Get the free Nyc-210

Get, Create, Make and Sign nyc-210

Editing nyc-210 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nyc-210

How to fill out nyc-210

Who needs nyc-210?

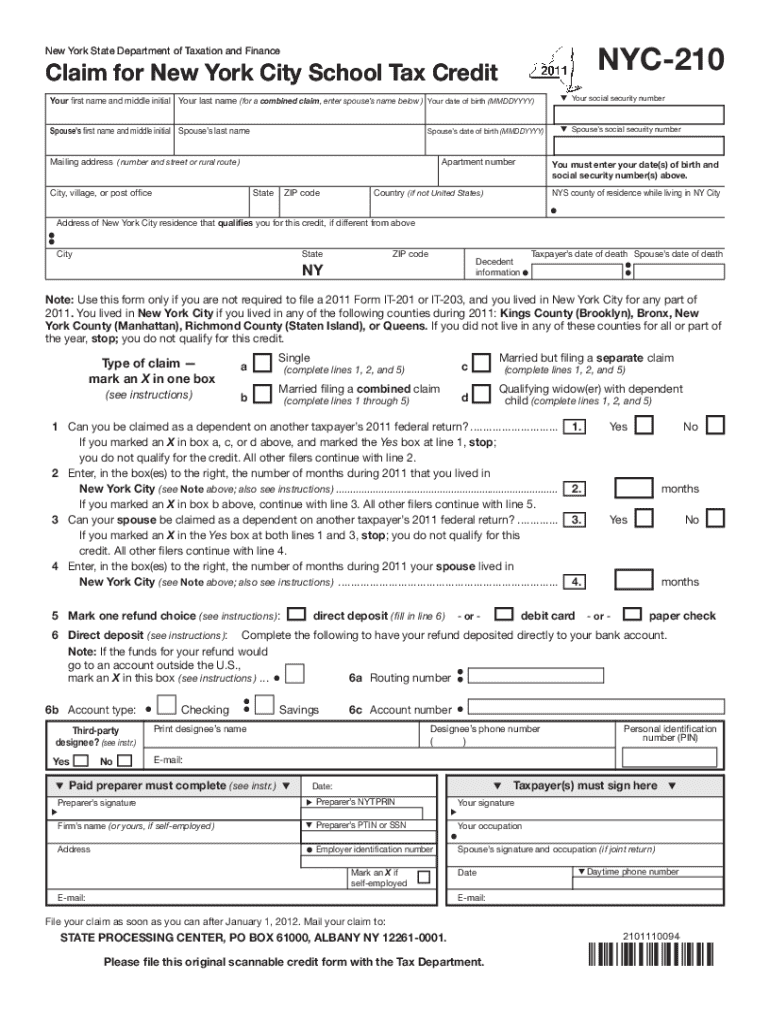

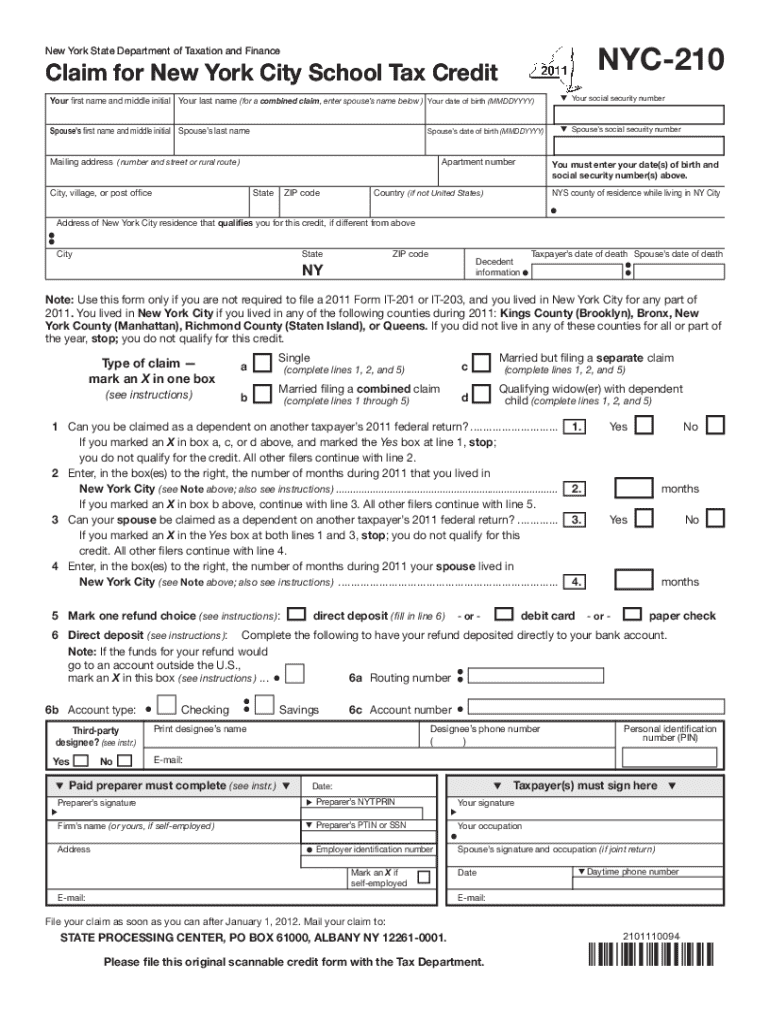

A Complete Guide to Filling Out the NYC-210 Form

Understanding the NYC-210 form

The NYC-210 form, officially known as the 'Claim for NYC Refund of Unincorporated Business Tax', is a crucial document for individuals and businesses in New York City aiming to recover overpaid taxes. This form is specifically designed to help taxpayers receive refunds from the NYC Department of Finance when they have overpaid their unincorporated business taxes. Given the complexity of tax regulations in NYC, a clear understanding of this form is essential for both individuals and teams seeking to manage their tax obligations effectively.

