like negotiating for better rates on services, can help adjust your budget effectively.

Afterwards, detail variable expenses by categorizing them and estimating amounts based on past spending habits. Having a clear overview enables more refined budgeting and helps identify areas to cut back on discretionary spending, ultimately leading to improved savings.

In the savings and investments section, set achievable savings goals for emergencies or future purchases. Allocating funds for potential investments forms a solid basis for growing wealth through strategic financial planning.

Key features of pdfFiller for budget worksheets

pdfFiller empowers users to optimize their budgeting process with powerful template features. The platform allows for easy editing of PDFs and templates, ensuring customization aligns with your unique financial goals. Not only can you personalize your budget worksheet, but it also offers eSigning capabilities which facilitate collaborations with team members or financial advisors seamlessly.

Real-time collaboration features enhance teamwork by allowing multiple users to make updates and adjustments simultaneously. Coupled with cloud-based storage, users can access their documents anywhere, ensuring that your financial planning is always at your fingertips, whether at home or on the go.

Managing and adjusting your fiscal year budget

To ensure your fiscal year budget remains effective, regular reviews against actual spending are crucial. Monthly performance assessments let you see where your estimates match reality and also where they diverge, empowering you to adjust your budget accordingly. This evaluation process helps maintain financial health by keeping your budget relevant.

Additionally, it’s important to be adaptable. Financial circumstances can change due to unforeseen expenses, such as home repairs or medical bills. Having a flexible budgeting approach allows for minimizing stress during such times while maintaining clear financial oversight.

Troubleshooting common budgeting issues

Many budgeters may encounter common challenges, such as budget shortfalls or unexpected expenses. Identifying the cause of a shortfall is key — perhaps expenses outpaced income, or savings were not prioritized. To counteract this, revisit your budget worksheet and see where cuts can be made or income can be increased.

Unexpected expenses are a reality; preparing for them involves maintaining a buffer within your budget. Allocate a small portion of your income to a contingency fund, ensuring you’re not thrown off course by life’s surprises. Flexibility in your budget plan will allow you to navigate these challenges smoothly.

Making the most of your budget worksheet

Staying committed to your budget worksheet requires strong motivation and the right tools. Strategies such as visually tracking expenses using charts or graphs can make budgeting more engaging. This visual representation offers an at-a-glance understanding, providing insights into spending patterns and encouraging adherence to financial goals.

Consider supplementing your worksheet with budgeting apps that sync your expenses in real-time, further aiding your budgeting journey. Leveraging the diverse features within pdfFiller allows you to continuously optimize your financial management practices, ensuring you remain aligned with your goals even as they evolve.

Frequently asked questions about budget worksheets

Occasionally, you may wonder what to do if your income is irregular. In these cases, base your budget on the lowest typical income, and adjust your spending baseline when higher earnings occur. Communicating your budget with your team is also vital; ensure clarity by presenting your worksheet visually during meetings.

Updating your budget worksheet regularly is a best practice. Aim for monthly revisions to reflect spending changes and financial goals accurately, and don’t hesitate to adjust priorities when necessary. This habit ensures your budget remains a relevant guide throughout the fiscal year.

Real-life applications of budget worksheets

Numerous case studies highlight the success of using budget worksheets for effective financial management. For instance, a household that began tracking their expenses with a simple fiscal year budget worksheet experienced a reduction in unnecessary discretionary spending within months, reallocating those funds toward savings. This anecdote showcases the power of budgeting essentials.

Testimonials from pdfFiller users echo similar sentiments, where platform features helped them visualize their spending, leading to better decision-making. The clarity gained through budget worksheets has empowered many to achieve their financial goals, emphasizing the importance of regular budgeting practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in budget worksheet fiscal year without leaving Chrome?

Can I create an eSignature for the budget worksheet fiscal year in Gmail?

How do I edit budget worksheet fiscal year straight from my smartphone?

What is budget worksheet fiscal year?

Who is required to file budget worksheet fiscal year?

How to fill out budget worksheet fiscal year?

What is the purpose of budget worksheet fiscal year?

What information must be reported on budget worksheet fiscal year?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.