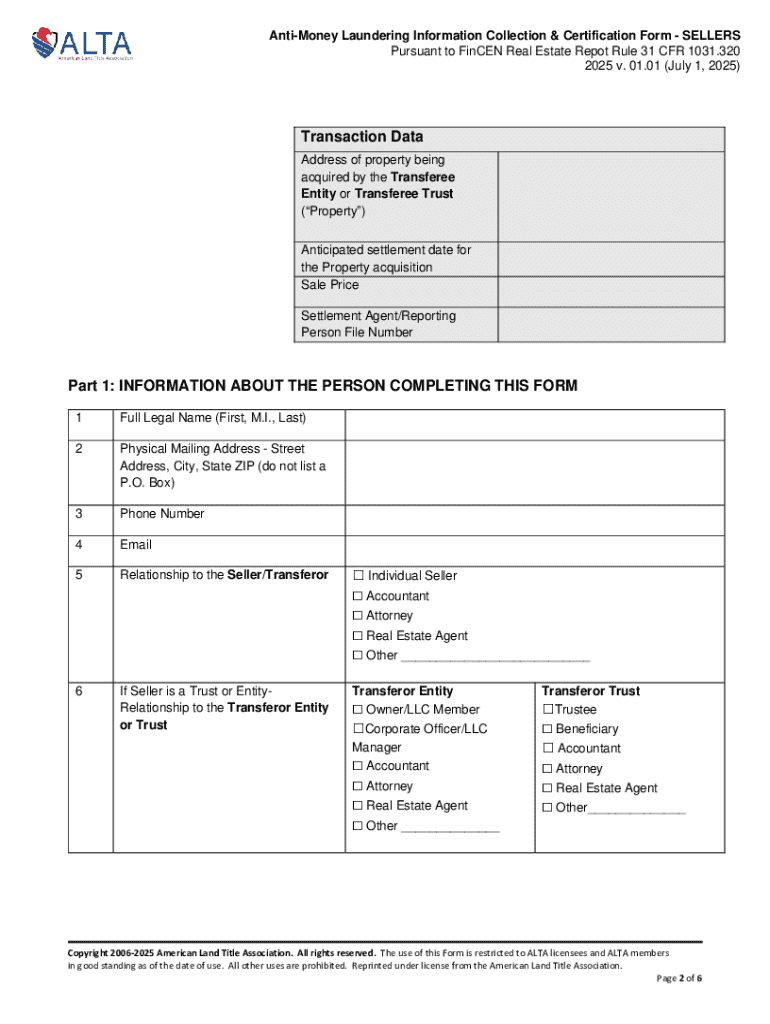

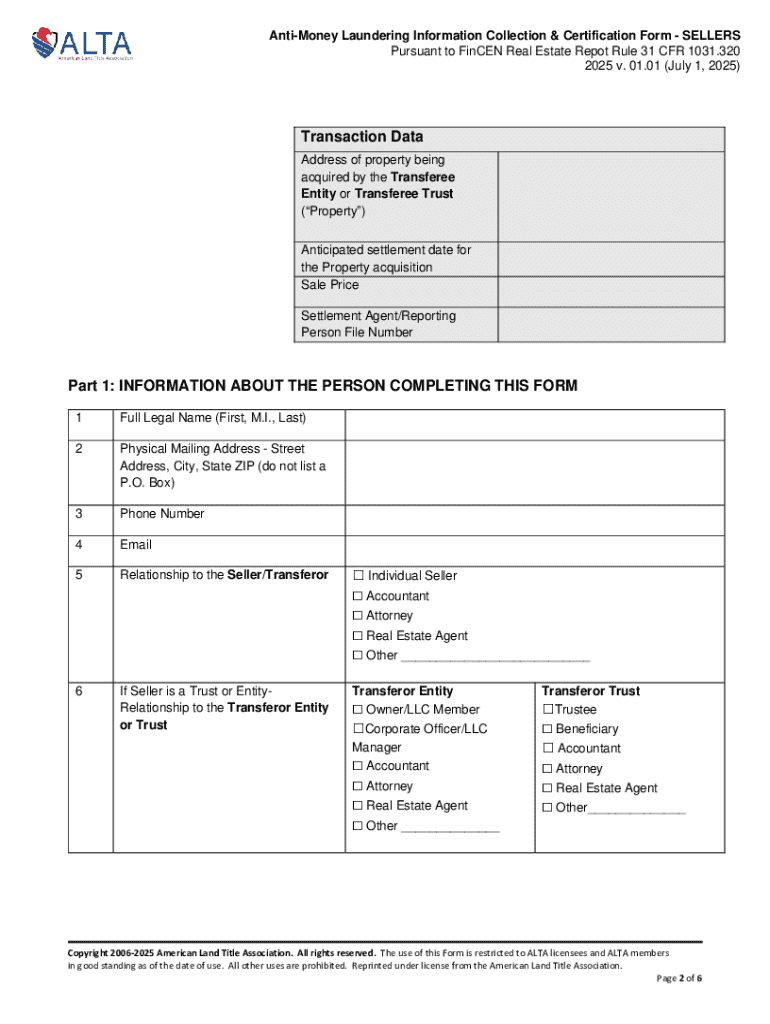

Get the free Anti-money Laundering Information Collection & Certification Form - Sellers

Get, Create, Make and Sign anti-money laundering information collection

How to edit anti-money laundering information collection online

Uncompromising security for your PDF editing and eSignature needs

How to fill out anti-money laundering information collection

How to fill out anti-money laundering information collection

Who needs anti-money laundering information collection?