The importance of the NYC-210 form lies in its ability to provide a structured mechanism for claiming refunds, ensuring that eligible taxpayers can retrieve funds that rightfully belong to them. By utilizing this form, applicants can navigate the often-complicated avenues of the NYC tax system while maximizing their potential refunds.

Who needs the NYC-210 form?

Eligibility for the NYC-210 form generally extends to individuals and entities that have paid unincorporated business taxes and believe they have overpaid. Common scenarios prompting the use of this form include adjustments made after audits or when deductions previously unclaimed can apply retrospectively. Essentially, any taxpayer who conducts business as a sole proprietor or as part of a partnership in NYC may find this form relevant to their needs.

Identifying eligibility ensures that the NYC-210 form is completed correctly and submitted in appropriate time frames, following specific guidelines set forth by the NYC Department of Finance. This careful approach not only facilitates quicker refund processing but also safeguards against inaccuracies that could hinder claims.

Key details and deadlines

The NYC-210 form submission deadlines are paramount for ensuring claims are considered valid. Generally, claims must be submitted within three years from the date of tax payment or two years from the date of filing the original tax return, whichever is later. Keeping track of these deadlines can greatly enhance the likelihood of successful claims.

Step-by-step guide to completing the NYC-210 form

Filling out the NYC-210 form can be straightforward when approached methodically. Start by gathering all necessary personal information such as your name, address, Social Security number, and any relevant business identifiers. You'll also need documentation that supports your claims, like previous tax returns and records of payments.

Next, when filling out the NYC-210 form, careful attention is required for each section to ensure accuracy. For each line item, refer directly to your documentation to provide precise figures and information. The form comprises several key sections, including details of your total unincorporated business tax liability, any refund sought, and calculations ensuring there are no discrepancies.

To avoid common mistakes, double-check entries for consistency and accuracy before submitting the form. This step will save you time and increase the likelihood of approval on your refund request.

Editing and managing your NYC-210 form with pdfFiller

After filling out the NYC-210 form, the next consideration is how to manage the document effectively. Using pdfFiller to edit your completed form allows for enhanced clarity and professionalism. Simply upload the NYC-210 form to pdfFiller’s platform, enabling you to access various editing tools that enhance presentation and readability.

Collaboration can also be streamlined using pdfFiller’s features. Invite multiple users to review and edit the form, facilitating group input and ensuring accuracy from various stakeholders. For effective collaboration, establish clear roles for team members and set deadlines to keep the process moving efficiently.

Signing the NYC-210 form

Once your NYC-210 form is complete and edited, it’s essential to sign it accurately. Electronic signatures are legally valid in New York City, making eSignatures a convenient tool for attorneys and business professionals alike. Different forms of eSignatures exist: typed signatures, drawn signatures, or uploaded images of a handwritten signature. Each option holds the same legal weight.

Using pdfFiller for eSigning is straightforward; simply navigate to the signing feature, select your preferred signature style, and apply it to the NYC-210 form. Security is paramount, so knowing that pdfFiller employs robust measures to protect your data ensures peace of mind while signing.

Submitting the NYC-210 form

With your NYC-210 form signed, it’s time to submit it. There are two primary methods for submission: online through the NYC Department of Finance or via traditional mail. Online submission typically provides quicker responses and is more efficient. To submit online, follow the specific instructions provided on the NYC Department of Finance website to ensure a smooth process.

Confirming submission is crucial after sending your NYC-210 form. Whether you submit online or through the mail, tracking confirmation ensures your form is received and under review. Utilize any tracking tools offered by the department to stay updated on your submission status.

Troubleshooting common issues

As you navigate the submission process for your NYC-210 form, certain issues may arise. Common errors on the form include miscalculations, incomplete fields, or discrepancies between provided documentation and submitted data. It's essential to familiarize yourself with these issues to mitigate potential conflicts.

In the event that mistakes are made after submission, there’s a process in place for rectifications. You can amend an already submitted NYC-210 form by following specific procedures detailed by the NYC Department of Finance. Should you encounter difficulties or require assistance, resources are available through NYC.gov or the support services of pdfFiller to ensure your issues are resolved promptly.

Additional features of pdfFiller

Beyond managing the NYC-210 form, pdfFiller offers numerous other document management solutions. Frequently used templates and forms within the platform simplify both personal and professional documentation needs. With an emphasis on accessibility, pdfFiller allows users to manage documents from anywhere, fostering productivity and collaboration.

The ability to edit, sign, and manage documents in one central platform saves both time and resources. With pdfFiller, the user experience extends beyond just the NYC-210 form, empowering individuals and teams to maintain better organization and efficiency throughout their document workflows.

FAQs about the NYC-210 form

Navigating the intricacies of the NYC-210 form raises many questions from users seeking clarity. Frequently asked questions typically revolve around the completion of the form, submission processes, and how to handle corrections post-submission. Understanding these facets is essential to streamline the process.

For users seeking to optimize their tax refund claims with the NYC-210 form, proactive approaches and best practices often yield successful outcomes. Engaging with tools such as pdfFiller not only enhances the ease of use but also contributes to more informed decision-making throughout the tax refund process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify nyc-210 without leaving Google Drive?

How can I fill out nyc-210 on an iOS device?

Can I edit nyc-210 on an Android device?

What is nyc-210?

Who is required to file nyc-210?

How to fill out nyc-210?

What is the purpose of nyc-210?

What information must be reported on nyc-210?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.