A comprehensive guide to the anti-money laundering information collection form

Understanding anti-money laundering (AML) information collection

Anti-money laundering (AML) information collection refers to the systematic gathering of data to detect and prevent money laundering activities. This collection is critical because it helps financial institutions and relevant authorities identify suspicious behaviors that may indicate illegal activities, such as terrorism financing or fraud. The significance of effective AML information collection cannot be overstated, as it protects the integrity of the financial system and promotes compliance with global standards.

Key terminology related to AML includes terms such as 'beneficial owner,' which refers to the individual who ultimately owns or controls a client, and 'suspicious activity report (SAR),' which is submitted when a transaction raises concerns. Furthermore, the regulatory framework surrounding AML varies by region, but typically includes guidelines set forth by entities like the Financial Action Task Force (FATF) and local regulatory bodies. Compliance obligations often require institutions to implement rigorous reporting protocols and employee training programs.

Purpose of the AML information collection form

The AML information collection form serves several critical functions in the broader AML compliance framework. Primarily, it plays a vital role in risk assessment and management, enabling institutions to identify and categorize potential risks associated with their clients and transactions. This proactive approach aids in formulating strategies to mitigate those risks effectively.

Moreover, by capturing essential data, the form contributes to compliance with AML regulations. It allows institutions to create a robust record for audits and regulatory inspections, ensuring they meet their obligations. Target users of this form typically include financial institutions, real estate agencies, and other businesses obligated to monitor and report suspicious activities to ensure compliance with AML laws.

Overview of the AML information collection process

The process of collecting AML information using the designated form involves several essential steps that ensure data is collected systematically and accurately. A thorough understanding of this process can significantly enhance the overall effectiveness of AML compliance efforts. First, it's crucial for users to recognize the types of information required, such as personal identification details, financial activities, and source of funds documentation.

Common mistakes during the completion of this form may include failing to provide comprehensive data or overlooking the importance of accuracy in reporting. Institutions should regularly train employees to avoid these pitfalls, ensuring that all aspects of the form are completed with care. Implementing checks and balances is also advisable to ensure completeness, especially when financial data is involved.

Step-by-step guide to completing the AML information collection form

Completing the AML information collection form efficiently necessitates a structured approach. Below are the detailed steps to ensure proper submission.

Interactive tools for completing the AML information collection form

Utilizing interactive tools enhances the efficiency of completing the AML information collection form. Platforms like pdfFiller provide various templates and editing tools designed to simplify the process. Users can easily customize forms, ensuring all necessary information is included while maintaining compliance.

Additionally, eSigning capabilities enable users to sign documents online securely, eliminating the need for physical paperwork. Collaborative features allow team members to work on the form together, ensuring no detail is overlooked, which is crucial for maintaining compliance.

Frequently asked questions (FAQs) related to AML information collection

As with any compliance-related document, there are common questions that arise concerning the AML information collection form. Understanding the answers to these FAQs can aid users in managing their responsibilities effectively.

Best practices for managing AML information

Effective management of AML information is critical for maintaining compliance and protecting the institution’s integrity. Regular updates and record keeping should be a part of the ongoing compliance strategy, ensuring that all data is current and accurately reflects client transactions and activities.

Enhancing security and confidentiality of data is paramount. Institutions should implement robust cybersecurity measures and train employees in data protection protocols. Furthermore, leveraging technology, such as cloud-based solutions, can streamline AML processes, making it easier to manage and access information securely and efficiently.

Key resources and additional information

For individuals and teams looking to deepen their understanding of AML compliance, access to key regulatory bodies and guidelines is crucial. National financial oversight agencies, such as the Financial Crimes Enforcement Network (FinCEN) in the U.S. or equivalent bodies in other jurisdictions, provide essential resources regarding compliance best practices.

Moreover, recommended online courses focused on AML practices can further enhance knowledge. Resources like webinars and training modules are widely available, making it easier for anyone in the finance field or related industries to stay informed.

How pdfFiller enhances your AML information collection experience

pdfFiller stands out as a leading tool in the cloud-based document management space, especially for completing the AML information collection form. Its user-friendly interface allows for seamless editing of PDF forms, ensuring that users can fill out their information correctly without hassle.

User testimonials highlight the effectiveness of pdfFiller for AML forms, with many praising its accessibility and collaborative features. Integration capabilities with other software suites further enhance its utility, making it an essential tool for teams focused on compliance and efficiency.

Next steps after completing the AML information collection form

Upon submitting the AML information collection form, it’s crucial to understand the follow-up procedures involved. Users should maintain communication with the relevant authority to monitor the status of their submission and be prepared to provide further information if required.

Fostering a proactive compliance culture within an institution is essential for long-term success. By promoting awareness about AML regulations and continuing to seek ongoing education, individuals and teams can improve their AML processes, ensuring they align with current practices and regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send anti-money laundering information collection to be eSigned by others?

How do I make changes in anti-money laundering information collection?

Can I create an electronic signature for signing my anti-money laundering information collection in Gmail?

What is anti-money laundering information collection?

Who is required to file anti-money laundering information collection?

How to fill out anti-money laundering information collection?

What is the purpose of anti-money laundering information collection?

What information must be reported on anti-money laundering information collection?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.